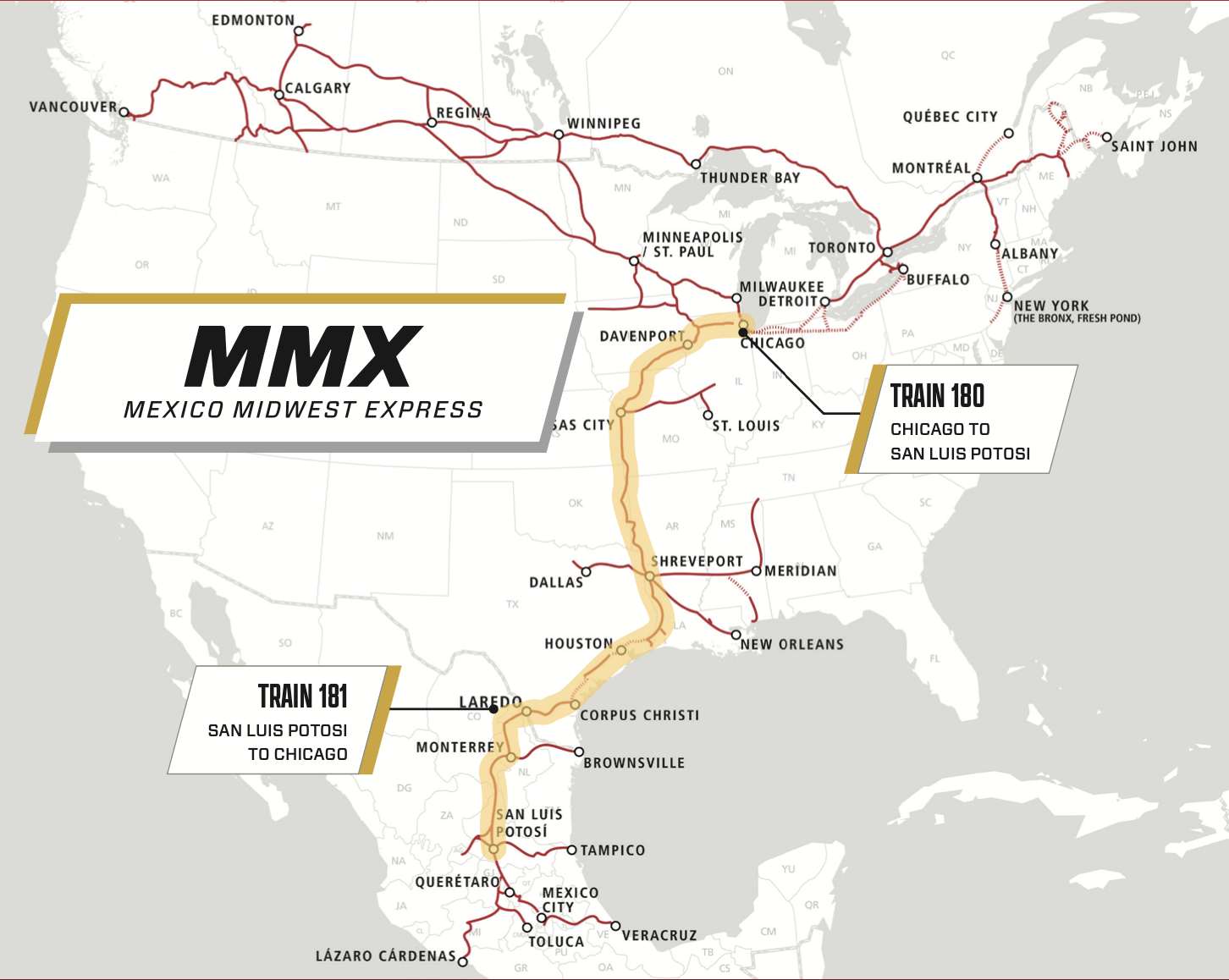

LAGUNA BEACH, Calif. – Canadian Pacific Kansas City Chief Executive Officer Keith Creel today touted the benefits of the railway’s flagship single-line Mexico Midwest Express service linking Chicago and Mexico.

