WASHINGTON — Canadian Pacific Kansas City and CSX Transportation have detailed their plans to acquire Genesee & Wyoming short line Meridian & Bigbee in order to create a shortcut interchange route linking the Southeast and Mexico via Myrtlewood, Ala.

The deal, announced in June but outlined in a series of regulatory documents that appeared on the Surface Transportation Board website on Tuesday, involves several related transactions.

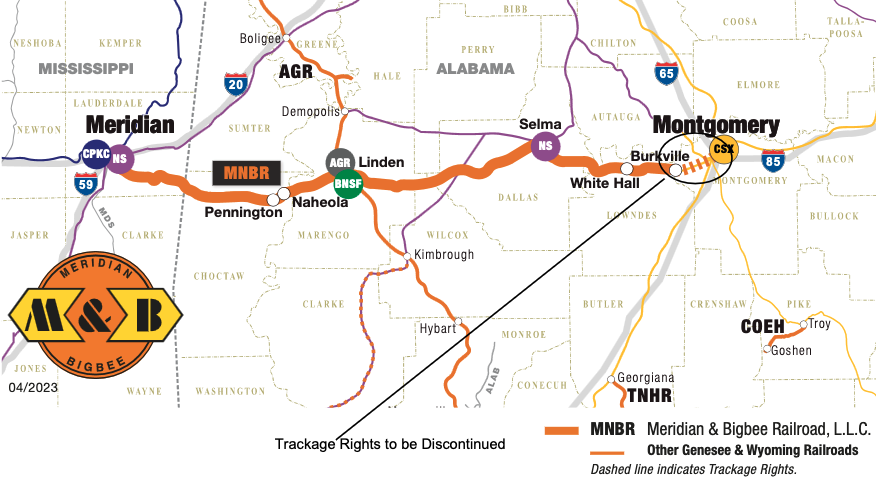

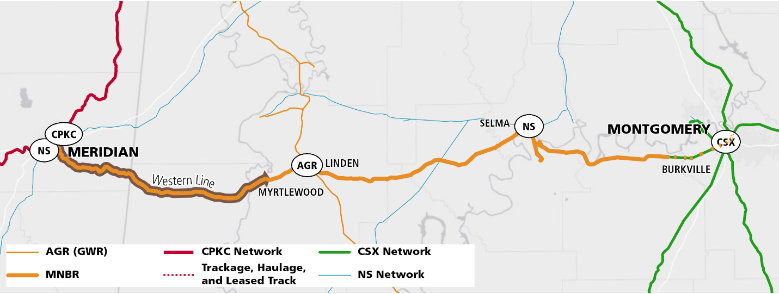

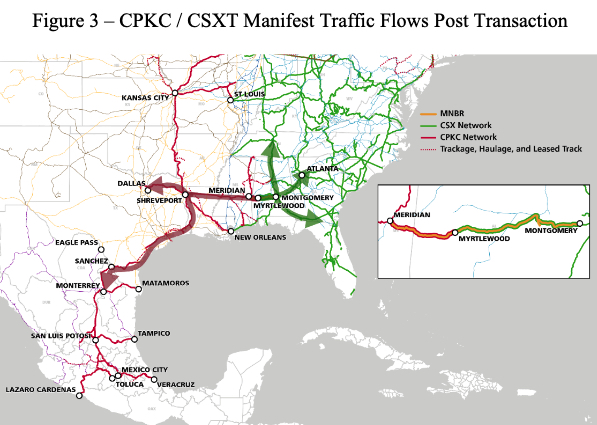

Meridian & Bigbee’s 168-mile route is the missing link between the CPKC system at Meridian, Miss., and the CSX network at Burkville, Ala., just west of Montgomery, Ala. The Meridian & Bigbee, or MNBR, owns the 50.4-mile route west of Myrtlewood and leases from CSX the 107 miles between Myrtlewood and Burkville. MNBR operates between Burkville and Montgomery via overhead trackage rights on CSX.

