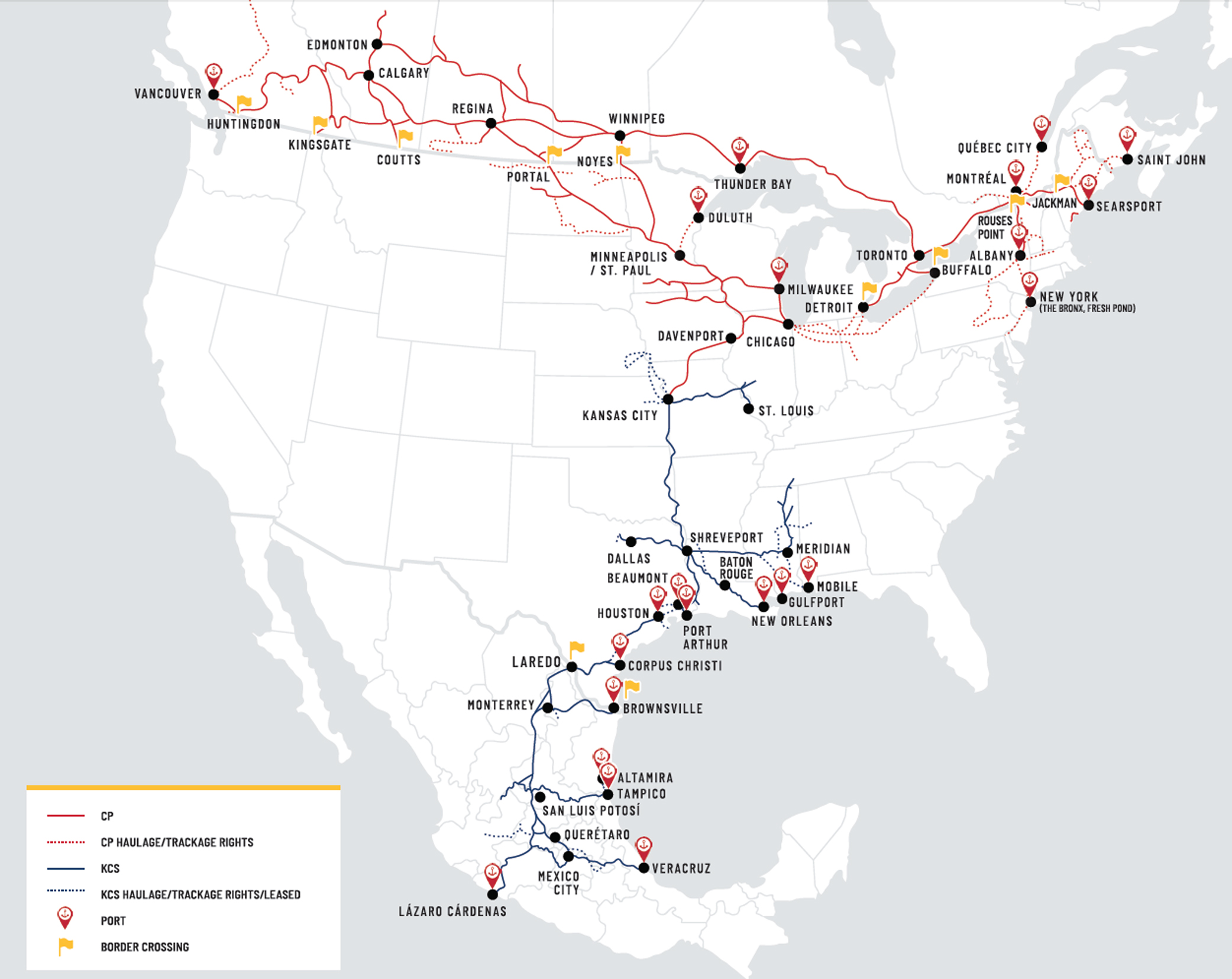

CALGARY, Alberta — Canadian Pacific and Kansas City Southern executives say combining their railroads into the first system linking Canada, the U.S., and Mexico will generate significant traffic growth across all commodities.

CALGARY, Alberta — Canadian Pacific and Kansas City Southern executives say combining their railroads into the first system linking Canada, the U.S., and Mexico will generate significant traffic growth across all commodities.

“What a historic day,” CP CEO Keith Creel said during a Sunday afternoon investor webcast where executives touted the $29 billion deal to create Canadian Pacific Kansas City, a combination of the two smallest but fastest-growing Class I railroads.

