WASHINGTON – Canadian Pacific and Kansas City Southern executives say there’s plenty of capacity in Houston to handle the eight additional trains per day they’ll run through the busy terminal within three years after their merger.

But Union Pacific and BNSF Railway told federal regulators, in testimony Thursday and Friday, that they have grave concerns that the unprecedented rise in through-train traffic would plunge Houston into gridlock, as it did following UP’s 1996 acquisition of Southern Pacific. The Houston meltdown spread across the UP system and affected the entire rail network.

“The Houston history is well known to this board. And it’s with this history, and a healthy respect for the historical operation implications, that we should view the step-function change in merger-related volume,” says John Turner, UP’s senior vice president of the Harriman Dispatch Center and network planning. “Failing to adequately prepare and plan and acknowledge these risks dooms us to repeat history.”

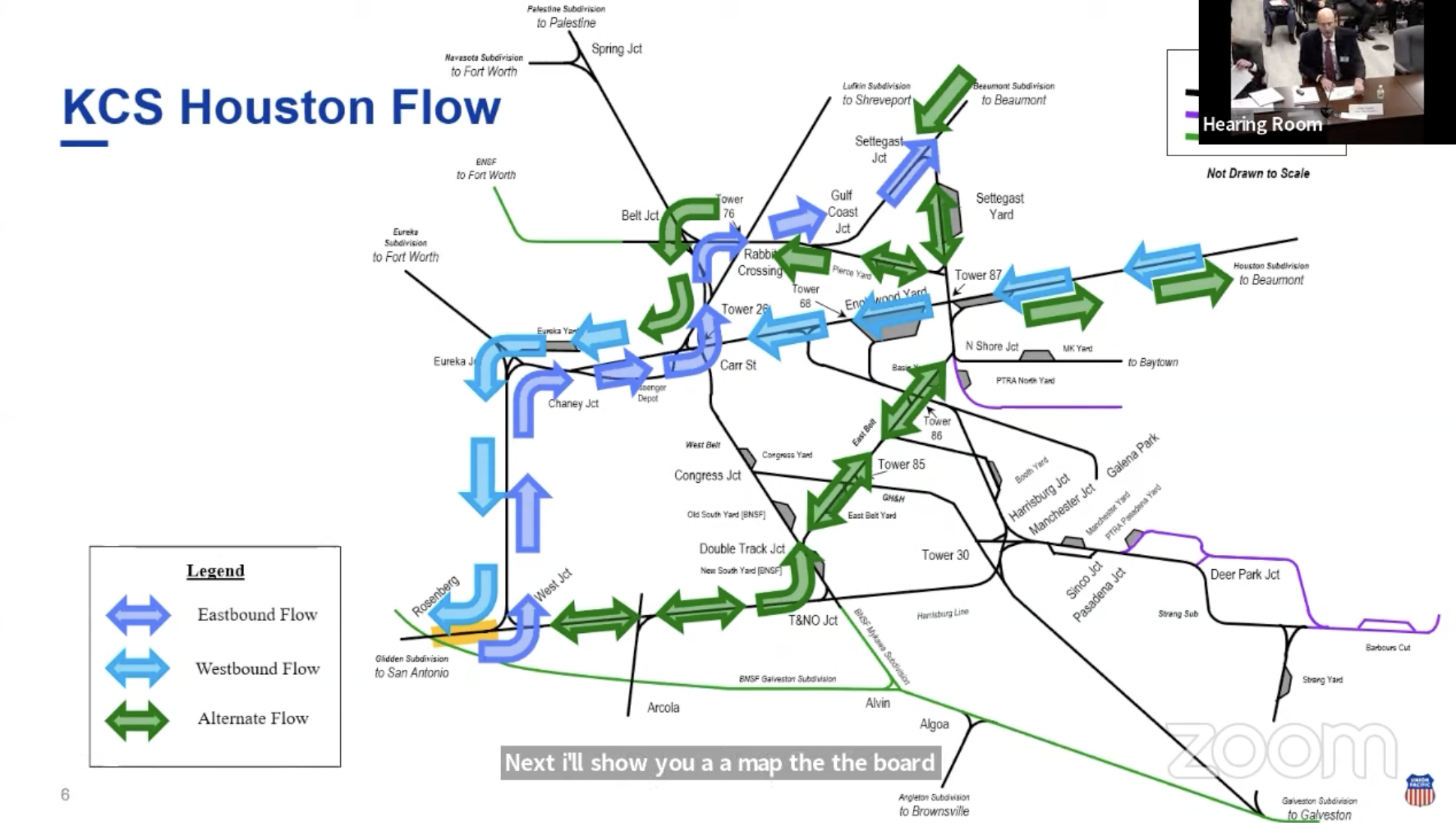

BNSF and UP officials criticized CP and KCS for not identifying necessary capacity projects in Houston and the Gulf Coast, even though the railroads plan to add and extend passing sidings on their lines between Beaumont and the Midwest. KCS currently runs 10 to 11 trains per day through Houston.

“I find it a little ironic that, in the detailed operating plan required all over the CPKC joint railroad, that they needed to add capacity on those lines but yet there’s an assertion that there would be no additional capacity required on the trackage-rights lines,” Turner says.

