Norfolk Southern says that activist investor Ancora Holdings’ detailed plan for the railroad, released last week in a 193-page presentation, contains misleading operational data and vastly overstated cost-savings projections.

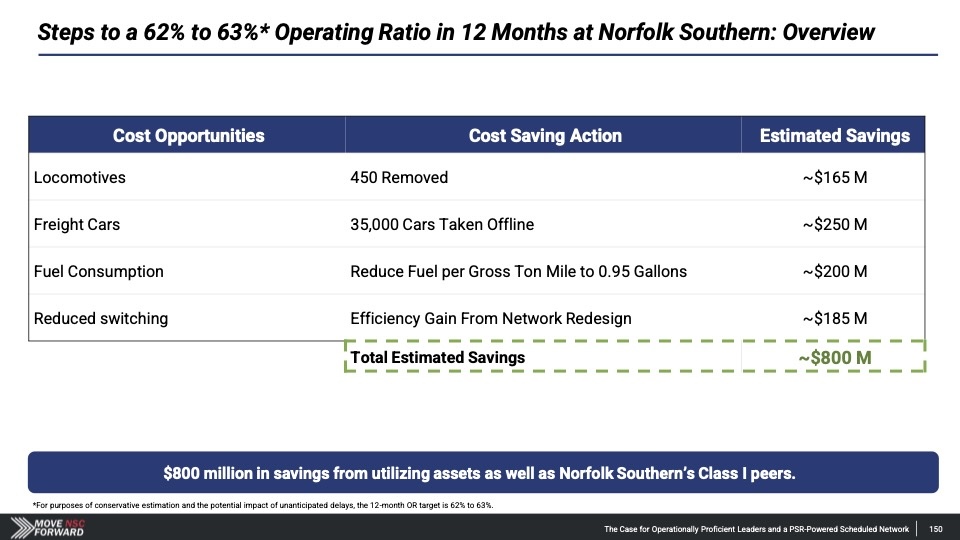

Ancora says its proposed management team would reduce costs by $800 million through a full-blown implementation of the low-cost Precision Scheduled Railroading operating model at NS. In the activist investor’s crosshairs: The size of the NS active locomotive fleet, the number of freight cars online, the railroad’s fuel consumption rate, and its switching workload.

But due to faulty data and assumptions, Ancora’s projected savings might be as little as $400 million, Norfolk Southern said last week. And that means that Ancora — which like NS has said it won’t cut jobs — would not be able hit its initial 62% operating ratio target without furloughing 2,900 employees, NS said in a presentation to investors last week.

Ancora stands by its plan and accuses NS of running a fear campaign. The Cleveland-based Ancora has proposed a majority slate of board candidates, who would then name former UPS executive Jim Barber Jr. as CEO and former CSX operations boss Jamie Boychuk as chief operating officer.