CPKC subsidiary Kansas City Southern will acquire the 50.4-mile segment of the MNBR between Meridian, Miss., and Myrtlewood, Ala., which it’s calling the Western Line. MNBR will continue to provide local service on the route after the transaction.

In a separate transaction, CSX will resume operations on its line between Myrtlewood and Burkville, Ala. — dubbed the Eastern Line — which has been leased to MNBR since 2003. As part of that transaction, MNBR will cease operations on the Eastern Line.

CSX will interchange with CPKC, MNBR, and its sister G&W short line, Alabama & Gulf Coast Railway, at Myrtlewood. The Alabama & Gulf Coast, meanwhile, will acquire 9.5 miles trackage rights over the Eastern Line between Linden, Ala., and Myrtlewood. The trackage rights will allow Alabama & Gulf Coast to interchange with MNBR, CSX, and CPKC at Myrtlewood.

Combined, the transactions will enable CPKC and CSX to make the investments necessary to create a Class I railroad freight corridor that will expand shipping options for intermodal, automotive, and other traffic.

“KCS is acquiring the Western Line in order to establish a direct, efficient interchange with CSXT at Myrtlewood, creating a new east-west Class I freight rail corridor linking CPKC-served markets in Mexico and the Southwestern United States with CSXT-served markets in the Southeastern United States and beyond,” CPKC said. “The new freight rail corridor will provide a shorter and more efficient route for existing CPKC-CSXT traffic and will provide a new, highly attractive option for new customers, thereby enhancing competition.”

As an end-to-end transaction, the acquisition won’t harm rail competition, CPKC says, and MNBR will continue to provide local service on the route under a new trackage-rights agreement.

“Thus, existing shippers on the Western Line will continue to enjoy the same rail service and options that they receive today, while shippers in CSXT-served and CPKC-served markets will benefit from the establishment of fast, reliable, and environmentally friendly premium rail service over the new Class I east-west freight rail corridor,” CPKC said.

CSX said the transaction is an end-to-end acquisition that will simply re-extend its system approximately 94 miles from Burkville to Myrtlewood.

CPKC and CSX are seeking STB approval of the separate deals as minor transactions. The STB must approve a minor transaction unless it finds that it would reduce competition, create a monopoly, or restrain trade – and if any anticompetitive impacts of the transaction would outweigh the public interest in meeting transportation needs.

The railroads requested a 210-day procedural schedule that would result in the deal becoming effective in May 2024.

