NEW YORK — The departure of two key operations executives this year won’t affect CSX’s service, Chief Financial Officer Sean Pelkey said at an investor conference today.

“We’re six years into the scheduled railroading journey. It’s in our DNA. And you’ve got a team of leaders across the operations group who understand what that plan looks like, how to run that plan. And the repeatability of that plan is what makes it so successful,” Pelkey says.

CSX announced the departure of Jamie Boychuk, executive vice president of operations, on Aug. 4, while Brian Barr, senior vice president of network planning and services, joined Union Pacific in April.

Upon Boychuk’s dismissal, CSX said Ricky Johnson, senior vice president of transportation, and Casey Albright, senior vice president of network operations and service design, will report directly to CEO Joe Hinrichs as the company conducts an internal and external search for a new chief operating officer.

Johnson and Albright both have decades of experience at CSX. “There’s a tremendous amount of continuity,” Pelkey says.

“I have a lot of respect for Jamie and what he brought to the railroad,” Pelkey adds. “He’s a good railroader and we were thankful to have him. The decision that was made to make a change was a decision that Joe and the board came to.”

The railroad this week began a daily morning conference call that includes people from operations and sales and marketing, with a goal of working through service issues that affect individual customers.

“There’s been a lot of optimism in terms of what we can do going forward,” Pelkey says.

“You’ve got the voice of the customer now on those calls, represented by the commercial team,” Pelkey says. “So that’s really exciting because I think we’re going to be able to push our way through some of the challenges that may have prevented us from unlocking some of the incremental opportunities in the past.”

CSX now has a better balance between operations and sales and marketing, Pelkey says, rather than one person having veto power.

“We at a vice president level … can bring ideas forward that are ultimately going to translate into bottom line growth, and those ideas are going to be heard and well received,” Pelkey says.

“We’re talking about things like, ‘Hey I’ve got a customer who we serve three days per week today. On days four and five you already have a local start that goes by that customer. Could we please add a fourth or a fifth stop at that customer?’ There’s really no incremental cost to that, potentially a little bit of overtime. And so in instances where we have those opportunities, the more we say yes the more trust we build with the customer,” Pelkey says.

CSX continues to hire conductors to keep up with attrition and anticipated traffic growth. It also has 80 to 100 engineers in training.

Once summer vacation season ends, CSX likely will be carrying more train crews than it needs to meet current volume, Pelkey says. That will add roughly $2 million a month in costs. But that figure pales in comparison to the revenue a fully crewed CSX will be able to bring in next spring assuming volume bounces back, he says.

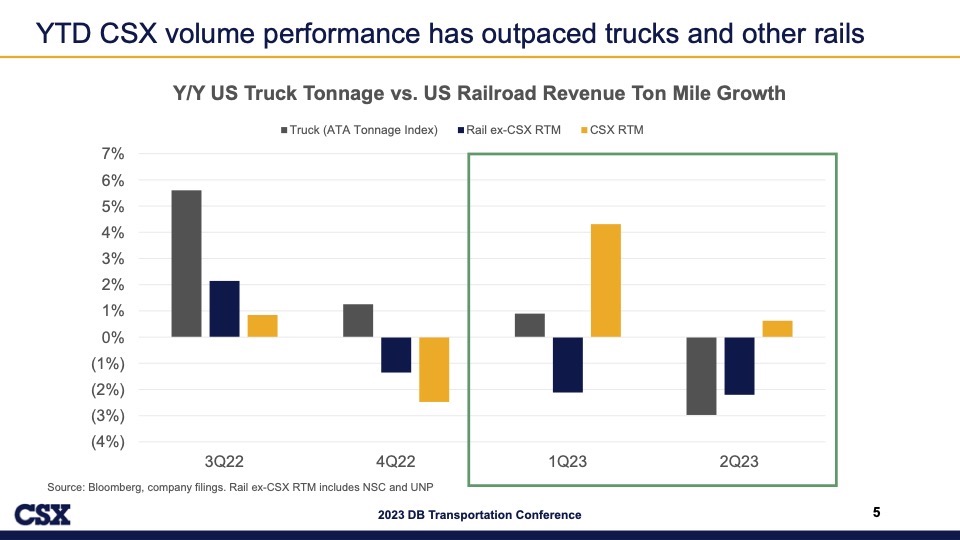

Despite the weak freight market, CSX has been gaining market share this year compared to trucks and Norfolk Southern and Union Pacific, Pelkey says.

Pelkey spoke at the Deutsche Bank 2023 Transportation Conference.

Jf Turcotte says:

August 15, 2023 at 11:30 am.

……………….Try operating a railroad with more than 75% of the required employees, locomotives and terminal place for a start.

mrw: I am confused by this statement, knowing that RR problems exist, due to less than 100% required employees. Was it meant to say….. WITH ONLY 75%…….? ENDMRW0817231358

If the RR is or will run OK without a COO & EVP Network, maybe they don’t need to refill that layer of bloat. Think of all the saving to the shareholders.

Carload is money, and also hard work…but it’s work worth doing. We have to pursue loose car service anywhere and everywhere.

Can’t be UP Fritz says they are doing better than CSX

Operations have been skipping way more than one beat since the implementation of PSR.

Try operating a railroad with more than 75% of the required employees, locomotives and terminal place for a start.

CSX and UP both have more carload traffic than intermodal traffic. In 2023 I don’t think that’s a situation to brag about. Right now, however, it makes them look better than their peers, thanks to the hit that consumer goods intermodal traffic is taking.

In terms of overall carloads and intermodal traffic to date in 2023, NS is ahead of CSX 3.96 million to 3.75 million units. The gap would be even larger had the East Palestine incident not happened.