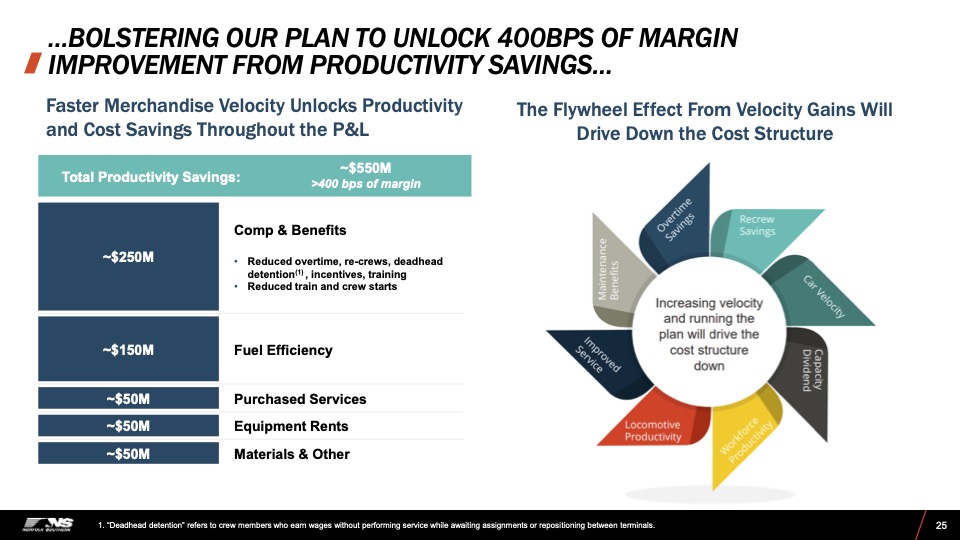

NS CEO Alan Shaw, who acknowledges that the railroad’s cost structure is too high, last month hired PSR veteran John Orr to accelerate operational and service improvements. NS has identified $550 million in productivity savings that will flow from making the railroad faster and more efficient.

Absent a settlement, the proxy contest will end on May 9 at the NS annual meeting, where investors’ votes will be tallied on the dueling visions for the railroad.

Rolling Stock Reductions

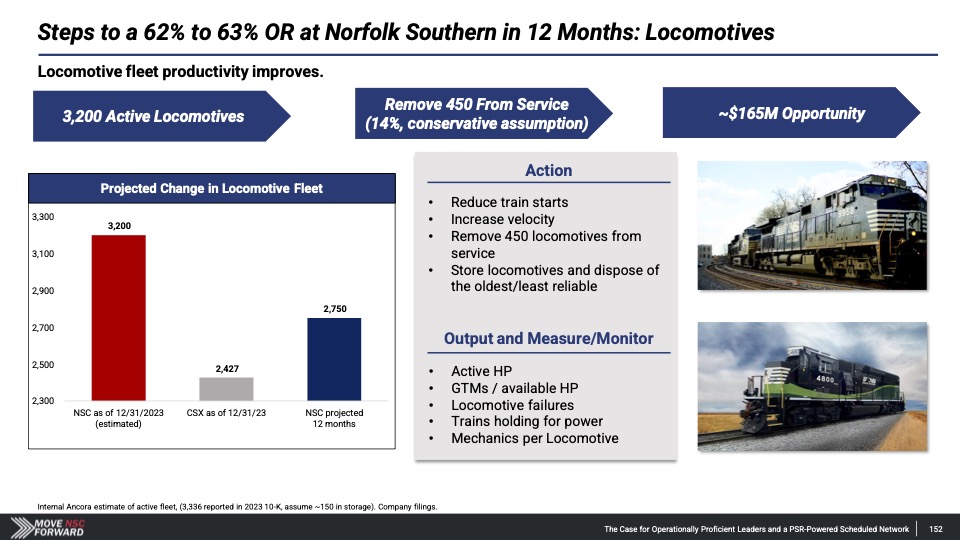

Ancora, citing two independent sources within NS, says that NS had 3,200 active locomotives at the end of 2023 and has substantially the same number today. Once Ancora’s operating plan is fully implemented — and NS’s network velocity speeds up — it would free up 450 units that could then be put into storage, the activist investor says. Estimated cost savings: $165 million.

But Norfolk Southern’s Locomotive Fleet Status report for Thursday notes that of the 3,278 locomotives the railroad owns, just 2,681 were in service — which is already 69 locomotives below Ancora’s target.

Ancora, in a letter to shareholders this morning, countered that NS has a larger active fleet than CSX despite handling less traffic.

Ancora aims to save $250 million by removing 35,000 freight cars from active service, largely through operational changes that would boost train speeds and reduce terminal dwell. The 20% reduction in the number of freight cars on the NS network is in line with CSX’s 21% reduction in freight cars during its PSR implementation that began in 2017.

NS says Ancora’s car-related savings figures are overstated and pegs potential savings at $135 million. NS also says that Ancora is using inaccurate figures in its comparison between the number of NS and CSX cars online. And since more than half of the cars are owned by customers, the savings would be lower than Ancora’s estimates, NS says.