“This combination is not about cuts, it’s not about line rationalization, it’s not about cutting heads,” Creel says. “It’s all about growth.”

The merger will allow the new 19,200-mile railroad to connect six of the seven largest metropolitan areas in North America, boost rail competition, divert freight off the highway, and benefit shippers, investors, employees, and the environment, executives say.

“This is truly a perfect fit,” CP Chief Marketing Officer John Brooks says, noting that the merger combines CP’s traffic origins in Canada and the Midwest with destinations on the KCS system in the U.S. and Mexico, including ports on the Gulf of Mexico.

“We see growth opportunities across all of our lines of business,” Brooks says, from grain and agricultural commodities to forest products, automotive, merchandise, and energy, chemicals, and plastics business.

But Brooks was most bullish on the potential of launching the first single-line intermodal service linking Mexico and Texas with the Upper Midwest and Canada. “There’s just a massive amount of freight that should be moving on the rail network,” he says.

Even gaining a fraction of that traffic from the highway will be enough to move the volume and revenue needle at CPKC, Brooks says.

The intermodal service will compete against existing interline service offered by both BNSF and Union Pacific but is really meant to take trucks off the highway, Brooks says.

Mexico continues to benefit from foreign investment in manufacturing, particularly by automakers. KCS CEO Pat Ottensmeyer expects the trend to continue thanks to the renewal of the North American free trade pact as well as manufacturers’ desire to nearshore production as part of an effort to shorten supply chains that are overly dependent on China and Asia.

“It just feels like this is the right time and the right circumstances to put these two companies together,” Ottensmeyer says.

The railroads see $780 million in annual merger benefits developing by 2025. Some $600 million of that will come from growth, with $180 million flowing from cost savings and efficiency gains. While some rationalization of duplicate functions is envisioned, by 2025 the combined company will be adding employees to handle volume growth.

To handle new traffic, CPKC will spend $50 million to add and extend passing sidings, as well as to install centralized traffic control on CP’s underutilized main line to Kansas City, Mo., which is the only place that KCS and CP connect.

Shippers will benefit from faster and more reliable single-line service, Creel says.

The combined company will share the same strong culture that’s focused on growth and safety, Ottensmeyer says.

Creel said he has complete confidence that the merger will receive approval from the U.S. Surface Transportation Board. KCS was granted an exemption from the more strict merger rules the STB adopted in 2001 after disruptive mergers in the 1990s that led to the creation of four big U.S. Class I systems, with BNSF Railway and Union Pacific dominating the West and CSX Transportation and Norfolk Southern blanketing the East.

The CP-KCS combination is so compelling, Creel says, that it would gain approval even under the STB’s newer, more rigorous rules that cover reviews of merger applications. He said he could not contemplate the STB rejecting the deal.

Shippers have been skeptical of Class I railroad mergers and largely lined up against the ill-fated CP-NS merger that was proposed in 2015-16. But Creel and Ottensmeyer say the CP-KCS combination is far different than prior mergers, particularly since it does not involve overlapping routes and not a single shipper will lose competitive options that they enjoy today.

The combination does not face a regulatory review in Canada. KCS has a concession to operate KCS de Mexico through 2047, which is renewable for another 50 years. The Mexican antitrust commission will review the transaction but KCS Chief Financial Officer Mike Upchurch says that’s a low hurdle since CP does not currently operate in Mexico or serve any of the border crossings.

Creel will serve as chief executive of the new company. KCS will be placed into an independent voting trust while the merger is under review. Former KCS CEO David Starling will serve as trustee, while the KCS management team will stay on at least until the merger is approved.

CP is paying a 23% premium to the KCS shareholders, based on the closing price of KCS stock on Friday.

See another goodie Cheapy Rail got on the cheap from the Milwaukee.

Mr. Winegar, what kind of shape is the railroad in between La Crescent/River Jct. and Savanna?

The Marquette Sub mainline between Sabula and La Crescent is in excellent shape. But with the increased traffic that’s sure to come, you will need some more sidings; most likely at Brownsville (MN) that’s been has been planned for a while now. I would think that another key location for a siding may very well just north of Bellevue, IA. Additionally, I would expect CTC to be installed as well.

It’s about time CP’s Davenport-Kansas City line got some love. Originally built by the Milwaukee Road, and shared with the UP’s ex-Rock Island Spine Line in Missouri, it’s got some challenging curves and grades. CTC will help, but it’s going to require mid-train and trailing distributed power to move long, heavy freights.