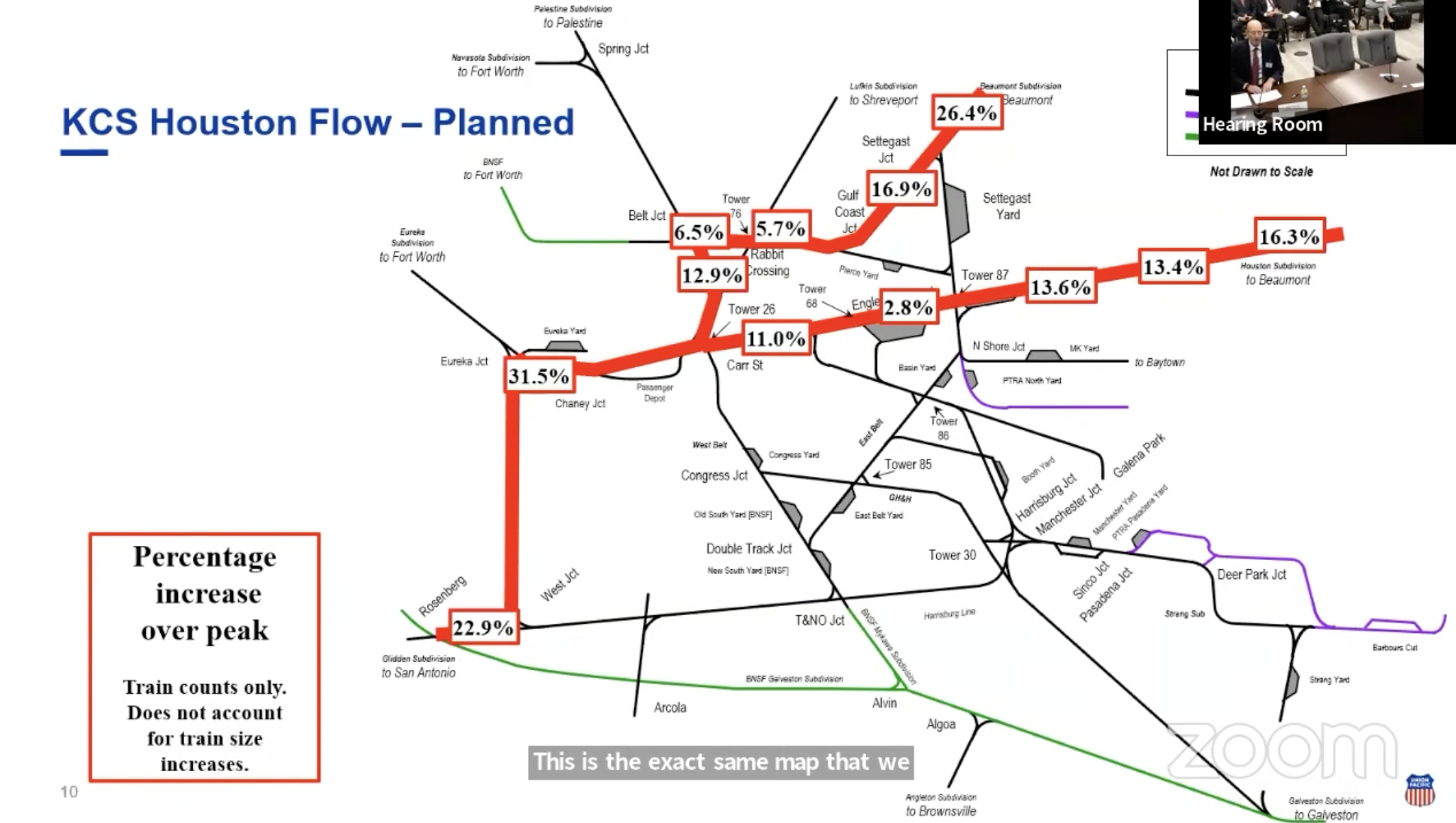

BNSF and UP officials said CP and KCS took a simplistic view of the Houston terminal by contending that overall volume through Houston would remain below peak levels of 2016 despite eight additional CPKC trains.

One of the flaws in that analysis, Turner says, is that the data used encompasses all of Houston, an unusual terminal chock-full of yard and local jobs that serve 900 customers. Much of the traffic remains within Houston as locals shuttle cars from plant to plant and yard to yard. UP and BNSF originate and terminate trains in Houston, but KCS is the only railroad to operate a significant number of trains all the way through the terminal that contains 15 yards.

On the trackage-rights routes KCS uses to traverse Houston, the projected volume increases would boost daily train counts by anywhere from 6% to 32% above peak levels for eastbound traffic and 3% to 32% for westbound trains, Turner says.

That would create congestion on Houston’s spiderweb of rail lines and junctions, Turner says. CPKC trains of up to 10,000 feet would block several key interlockings simultaneously as they thread their way through Houston, he says.

UP and BNSF also raised concerns about potential bottlenecks elsewhere in Texas, including on UP’s Brownsville Subdivision and around the Neches River bridge in Beaumont.

CP and KCS have not approached UP or BNSF about studying capacity needs, identifying capacity expansion projects, or funding them, UP and BNSF say. That’s a problem, Turner says, because CPKC envision adding traffic within three years after the merger when it can take five to seven years to plan and complete capacity projects in Houston.

BNSF and UP asked the STB to condition approval of the merger on CPKC holding off on traffic increases until capacity projects are identified, funded by CPKC, and completed.

Jon Gabriel, BNSF’s vice president of service design and performance, told the STB that it would take as little as three to six months to complete a traffic study.

STB members questioned how such a condition would be practical, given that CP and KCS wouldn’t know the extent of capacity projects or their cost. But UP lawyer Michael Rosenthal said that was a problem CP and KCS created by not addressing the issue in their merger application.

Board member Karen Hedlund said she was worried the capacity study process could drag on for years given the ongoing dispute between Amtrak and host railroads CSX Transportation and Norfolk Southern on the proposed launch of Gulf Coast passenger service.

CP and KCS have said they have every incentive to ensure that the Houston terminal remains fluid because their ability to capture traffic currently handled by UP and BNSF hinges on providing consistent and reliable service.

Laredo Gateway Issues

BNSF and UP also said they CPKC would have every incentive to choke off their interchange traffic at the Laredo gateway, the busiest border crossing to Mexico, in favor of their own new single-line routes to Chicago and Canada. So they asked the board to establish a rate division mechanism that would be an effective way to enforce CP and KCS promises to keep all gateways open on commercially reasonable terms.