Interchange impact

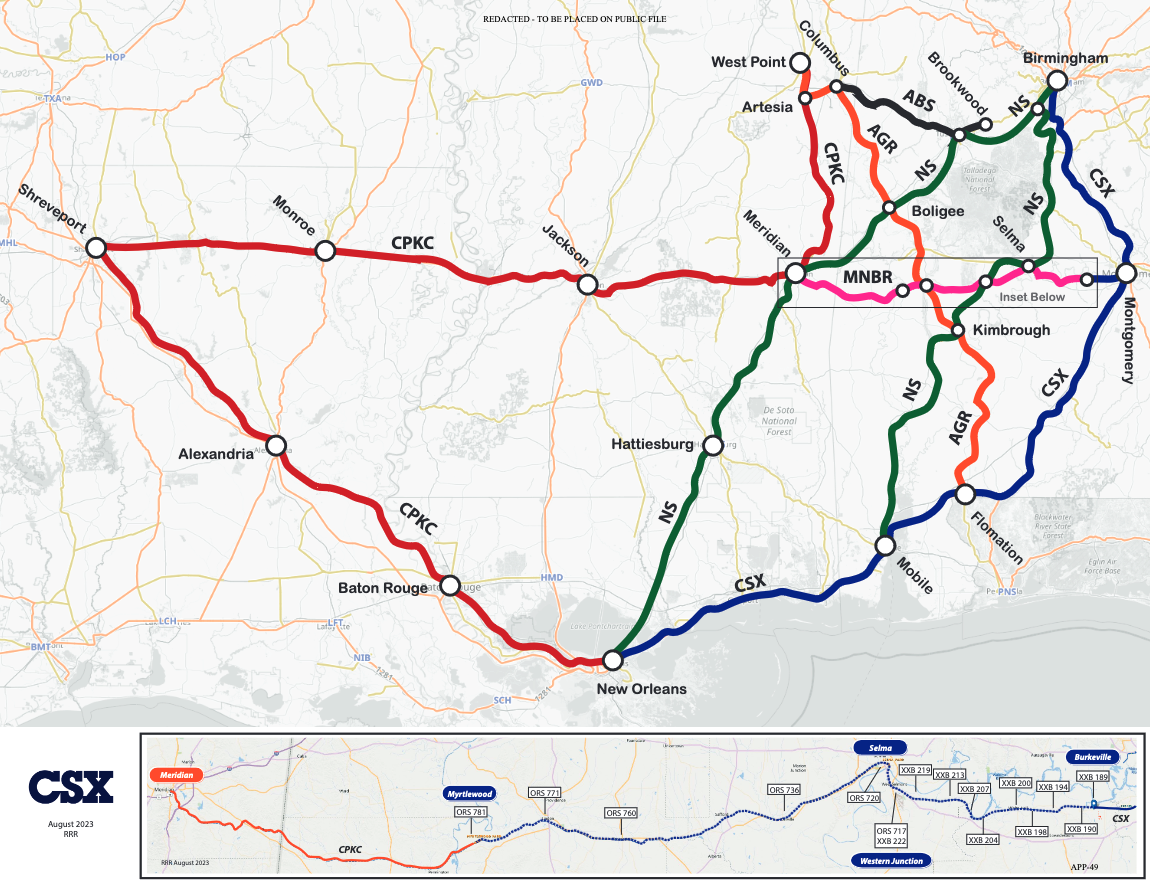

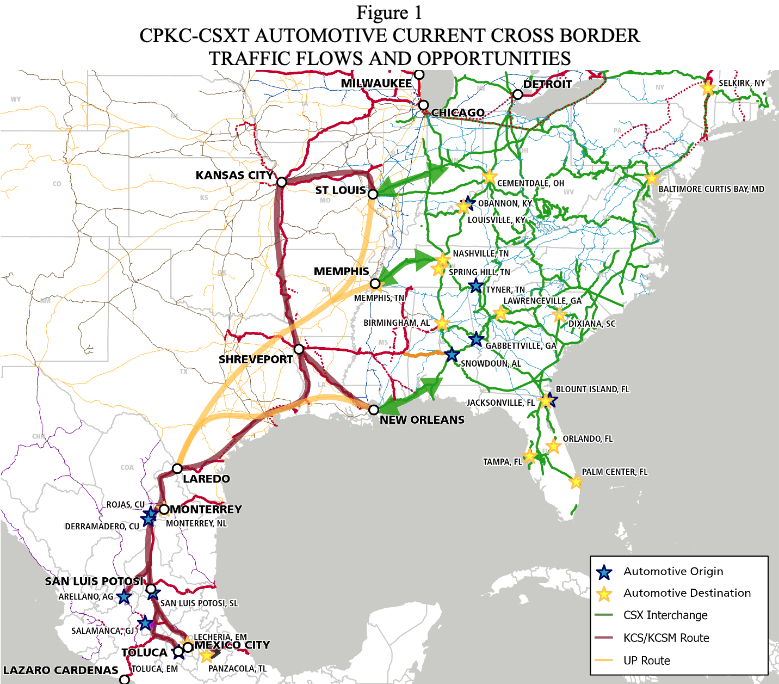

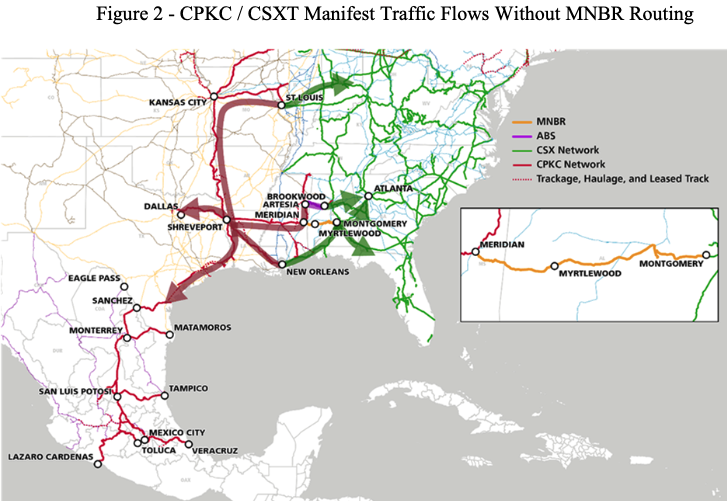

The new CPKC-CSX route via Myrtlewood is 158 miles shorter than using the New Orleans gateway, which is currently used for traffic moving between the Southeast and Mexico. The direct interchange at Myrtlewood also will eliminate the middleman role played by the New Orleans Public Belt Railway and Union Pacific, which bridges the CSX-CPKC traffic between New Orleans and Laredo, Texas.

The shorter Myrtlewood interchange also would siphon some traffic from the CPKC-CSX interchanges at Memphis (via UP) and East St. Louis, CPKC said.

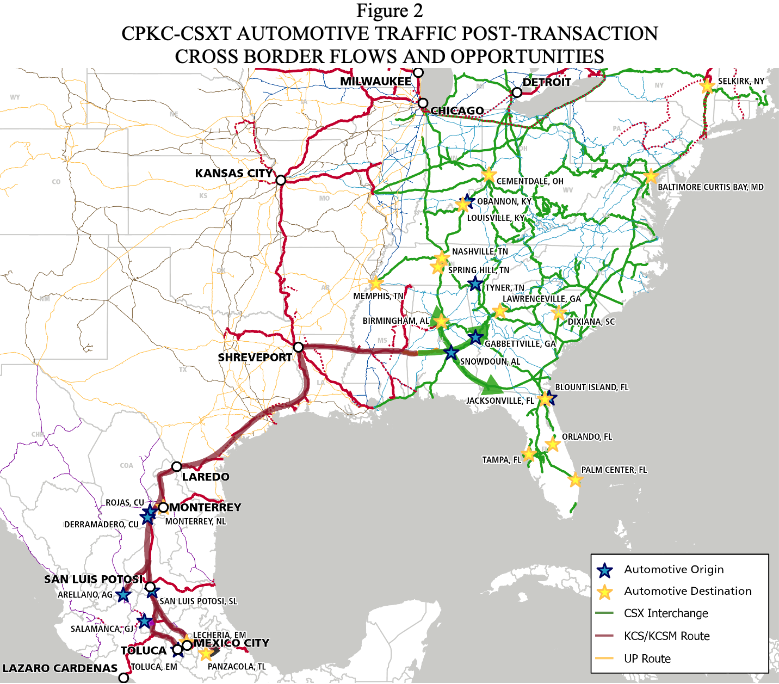

The new interchange will enable CPKC to compete for the new traffic that will be generated by several new auto plants that are scheduled to open over the next few years in the Southeast. Among them: a Ford Motor Co. plant in Stanton, Tenn.; a Hyundai plant in Bryan County, Ga; a Rivian plant in Commerce, Ga; and a VinFast plant in Moncure, N.C.

“While we cannot reliably estimate the volumes, establishing a premium train service product via Myrtlewood will put us in a strong position to compete for, and win, any such traffic,” wrote Jonathan Wahba, CPKC’s senior vice president of sales and marketing for bulk and intermodal.

The route also is a candidate for premium intermodal service linking the Southeast with Mexico. Schneider has said it will use the route for cross-border intermodal traffic.

“The most promising opportunities in that regard are automotive parts, particularly for companies that have plants in both Mexico and in the Southeastern United States,” Wahba said. “We also see opportunities to attract temperature controlled commodities, such as frozen poultry, that currently move from the Southeastern United States to Mexico in refrigerated trucks.”