Ancora counters that customers will save money by being able to use fewer railcars as the NS becomes more fluid.

Yet Ancora’s figures are based on the average number of cars online at NS last year, when its operations were significantly affected by two major events. First, the Feb. 3, 2023, hazardous materials wreck in East Palestine, Ohio, reduced Norfolk Southern’s primary Chicago-New Jersey main line to a single-track, speed-restricted bottleneck for more than five months. Second, after a subsequent derailment in Ohio that was attributed to in-train forces, NS in March severely restricted train lengths until it could set new, tighter standards for the way merchandise trains are built.

East Palestine and the train building restrictions slowed average train speed and increased the time cars spend in yards, prompting customers to use more freight cars as transit times increased. Although NS train speeds have improved by 8% since the railroad hired Orr as its chief operating officer last month — and were at a nine-week high in the week ending April 12 — its system velocity still lags.

Ancora says the NS merchandise network should have recovered by now, but instead its key operational metrics remain below the peak levels of 2019 and the number of cars online remains stubbornly high.

Fuel Savings

Ancora is targeting a 15% reduction in fuel consumption per gross ton-mile by retiring the least fuel-efficient locomotives, reducing idling and horsepower/ton ratios, and increasing use of distributed power and fuel-saving software systems like Trip Optimizer. This would translate into a savings of $200 million.

But NS points out that PSR implementations have typically produced roughly 5% fuel savings and that a 15% improvement is an unrealistic target. The likely first-year savings, NS says, would be closer to $90 million.

Ancora says its 15% fuel consumption goal is a multi-year target, not a figure it expects to achieve in a year.

Car Handling

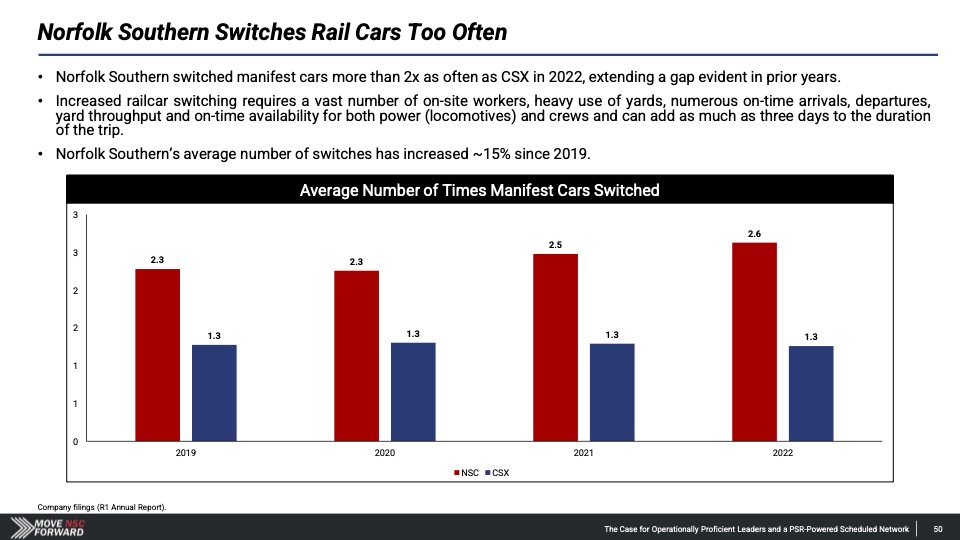

Citing data in the railroads’ annual Surface Transportation Board R-1 filings, Ancora says that NS switches merchandise cars twice as often as CSX: An average of 2.6 times per car in 2023 compared to just 1.3 times at CSX.

But an apples-to-apples comparison using internal data, which excludes through interchange blocks and the first-mile move to the local serving yard, paints a different picture, according to NS. NS averages 3.27 handlings per merchandise carload, while CSX averages 2.93 times.

