MIAMI — As the Spring Break surge approaches, Brightline continues to seek the right pricing strategy when operating 16 daily fixed-consist round trips between South Florida and Orlando, plus another two to handle early morning and late evening Miami-West Palm Beach travel.

A password-protected, 2,044-page supplement to a “Preliminary limited remarketing memorandum relating to $770 million in Florida Development Finance Corporation Revenue Bonds” contains a wealth of information most transportation providers aren’t required — or willing —to share. It reveals revenue and ridership data for February, released Wednesday, which reflects the balance Brightline marketing strategists face as demand varies by time, day, and dramatically different prices for city-pair combinations.

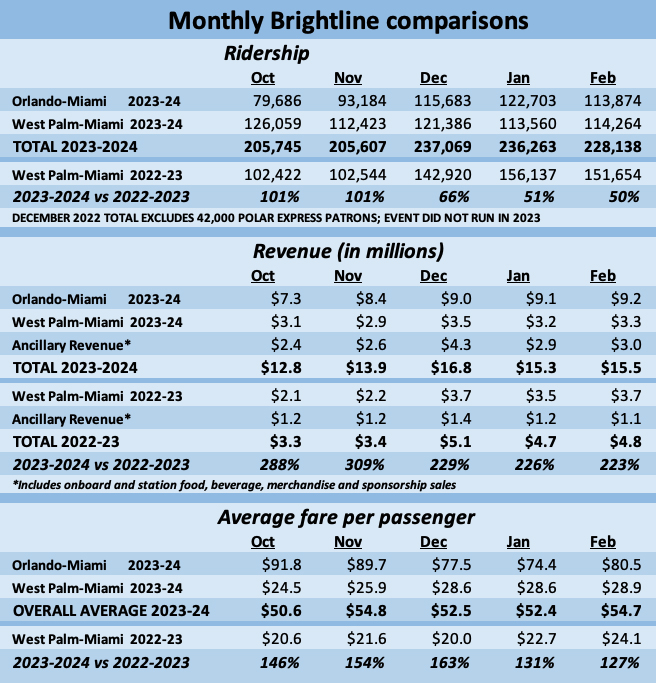

The table above adds two operating months to an initial Trains News Wire evaluation [see “Brightline growth continues …,” Feb. 5, 2024]. During January and February, fares were deeply discounted on some runs while others sold out at higher prices. The supplement provides additional context behind the numbers:

— Approximately one of three trains operates at or near capacity; about half of departures have load factors of 80% or more.

— Restricting available capacity for short-distance trips is responsible for the continuing year-over-year decline of Miami-West Palm patronage. Higher short-distance fares could also be a factor.

— Daily bookings have risen from an initial 2,800 in October 2023, to 4,300 in February 2024, and 4,500 for the first half of March.

— South Florida-Orlando repeat customer bookings are increasing 15% month-over-month

— Confirming that 10 additional coaches are to be delivered by Siemens in 2024, the company estimates strategic placement of this extra capacity would have added an additional 50,000 passengers to the February totals.

Brightline is now predicting 4.9 million passengers will use its trains in 2024. This is a downward revision from the 5.5 million it projected in December after it became clear that capacity constraints were impacting the Orlando-South Florida month-over-month trajectory

Additional growth sources are anticipated. An intermediate Treasure Coast station at Stuart, Fla., 37 miles north of West Palm Beach, could be ready as early as 2026 [see “Brightline ceremony marks the selection of Stuart, Fla. …,” News Wire, March 4, 2024]. Adding the stop in a congested coastal area that lacks speedy public transportation will clearly strengthen overall demand as stations at Aventura and Boca Raton, Fla., have done south of West Palm Beach.

With another “infill” stop at Cocoa, Fla., under development [see “Brightline to add Cocoa, Fla., station,” News Wire, March 13, 2024], it appears that congestion-free regional travel is poised to become a more important component of the Orlando-Miami mix than originally envisioned.

A more immediate wild card continues to be not if, but how many, non-Florida U.S. and international travelers will augment the growth as summer travel months approach. The company has stepped up its efforts to incentivize distribution channels that could help steer increased patronage its way.

However, figuring out when to add coaches to certain round trips is sure to make operations more complicated—but necessary, if Brightline is to accommodate the additional demand its marketing is able to generate. Will six-car trainsets be the answer? If so, which departures? Will amenity offerings change?

The bond memorandum projects that by 2026, Brightline will carry 8 million passengers, generating $695 million in ticket revenue. This is based on a WSP consultant’s study that assumes a 0.8% “real” and approximately 2.0% “nominal” fare growth in 2021 dollars.

This is how that forecast translates on a monthly basis.

Comparing these numbers with what has been achieved in the first five months of operation shows there is a long way to go. Monthly delivery throughout the remainder of 2024 will likely fluctuate as the company tests different capacity and pricing. Trains News Wire will continue to monitor the journey in the months and years ahead.

The obvious solution to limited capacity per train set is to combine two train sets as practiced in Europe and Asia until additional coaches come online from Siemens.

