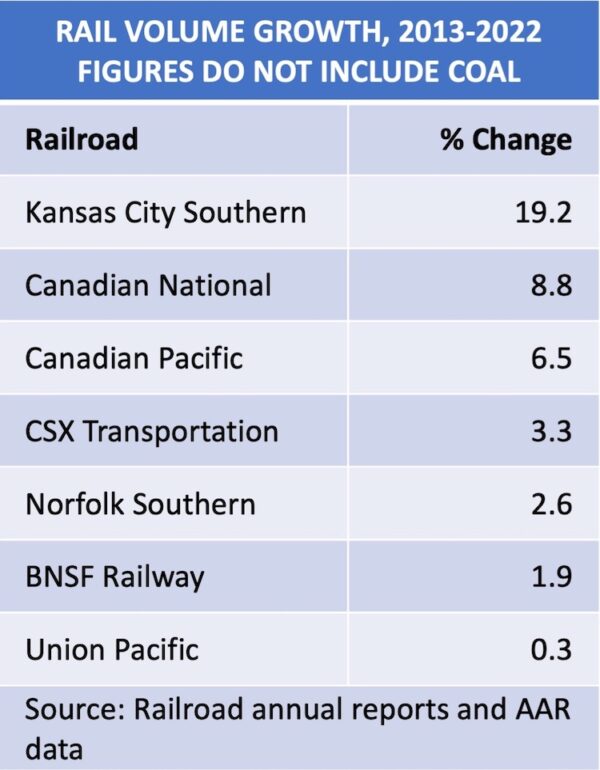

Well, this isn’t a pretty picture. From 2013 to 2022 U.S. industrial production eked out 3% growth, overall economic output increased 57%, and truck tonnage grew 26%. Yet volume on the big four U.S. railroads increased by an average of just 2% for the decade — a figure that mercifully does not include coal traffic.

What this tells you is that railroads are falling farther behind trucks and are becoming uncoupled from the economy. They’re still earning record profits and their physical plants have never been in better shape. But it’s obvious that the Rail Renaissance — when railroads hit the trifecta of growing revenue, profits, and volume — is officially and utterly kaput.

Yes, there are pockets of growth out there. The two big Canadian railways grew by an average of 7.7% thanks to the traffic boom in Western Canada, where the hauls are long and the highways are few. And the late great Kansas City Southern, the smallest Class I, grew 19% over the past decade due to surging cross-border U.S.-Mexico traffic. (Again, these figures exclude coal.)

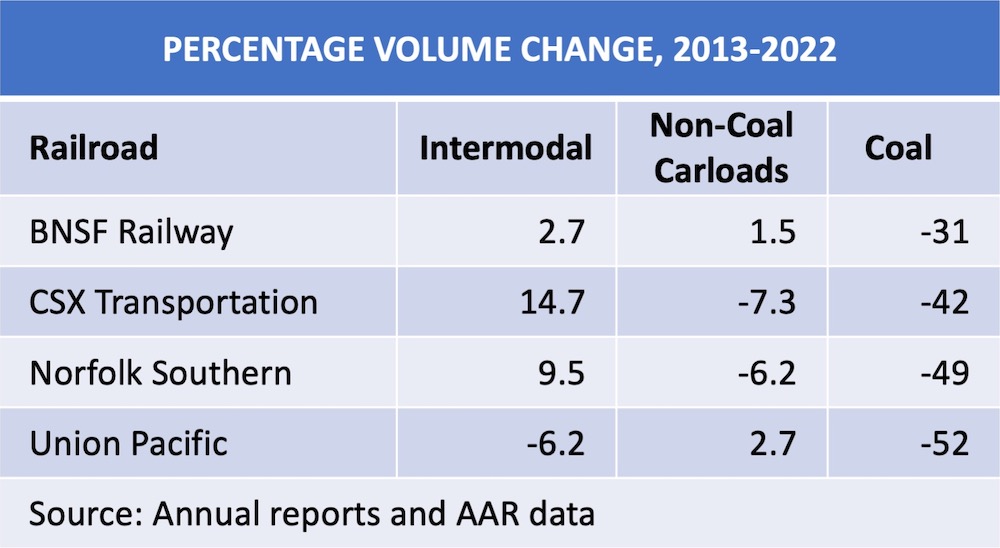

But carload continued its long decline in the Eastern U.S., which dragged down the impact of intermodal gains. In the West, carload grew slightly, while BNSF Railway’s intermodal growth was anemic and Union Pacific somehow managed to lose intermodal business.

