If activist investor Ancora Holdings wins its Norfolk Southern proxy battle this week, its new management team aims to generate unprecedented growth in carload traffic over the next four years.

Ancora plans to run the same playbook that CSX has used since it shifted to a Precision Scheduled Railroading operating plan in 2017. Improve your service, the thinking goes, and you can get more wallet share from existing customers and grow merchandise volume in the process.

That’s a great strategy except for one flaw: It has not worked.

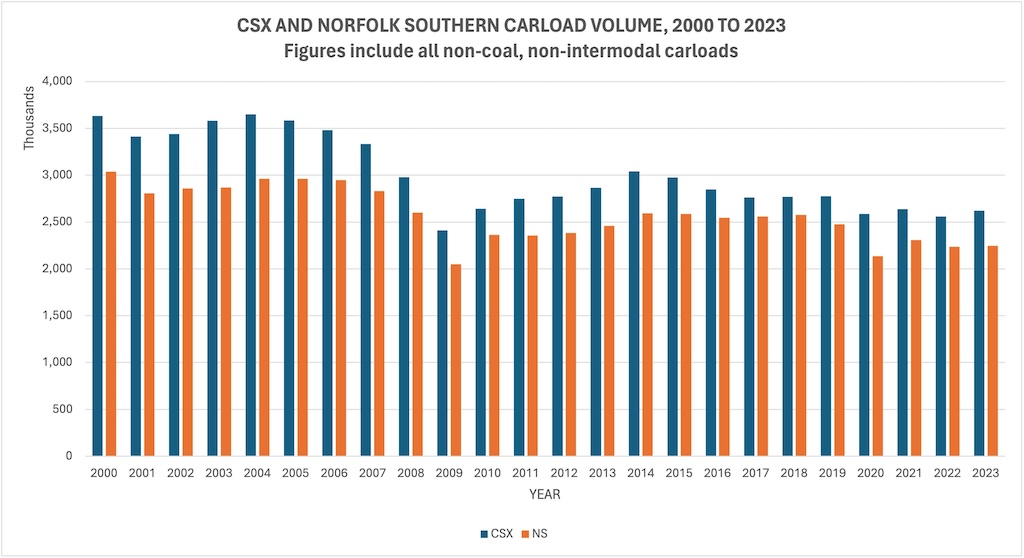

The CSX of 2023 handled 6.4% fewer merchandise carloads than the pre-PSR CSX of 2016.

Over this same stretch, carload volume fared even worse on Norfolk Southern. Its merchandise volume is down 10.1% from 2016 through 2023, which is likely due to erratic service and the “yield up” profit margin strategy that has raised rates. It’s a combination that pushed customers past their pain thresholds and they shifted their freight to trucks.

These volume declines follow the overall trend in the East this century. CSX and NS have lost a combined 1.8 million non-coal, non-intermodal carloads since 2000. That’s a punishing 27% decline.

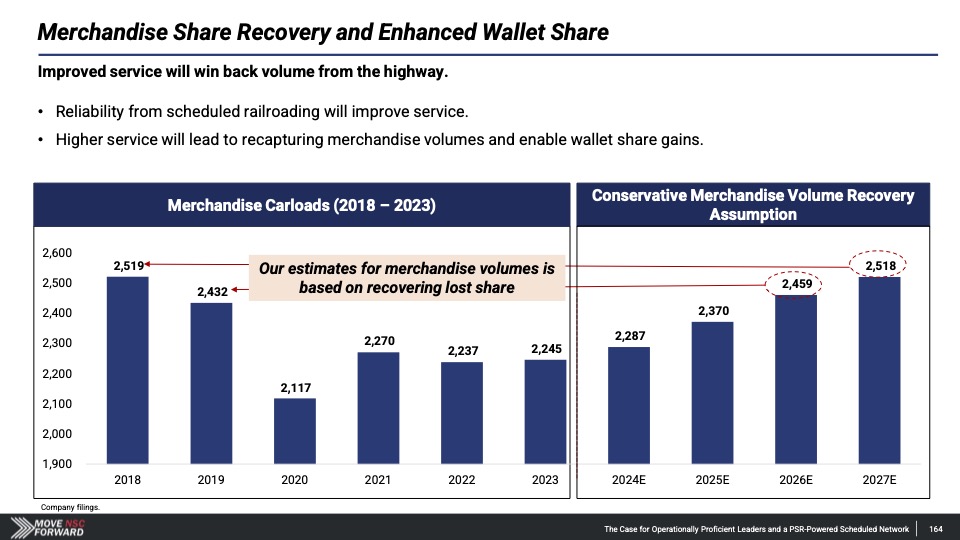

Against this backdrop Ancora projects 10.1% carload volume growth at NS through 2027, enough to get carloads back to 2018 levels. “Improved service will win back volume from the highway,” Ancora proclaims — noting that its merchandise recovery assumptions are “conservative.”

“Wildly optimistic” would be a better term.

NS has never experienced four straight years of carload growth this century. The closest it’s come is growing four out of the five years following the Great Recession, when NS carload volume rebounded 9.7%. Yes, that’s close to Ancora’s four-year target. But we’re not coming out of the worst economic downturn since the Great Depression.

CSX and NS were able to grow carload traffic in the years immediately following the three recessions this century. Yet overall carload volume never returned to pre-recession levels, continuing the decades-long loss of market share in the highly truck-competitive East.