Part of the difference can be attributed to the ways CSX and NS shifted to Precision Scheduled Railroading. During its 2017 implementation of PSR, CSX killed off many of what CEO E. Hunter Harrison called “heavy handling” carloads that required more switching en route, according to people familiar with the matter. NS did not.

In addition, contrary to what Ancora states, the average number of times cars are switched at CSX has been rising in recent years as yards have been closed, according to data CSX officials shared with their NS counterparts during a meeting last month.

Yet Ancora says that redesigning the merchandise network would reduce switching at NS by 50% and produce $185 million in savings. NS estimates savings of just $50 million.

Operational Data Comparisons

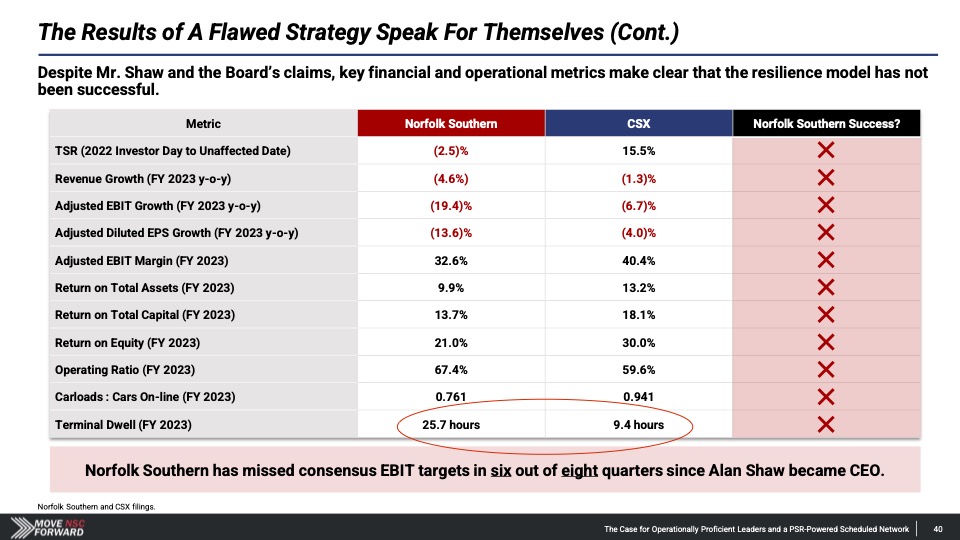

Ancora’s presentation makes apples-to-oranges comparisons of various NS and CSX operational data. It cites Norfolk Southern’s STB-reported 2023 terminal dwell figure of 25.7 hours, for example, and stacks it up against the 9.4-hour dwell figure that CSX reports on its website using different calculations.

“The STB definition of terminal dwell specifically excludes run-through trains, which only stop relatively briefly to change crews without performing any switching work,” says Loop Capital Markets analyst Rick Paterson, who closely follows railroad performance figures. “Including run-through trains dramatically distorts terminal dwell. CSX reports dwell excluding run-through trains to the STB, but almost certainly includes run-through trains on its website.”

The difference is stark: For the week ending April 12, CSX’s website dwell including run-through trains was 10.3 hours compared to the 21.2 hours reported to the STB. In the same week, NS’s average dwell was 22.5 hours, according to data it reported to the STB.

“If Ancora is comparing CSX dwell with run-through trains to NS dwell excluding run-through, that would really be a rookie mistake,” Paterson says.

Even using STB train speed data as a yardstick is problematic: NS and CSX use different formulas to calculate their average train speeds.