New through-train pair

CPKC and CSX would use run-through power on their Myrtlewood interchange trains. “This will enable the delivering carrier’s crew to spot the train on the interchange track at Myrtlewood and step off the train, and the receiving carrier’s crew to step on, perform any required inspections and depart – an arrangement that is second only to the efficiency of a single-line move,” CPKC said.

CSX crews may have to spot and pull Meridian & Bigbee and Alabama & Gulf Coast traffic at Myrtlewood, but the interchange traffic would be pre-blocked to minimize yard activity and dwell.

CPKC and CSX plan to interchange one 70-car train per day in each direction and estimate that they will interchange 24,280 carloads per year by 2029 – primarily consisting of intermodal, automotive, and forest products.

“CPKC intends to grow the volumes served on this route; however, one train pair a day should have sufficient capacity to accommodate much of the growth in the first five to 10 years,” Raymond Elphick, CPKC’s vice president of service design and capacity management, wrote in the filing. “Eventually, CPKC hopes to add an additional regularly operated train pair, but the volumes to support a second train pair likely would not materialize for several years.”

Capital investment plans

CPKC plans to invest $46 million to bring the 50.4-mile Western Line up to 25 mph from the current 10 mph, add wayside detectors, and make track improvements that enable the line to be operated during the day when temperatures exceed 95 degrees. To avoid heat-related track issues, Meridian & Bigbee currently operates only at night when the daytime high is above 95.

CPKC also will invest $9 million in five years to improve 31 bridges on the line, most of which are more than 85 years old. CPKC intends to spend more than $100 million on the route’s bridges as part of a multi-year bridge rehabilitation and replacement program. In the future, CPKC may make the investments necessary to raise track speeds to 40 mph and ultimately to 60 mph if warranted.

CSX said it would make similar track, wayside detector, and bridge investments on the Eastern Line so that trains can initially operate at 25 mph.

CSX said it expects to reach an agreement with MNBR for certain maintenance work and the installation of AEI readers and wayside detectors prior to STB approval of the deal.

“This MNBR work will upgrade the Eastern Line to CSXT’s operating and safety standards, enabling CSXT to begin operating the line soon after the Board grants CSXT’s Application,” wrote Arthur Adams Jr., CSX’s senior vice president of sales and marketing. “The work will also benefit MNBR’s operation of the Eastern Line, which will continue into 2024.”

Once the deal is approved, CSX plans to make significant additional investments in the track, roadbed, bridges, warning devices, and wayside detectors on the Eastern Line.

“These investments will result in increasing safety, reliability, and speeds,” Adams wrote. “Based on an initial review of the facilities, CSXT plans to upgrade the rail, replace ties, and improve track ballast and track surface. CSXT has identified a number of bridges that require substantial upgrades. Additionally, CSXT intends to improve interchange tracks at Myrtlewood Yard to accommodate efficient interchange at that yard post-transaction.”

CPKC said it would hire a dozen employees to support its operation on the Western Line, while CSX said it would hire 37 employees on the Eastern Line.

Terms of the CPKC-G&W deal were redacted. But CPKC said that G&W will receive “equivalent value in the form of rights with respect to two CPKC operating properties in Canada, the 43-mile line on CPKC’s Hoadley Subdivision, south of Edmonton, and property in the Scotford area in the Alberta Industrial Heartland.”

CPKC’s Hoadley Sub — located midway between Calgary and Edmonton — runs between Jackson and Homeglen, Alberta.

CSX said it would pay G&W cash for the Eastern Line transaction. The amount was not disclosed.

MNBR and Norfolk Southern currently interchange at Selma, Ala. CSX said it would keep the NS interchange open on commercially reasonable terms.

NS blew it. They should have seen this coming (the purchase of the M & B). Probably distracted by the East Palestine derailment disaster.

CSX had no idea the success NS was going to see with the purchase of 30% of Meridian Speedway. Fast forward 20 years, CSX was trying to get a part of the action when CP was buying KCS.

NS should have leased the M & B. This would have frozen out, or limited, CSX as an interchange partner with KCS’s Meridian speedway.