TBH, the 4.9m rider number is probably still a dog that ain’t gonna hunt. While I suspect there is still additional ridership to be found on the existing capacity (e.g. no longer allowing self seat selection in Smart within South Florida might shake out some more capacity), I don’t think there is anywhere near /that/ much. With only 10 cars on order, 4.0m would be a massive stretch. 3.5m feels more realistic (they’re currently on a path to around 2.9m). Given the probable publication date, I have to sincerely ask how their lawyers aren’t screaming at those projections. For reference, adding one car per train with a presumed 64 seats (with 16 round-trips per day) adds 747,520 seats per year, so expecting it to add 500-600k riders/year feels about right (there’s going to be some seat turnover to offset the fact that you’ll almost never get but so close to a 100% load factor). This is somewhat problematic, however, as if you extend that out further, it implies that in order to get to the 4.9m riders you need seven-car trains, not five-car trains. Setting the uncertain timelines on Stuart, Cocoa, and the Sunshine Corridor aside, Brightline’s 2026 projections of 8m riders or so would nominally require 13-car trains under such a model (I presume you’d instead be looking at additional sets of perhaps 10-car trains), and Brightline does not have anywhere near that many cars on order (I believe they have 30 cars on order at the moment, not 90).

Another issue is that they need a few more sets to cover Miami-West Palm Beach with a modest number of dedicated runs at peak times. I know that heavy commuter traffic was not really the original plan, and whenever the Northeast Corridor gets rolling that’ll muck with ridership, but around that time they should have the Tampa segment coming online. By their own numbers, the MIA-WPB segment went into the black last March, but they’ve run away quite a bit of that ridership because of the need for through pax from Orlando to points south of West Palm Beach (Boca-Fort Lauderdale is the “pinch point” in almost every model bringing everything together).

I’ve been fiddling with ridership forecasts on this front for a while, and Brightline’s projected ridership has always been somewhat at odds with their capacity. I forget the exact numbers, but one version of their modeling was projecting something like a 130% load factor Boca-Fort Lauderdale versus stated/expected train capacity. It has been exceedingly obvious that they were going to need more trains to reach their stated ridership numbers for several filings (see the notes above on the capacity needed to achieve 8m riders/yr).

As to trying to run different-length sets, the issue there is that if I had to guess the trains that are running emptier don’t “turn” as one another. Let’s take the last train out of Miami and the last train out of Orlando: The last train out of Miami leaves at 9:45 PM and tends to be a cheap fare (the one before it leaves at 8:50 PM and is sometimes the same price and sometimes a bit more). For tomorrow (Wednesday), they are presently $39 and $44, respectively, MIA-ORL. However, both of those are going to turn off of either the trains arriving at 9:15 PM/8:20 PM or 8:20 PM/7:15 PM, which in turn depart Orlando at either 4:50 PM/5:50 PM or 3:50 PM/4:50 PM. Going the other way, the last train out of Orlando departs at 8:50 PM, meaning it is going to turn off of either the train arriving into Orlando at 8:15 PM or the one arriving at 7:15 PM. Note that the former is a peak rush hour train out of Miami which is basically turning to run as a “cleanup train” in terms of relative loads. By the same token, those early-morning trains into Miami from West Palm Beach are basically positioning moves for peak rush hour runs back north. So it isn’t “that simple” and in all likelihood the juice isn’t worth the squeeze for doing this on a sustained basis.

“However, figuring out when to add coaches to certain round trips is sure to make operations more complicated, but necessary”

To quote the article.

Sure glad Brightline operates from this prospective, unlike disfunctional Amtrak.

Ten sets in service. Ten coaches to delivered this year. The way it was, no guarantee any specific set operates the same schedule every day. The sets needed to be homogeneous so any train can run any schedule any day. I don’t think it likely they would mix six and four car sets. Five car sets this year, six car sets sometime in 2025…unless they kick it up a gear.

All nice charts but are they making any money after expenses, equipment costs, employee costs, new stations, track work, etc

This only shows passenger operations revenue. There are other revenue sources not shown. Ancillary revenue is also expected to grow, especially on the Miami – Orlando route.

This is a long term play, so there are still more revenue sources that haven’t even developed yet, especially on the real estate side.

They desperately need those additional cars in the West Palm – Miami segment. Complaints of sell outs as the trains get closer to Miami Central are becoming more normal. Also, complaints about delays of up to 45m due to the “bridge open” rules at Stuart is causing problems.

On the Orlando destination side, there is more tolerance of the delays, but its the heading back to Miami where a 45m bridge open delay hurts the most, hence the need for another trainset so they can turn it around faster to maintain frequency.

This is puzzling. BL expected how much capacity they would have by this time. How could revenue projections for this year originally be inflated? Could it be BL originally expected the additional cars by this time? So, when are the cars now due to be in revenue service?

This private venture in high-speed travel (American style) is an interesting contrast to Amtrak. How many new Acela trainsets are sitting in yards unused – a sad measure of their competence to purchase and operate new equipment.