WASHINGTON — CSX Transportation executives touted their proposed acquisition of Pan Am Railways during a daylong Surface Transportation Board hearing Thursday, saying their deal to acquire the New England regional will significantly improve freight and passenger service.

But board members questioned several aspects of the merger, including concerns surrounding the Pan Am Southern and CSX’s projections for anemic traffic growth.

CSX CEO Jim Foote said the merger is good for shippers, passengers, and the national transportation network because of investments CSX will make in Pan Am’s run-down physical plant.

“It’s widely known that this New England rail network was on the brink of bankruptcy not too long ago before it was saved by the Guilford group, now Pan Am. That effort did a great job of keeping the New England network viable,” Foote says. “And now we have higher aspirations for Pan Am and its customers. We want to bring Pan Am and its customers into a new era, which will start by bringing them into our Class I network.”

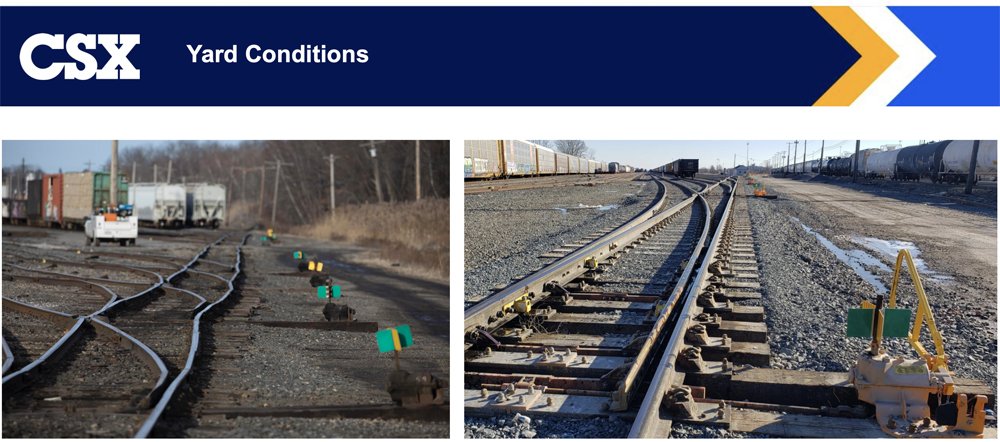

Over three years CSX will spend more than $100 million to improve Pan Am’s track, bridges, and yards as well as its aging and failure-prone locomotive fleet. Jamie Boychuk, CSX’s executive vice president of operations, showed the board a series of photos that compared Pan Am’s deteriorating track to CSX’s modern and well-maintained railroad.

Top track speed on Pan Am is 25 mph outside of areas where there’s passenger or commuter service. Pan Am has 200 miles of long-term slow orders on its 1,200-mile network, Boychuk says, compared to just 20 miles on CSX’s 20,000-mile system.

Foote says CSX is committed to rebuilding the Pan Am network, including main lines that are “so overgrown with trees and weeds that you don’t even know there’s a railroad there.”

STB Chairman Martin J. Oberman questioned why CSX would pay a significant sum to acquire Pan Am and then spend $100 million on top of that to rehabilitate the railroad. CSX projects 2.3% traffic growth in the first three years of the merger, and 1.5% in the following two years, he noted.

“I’m having trouble understanding how you are committing $100 million on top of the purchase price to generate basically no new growth resulting from the merger,” Oberman says. “I don’t understand the economics of that. And it troubles me.”

Boychuk says CSX is taking a long-term view of Pan Am when bolting the regional onto its network. “The investments, no matter who takes it over, have to be done .… If nobody puts this money into this railroad, at some point in time I’m not sure what kind of a railroad’s going to be left up there,” he says.

Sean Pelkey, CSX’s acting chief financial officer, says the railroad will “fight vigorously” to win new business from trucks and added that he’s confident the physical improvements CSX will make to Pan Am’s network will lead to more reliable service, which in turn will produce growth that exceeds projections.

Kevin Boone, CSX’s executive vice president of sales and marketing, said introducing single-line service in Pan Am territory will help win business that currently moves by highway. Pan Am currently hauls Maine forest products to a transload terminal in Ayer, Mass., for example, where trucks then take over for the trip to the metropolitan New York market. CSX will make this an all-rail move to northern New Jersey via Selkirk, N.Y., Boone says.

Board members spent significant time probing the structure of the Pan Am Southern deal. CSX will step into Pan Am Railways’ 50% interest in the Pan Am Southern joint venture, which provides rival Norfolk Southern with a route to New England. Genesee & Wyoming’s Berkshire & Eastern will be the neutral operator of Pan Am Southern, which includes 425 miles of Pan Am trackage west of Ayer.

The Justice Department has raised competitive concerns about CSX having a say in its primary rail competitor’s route into New England, while Canadian Pacific says the deal could threaten the viability of the former Boston & Maine main line between Mechanicville, N.Y., and Ayer.

Several board members expressed concerns that CSX would essentially have veto power over maintenance and improvement projects on Pan Am Southern that would benefit NS.

Pelkey encouraged the board to reject the Justice Department’s call for CSX to divest its stake in Pan Am Southern. He compared Berkshire & Eastern operation of Pan Am Southern to CSX and Norfolk Southern’s shared ownership of Conrail, which serves as a neutral switching operator for both railroads in shared asset areas. “We have proven this can work,” Pelkey says, noting CSX, NS, and Conrail jointly develop Conrail’s capital budgets.

Board member Michelle Schultz asked what would happen if the board ordered CSX to divest its interest in Pan Am Southern and there wasn’t a buyer who could successfully operate the joint venture.