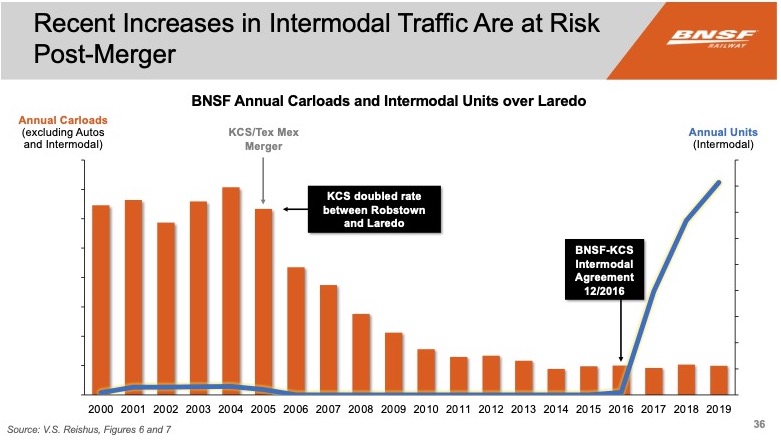

UP and BNSF say KCS made a similar open-gateway promise when it acquired short line Texas-Mexican Railway, which runs from Laredo to Robstown, Texas, and is a key part of the KCS international corridor across the Lone Star state.

BNSF claims that KCS has used its control over pricing of cross-border movements to freeze BNSF out of the market for carload traffic, citing the precipitous decline of its interchange with KCS for Mexico traffic after it acquired full control of the Tex-Mex. BNSF says KCS doubled rates from Robstown to Laredo.

But CP and KCS have said that BNSF shifted its business to the Eagle Pass gateway, where it interchanges with Ferromex.

“This is not true,” says Paul Hirsch, assistant vice president of BNSF’s Mexico business unit. “BNSF was foreclosed from business at Laredo, and lost business and never recovered it. BNSF built new business with new customers and destinations from Eagle Pass. Laredo and Eagle Pass serve different markets and can’t substitute for each other.”

Now BNSF fears CPKC would similarly choke off its fast-growing intermodal and automotive traffic that currently moves under a 2016 agreement with KCS.

Board members raised several questions in separate and extended exchanges with both BNSF and UP representatives.

Among the issues: BNSF was asking the STB to establish a cross-border rate mechanism that included intermodal shipments, which are exempt from board review. BNSF, board member Patrick Fuchs notes, has consistently said intermodal should remain exempt from regulation because intermodal faces strong competition from trucks and other railroads.

STB Chairman Martin J. Oberman said BNSF’s request seemed reactive because the merger proceedings allow the railroad to request “goodies” that it had not sought despite losing cross-border carload traffic to KCS since 2005. No rate challenges have been filed regarding cross-border traffic, he noted.

BNSF attorney Peter Denton said he strongly disagreed, noting that mergers change the competitive landscape forever and that the railroad was simply seeking the ability to compete on a level playing field.

BNSF and UP also noted that several major shipping groups support their proposal for a proportional rate mechanism that would allow customers to ask for interchange rates covering moves on both sides of the border.

The board has also detailed its schedule for the remainder of the hearings. Monday’s session will run from 1:30 p.m. to 6 p.m. ET, with Tuesday from 9:30 a.m. ET to no later than 1 p.m. to address any remaining witnesses. The CP-KCS closing arguments will begin at 10:30 a.m. ET on Thursday.

This literally hits close to home. The old Houston Belt & Terminal is really needed to help resolve the rail traffic issue with a proposed CPKS merger.

Meanwhile, poor Union Pacific is rudely being sued by the City of Houston for the underground storage of creosote by one of its predecessor Southern Pacific allegedly causing an epidemic of cancer to nearby residents on the North side in 5th Ward.

