It’s hard to say when a trend becomes a trend. But yesterday’s announcement that Canadian National will acquire the 253-mile Iowa Northern Railway suggests that short lines and regionals getting gobbled up by Class I railroads is now a thing.

Since 2020, Class I railroads have reached a half-dozen deals with short lines and regional railroads. There’s not necessarily a common thread among transactions that include:

- Canadian Pacific + Central Maine & Quebec, 2020

- CSX + Pan Am Railways, 2022

- BNSF Railway + Montana Rail Link, effective Jan. 1, 2024

- Canadian Pacific Kansas City and CSX + Meridian & Bigbee, expected 2024

- CN takes stake in Cape Breton & Central Nova Scotia Railway, 2023

- CN + Iowa Northern, expected 2024

Two of those deals — the CMQ and MRL — were made to correct spinoff mistakes the Class I lines made long ago.

CP jettisoned its trackage east of Montreal in the mid 1990s, including its line to Saint John, New Brunswick. After a succession of shortline operators, the route ultimately became the CMQ, with a main line stretching 262.7 miles from Montreal to Brownville Junction, Maine. From Brownville Junction to Saint John, the 185.9-mile former CP line is operated by J.D. Irving short lines New Brunswick Southern and Eastern Maine Railways.

CP paid $130 million to reacquire the CMQ portion of its historic shortcut to Saint John and then invested $90 million to raise track speeds to 40 mph from 25. Cutting out the CMQ middleman, combined with a haulage agreement with the Irving short lines, enabled CP to attract shipping lines to an expanding container port at Saint John.

CP’s plans to gain transatlantic international intermodal business from Port Saint John have come to fruition. New finished vehicle traffic for the Atlantic Canada market sold out soon after launch. And growth in carload traffic, from propane to lumber, topped the railway’s forecasts. Overall, CMQ traffic volume has ramped up 50% more than what CP was predicting.

If anything, the CMQ deal proved that a motivated Class I can buy a short line as a through route and still pay attention to local traffic.

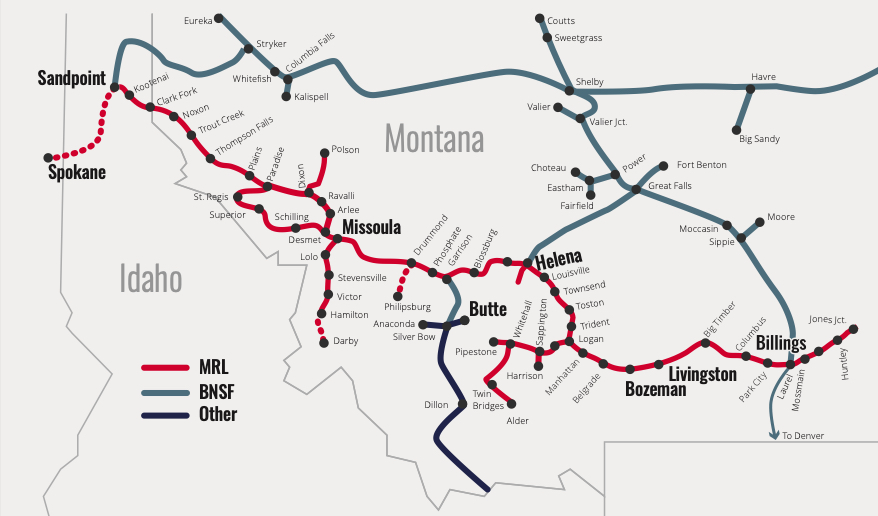

BNSF’s $2 billion Montana Rail Link deal is definitely not about local traffic. It’s slim pickings on MRL. Instead, BNSF bought out the remaining years of the 60-year lease of the former Northern Pacific main line in order to gain more capacity and operational flexibility on its routes to the Pacific Northwest.

BNSF came to view Burlington Northern’s 1987 decision to spin off the NP main between Jones Junction, Mont., and Sandpoint, Idaho, as a costly and shortsighted blunder.

BNSF always used the 590-mile MRL as a through route. But because of the way the lease was structured – with volume guarantees for MRL – the regional had little incentive to lay new track or hire more train crews to support BNSF volume growth and seasonal traffic surges. By bringing MRL back into the fold, BNSF will be able to control its own destiny, make better use of its former Great Northern and Northern Pacific main lines across Montana, and take full advantage of capacity improvements made both east and west of the MRL.

It’s hard to pigeonhole CSX’s $600 million acquisition of New England regional Pan Am Railways. You could call it a rescue. Trackage that Pan Am owned was a shambles thanks to years (decades?) of deferred maintenance as two of the railroad’s mainstays — the Maine paper and forest products industry and coal traffic bound for power plants in New Hampshire and Massachusetts — declined or dried up.

Now with CSX investing $107 million to bring Pan Am’s 10-mph main lines up to 25 mph and 40 mph, and to rebuild its decrepit yard trackage, there’s hope that the physical plant improvements will lead to more reliable service and traffic growth. Getting Pan Am’s train crew staffing back to full strength won’t hurt, either. And single-line service is always a plus.

