You know it’s been a big news year when the first merger of Class I railroads in more than two decades — and likely the last — is judged the No. 3 story of 2023.

In a typical year, Canadian Pacific’s $31 billion acquisition of Kansas City Southern would have topped the headlines. The Surface Transportation Board approved the merger in March. A month later — on April 14, 2023 — Canadian Pacific Kansas City was born. At a ceremony in Knoche Yard in Kansas City, the only place the two railroads touch, CEO Keith Creel drove home the ceremonial spike to celebrate the creation of the first railroad to link Canada, the U.S., and Mexico.

That day CPKC also unveiled its new logo, a modified version of CP’s iconic shield, beaver, and maple leaf. In June the railway introduced its locomotive livery, which employees selected from five options. The paint scheme is CP red, features the CPKC beaver and shield logo on the long hood, and ends with a splash of gold and black that begins at the radiator section of the locomotive. No locomotives have yet emerged from the paint shop clad in the new livery.

That day CPKC also unveiled its new logo, a modified version of CP’s iconic shield, beaver, and maple leaf. In June the railway introduced its locomotive livery, which employees selected from five options. The paint scheme is CP red, features the CPKC beaver and shield logo on the long hood, and ends with a splash of gold and black that begins at the radiator section of the locomotive. No locomotives have yet emerged from the paint shop clad in the new livery.

At the railway’s June investor day, executives dramatically increased the revenue growth anticipated from the CP-KCS merger, saying they’ll be able to capture more freight from other railroads and divert more trucks off the highway than originally envisioned.

CPKC expects $5 billion in revenue growth through 2028, a fivefold increase over the pre-merger outlook period that covered the next three years. “The pipeline is big,” Chief Marketing Officer John Brooks said at the railway’s investor day held in Kansas City Union Station.

CPKC expects industry-leading growth through 2028 by gaining $925 million worth of traffic from other railroads; $1.4 billion in truck-to-rail conversions; $1.5 billion from industrial development and near-shoring projects; and $1.1 billion in other new business, including from transloads and partnerships with short lines.

The more upbeat outlook was due to CPKC’s ongoing conversations with customers and CP officials gaining control of KCS once the merger became effective on April 14. In the 60 days after the merger, CPKC’s sales team combed over every commodity group and customer looking for opportunities that could arise from the combined network.

CPKC in May launched the Mexico Midwest Express premium intermodal service linking Chicago, Kansas City, and Laredo, Texas, with Monterrey and San Luis Potosi in Mexico. Trains 180 and 181 are billed as the first truck-competitive, single-line rail service option between the Midwest and Mexico. Schneider and Knight-Swift Transportation, which shifted their cross-border business to CPKC from Union Pacific, are the train’s anchor customers.

MMX trains make the 2,150-mile run between Bensenville, Ill., and San Luis Potosi in four days. “We’re doing it at a trucklike speed. We’re beating what we advertised, and that train is 95%, 96% on time,” Creel told an investor conference in September. “I look at it every day, every morning. If it gets late I know about it. It is really symbolizing the power of this extended haul network – and it’s attracting business.”

The MMX service prompted Canadian National, Union Pacific, and Ferromex to team up for Falcon Premium service that links CN’s terminals in Canada and Detroit with points in Mexico. Like MMX, the service was launched in May. New UP CEO Jim Vena subsequently took 24 hours out of the schedule after he rejoined the railroad in August.

BNSF Railway and intermodal partner J.B. Hunt on Jan. 1 will shift their cross-border service away from CPKC and the Laredo, Texas, gateway to a Ferromex routing via the Eagle Pass, Texas, gateway. The service via Eagle Pass will be 24 hours faster than the current Chicago-Monterrey route, BNSF and J.B. Hunt say. The route is 5% shorter between Monterrey and BNSF’s terminal in Alliance, Texas, where traffic can be routed to various destinations on the BNSF system.

CN also signed an interline agreement with Norfolk Southern so that its intermodal customers could reach Kansas City. UP, meanwhile, began offering interline intermodal service between Mexico and the Southeast via connections with NS and CSX at Memphis.

