KANSAS CITY, Mo. — The four-month battle for Kansas City Southern is officially over.

KCS and Canadian National ripped up their $33.6 billion merger agreement today, 15 days after the Surface Transportation Board denied CN’s request to place KCS into an independent voting trust.

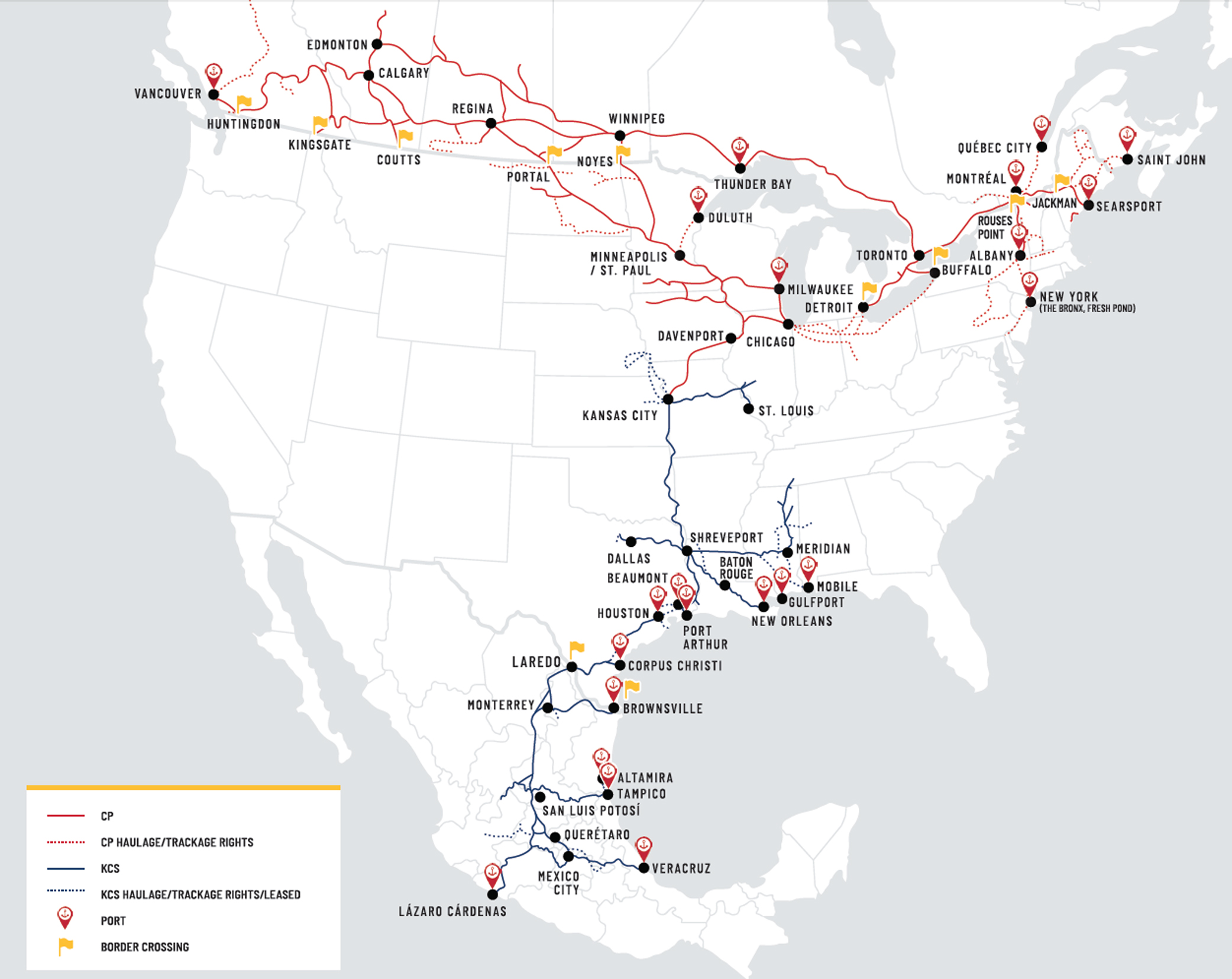

Canadian Pacific and KCS, with voting trust approval already in hand, have signed a merger agreement and will seek STB review of their $31 billion deal to create the first railroad linking Canada, the U.S., and Mexico.

“Our path to this historic agreement only reinforces our conviction in this once-in-a-lifetime partnership,” said CP CEO Keith Creel said in a statement. “We are excited to get to work bringing these two railroads together. By combining, we will unlock the full potential of our networks and our people while providing industry-best service for our customers. This perfect end-to-end combination creates the first U.S.-Mexico-Canada rail network with new single-line offerings that will deliver dramatically expanded market reach for CP and KCS customers, provide new competitive transportation options, and support North American economic growth.”