Having studied this for the better part of a decade I have a suggestion that will be expensive, controversial, politically impossible and most likely DOA: There is a utility easement running north from Eureka Jct. to Waltrip High School, some 2.5 miles. Making this a shared use corridor with the powerlines redesigned to accommodate two tracks running beneath them would make a “belt line” that avoids all the major yards. Of course, due to the sprawl that is Houston everyone and their mother will scream to high heaven about having a railroad running next to their house, park, landfill, etc. The school will have to relocated. This would involve all railroads involved. Yes, it’s an expensive and uncomfortable solution but at this point any answer is difficult to say the least.

Houston Terminal does need to be cleaned up, no arguments here. But if I was running CPKC, I would not show my hand on shared rail assets until the merger is approved. THEN I would sit down with UP and work on a deal or see what the STB demands instead.

CPKC is just being shrewd negotiators. No sense offering up money until they are absolutely required too. In a sense they are forcing UP to fess up to their own limitations in the Houston Terminal in front of the STB. If UP says its a PITA, then tell the STB about it, not us.

As for BNSF moaning about the Laredo Gateway, hey, cry me a river. You got beat and you don’t like it. Fine. No problem. Open that other piggy bank and get a Mexican operating franchise and go nuts. And I actually *like* BNSF, but don’t go to the STB with your hat in your hand just because someone else took the risk and you didn’t.

Right you are, Jack. I have maintained that since they first proposed it. There was NO NEED for a merger since they met end to end and could cooperate. But, the real kicker is no executives would get big bonuses for a merger. Uh huh, its a “gimmie my money game”.

Merger or not, CP and KCS could offer “joint” service between the Midwest and Mexico. End-to-end connection at Kansas City.

Asuggested test: suppose CP and KCS did start acting “jointly”, in ways that doesn’t violate the voting trust. Would we then not get an idea of the suggested traffic increase thru Houston?

I tend to agree with Mark Meyer here, they’re all looking for a handout or some competitive edge at the others’ expense. And they’re all hypocrites regarding merger conditions and what they ask for. It’s okay for UP to meltdown the Houston terminal with a huge merger but claim a rather minor merger comparatively will somehow do the same? Highly doubt it, esp since merger traffic claims rarely play out as initially stated. And that’s the biggest thing here you folks seem to be missing: Does anyone really believe they’ll actually be an additional 8 trains a day growth within 3 years? They’ll be some growth, but CPKC routing from MX to the midwest is pretty rotten compared to the competition, and we all know railroads hate to discount rates THAT much to steal traffic. If we check back on this in 3 years I’d be surprised if the number is greater than 4…

Injuns

Even though Mr. Landey rates Mr. McFarlane’s comments “10.00 out of ten,” I’d rate it more like zero.

Mr. McFarlane’s comments are patently ridiculous. This is not “future growth” on BNSF and UP, and therefore it is illogical to criticize them for not planning for it. How could UP anticipate that one of the tenant’s railroads would have an upswing in traffic while at the same time refusing to fund any upgrades? And even though Mr. McFarlane chastises UP for not being clairvoyant about the CP-KCS merger and its potential effects, you know one entity who doesn’t think there is anything wrong with the current UP infrastructure KCS uses through Houston? That’s right: CPKC. While acknowledging that they (CPKC) need to upgrade THEIR railroad, CPKC is quoted in the article as saying there’s “plenty of capacity in Houston” to handle additional trains. So, Mr. McFarlane: You’re obviously showing your bias in favor of CPKC, but which is it? Is CPKC at fault for not proactively upgrading their portion of the railroad already (like you expect UP to have done), or is CPKC just trying to cover their butt and deflect the reality that they’ve not consulted UP about how the extra traffic would affect the Houston terminal? What is truly hypocritical on the part of CP(KC) is that when a tenant on THEIR railroad wanted to add service (Amtrak from Chicago to St. Paul), they demanded funding for upgrades to the tune of $53 million to accommodate one train per day each way. But 8 freight trains per day through one of the busiest terminals in the country? Nope, we’re good. Rather, UP is good, and we don’t need to put up any money.