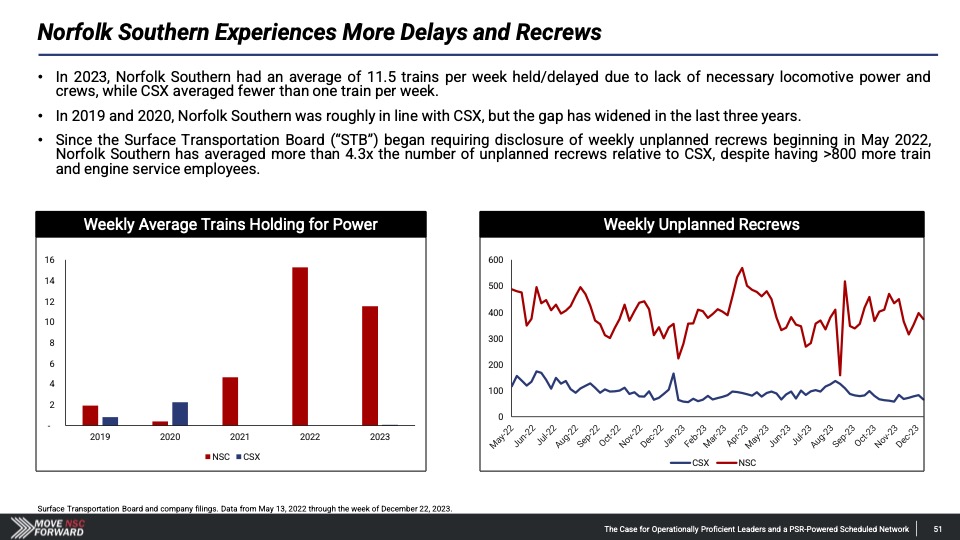

Ancora compares the unplanned recrew figures that NS and CSX report to the STB, noting that NS has averaged 4.3 times the number of unplanned recrews than CSX, despite having 800-plus additional train and engine service employees.

But the railroads don’t calculate recrew data the same way. “Ignore the recrew rate, which is based on an unusual CSX formula that renders it immaterially small,” Paterson has written in his weekly rail report.

In general, Paterson says caution should be used when comparing one railroad’s operating metrics to another’s.

“While most of the railroad operating data is standardized in terms of how it is defined and measured, in some cases it is not and some railroads measure and capture the data very differently,” he explains. “Given these inconsistencies, readers should primarily focus on how these metrics change over time at each individual railroad and be very careful comparing railroads with each other on any of the reported numbers. Differences in business mix, length of haul, and geography also make direct comparisons inaccurate.”

Independent analyst Anthony B. Hatch is critical of Ancora’s misstated operational comparisons between NS and CSX. “This seems to be indicative of a pattern perhaps designed to sway sophisticated investors who are not sophisticated in railroad operations,” Hatch says. “If you have a good case, investors will vote for you. If you don’t have a good case, they won’t.”

The comparisons, Hatch says, should prompt investors to use a sharp pencil when analyzing financial targets.

But Ancora says its presentation also compares NS to itself over time – and that today’s NS is a far slower and less efficient railroad than it was in 2019.

Focus on the Big Picture

Ancora says it has high conviction in its plan for NS and stands by the numbers and forecasts in its presentation. And Ancora asks that if CSX and NS were operating similarly today, why has the railroads’ operating ratio gap grown to 9 points?

The reason for the difference, Ancora says, is that NS expenses have ballooned because it is carrying extra train crews, locomotives, and freight cars rather than matching its resources to traffic volume.

It’s an indication that the NS resilience strategy — which relies on not furloughing train crews during freight downturns — is not working, Ancora says, particularly since traffic volume has been growing since last summer.

Meanwhile, Ancora says its plan’s savings projections have ties directly to prior implementations of Precision Scheduled Railroading at other Class I railroads, including NS rival CSX. Its plan also doesn’t include $250 million in labor cost savings that NS says it will achieve as the railroad becomes more fluid.

