CALGARY, Alberta – CPKC has landed a multi-year contract to handle Schneider National’s intermodal traffic between the U.S. and Mexico.

The announcement today – which comes just a week after the Canadian Pacific-Kansas City Southern combination became effective – backs up pre-merger projections that CPKC’s single-line service would enable it to compete in the Chicago-Mexico corridor that’s dominated by Union Pacific and BNSF Railway.

“The CPKC combination creates compelling new transportation solutions for Schneider’s current and future customers looking for more reliability and increased capacity in their supply chains,” CPKC CEO Keith Creel said in a statement. “Our team is eager to deliver truck-competitive services to Schneider on our newly created, cross-border single-line network from Mexico into the United States.”

In March, Creel told an investor conference that the first new service CPKC will launch is a cross-border intermodal train linking Chicago and Mexico City. It was expected to begin service in late April or early May.

“It is a natural fit to pair CPKC’s rail operating excellence and Schneider’s superior dray execution to provide unparalleled service,” Schneider CEO Mark Rourke said in a statement. “Our 30-plus years operating in Mexico and broad portfolio of services will bring an intermodal service offering into and out of Mexico that is comparable to the speed and efficiency of shipping over the road, but with the added benefit of sustainability.”

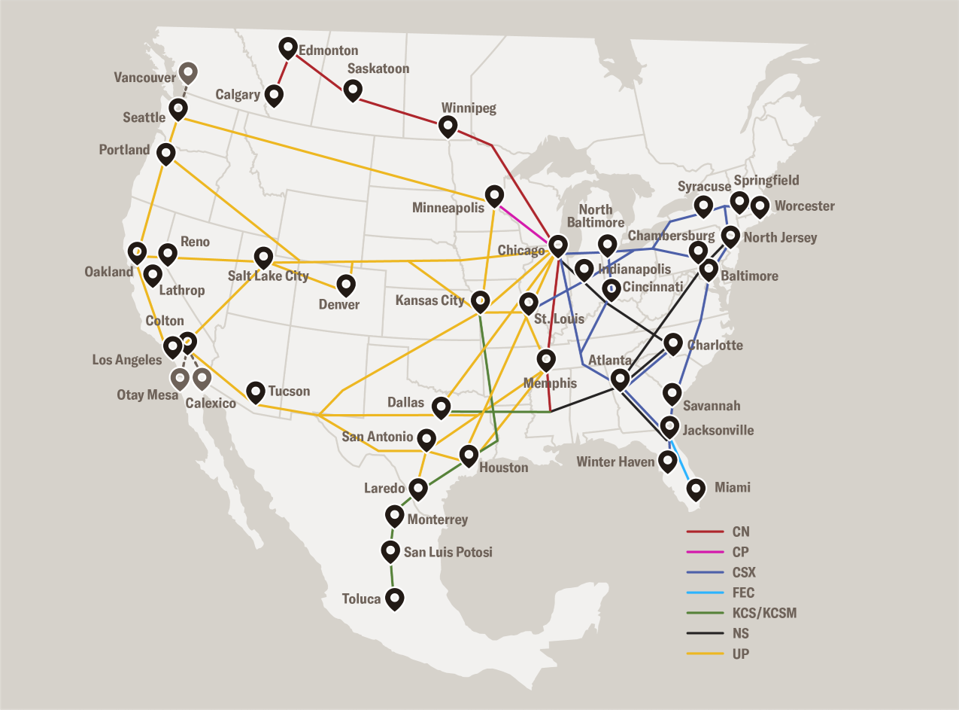

KCS already handled Schneider intermodal traffic on its network. Schneider on Jan. 1 shifted its western intermodal traffic to UP from BNSF. Schneider currently reaches the Laredo, Texas, border crossing via both UP and KCS, according to its current intermodal network map. Schneider relied on CP in the Chicago-Twin Cities lane.

Schneider and CPKC said the first single-line service between the Midwest and Mexico will improve the reliability of cross-border intermodal.

“A single-line move all the way has a lot of attraction because it’s under control of one railroad,” intermodal analyst Larry Gross says, even though the CPKC route is longer and has more curves and grades than UP and BNSF routes. “It matters a whole lot more about how consistent the service is than how fast it is.”

CPKC has said its transit time will be truck-competitive and that it expects to gain nearly 138,000 containers annually that currently move on other railroads in the north-south corridor.

“CPKC will shake things up and force everybody to raise their game,” Gross says. “It’s an opening salvo.”

CPKC’s International Railroad Bridge over the Rio Grande at Laredo offers an alternative to congested highway ports of entry. A second span to expand CPKC’s cross-border capacity is under construction and expected to be completed by the end of 2024.

About 16,000 trucks cross the border at Laredo every day compared to just a few hundred intermodal containers, which CPKC executives have said represents a major growth opportunity.

Vincent, the Rathole and CSX New England line were both cleared for stack trains a long time ago.

As far as this announcement, This is just another effort by CP to show they are a provider of this kind of traffic. KCS has been handling some of the cross border traffic for UP at Laredo as they already utilize track rights over UP to get to Laredo anyway. This was due to KCS’s purchase of Texas-Mexican several years ago as T-M already had trackage rights access over UP.

UP already servers the other five U.S./Mexico gateways, Calexico, Nogales, El Paso, Eagle Pass and Brownsville, and is the only rail provider to do so directly. The fact that the business CP is referring to is North-South Midwest traffic is no threat to UP’s business with Schneider which is generally East-West and the larger majority of Schneider’s business with UP anyway. The key will be after some time has passed to see if CPKC can continue to afford the low rates they offered Schneider as well as whether they will abandon the mexican port business once the new west coast (Canada) container terminal is completed.

On the Schneider map, I notice that there’s a line on the UP part showing a line from Salt Lake City to Denver. But the line that goes from SLC to Denver (the old Rio Grande line that includes the Moffat tunnel) has a couple of tunnels that aren’t tall enough for double stacked intermodal trains. Does Schneider and UP run single stacked intermodals on that line, because I have seen a few pictures of intermodals that were single stacked on the Moffat Line or is that line just in case there was a derailment on the UP’s original Overland line?

Up handles most of their stack train business via Wyoming over Sherman Hill. If you see singles cans on cars it is usually because their final destination is on CSX or NS lines where tunnel clearances are not substantial enough for two cans stacked on cars, like a lot of the “Rat Hole” line and also in New England.