Kansas City Southern CEO Patrick J. Ottensmeyer said, “We are glad to be partnering with CP to create a railroad that is able to compete by providing the best value for the transportation dollar. The CP-KCS combination will not only benefit customers, labor partners, and shareholders through new, single-line transportation services, attractive synergies and complementary routes, it will also benefit KCS and our employees by enabling us to become part of a growing and truly North American continental enterprise.”

The KCS board on Sunday determined that CP’s lower bid was superior to CN’s because it was all but certain that a CN-KCS merger could not gain regulatory approval under the STB’s untested and tougher 2001 merger review rules. And without a voting trust, KCS shareholders would have had to wait through the lengthy STB review process before receiving their cash and CN shares.

The KCS board on Sunday determined that CP’s lower bid was superior to CN’s because it was all but certain that a CN-KCS merger could not gain regulatory approval under the STB’s untested and tougher 2001 merger review rules. And without a voting trust, KCS shareholders would have had to wait through the lengthy STB review process before receiving their cash and CN shares.

Under the terms of its merger agreement, CN had until Friday to sweeten its bid. CN declined to do so, and KCS today terminated the deal.

CN noted that since it launched pursuit of KCS in April there have been significant changes to the U.S. regulatory landscape that made completing any Class I merger much less certain, including President Joseph Biden’s July 9 executive order that focused on increasing competition across the economy.

“While we are disappointed that we will not be able to deliver the many compelling benefits of this transaction to our stakeholders, the decision to bid for KCS was a bold and strategic move that still resulted in positive outcomes for CN,” CN CEO JJ Ruest said in a statement.

“We believe that the decision not to pursue our proposed merger with KCS any further is the right decision for CN as responsible fiduciaries of our shareholders’ interests,” Ruest said. “CN will continue to pursue profitable growth and opportunities for excellence as a leading Class I railroad, and we look forward to outlining more details on our strategic, operational and financial priorities in the near future.”

Because of the way their deal was unwound, CN will not be on the hook for merger breakup fees. KCS will pay CN a $700 million cash termination fee, as well as a $700 million cash “CP termination fee refund” provided for in the CN merger agreement. CP, which received a $700 million breakup fee from KCS in May, will reimburse KCS for the payments to CN.

CP and KCS announced a friendly $29 billion merger deal in March, but KCS in May accepted CN’s higher, unsolicited bid. That set off a war of words between the rival Canadian railways, with CN and CP arguing that they were the best partner for KCS.

CP and KCS expect to file their merger application with the STB in October. The merger will be judged under the board’s less onerous pre-2001 merger rules. The STB review is expected to take about a year.

Creel will lead the combined company, which will be named Canadian Pacific Kansas City, or CPKC. Measured by revenue, CPKC will be the smallest of the Class I systems. But with a network spanning nearly 20,000 miles the combined railroad will be roughly the size of CN.

Calgary will be the global headquarters, and Kansas City will be the U.S. headquarters. The Mexico headquarters will remain in Mexico City and Monterrey. CP’s current U.S. headquarters in Minneapolis-St. Paul will remain “an important base of operations,” CP says.

— Updated at 8:55 a.m. CDT with CP, KCS statements, additional details

1. I seem to remember that Gateway Western (now KCS’s line to St. Louis and Springfield) had trackage rights to Chicago from Springfield. Did KCS inherit those rights? (Of course, it’s CN north of Joliet.)

2. Rights on NS Detroit to Springfield would probably not be a shortcut from Chicago because NS itself uses rights on CN from Chicago to Gibson City, and CN would probably object to extending those rights to CP.

I think I had a 3., but now I forgot what it was.

I saw where someone suggested (not sure if it was on this site or elsewhere) that they could bypass much of the congestion of Chicago with rights on Iowa Interstate, but again, those rights are not Iowa’s to give. Don’t know what CSX would say about it, not to mention Metra. And it wouldn’t really help that much in Chicago.

Someone else suggested they buy the TP&W to bypass Chicago, but why? They would still need NS on the east end, and either NS (and probably the Bloomer) or a convoluted route over IAIS at the west end.

When Santa fe Southern Pacific had to sell SP they stripped out everything but the railroad. (Also the Santa Fe CEO was fired after the failure.)

The ICC may have done Santa Fe and SP a favor had they denied the voting trust. As it was, the SF & SP corporations merged, put the SP in a voting trust, and then had to sell the SP when the merger was denied. Maybe if SPSF had been willing to agree to a lot of conditions, it could have been salvaged.

There are several reasons they are being judged under different rules.

1. CP/KCS will still be the smallest Class I. It is unlikely that CP/KCS will lead other RRs to merge, which the STB wants to avoid.

2. CP/KCS only connect at Kansas City. There are no parallel lines and no competition is lost.

3. CP/KCS only connect at Kansas City. There will likely be no major operational changes that might result in a meltdown.

This is not to say that a CN/KCS combination couldn’t be approved. It does have some advantages such as more direct routes. However, the STB would want to review it more thoroughly to promote competition. Approval, if possible. would likely require significant concessions to promote competition and KCS stockholders would have to wait for their money. CN & KCS might still be trying to get it approved if CP didn’t have its offer waiting in the wings.