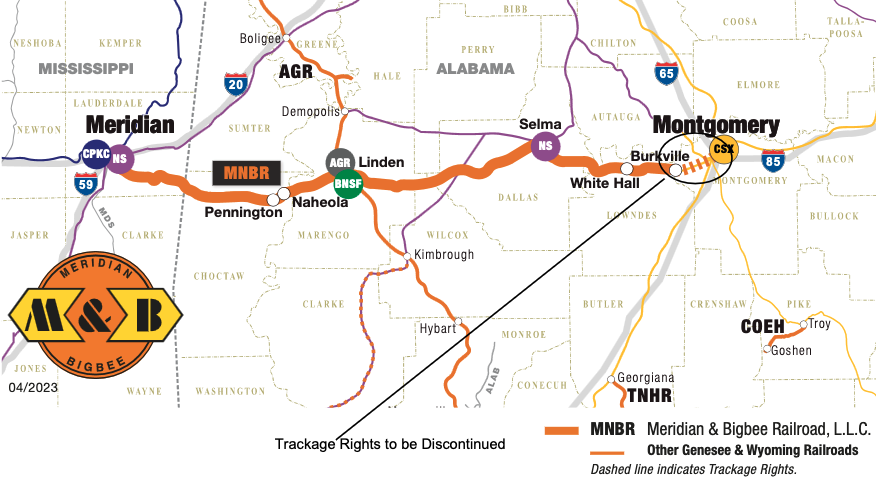

The new UP service will have a head start on cross-border service that CPKC and CSX say they’ll begin late next year assuming STB approval of their plan to acquire and upgrade Genesee & Wyoming short line Meridian & Bigbee. The Meridian & Bigbee will serve as a link between CPKC’s Meridian Speedway at Meridian, Miss., and CSX’s Montgomery, Ala., hub.

The deal will create a new corridor linking CPKC-served markets in Mexico and Texas with CSX-served markets in the Southeast. It’s expected to attract intermodal shipments of auto parts, finish vehicle business, and forest products traffic.

In November, Creel said he is not the least bit surprised at how rival Class I railroads have responded to the CP-KCS merger by launching new and faster cross-border intermodal service. “We’re creating competition and this industry is getting stronger as a result,” Creel told the RailTrends conference.

“The UP, they’ve introduced their service. They’ve always had the best route to the border, but they never had the best transit time. Now they’re inspired to compete and are matching, with their combined three-line move, similar transit times,” Creel says. “And then … BNSF and J.B. Hunt got into the fray, too. And they are shaving time off their existing transit times. So you’ve got three railroads that are motivated, that are inspired.”

Creel says Class I railroads got complacent after the last round of mergers two decades ago.

“When you’re not challenged – and this is human nature, this is railroading nature, this is any business nature, this is competitive sport nature, this is just a fact of life – sometimes complacency can set in,” Creel says. “And this industry is in a place where we needed to be better. We need to be better for all stakeholders, not just our own, but for this nation.”

The rail competition will extend to automotive and merchandise traffic, as well, Creel says. With 10,000 trucks crossing the U.S.-Mexico border at Laredo every day, Creel says there is plenty of business to go around for CPKC, UP, and BNSF to all be successful.

Previous News Wire coverage:

“Regulators approve Canadian Pacific-Kansas City Southern merger,” March 15, 2023

“Conditions placed on CP-KCS merger designed to ensure competition, smooth operations,” March 15, 2023.

“Metra, Chicago suburbs see few concerns addressed in merger decision,” March 15, 2023.

“CPKC unveils new logo on first day as a merged system,” April 14, 2023.

“New CPKC Chicago-Mexico intermodal service to debut May 11,” April 26, 2023.

“Union Pacific challenges STB’s Canadian Pacific-Kansas City Southern merger decision,” May 5, 2023.

“CPKC launches first Midwest Mexico Express intermodal hotshots,” May 11, 2023.

“CPKC and CSX to create direct interchange via G&W short line in Alabama,” June 28, 2023.

“Competition from CPKC makes the rail industry better, CEO Keith Creel says,” Nov. 17, 2023.

Coming Saturday: Story No. 2.

This is just a merger on paper! Have we seem any locomotives repainted to the new scheme? No. not one. Have we seen the new logo applied to any locomotives or rolling stock? No, not one, at least that I have seen on Virtual Railfan. The only acknowledgment of a merger is a few “cans” have been painted white and CPKC painted on them, less than 100, I believe. But no other rolling stock or locomotives, leading one to believe that this was never intended to be a merger but a take over costing more than a few KCS people to lose their jobs, but none at CP.

Yes Mr. Creel there has been more competition as your competitors strengthen their offerings while you try to undercut everyone in an unsustainable way and depend on other railroads to provide your US infrastructure. Everything you have done speaks CANADIAN PACIFIC, not Canadian Pacific Kansas City as you told the world, even down to your tired Beaver and Maple Leaf which clearly mean a Canadian and not a North American Railroad. Even CN on many of their locomotives at least show the Canadian and American Flags together.

I say yes, Trains Magazine. How about getting someone at CP to give a timeline for when the KCS part of the equation will be shown in a permanent way on something more firm than a piece of paper or multimedia presentation… So far all we have seen or heard is talk, talk, talk. THE PROOF IS IN THE PUDDING!

And by the way, Schneider’s shift of Traffic is the smallest amount of their business and is only the North-South traffic from the midwest going to Mexico and not other US Ports. CP doesn’t have the horsepower to make that move on their own…

A progress report on the post-merger CPKC would make for an excellent in-depth article. (hint, hint)

I presume that Mr Stephens and his editors have thought of this, and like you I am looking forward to it.