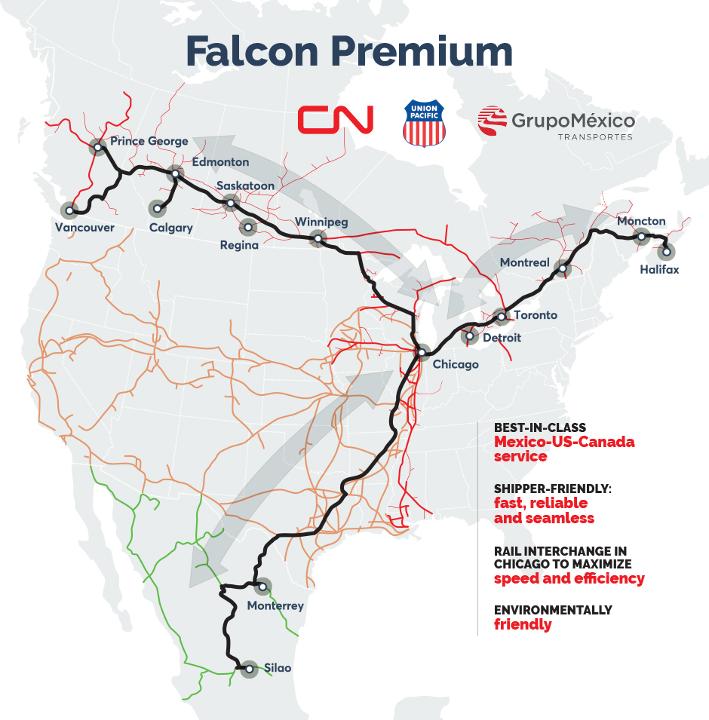

Yesterday Union Pacific announced that it had shaved a day off of its rival cross-border Falcon Premium intermodal trains run in conjunction with Canadian National and Ferromex, as well as the joint UP-Ferromex Eagle Premium service.

“If you’ve got a three railroad move, you can take a day out of it,” Creel told an investor conference today. “But you can’t take the complexities out of three railroads run by three different operating groups being guided by three different sets of priorities versus one.”

Interline intermodal service can’t realize the same potential as single-line service unless the joint service has a significant mileage advantage, Creel says. UP has a great network with the shortest route between Chicago and the Mexican border, he says, but that mileage advantage in the U.S. is erased by CPKC’s shorter route from the Laredo border crossing to Monterrey and San Luis Potosi, outside of Mexico City.

Falcon Premium service uses the Eagle Pass, Texas, gateway.

“So at the end of the day — their best day versus our best day — I think there’s a place for both,” Creel says. “But I do think, if we do our jobs, that the premium freight is going to be on our railroad because it’s going to be the most reliable, the most consistent, and the transit time is going to be the best.”

MMX trains Nos. 180 and 181 make the 2,150-mile run between Bensenville, Ill., and San Luis Potosi in four days.

“We’re doing it at a trucklike speed. We’re beating what we advertised, and that train is 95%, 96% on time,” Creel says. “I look at it every day, every morning. If it gets late I know about it. It is really symbolizing the power of this extended haul network — and it’s attracting business.”

An unnamed auto manufacturer began using MMX service today to ship finished vehicles from Mexico to the U.S. and Canada, Creel says.

Next week four new customers will begin shipping perishables between Chicago and Laredo, Texas, using CPKC’s expanded reefer container fleet, Creel says. Initial volume is expected to be 250 loads per week.

A key advantage of the CPKC service is the cold storage supply chain the railway and partner Americold are building, starting with a warehouse at the CPKC intermodal terminal in Kansas City, Creel says.

“It is going to be the premium supply chain connecting Chicago to Mexico or Mexico to Chicago,” Creel says.

Creel also noted that CPKC is targeting the Mexico-Chicago market, not the Mexico-Toronto market that rival Canadian National is aiming at with Falcon Premium. Both services were launched in May. “I wish them well. I think they’ll grow. I think they’ll do OK,” Creel says.

Canadian National Chief Financial Officer Ghislain Houle, who spoke after Creel at the Morgan Stanley investor conference, says he was pleased that new Union Pacific CEO Jim Vena, who spent four decades at CN, was able to take a day out of the Falcon Premium schedules.

“Here’s what we need to do, and Jim knows this very well and we know this. There’s three railroads: FXE, UP, and us. We need to work as a single line railroad. That’s the key,” Houle says. “We cannot let that train sit in Chicago, for example, for a week or two. We cannot, we cannot, we cannot. We need to work and we need to make these interchanges as fluid as if it had been our own network, our own railroad going from Mexico to Canada.”

The three railroads will hold each other accountable for meeting service standards, Houle says, adding that’s no different than what can happen within the operating department of a railroad that’s offering single-line service.

For Chicago interchange with UP, the Falcon Premium relies on CN’s congestion-free former Elgin, Joliet & Eastern route around the city, Houle notes.

CN sought to merge with Kansas City Southern but lost the battle to Canadian Pacific after an unfavorable regulatory review. Falcon Premium is CN’s competitive response to the $31 billion merger of CP and KCS. “I’m extremely excited by this because it allows CN to access Mexico without having to make a huge bet and without having any integration issues,” Houle says.

Morgan Stanley analyst Ravi Shanker noted that his firm’s customer surveys showed surprisingly strong demand for Falcon Premium service.

“The key service from Monterrey to Toronto is five days, which is trucklike. So I think, like anything else, it starts small but … the opportunity that presents is unbelievable,” Houle says.

CN officials have said they believe the service ultimately can divert 350,000 truckloads annually, which would amount to two train daily train pairs. CN expects customers to move test loads before fully jumping on board.