It’s hard to see NS regaining this carload volume amid the oodles of truck capacity currently available, which has sent trucking rates down. It’s also hard to see NS clawing back volume from CSX — at least not without igniting a rate war that would reduce the fat profit margins that Wall Street demands.

If you think all of this calls Ancora’s carload traffic projections into question, you’re right. And that’s not all. It also makes you wonder how Ancora can reach its projected operating ratio of 55.4% in 2027. If that 10% carload growth doesn’t materialize, then neither would its more than $750 million in revenue — or that 55% operating ratio. (If you factor in a 3% rate increase annually, the revenue figure climbs to $939 million.)

When deciding how to cast their proxy votes this week, Norfolk Southern investors would be wise to consider how realistic Ancora’s carload volume targets are, along with the financial assumptions that rest upon them.

If Ancora’s management team — former UPS executive Jim Barber Jr. as CEO and former CSX operating boss Jamie Boychuk as chief operating officer — can pull off a miracle and reverse the decline of merchandise traffic on Norfolk Southern, the entire railroad industry would rejoice.

But don’t count on it. Ancora’s carload growth expectations seem to be nothing more than a pipe dream.

You can reach Bill Stephens at bybillstephens@gmail.com and follow him on LinkedIn and X @bybillstephens

Bill is right. Wall st will never grow a business, but will destroy it.

I don’t often agree with Bill Stephens on some of his rants, especially those extolling his love affair with Canadian Pacific.

But in this case, his analysis is dead nuts on and is backed by Proxy analyst ISS and rail industry analysts Anthony Hatch, who has been at this a lot longer than anyone at Ancora. If you own stock in Norfolk Southern, ask yourself: Why would so many people with nothing to gain be so against this type of snake-oil purveying? Because they all understand what will happen to the rail industry if Ancora pulls the wool over enough of you: DISASTER.

I’ve already voted. It wasn’t for Ancora.

The reality is that no Class 1 really has much of a plan for growth. Lots of talk, some different thoughts on the margins, some unique scenarios (CPKC Mexico) but all about the same. Until there is a strategy to make money on anything other than ‘run a very long train’, the decline continues.

Is it fair to say that for a variety of circumstances a good portion of the carload traffic shifted to intermodal? Also, where are the T&E crews going to come from to handle the projected growth in carload volume? PSR reduces train starts, no?

Spot on, Bill!

Excellent service in 2012 and 2013 did not lead to increased carloads in 2014 on NS.

https://blerfblog.blogspot.com/2023/12/how-to-kill-rail-renaissance-and-maybe.html?m=1

This analysis deserves distribution beyond the Trains community. Would hate to see NS go down the Ancora path.

Would not even buy a new car from them. “IF” carloads were able to be increased it would definitely add revenue and increase profits. However, the OR would go higher as carload servicing requires more T&E and more at times many idle locos that are waiting for the single crews for non 24 hour use.

Unfortunately the “Overton Window” regarding class 1s and Norfolk Southern in particular is a very narrow one… it is PSR-Shaw vs. PSR-EHH. Nowhere is there debate about PSR existence in the first place.

While the economy has grown in this century, carload traffic is down across-the-board on all class 1s. Trains breathlessly reports on the decade plus double tracking the BNSF southern transcon or a new bridge at Sandpoint like it is something huge miraculous, accomplishment. Well, BNSF is private and hands over huge dividends to Berkshire in excexs and public class 1s borrow money for share buybacks.

In every case these costs FAR exceed CapEx and most CapEx is for replacement and not capacity or technology, much less electrification.

The looters have won, whether Ancora or Shaw. It is a rigged game for the customers, public and environment “Heads I win, Tails you lose”.

Voodoo economics and legalized marijuana? Maybe Ancora thinks the increased volume will come from the snake oil they’re selling. Seen this too many times. Grab short term benefits and bail out leaving the real stockholders and the corporations in the hole for years. Major corporations such as railroads need long term planning and results, not quick hitters that leave future earnings in doubt. Won’t we ever learn?

I would not buy a used car from Ancora. Besides all the unrealistic projections, whee will these carloads go? The industrial sidings have been removed and sorting yards downsized so exactly where is this traffic coming from and where will it be delivered to? (cue the crickets!)

Ancora is trying to blow smoke up you know where.

Exactly, all their numbers a based on the perfect scenario which is a fantasy. If carload/merchandise traffic was a winner, ,wouldn’t very class one already be doing it? The shortlines can make money at it because their haul is designed for it. A few cars each day handed off to the class one who moves it to a classification yard or block swaps it with another train headed in the direction the cars are going. American business has moved beyond carload/ merchandise traffic as described by the brilliant mnds at Ancora. They will tell people what they want or they won’t be served! HAH! Get off your Wall Street butts and watch a few trains go down the tracks, You will see a few merchandise trains, BUT MOST ARE INTERMODAL or BULK COMMODITY. Why? Because that is the way business ship by rail these days. Smaller loads go by truck. Its the economy of scale…

The real truth is that Ancora picked NS because they are in a tepid financial position following East Palestine disaster and the dramatic drop in Coal. You think they could pull this same stunt at the other class ones? Doubt it…

In reality, the only one that is really safe is BNSF, and that is because they are not publicly owned. Thank you Warren Buffett for that. He is the kind of investor that railroads need. He once said, Railroads (and other service utilities) won’t make you rich, but they will keep you rich. Too bad Ancora can’t learn from the Oracle of Omaha. He’s a smart guy… As opposed to…?