MIAMI — After four months of operation between Orlando and Miami, Brightline has dramatically increased patronage and revenue every month, especially for the component it designates as “long distance.” These are passengers who take the train to or from South Florida. A closer look at monthly data shows the company is actively managing the demand-influenced tradeoff between filling seats and raising prices.

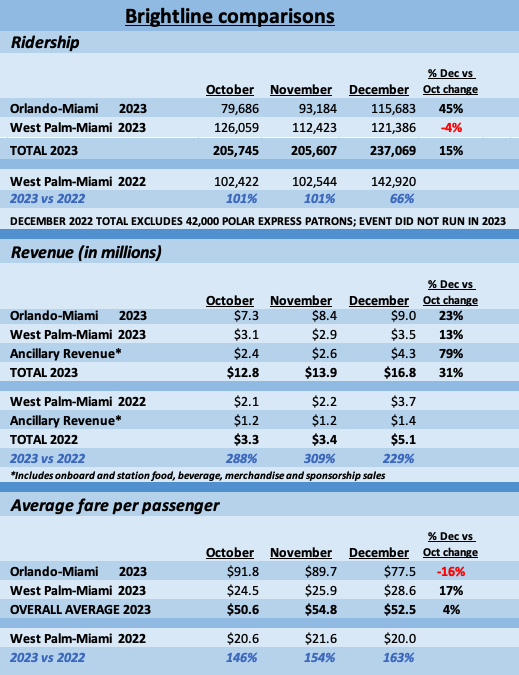

The December 2023 Monthly Revenue and Ridership report issued on behalf of Florida Development Finance Corp., for the benefit of private activity bondholders, shows full-route passenger counts are up 45% from October and monthly ticket revenue increased 23% during the quarter.

For all of 2023, Brightline carried 2,053,893 passengers, generating $87.7 million in revenue, a ridership increase of 67% and revenue jump of 174% from calendar 2022, when the company operated only between West Palm Beach and Miami. Orlando service began Sept. 22, 2023 with six daily round trips and 15 by mid-October [see “Pricing hints at early patterns …,” Trains News Wire, Oct. 18, 2023].

The ridership, revenue, and average fare per passenger tables below, from three months of bondholder reports, reveal trends affecting both Orlando and West Palm Beach-Miami patronage as Brightline ramped up to hourly frequencies. This delivery is compared with the same months in 2022, when only the short-distance trains operated.

With pricing based on demand, each train’s limited capacity of one “Premium” and three “Smart” coaches creates wide fare swings throughout the day, from departures that might be sold out for the southern portion of the route to a bargain $49 fare on a late-night train to Orlando. Nevertheless, the ridership table shows full-route patronage continued to gain acceptance each month. In part, this appears to have been accomplished with fare deals to fill seats during slack travel periods, such as early to mid-December.

Note that the “average fare per passenger” paid by long-distance patrons dipped in that month as Brightline actively sought new customers by offering fare deals. These have continued into January and early February; current promotions include children up to age 12 ride free “on select trains” (indicated by an icon on the website booking page) with a paid adult fare.

A survey of Orlando-Miami advance pricing for the week of Feb. 4 shows Smart fares range from $49 to $184, with Premium at $119-$269 with sporadic sellouts occurring prior to travel days. Passengers attempting to ride the Miami-West Palm segment may find seats “sold out” in either Smart or Premium on departures that are available at higher prices for travelers attempting to book the same train to Orlando.

It is clear that the high-value South Florida-Orlando passengers compete for seats with those traveling south of West Palm, but relative travel demand is likely to vary monthly throughout the year as the mix of customers change. As Brightline moves through the heart of vacation season, this is uncharted territory. But it is also significant that December pricing manipulations resulted in increased revenue and strong ridership in both customer categories.

Another interesting increase occurred in “ancillary revenue,” which includes food and beverage sales and sponsorships. It has nearly tripled with the extension to Orlando and showed especially strong gains in December.

One category from the report that has remained flat is Brightline+ usage, the option to add door-to-door ride share ticketed connections between the train station and origin and destination. It hovered at around 15% in both December 2022 and 2023.

As noted recently by Bloomberg news, Brightline’s December 2023 report is projecting 5.5 million passengers for 2024 compared to the 7 million forecast earlier in the year. The December bond report also explains that the company remarketed $190 million in bonds on Jan. 2, 2024, and plans to refinance $4 billion during this quarter.

Running 16 daily round-trips to Orlando (18 between Miami and West Palm Beach) offers costly convenience if patronage is light at certain times of day. But generating revenue through pricing to match demand is what counts. That’s the challenge Brightline will continue to face throughout the year.

Brightline may require those 5th coaches sooner rather than later at this rate. This also bodes well for Brightline West, with a destination that draws in far more customers in Las Vegas, bundling the train with cruise lines and airlines(that might want to serve Las Vegas but can’t) is also an incentive.

The next big metric for Brightline is how many passengers they can quarry from the European travel bundlers. “All-in-One” Florida vacation packages are very, very popular and Brightline can bury tickets in the package and make coin on the “ancillary” stuff while they ride.

Pre-COVID they had several deals in the works along with the Virgin thing which totally blew up. Unemployment is dropping in the UK currently and that usually portends a healthy travel season in the near future.

From the time service started at the beginning of 2018, through the Covid shutdown and restart they were still refining their product figuring out what gets fannys in seats and ultimately growing the product. Now they have to do that again with a larger set of parameters.