I wish CP would start worrying about their local service and customers that rely on rail because there local service has all but disappeared

May we respectively suggest everyone is missing the larger point here. Mexico is one of our largest trading partners and all these two genius railroaders can manage is two trains per day in each direction. To quote an iconic commercial, “Where’s the beef?”

The Plain and Simple Truth is UP wants to Rule the Railroad Industry By Asking It’s Competitors to Join Forces But There are Advantages and Disadvantages It’s Not if you Win or Lose It’s How You Play the Game

And CPkc isn’t? Don’t tell that to Keith Creel or burst a blood vessel in his neck… Oh and by the way, they aren’t joining forces, they have merely created 3 lanes with no waiting since they don’t depend on anyone else’s railroads to get them where they need to go. Sounds pretty smart to me…

Notice something on the C-PACK map? The route from Detroit (therefore Eastern Canada) to Kansas City not only is indirect (and plows through Chicago), much of it is on trackage rights.

Same with a lot of the Texas traffic that is anywhere near Houston/Galveston. But then it appears that CPkc didn’t tell any of their customers that little problem…

Keith Creel says, ““We’re doing it at a truck-like speed. We’re beating what we advertised, and that train is 95%, 96% on time…” Yeah, well when it only has a couple dozen containers on it, It should be at those percentages.

But what happens when they get a bigger train that has to wait for a chance to get on those “trackage rights” lines and they are put at the bottom of the list? Are they going to have extra locomotives staged all along the right of ways and crews to try to make up time where they can or will they even be able to? When they tested this concept of single line handling, they had one engine and one well car with two containers on it as shown in an article in Trains Magazine. That’s like a truck pulling a 35′ van. That ought to be able to go about anywhere very quickly. But neither one gets the proposed and promised job done.

Creel has to get the trains through Chicago, depending in UP or EJ&E to expedite them or wait in traffic for an opening and the once he gets to Houston, he expects UP and BNSF to just get out of his way. Not happening.

If I were customer thinking about this service, I would have serious questions to ask about these two bottlenecks…

If you are connecting Chicago with Mexico, why do you need a cold storage facility in Kansas city? For when they sit for a week or two?

Wow. I did three loads of laundry today, but my Maytag didn’t generate as much spin as Keith Creel has demonstrated in this article.

SINGLE LINE SINGLE LINE SLINGLE LINE. That’s all anyone hears from this guy. What he doesn’t tout is CPKC’s SINGLE ROUTE, which is highly inferior to UP’s multiple routes between the Mexican border and Chicago. And that his SINGLE ROUTE through Texas is at the mercy of UP much of the way.

But the real fallacy of Creel’s blather is that he makes it sound like the efficiency of the single line is a constant, and that routes with multiple carriers will always be inherently inefficient without any chance of improvement. Actually, he’s got that backwards. It is CPKC which is locked in to their circuitous, hilly, inefficient single routing between the border and Chicago. It’s not likely they will ever have the resources to build another railroad that’s competitive. But there’s no reason that competitors can’t streamline their operation at interchange points if demand and the financial benefit so dictates. If this lane of service is as lucrative as Creel claims, such operational improvements will happen.

And if Creel is really interested in taking on the real competition, aka the trucking industry, why doesn’t he start a joint operation with UP at Laredo to create the most efficient routes on both sides of the border?

Rail freight traffic continues to be flat nationwide. But when it picks up and CPKC trains 180 and 181 began getting hammered on UP between Beaumont and Robstown, it will be interesting to see the response. After all, CPKC has made it clear that they need $54 million to run a second Amtrak train between Milwaukee and St. Paul (325 miles), but they don’t need to spend a dime to improve the 303 miles of track in Texas where they expect to operate 11 more trains daily on UP trackage rights.

Yes this is not single line.. More like single rate. Also they can’t compete between Eastern Canada and Mexico because of a lackluster network east of Chicago, and most Mexican origin containers don’t land in Chicago.. They want to land in Michigan and Ontario….

The excellent book ‘Set Up Running’ tells a Depression era story of, back when ICC mileage rates applied, the PRR ran a perishables train east from Chicago to Wilkes Barre, Pennsylvania, and interchange with the Central Railroad of New Jersey to save a few miles in cost. When that train arrived at interchange there was a hot locomotive and crew, swapped power and off they went. Why are we treating this like a new idea?!

Because, as Mr Meyer pointed out, PRR owned the route it was on. CPkc doesn’t. And as he said, unless they are willing to come up with a minimum of 54 MILLION (more like Billions) dollars to make it happen, it won’t.

The truth is, three single lines controlled by interested parties have a much better chance of doing this task than one which owns only part of it needed lines and most of the others run through bottlenecks. Doesn’t sound like a sound formula for long term success.

“We cannot let that train sit in Chicago, for example, for a week or two. “. Well, that’s heads-up Operations and Marketing!