WASHINGTON – Federal regulators today approved Norfolk Southern’s proposed $1.62 billion acquisition of the Cincinnati Southern Railway, which it has leased from the City of Cincinnati since 1881.

But Cincinnati voters will have the final word: They’re scheduled to vote on the proposal on Nov. 7.

The Surface Transportation Board decision also authorized NS subsidiary Cincinnati, New Orleans and Texas Pacific Railway Co. to operate the line if the acquisition is approved.

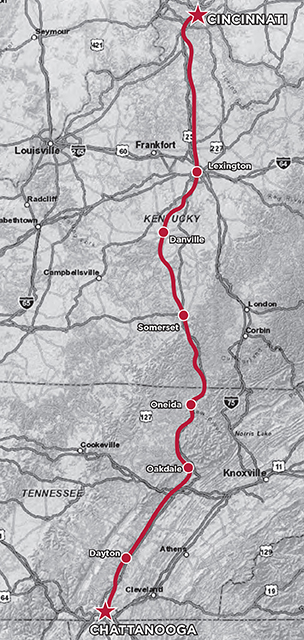

The municipally owned railroad forms the 338.2-mile Chattanooga-Cincinnati backbone of NS’s key corridor linking Chicago with Atlanta and the Southeast. In November the railway’s trustees unanimously agreed to sell the line to NS.

Under the current lease that was set to expire in 2026, NS pays the city around $25 million annually. Negotiations over renewal of the lease began in 2021, as required, and resulted in the sale agreement.

NS officials say it’s always better to own critical rail lines than to lease them due to the uncertainty around future lease costs. As part of the transaction, NS will own 9,500 acres of land that the railroad is built upon.

No operational changes are planned as part of the acquisition. The route handles about 30 trains per day.

What is a multilevel train?

Looks like a unit train of auto racks to me…

If I calculate correctly, the current annual payment represents a return of 1.54% on the 1.62 Billion value. Most money managers can beat that. And todays interest rates are above 5%.

The city could of course squander it as politicians have been known to do.

If I were a Cincy resident, that is why I would vote no. You can’t trust the politicians to do the right thing with a pallet of cash.

This should be a matter between the buyer and the seller. The Federal government should have no involvement at all.

As common carriers, railroads (in this case, mergers, acquisitions and other matters that impact the public interest) fall under government oversight. Thus, this sale has to receive STB approval. It’s not a matter of “government meddling” or similar — this is a normal procedure and has been part of railroad regulatory affairs for 150 years.