“One of the issues with divestiture, one of the big issues, is that there are a lot of unknowns and a large amount of risks that come up if the board were to take that extreme step of ordering divestiture,” says Peter Denton, a lawyer for CSX.

CSX would have to reevaluate its agreement with Norfolk Southern and consider restructuring the deal. “We’d have serious concerns that this transaction could unravel,” Denton says, noting that the board has never ordered divestiture without first knowing who the operator would be.

Board members also questioned whether the former B&M route through Hoosac Tunnel would remain viable and if CSX and NS would have an interest in maintaining it. Norfolk Southern’s intermodal and automotive traffic will shift to new trackage rights over CSX’s faster and fully cleared Boston & Albany route to reach Ayer, removing a significant amount of traffic from Pan Am Southern.

CSX will continue to send carload traffic over the B&M to Rotterdam Junction, N.Y., and will need the route, officials said. On a carload basis, CSX will remain the second-largest user of the former B&M.

NS has no other way to route merchandise traffic to and from New England, spent nearly $150 million on the joint venture initially, and subsequently spent $215 million to acquire the south end of the Delaware & Hudson from Canadian Pacific to gain full control of its route to Pan Am Southern, NS lawyer William Mullins says.

So NS, like CSX, has an interest in ensuring the continued viability of the Pan Am Southern, he says.

Oberman noted that NS is limited to one 9,000-foot intermodal and automotive train via CSX trackage rights daily. What would happen, he asked Mullins, if volume grew beyond 9,000 feet and NS had to route more traffic over the single-stack route through Hoosac Tunnel?

Mullins said NS could resort to the current fillet-and-toupee, single-stacking operation at its Mechanicville terminal, work with CSX and Massachusetts on funding a $300 million tunnel clearance project, or simply buy PAS outright if CSX objected to a clearance project.

Several shippers, third-party logistics providers, and elected officials from New England expressed support for CSX’s acquisition of Pan Am.

The hearing resumes today, with Amtrak, the Massachusetts Bay Transportation Authority, Canadian Pacific, and more shippers and public officials on the schedule. It is being live-streamed, with a link available in the Quick Links section of the STB website.

Although I’ve been retired for about 2.5 years, I’ve retained what I’d characterize as something of a “recreational interest” in railroads and rail regulatory matters.

I’ve been watching the first day of the hearing on YouTube and my immediate (and very positive) impression is the fresh approach Chairman Oberman has brought to what in the past would have been something of a “rubber stamp” hearing. His and Commissioner Prius’ pointed questioning concerning the intended capital outlay versus the meager traffic growth projections are, in my mind, spot on! One might surmise that captive shippers elsewhere on CSX may be the ones making up any shortfalls.

I also found it interesting that Jim Foote favorably compared the competitive concessions CSX is proposing to those negotiated with the NITL during the CN/WC merger process. I was chair of the NITL rail committee at the time and neck deep in that process. I’ll note that when CN and BNSF were proposing to merge, NITL engaged in similar negotiations with those parties for concessions to address competitive concerns. One aspect of that negotiation was for reciprocal switching concessions remarkably similar to the NITL Competitive Switching proposal currently on the STB’s docket.

It would appear to me that Jim’s experience at CN in working with interswitching in Canada has led him to understand that allowing rail customers competitive rail options is not “the end of life as we know it”. Hopefully CSX will carry that same open minded approach into the March STB hearings on reciprocal switching.

Apologies to Commissioner Primus for misspelling his name. Autocorrect is not my friend…

And to Kalmbach, an edit function would be greatly appreciated.

CP has voiced concern about the loss/potential loss of a friendly connection to the Boston area. CP obviously has their hands full right now but this could/should be an easy repeat of the Meridian Speedway.

One could argue that two thru-routes across Massachusetts is redundant.

Something we should consider with respect to interchange of traffic from the former B&M at Rotterdam Jct. to CSX is that it is west of Selkirk yard. This necessitates a reverse move into or out of Selkirk with a crew that does little else. This is wasteful and slow. I would suspect that the reason Conrail agreed to handle this traffic via Worcester at the same rate division was that one crew could have forwarded that traffic to Worcester at little more cost than this reverse move with probably a day or more saved in transit. In days gone by the New York Central interchanged via this. Jct . by building trains of B&M routed traffic at Dewitt Yard in E. Syracuse, N .Y. Crews and power went through to Mechanicsville with no delay. All this militates against CSX using Rotterdam Jct. for any traffic to or from New England and therefore any CSX spokesperson who mentions using the Pan Am Southern must be questioned carefully.

Boychuk must have picked the picture on the right…. the picture on the left could be CSX Rice Yard in Waycross Georgia. Even the yard tracks in Jacksonville look in similar condition as the picture on the left…..

NS seems to persist in putting forth the falsehood that the current intermodal trains are subject to a ” fillet-and-toupee, single-stacking operation at its Mechanicville terminal”. They are not. The NS Chicago ramp loads single stack Ayer intermodals and double stack intermodals for the Mechanicville ramp. The Mechanicville cars are set off and the train continues east.

Conrail Shared Assets is most certainly not an accurate description of how PAS would operate under this deal. If it were, CSX would be committed to financing the $300mil to upgrade the Hoosac Tunnel route to double-stack clearance, instead of this troglodyte toll plan. And what a trick of words, to tell people you plan to replace the intermodal volume lost with manifest traffic, when all you really plan to do is maintain the traffic on a train that was running before the deal.

It concerns me that a lawyer is speaking on behalf of NS, as do his words on how this lane is to survive let alone grow. In their current mindset, this lane is ripe for de-marketing if the deal passes. Enjoy your new monopoly, New England!