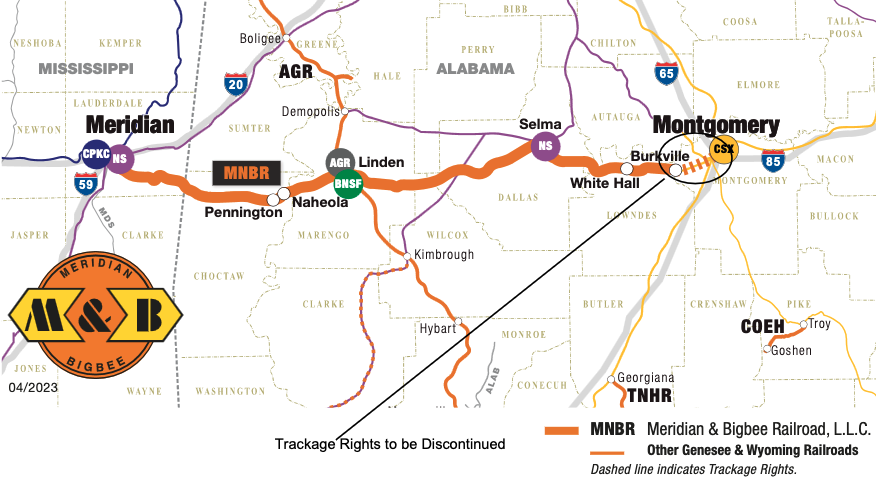

Down South, CSX and Canadian Pacific Kansas City plan to acquire Genesee & Wyoming short line Meridian & Bigbee. The short line’s 168-mile route is the missing link between the CPKC system at Meridian, Miss., and the CSX network at Burkeville, Ala., just west of Montgomery, Ala.

By acquiring and operating the trackage, CPKC and CSX will create a new through route for intermodal, automotive, and forest products moving between the Southeast and Texas and Mexico. Yet local traffic won’t be ignored: Meridian & Bigbee will continue to provide local service on the 50.4 miles of trackage that CPKC will acquire between Meridian and the new interchange at Myrtlewood, Ala.

CN was thinking long term when in November it announced it was taking a stake in G&W’s 145-mile Cape Breton & Central Nova Scotia Railway. CN now manages interline shipments, while G&W continues to provide local service. Ultimately CN sees the potential for carload commodity export opportunities down the road.

CN’s acquisition of Wisconsin Central in 2001 was an absolute home run from a network strategy perspective. When paired with the former Duluth, Winnipeg & Pacific the WC formed the U.S. backbone of CN’s own Winnipeg-Chicago main line. But shippers on WC branch lines say the deal was a disaster due to the Class I’s inflexible service and lack of focus on local customers, which drove away business. It took CN two decades to dispose of the branch lines it never wanted in the first place. In one of the few Class I spinoffs in recent years, Watco in 2022 took over 328.52 miles of former WC track in Wisconsin and 142.6 miles on Michigan’s Upper Peninsula.

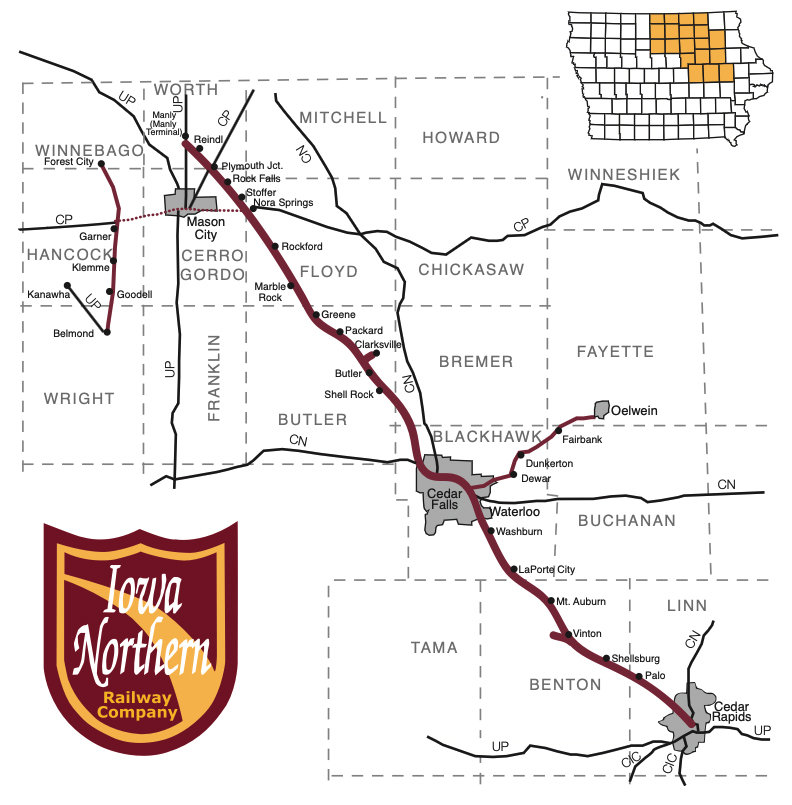

Which brings us back to the Iowa Northern. The railroad is one of those short line rags-to-riches stories. The railroad was founded in 1984 to operate the former Chicago, Rock Island & Pacific trackage. The current ownership group, headed by second-generation railroader Dan Sabin, took over in 1994, when the Iowa Northern handled 15,000 cars per year on rickety 10-mph track.