Wouldn’t be surprised if CSX is behind CPKC limiting train length to 8,500 feet.

Have the objections of NS to all this “Speedway” work-around activity been dismissed?

“Union Pacific, which bridges the CSX-CPKC traffic between New Orleans and Laredo, Texas. ” So does this mean that the Maps are in error, as none make mention of CSX-CPKC traffic being routed over UP.

Correction to above – CPKC.

Although given the plans for interchange, it would not be surprising to see CN make another run at the former Gateway Western.

Also, UP will weigh in on track capacity through Houston and will likely want CPKC to fork over some cash for improvements to capacity through Houston.

The old B&O (CSX Illinois Sub) is already dead, for all intents and purposes. Small sections of rail have been removed in a few places. Truly sad, but that line became redundant in 1999 … the former Conrail St. Louis Line could handle 30-40 trains/day and the average daily count is far, far below that. I think it’s hovering around 10 west of St. Elmo, on a good day.

Yes, for tax purposes a section of rail was removed near O’Fallon on the Illinois Sub and the diamond at Shattuc is sitting nearby waiting to be re-installed. It was for sale during the great CSX route selloff, but they never moved on the offers.

The reason I say “another nail” is this sub used to see a lot of auto racks and parts coming across along with California fruit.

The more of the Mexican sourced traffic that moves east south of Memphis means less traffic in the St Louis gateway as the rest will go to Chicago for movement.

As for this sub, I think if CSX wanted to close the door on it they would have done so a long time ago. For now it seems to be in a deep freeze until the west coast perishables market comes back.

For this to be a through route, the gap between Decatur and Springfield would have to be filled. I doubt NS would willingly reinstate the trackage rights between those two points CSX gave up in the 80s or 90s.

What will happen to the CPKC line from Shreveport to New Orleans? CSX interchange at New Orleans currently supplies most of the traffic. Chemical business would remain between Baton Rouge and New Orleans. But CPKC could sell that trackage to CN.

I wouldn’t be surprised if CPKC finds new grain and chemical traffic from/to the combined system to take there.

I do wonder what this means for the future of the Gulf Coast Route from New Orleans to Montgomery. If CSX and CPKC follow through on upgrading the line to 40 mph, CSX could start shifting traffic off of the Gulf Coast Route to the Meridan & Bigbee.

CSX did ditch its Panhandle Route (which was operated as an extension of the Gulf Coast Route) selling it to the Florida Gulf & Atlantic in 2019. Maybe if the previous regime at CSX was still in charge, they would also consider ditching the Gulf Coast Route too after the Meridan & Bigbee is upgraded. I don’t know if the current people running CSX would want to do so though.

Thanks to TRAINS for providing accompanying maps with the article.

This is great news for our transportation network. Shreveport, La., has been the missing link between Atlanta and Dallas. Mr. Mike Haverty saw this corridor and envisioned the necessary moves to make it happen. An example of compromise that works for the better good.

I will assume this will probably kill the CPKC/Jersey County Illinois logistics hub project started by KCS. If auto parts are going by way of MBNR, no longer need to hub them at Jerseyville near the CSX East St Louis Gateway.

Also puts another nail in the CSX Illinois Sub as any leftover CPKC movements east via East St Louis will go to Avon and not Queensgate.

Seems to ensure that the former Gateway Western is permanently relegated to branchline status.

It is much less expensive for CN to upgrade a few dozen miles of line compared to several hundred from KC to St. Louis.

That could ultimately become another G&W or Watco or whomever shortline operation.

Paul, Last time I drove up there the line between the Jacksonville Branch and the switch at Curran (West Springfield) was looking somewhat forlorn. If CN pulls up the Gilman Sub back to Lake Fork (due to closure of the power plant at Kincaid) that will leave no one to interchange with CPKC except the CIM, which is pretty much a coal hauler.

As long as CN keeps the Gilman, CPKC will keep the Springfield Sub. Once CN abandons in Springfield, then I wouldnt be shocked if CPKC pulls it up back to the Jacksonville switch and turn Curran over to CIM or some other short line.