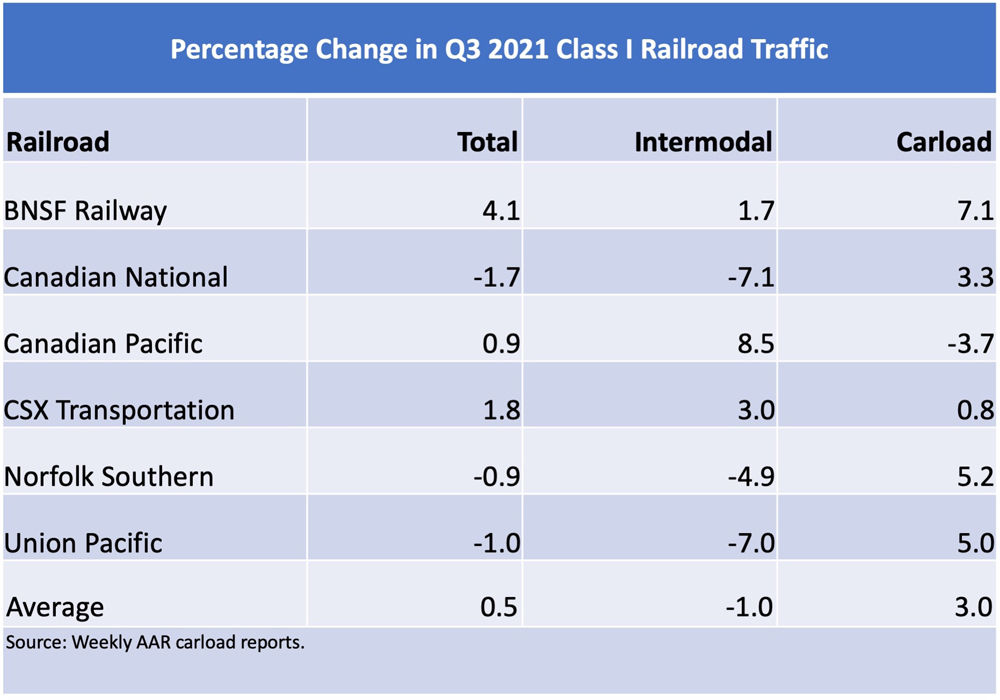

Traffic on the big six Class I railroads was a mixed bag in the third quarter, as three systems saw gains versus a year ago and three experienced volume declines.

For the third quarter, which ended Sept. 30, total volume on the big six systems was up an average of 0.5%, according to a Trains News Wire review of their weekly carload reports.

BNSF Railway outperformed the rest of the industry with 4.1% traffic growth in the quarter, led by 7.1% growth in its carload traffic thanks to strong gains in coal and chemicals.

Canadian National lagged the pack, with traffic declining 1.7% overall as intermodal tumbled 7.1%. Rival Canadian Pacific saw its traffic increase nearly 1% as its intermodal volume grew 8.5%.

In the East, CSX Transportation’s volume was up across the board, producing an overall gain of 1.8% Norfolk Southern’s carload volume spiked 5.2% for the quarter, but intermodal sank 4.9% to drive a nearly 1% decline in overall traffic.

Union Pacific’s carload volume was up 5%, which was more than offset by a 7% decline in intermodal. Overall, its traffic was down 1% for the quarter.

Common threads among the big six systems: Coal volume was up as natural gas prices rose, and automotive traffic tumbled thanks to the ongoing computer chip shortage that has forced automakers to curb production.

The publicly traded Class I railroads will report their quarterly earnings this month. CN and Kansas City Southern will release their financial results on Oct. 19, followed by CP and CSX on Oct. 20. Union Pacific’s quarterly numbers come out on Oct. 21, and NS closes out the earnings reports on Oct. 27.

BNSF, a unit of Berkshire Hathaway, is expected to report its quarterly results alongside its corporate parent in November.

— Updated at 11 a.m. CDT to add table

Interesting to see how carload has jumped in the past few months. Both CSX and NS have been doing their own big carload initiatives recently, and there is no doubt in my mind they are a big contributing factor.

Volumes here are compared to 2020 when the world was more affected by the pandemic, with many factories just recovering from lockdowns. A better comparison would be to compare 2021 volumes against 2019 (a normal business year).

Cogent observation. We need to see these stats over several years to know the bigger trends. Yes, it would be a research project.

ROBERT RAY — Absolutely correct! Anything that’s alive is an improvement over the year 2020. My overfed cat Burlington moves more than he did in 2020. Gains over 2020 mean little. Small gains over 2020, single-digit percent gains, mean zilch.

To be fair, though, rail is a victim of other industries – like the collapse of automotive due to the chip shortage, and the difficulty of railroads handling containers given the dysfunctional connections, sea and highway, at each end of the rail segment.

BNSF superior results have to be at least partly reflective of the move to combine trains — see Stephens’ “Going Long,” page 34, Nov 2021 Trains mag.

How does combining trains increase volume? It (hopefully) saves crew costs but has nothing to do with volume.

Nice article could you do a chart like in “Progressive Railroading” would show information better to compare it.