Amid this gloom is there a sign of hope, a reason for optimism, something we can cheer? Can the Rail Renaissance be revived?

Maybe. Here are three reasons why it could happen — and three that say it’s not likely.

First, you can chalk up at least some of the dismal volume figures to the wildly successful formula railroads have used to reward their investors: Cut costs, raise rates faster than inflation, turn away less profitable traffic, and buy back gobs of stock to juice earnings per share. Any volume growth, if it came, was simply gravy.

The bounce has gone out of that bungee. There’s only so much cost that railroads can wring out of their operations — and there’s nothing left to squeeze. So the only way to move the earnings needle in a meaningful way is to gain volume. This explains why the Class I railroad CEOs say they’re focused on growth.

Given the paltry volume gains since 2013, you’re right to be skeptical that railroads can put a line in the water and reel in more fish. But the publicly traded U.S. railroads’ management incentive plans are now putting bait on the hook: They’re offering annual bonuses that, for the first time, reward things like on-time performance, carload growth, and customer satisfaction. Incentives matter — and they work.

But these service and growth incentives don’t total more than 20% of executives’ annual bonus packages. It’s a good start, but you wonder whether that’s nearly high enough, given volume trends.

Growth will depend on service. Get service right and everything else — including revenue and profits — should follow. So shouldn’t incentive plans put more weight on providing the service customers want? And why not get the union folks involved, too, and reward them with bonuses tied to on-time performance? Absent sustained reliable and consistent service, the next decade’s volume trends will look like the last. No one wants that.

Second, the new generation of CEOs fully grasp the challenge. Norfolk Southern, CSX Transportation, and Canadian National say they won’t furlough engineers and conductors during downturns so that they can be prepared to capture volume and maintain service levels when traffic comes back. It’s hard to overstate the importance of this change.

Service has been a yo-yo — good for a year or two, then poor for a year or two — because of recurring bouts of crew shortages. Keeping enough people and power on hand to handle traffic surges is crucial if shippers are to gain confidence in rail.

Third, there’s untapped demand for rail service. Entrepreneurial short line railroads have proven that with the right service, shippers will send more volume to the rails. Even short lines in the heart of the Rust Belt have been able to grow significantly.

Plus, there’s more talk about retailers and other big companies wanting to shift freight to rail as a way to reduce greenhouse gas emissions. This is the biggest, broadest growth opportunity the rail industry has seen in decades. But no one in their right mind is going to trade the dependability of trucks for unreliable rail service, no matter how much it reduces emissions.

Which brings us to the reasons to be skeptical.

The first is that railroads keep hoping that external forces — a shortage of truck drivers, worsening highway congestion, high fuel prices, rising inflation, the green movement — will push volume to rail. This is nonsense. Railroads need pull volume off the highway by offering the right combination of price and service that will attract and keep shippers.

The second is that railroads haven’t gone where the freight is. More and more freight moves in smaller volumes over shorter distances. Yet for the most part railroads are sticking to high-volume, long-distance markets.

The third and biggest reason is that railroads have been talking about improving service for decades. It hasn’t happened, which does not inspire confidence.

But give NS, CSX, and UP credit for adding service and growth components to their management incentive plans. In the next few years the volume figures will show whether the new incentives worked as intended.

You can reach Bill Stephens at bybillstephens@gmail.com and follow him on LinkedIn and Twitter @bybillstephens

A dismal decade in which NROI has at least doubled, or more, since 2013. Which is what investors want.