The UP and SP merged in 1996 and a service meltdown ensued, with plugged yards and parked trains all over Texas and beyond. In 1997 NS and CSX engaged in a bidding war over Conrail, ended up splitting it 58/42 and another meltdown occurred. The merger rules were put in place by 2001 in order to prevent any further meltdowns of large systems. I guess CP + KCS is a small enough combination that it falls under the pre-2001 rules, whereas CN + KCS would have been too large. [Anyone correct me where I’m wrong.]

Why are the CN and CP mergers being judged under different merger rules? Pre-2001 vs. 2001?

I am pretty sure those upgrades will be coming.

There is also a weak link from LaCrescent MN to KC the old I&M Railink route. Single track, slow running it will need upgrades.

Canadian Pacific & Atlantic (CPA). Yes, drops the Southern and therefore its tie to KCS but it is truly a transcontinental railway that touches both Pacific and Atlantic. or maybe

Canadian Southern & Pacific (CSP)

Name that works for me: Canadian Pacific.

Canadian Southern. Would have worked when they tried to merge with NS also.

The name doesn’t impress. Canadian Pacific Kansas City? That name is both clunky and it sounds like KC is as far as it goes and doesn’t provide the marketing handle that emphasizes the new railroads reach. Why not Canadian Pacific Southern (CPS) or Canadian Pacific & Gulf (as in Gulf of Mexico) (CPG). Actually I prefer the second one, sounds better and brings back memories of it’s now rival CN route when it was Illinois Central Gulf (after the IC & GMO merger in 1972).

Agreed. Canadian Pacific & Kansas City Southern flows better and hints at service beyond KC. You could also have Canada, KC and Southern. There have got to be a lot more better options than what they chose.

CN will still run circles around CPKC due to its superior network.

Once they close the gap between Detroit and St Louis (Springfield IL actually) they will do just fine.

Agree but Is it even possible for the that gap to be closed? In terms of existing rail line still there, and who owns it? Clueless so hoping someone can fill in some history.

..

Somehow filling in the gap southward between St. Louis to Meridian would make for an impressive network by having alternate north south corridors that CN-KCS proposal offered.

Re: the Detroit – St Louis gap — The old Michigan Line is a pretty straight run from Porter( east of Chicago ) to Detroit. Amtrak owns it or most of it now. That was a double main in its day — single now but well maintained on the parts that I see.

Amtrak is not at all likely to grant rights on the Michigan Central. They have been spending lots and lots of money to upgrade it for 110 mph passenger service and won’t want freight trains pounding it to death. I’m sure they would be quite happy for NS to give up the local freight service on it.

Please elaborate on how CPKC will “close the gap” between Detroit and Springfield. The only real way is trackage rights on NS (ex-Wabash). Sure, CN has a route, too, via Harvey (ex-IC/GTW), but somehow I don’t think they would be too receptive.

CP getting KCS will preserve the CP north of Kansas City and the KCS south; both lines would’ve been in jeopardy had CN and KCS merged. But the CP line is still the worst remaining railroad from Chicago to Kansas City, and KCS’s ex-GM&O route from Kansas City to Madison/East St. Louis is just a very long branch line.

I can’t see where CPKC will be stealing much business from UP and even BNSF, because they don’t HAVE to route everything through Houston like KCS does (running on UP).

Yes I’m curious to how they will close this gap.. Not to mention you miss a key origin point of Louisville, KY. which produces significant amounts of autoparts for the Big 3 south of the border..

Now. They could make an agreement with UP in the Laredo-Beaumont section for track and capacity improvements. In exchange for rights to Springfield, IL from Shreveport, LA up the old Cotton Belt. I don’t think NS would have a problem granting CP rights up the Wabash to Detroit.

CPKC has trackage rights on the NS Chicago Line from Detroit down to Butler Indiana, then west to Chicago.

CPKC has trackage rights on CSX from Chicago all the way to Buffalo NY via Cleveland.

CPKC has trackage rights from Chicago to Fort Wayne, Indiana and on to Lima Ohio on the CFE (Chicago, Fort Wayne & Eastern)

To reach Bensenville Yard, they would have to exercise their rights over Indiana Harbor Belt (IHB) or BRC which is very slow going and congested.

If they want to route auto parts from Mexico to Canadian auto factories without having to navigate the mess in Chicago, they would have to extend their rights on NS from Butler, Indiana to Springfield, Illinois. But I find this difficult because NS carries a lot of parts to Detroit from KC using the former Wabash. So it would have to be some kind of JV like KCS has with NS on the Meridan Racetrack.

The TPW, IAIS, NS Kankakee Route, UP’s former C&EI to St Louis or UP’s former CNW Nelson Line to Barr all require help from NS or a Chicago passage to get to it and they are terribly indirect.

All things considered look for a CPKC-NS agreement on the former Wabash.