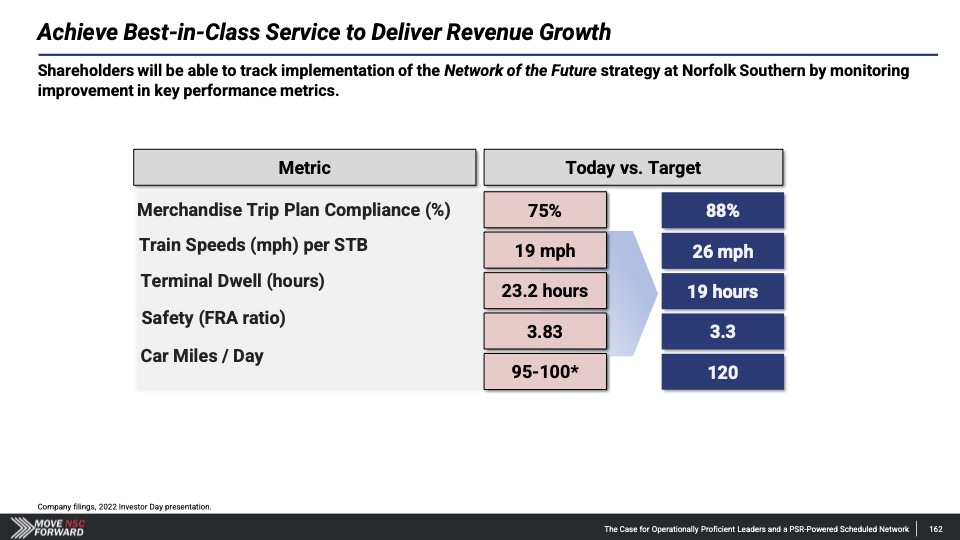

Ancora also says its operational goals for NS were not plucked out of thin air: They mirror the railroad’s peak operational performance after it rolled out a new PSR-based operating plan in 2019.

Shaw points to those same 2019 operations and service metrics, as well as gains in the months leading up to East Palestine, as proof that the current NS management team can run an efficient railroad with an operating ratio below 60%.

NS will return to a 60% operating ratio, Shaw insists, but it will take a year longer than Ancora’s plan, which NS considers to be a short-term, slash-and-burn approach that will disrupt service, erase safety gains, and damage relationships with customers, rail labor, and regulators.

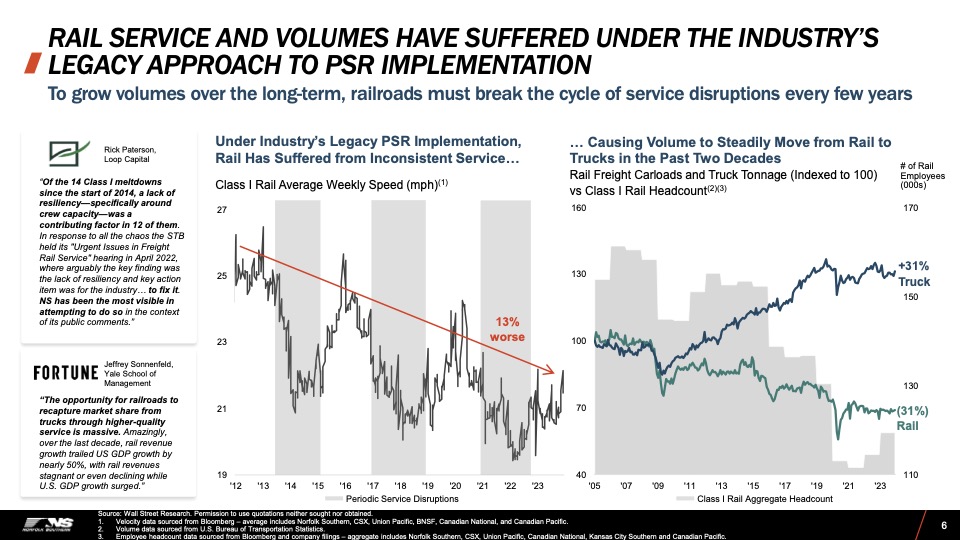

Norfolk Southern’s Better Way strategy, which Shaw introduced at the railroad’s December 2022 investor day, is at the core of the proxy battle. The resiliency strategy reduces the emphasis on the operating ratio and maintains resources during freight downturns so that the railroad is ready to handle an eventual traffic rebound.