Class 1s understand that retail manifest traffic is irretrievably lost to trucks, because of truck service levels that RRs cannot match.

Short-haul i/m generates no profits.

Therefore, to the low-cost carrier goes the spoils.

Ridiculous! Many short-lines say otherwise.

Get rid of PSR and the worship of Wall st and run more frequent and shorter trains and you just might get traffic back. I know one railroad (yellow paint) that cut back from 5 day service to one day. and they have 2 customers on line of several ,that would ship 100 cars a week.

I have a prescription ready for pick-up. I’m going to suggest the pharmacy cut back from seven days a week to one. Save the pharmacy money which I’m confident they’ll pass on to the customer.

The mega merger movement of three decades ago started the anti-competitive mindset at the surviving carriers. Then, the operating ratio game began, and big rail was heading for trouble in terms of market share and revenue growth. PSR has since brought all kinds of ills with it. Too numerous to mention. End result, the rails have been committing slow suicide since embracing PSR, and will doubtful return to the brief glory days of intermodal and coal transport of two decades ago. The rails are not serving customers the way they used to. So, customers switch to trucks. There are some glimmers of hope in the industry, but not enough.

Where are the MEANINGFUL incentives or mandates to grow the business? The notion that 20% of executive compensation geared on service and growth leave many question. First is much (most?) Of executive compensation is stock grants and options. Is the strike price variable based on meeting the targets? Or is this applied to salary? Do the class 1s clearly define to the public the compensation schemes and targets or are they confidential? Can targets be gamed or reset?

Given that the entire generation of executive management’s grew up in the slash-and-burn environment of the 80s and 90s how can these people unlearn the destructive yet rewarding behaviors that made them centimillionares? Why would they even try? The new up-and-coming generation of golden boys and girls have cut their teeth in the PSR world where asset stripping became an art form.

Lastly, the STB and Congress have allowed the industry free rein for 40 years now. Deregulation has created this mess and the huge under investment of what ultimately is a public good. Can we expect change from Amtrak Joe or Mayo Pete and Congress? Of course not; you only need to look at the Rail Safety Act that had a promising start, but had the most significant components (train length at DOT-111 ban after 2025) stripped out. It is hopeium to think nthat railroads will be compelled to honor their common carrier obligations by their self-dealing executives or corrupt government.

Almost all of this can be expressed in: “You can’t save yourself into prosperity.” That has been the mantra of the mainlinerailroads for 100 years. The worst shame is BNSF, with a patient owner who wants you to manage for 100 years. But they seem to all draw from the same pool of management morons.

Michael, perhaps you can explain your comments about BNSF. So far in this century they have completed double tracking the entire 2,000-mile LA to Chicago main line. We only dreamed of doing that when I worked for Santa Fe.

They just reacquired the Motana Rail Link mainline for a nice chunk of change and their plans for Barstow are nothing short of spectacular. They did a deal with CSXT for North Baltimore which is a VERY creative way of opening up the Chicago terminal. Seems like a bold, aggressive and very smart management team to me.

One of the things I heard Mike Haverty say at my very first IBU staff meeting after I started there in 1990 was “you can’t starve a railroad into prosperity”. I would say his legacy speaks for itself.

Well so far, a lot of silliness. First please try and remember that about 70 percent of what comes in the Ports of long Beach and Los Angeles stays somewhere within the state of California. Not really a rail market for now although the Barstow Inland Port Project may help.

Second, JB Hunt is the largest intermodal carrier in North America a fact which Mr. Stephens almost always seems to overlook. JBH is twice the size of intermodal carrier #2, the Hub Group. And now they own the largest fleet of refrigerated intermodal containers. It is difficult for BNSF to grow market share when they already have almost all of the market to begin with. But I think there are still substantial overlooked opportunities in the Columbia River Valley.

One of the biggest untapped long-haul markets is the border crossing at Otay Mesa. All truck because no rail intermodal line or terminal capacity in San Diego. Closest rail terminal is San Bernardino. I have personal experience with Santa Fe on this one.