The obvious reason that UP is correct and CPKC is dead wrong referencing the Houston terminal capacity discussion is that part of the traffic CPKC is hoping to snag is some of that currently being handled by BNSF and UP between Mexico, the Upper Midwest, and Canada because CPKC can offer “single line” service. Very little of this traffic handled now by BNSF and UP needs to traverse the Houston terminal and therefore such traffic could not be a consideration for either railroad in determining Houston terminal capacity. Changing the routing to a proposed CPKC is not only artificial – it is illogical because both BNSF and UP have vastly more efficient routes to move the traffic, despite their needing to interchange with another carrier (as will CPKC in many instances because there are oh so many places where CPKC doesn’t serve). “Single Line” service might sound good, but it’s unlikely to sway too much traffic when the “Single Line” route is much longer in distance and running time, has a vastly inferior operating profile to the competition, and lacks alternate routes and better interchange locations which the competition enjoys.

That’s why I find this whole thing pretty entertaining. It appears CPKC is painting themselves into a corner. On the one hand, they tout all the new traffic they will gain and how they’re planning to upgrade their routes north of Kansas City to accommodate it, and on the other downplay its effect on one of the busiest and most historically-congested terminals in country. And by not “paying to play” in the Houston terminal, they’re pretty much setting themselves up for no one paying attention to their whine if their trains really are severely delayed getting through Houston because: Hey, you said at hearings that everything was fine there!

In the end, this will be much ado about nothing, regardless of how the STB rules. If the board rejects the merger, that’s it until next time. If it’s approved, it’s very likely that the additional traffic CPKC claims will materialize will not simply because it is illogical that it would. There are simply too many barriers for such an inferior route to garner this traffic.

The Houston melt-down was entirely the fault of UP management. When they purchased SP, UP knew how to run SP’s railroad. Or so they thought.

Ditto when they swallowed CNW. That only led to fancy slogans on their locos and rolling stock.

Sour grapes.

Houston was a problem is Espee days. It was a (huge) problem after the Uncle Pete assimilation. It is a problem now. Guess what? It will continue to be a problem with or without CP[KC].

The issue is competition. The CP-KCS merger represents a threat to the nice duopoly that UP and BNSF have enjoyed for more than two decades in Texas, a Canada-size economy that is expected to continue posting strong growth. UP has more to lose with surging traffic to and from Mexico, while BNSF, a minor player, seems to be trying to benefit however it can by obtaining “goodies,” as Mr. Oberman suggests. If anything, this is an opportunity for the STB to thoroughly review the competitive landscape along the chemical coast where UP dominates.

1. No where did anyone say what percent increase in KCS traffic 8 additional trains would be.

2. UP and BNSF claimed that 10,000 foot long trains would clog the network. Isn’t KCS running trains that long now?

3. I thought well designed yards had provisions for through tracks for trains not stopping in or originating from the yards.

They want “a level playing field?” Since when do large businesses give a competitor a break? Time to get real guys and gals – just accept it, adapt and move on.

From what I’ve read, it is definitely obvious that lack of planning and investment over the years is all the complaining RR’s are bring to the table. As well as Mr. Oberman pointed out the other day to CN, you could have done something in years gone by but chose not to.

This is what happens when the railroads don’t fix their own problems…try and get someone else to pay for it. Both BNSF and UP could’ve planned for future growth by doing these capacity expansions themselves, but chose not to, and now that CPKC is on the horizon, they want them to pay for it. I say screw UP and BNSF, approve CPKS as is and let the two pay out of their own pockets for something that should’ve been done years ago.

GERALD — Your post (above) is 10.00 on a scale of ten. This needed to be said. You said it.

What is the answer to railroad capacity issues?

More trucks on the Interstate.

If Houston is a problem, then fix it.