Today the Iowa Northern handles more than 60,000 cars a year and the railroad has invested millions of dollars to bring the track into a state of good repair. Customers include 20 grain elevators, two ethanol plants, two mineral processing facilities, and shippers and receivers of fertilizer, farm machinery, food, chemicals, and lumber. Iowa Northern is the serving carrier to Manly Terminal, a liquids storage and transloading facility that serves biofuel production industries handling fuels, chemicals, and co-products. More growth will come from the boom in biodiesel production.

CN says the short line’s customers will benefit from single-line service to points on its 19,200-mile network, as well as retain their options to connect with Union Pacific, CPKC, and Cedar Rapids & Iowa City. “We are confident that, as part of CN, IANR will be able to continue to provide reliable first and last mile service to our local customers while providing them access to a much broader network and market,” Sabin said in a statement.

Details haven’t been released, but that sounds like the best of both worlds: Iowa Northern customers can take advantage of single-line service via CN while still receiving the frequent and flexible service that short lines are known for. With Iowa Northern, CN seems intent on not repeating the mistakes it made with the local traffic that WC spent years cultivating.

The Staggers Act of 1980, which made it easier for Class I’s to spin off trackage, led to a golden age for short line and regional railroads. The most successful of today’s 600 or so short lines have revived forlorn branches, reversed their fortunes, and become key contributors to the carload network.

Now the pendulum seems to have swung in the other direction, with Class I railroads snapping up short lines and regionals. But in a trend within a trend, Class I lines are leaving short lines in charge of local service on acquired lines where it makes sense to do so. It should be a formula for growth.

You can reach Bill Stephens at bybillstephens@gmail.com and follow him on LinkedIn and X @bybillstephens

Trains Iowa map for reference: https://www.trains.com/wp-content/uploads/2020/10/iowa-abandonment-map.pdf

The new owners will soon do away with the “local control ” of switching as they will consider it to costly. Big railroads have a history in buy outs of cutting “to much service” on the prior independents. Anyone want to bet against that?

YES, they will cede the switching to the subsidiary so that they can get around the open switching actions being pursued by the STB for all the shippers trying to get things their own way. The Class Ones will put the pressure on the former short lines to keep the customers happy or changes will be made!!

Problem solved…

CP-IAIS makes sense. It is a long slow trip from NS or CSX to Bensenville, They could probably get to Davenport on IAIS faster than getting to Bensenville.

CN-IANR parallel for nearly all the length of IANR and are the only RRs to serve Waterloo. I see that as very anti-competitive and hope the STB rejects it unless there are major concessions.

UP-IANR might make sense. Along with UP lines North to St Paul and South to St Louis (via Peoria), it could restore the line to the though route that it was for RI and CB&Q.

IANR with IAIS or Crandic might make sense also. Not IANR with CN.

Wild prediction: CPKC buys IAIS to improve its route from Chicago to KC. Chicago to Savanna spun off if required for approval.

All the Class 1 CEO’s have promised “growth” to the STB and Wall Street. So now they are buying it from the customer focused short lines. Short Line Monopoly will probably be done soon. All the shuffling of them among the small players in the business is almost done. Now that Class 1’s are getting involved, the prices will start going up and the small fry won’t be able to afford to play.

Just you wait, this time next year the CEO’s will be crowing about their percentage “growth” in business.

Let’s hope the “bigs” adopt the marketing and service principles of the “smalls”, and not play we’re big, we know best, and here’s how WE do it (poorly!)

In a consulting capacity I handled a number of branch line spinoffs for BNSF in 2004-2009, but it was already then becoming apparent that reduced labor costs on Class I’s due to win-win labor agreements had changed the economics. Turning to a special case, I was in management at Soo HQ when the sale of the ex-Soo main line to WC was done; this was a unique situation in which the merged Soo-MILW needed to make the sale to reduce the debt from the MILW acquisition. Several of us opposed the sale on grounds that the Soo main between Duluth-Superior and Chicago was 93 miles shorter (and one crew district shorter) than the ex-MILW route, and also lost an opportunity to build combined direct delivery trains in Milwaukee for major Chicago connections, because of losing the volume the WC took away. I suspect that if the whole subject had come up a year later it wouldn’t have been done, but in 1987-88 CP was apparently in a period of doubt about the rail business, and didn’t stop it; that changed dramatically when they bought out the public minority shares of Soo as well as acquiring the D&H-LV routes, but it was too late to head off the strategic mistake that CN has so well exploited.

I concur, frequently Trains mentions locations, but the accompanying map (if there is one) does show the specific location. Very disappointing to have well written article without a map, scale and North arrow.

A nit-picky point: In so many articles Trains has written about the M&B takeover by CPKC and CSX, they always mention the interchange point/division of ownership at Myrtlewood yet consistanly fail to locate it on any map they have accompanying the story. Why is that?

Steve, Thank you! I have noticed, and been frustrated by, the Myrtlewood omission.