UPRR has a natural monopoly at El Paso which is the second largest crossing on the southern border. Where is that volume at Mr. Fritz???

Now for all you dumb railroaders out there (including Mr. Stephens) the sweet spot for the truck industry is the 400 – 600-mile range. Trying to compete with them here would be a commercial version of Pickett’s Charge at Gettysburg.

The one bright spot here is the short-haul inland port business which was put together by the port authorities. Double stack can make short-haul profitable with double stack using private containers with zero per diem cost.

And here one more thing, leave the street fighting to the truckers who know what they are doing. The dumbest trucker is still 25 times smarter that the smartest railroader. The one thing that will save the dumb railroaders is the smart truckers. If UPRR can get rid of Lance the Loser and go hire someone with at least half a brain, and then have him or her listen to your trucking customers, there may yet be hope for the railroad industry. That’s what my boss Mike did with J.B. and they made an incredible amount of history together.

Remember, truckers operate in a world of 100 percent open access. No government sanctioned oligopolies or monopolies in the trucking industry.

It is fine to hold an opposing view point, but I see no reason at all for personal attacks. Mr. Stephens is “dumb?”

Also, you seem to overlook the fact that truckers operate on 100% government-funded rights-of-way.

Thank you, Laurence, for your delightfully absurd response. Please allow me the courtesy of presenting some facts not in evidence so far.

First, in exchange for government financing (not funding) of the ROW the truckers are blessed with something called 100% OPEN ACCESS. As I recall the railroaders are a bunch of crybabies when it comes to any kind of improve completive access much less true open access.

Second if you did your homework or were a true transportation professional with 50 years’ experience like I am, you would know that the federal funding formula was changes by the Reagan Administration in the early 80’s and now truckers pay or cover about 90 percent of their highway funding responsibility.

Very good article but none of it should be a surprise to anyone who has been keeping up with the rail industry for the past 50 years. Starting with deregulation, which the railroads could have used for growth. Instead they cut ties with thousands of their least profitable customers by pulling spurs and abandoning thousands of miles of track. And every year there was another new batch of marginal customers to cut. Then year after year they turned possible new business away that didn’t meet their profit goals. And on and on year after year it goes. Trying and mostly succeeding to cut their way to ever higher profit margins at the expense of an ever growing list of customers. Then mix in a few economic downturns and several bouts of mostly self induced labor unrest. It’s almost a miracle that railroads here in the U.S. have as much business as they still do. One can stand along most mainlines in this country and go hours and hours without seeing a train. But go out on any highway and you’ll be confronted with ever growing numbers of trucks, many carrying intermodal containers. And all across America companies are building factories and warehouses by the thousands far from any railway. My dad worked 40 years on the railroad and my grandson hopes to one day, I hope he gets a chance. But unless the class one railroads decide to get serious with BIG changes in their LONG term attitudes towards REAL growth at ALL cost then the traffic decline will continue at an ever increasing pace until there’s nothing left to move by rail.

Part of the problem was the quest for the lowest operating ratio. One of the factors listed above was “turn away less profitable traffic, ” It doesn’t say UNprofitable traffic; it says LESS profitable traffic. The RR overcharged for service, or downfraded it, or both, and the shipper found another way to move the material. Not railroad: the Class 1’s basically each have a rail monopoly.

Will the shippers come back? Will they trust the RR’s not to leave them hanging again is the real question.

Think about this? Of the 10million containers that come into Los Angeles each year from the ships. Only 26% gets moved by rail. Customers vote with their feet

Well written Bill, however I’m not so sure I can agree with the statement “thanks to the traffic boom in Western Canada, where the hauls are long and the highways are few”.

I believe the major increase in traffic here can be contributed to intermodal from the two main ports, export coal and grain, lumber and oil.

Prince Rupert especially has grown as a major west coast port diverting sea can traffic from the US due to its shorter sailing distance to Asia.

Sure, ditch PSR and focus on growth rather than cutting operating ratio to the bone.