Keeping train crews on the payroll during freight downturns would hurt the operating ratio over the short term. But not furloughing crews would pay off in the long run by enabling NS to maintain service levels and handle the eventual traffic upswing. And providing consistent and reliable service year in and year out will allow shippers to build more of their supply chains around the railroad, which in turn will bring NS new traffic, higher revenue, and bigger profits.

Shaw says the approach is a better way forward for an industry that has struggled to grow due to periodic service problems related to crew shortages.

Ancora says the problem with the NS strategy is that it’s impossible to predict how long a freight downturn will last, how deep it will be, and how strong the rebound will be. And so it makes no financial sense to keep a buffer of resources, including train crews and locomotives, at the ready.

Note: Updated at 9:40 a.m. Central with additional information from Ancora regarding locomotive fleet size and to add a link to a letter to NS shareholders than Ancora released this morning.

its all about shareholders and their greed to make as much money to line their pockets as possible…never thinking about all the hard working train crews that make it all happen. No wonder the majority of ‘working ‘ men and women in the field feel like pawns ! Remember the days when railroad presidents, managers knew and respected the people in the trenches, because some of them worked their way through the ranks ….I am so tired of rich spoiled, pencil pushers making money from others sweat and toil.

For Shareholder greed please read “pension fund greed” because it is the pension funds that are driving today’s markets. Plus a lot of those pension funds also own Big Chunks of “Hedge” Funds which are “legalized somehow” versions of the old 1934-outlawed Stock Market Pools.

With your attitude you’re just playing into The Big Guy’s hands and having a government takeover of the RR’s so the whole country will be just one big Freight-MBTA. I was out chasing trains last week and there were few of them on the rails. PSR means run fewer, slower, longer trains; note that E H Harrison was busily chasing away business. Penn Central tried that technique once, Dave Fink the Elder told us once at an RRE meeting—it didn’t work out well!

We will just take locomotives and freight cars out of service. What’s next, take the track out of service?

DON’T give ’em ideas! That killed the CRI&P once the RR was worth more dead than alive!

the saying ” figures don’t lie, liars do figure”, is true, just trying to take control long enough to drain off the resources, than move on to the next victim.

Excellent article! As the guy who developed NS’s STB metrics (speed, cars on line, dwell) back in 1999, and later industry standard reporting measures, NS has it right (even though I’m critical of how the industry is planning fir the future).

The vote will very likely follow the “greed is good” philosophy, as the shareholders voting the majority of shares are hedge funds, institutional fund holders and so forth, each having a responsibility and expectation from their investors for the largest returns possible. Sorry to say but this is a foregone conclusion.

If we’re to quote Ancora directly in that their goals are to regain the metrics right at the onset of PSR at NS, when business was booming and before any profound changes happened, then that would mean NOT using PSR.

Just look at how both parties want to design operations. “DPU Slop” is not an effective strategy and it certainly wasn’t how things were operating on NS even by the time the pandemic happened.

CSX changed their reporting formulas while implementing PSR to intentionally obscure them. Like when they would change the train ID to hide recrews. The STB should demand all the railroads report the same way and those be included in earnings reports so investors can see how the railroads are really operating using the same formulas.

Impressive detail, Bill. You had a busy weekend! I’ll have to return to re-read this in the afternoon.

Patterson’s statement is key: “Given these inconsistencies, readers should primarily focus on how these metrics change over time at each individual railroad and be very careful comparing railroads with each other on any of the reported numbers.” I spent 25 years benchmarking electric transmission reliability and legacy design/operating environment factors render between system comparisons as always “apples versus oranges”. But simpletons gravitate to such comparisons. No amount of capital or practices can fundamentally change legacy/environmental factors.

The last paragraph shows how out of touch with reality Ancora’s arguments are. Just look back a couple of years to how service levels crashed when the railroads tried to come back from the pandemic with crew levels they had cut to during the pandemic. Maintaining crew levels saves money, time, and service in the long run.