CHICAGO — Canadian National, which led the big Class I railroads in volume growth over the past decade, expects to keep it up over the next three years.

CN believes it will add as many as 900,000 annual new carloads and intermodal containers to its system by 2026, which translates into 5% volume growth per year. “We have a network that’s geared for growth, a network that’s also able to grow and add capacity,” Chief Marketing Officer Doug MacDonald said during CN’s investor day on Wednesday.

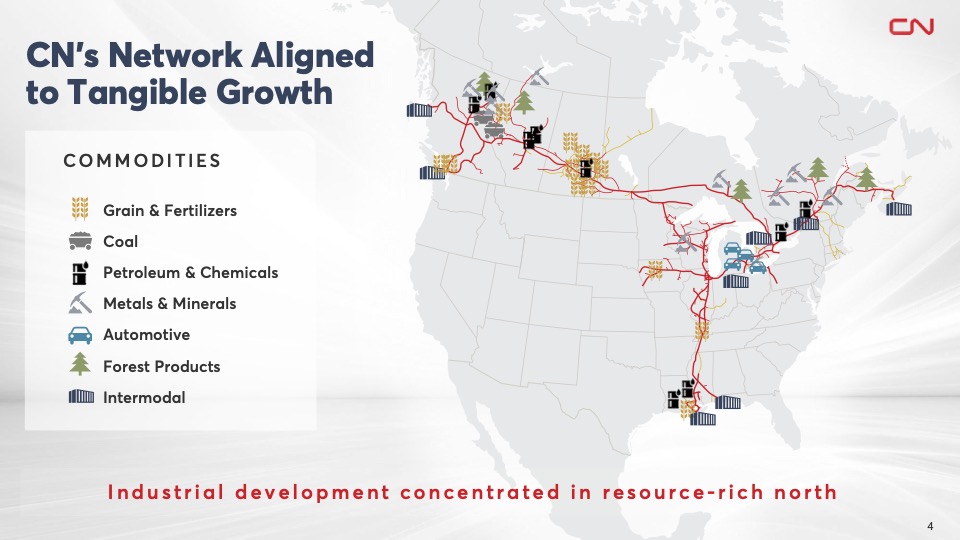

CN expects growth to come from ports it serves in British Columbia, Atlantic Canada, and the Gulf Coast, as well as from multiple new projects on the northern tier of its system.

“The one thing I really want to highlight is our northern network. When you talk to the operations team they’re going to say, ‘Man it sucks operating in the north, especially in the winter,’” MacDonald says. “But what you’re going to see is that’s where all the development is.”

Northeastern British Columbia is experiencing a rebound in forest products, mining, and natural gas drilling that will account for 80,000 to 90,000 new carloads annually over the next three years. Mining includes copper, zinc, ores, and metallurgical coal.

CN has 17 different projects in the works with 17 different customers in the area. “There’s potential to double the volume in this region,” says Kelly Levis, vice president of industrial products.

Fort St. John will become a rail hub for products moving in and out of the northeast part of the province. CN is upgrading a portion of the Chetwynd and Fort St. John subdivisions, the former BC Rail line that runs north from Prince George to Fort Nelson, to handle the new traffic.

“The best way I can describe this line is it truly is a diamond in the rough, one we’ve started to polish just a little bit and are starting to see some shine on,” says James Thompson, vice president of transportation for CN’s Western Region.

Prior to 2018, CN hauled fewer than 4,000 carloads on the line. CN has installed new ties and rail to boost track speeds over the past few years and will add a pair of passing sidings over the next two years.

In the Prairies, CN expects its bulk business – including grain and potash – to grow by 80,000 to 90,000 carloads over the next three years. The transition to renewable energy, including biofuels, will add up to 75,000 carloads over the next three years as CN moves canola and soybeans to processing plants, then hauls the plant oils to refineries, and finally moves refined products to customer locations, particularly in Ontario.

In the Alberta Industrial Heartland north of Edmonton, CN and Keyera are partnering on a clean energy distribution center that can handle six inbound and outbound unit trains per day for export of natural gas liquids to Asia via Prince Rupert. The carload growth potential from this project and other customers in the area will add up to 45,000 annual carloads.

A fuel distribution center is under construction at CN’s MacMillan Yard outside of Toronto that will handle up to 20,000 annual carloads of ethanol, renewable diesel fuel, and jet fuel.

New supply chains are springing up to support electric vehicle production, including a CN-served lithium mine in Northern Quebec that will ship its first loads by the end of June. CN also expects to handle shipments of batteries from battery plants to assembly plants, new vehicles out of the plants, as well as spent batteries bound for recycling. In all, this should add up to 55,000 carloads per year.

CN also expects to see growth in its biggest traffic segment: International intermodal, which accounts for 20% of the railway’s revenue.

The crown jewels, MacDonald says, are the ports of Prince Rupert, B.C., and Halifax, Nova Scotia, both of which are sole-served by CN and have room to expand. “You’ll see great growth coming out of those, I think, for years and years to come,” MacDonald says.

But CN also expects expansion projects at other ports, including Vancouver; Montreal; Saint John, New Brunswick; Mobile, Ala., and New Orleans, to drive international intermodal growth.

In all, CN expects to see growth of 450,000 international containers annually over the next three years. CN is expanding its inland terminals in Toronto and Chicago, and has room to expand in Montreal, to handle the new volume.

CN’s new partnership with Union Pacific and Ferromex to connect Detroit and Canada to Mexico is expected to add up to 70,000 domestic containers annually. The service will launch on May 15 and targets freight that’s currently moving on the highway.

Crowley Services announced a new Gulf of Mexico shipping partnership with CN this week that will handle containers between the Port of Mobile, Ala., and Tuxpan, Mexico. The weekly service, which can handle 1,000 twenty-foot equivalents per vessel, plus 200 refrigerated containers, will begin in September.

It’s nice to hear about a railroad talking about expanded facilities to help grow traffic over its tracks. If they follow through with the expanded facilities and provide good customer service there is no reason for them not to be sucessful. Maybe this will also show the Wall Street investors that investment in the railroad can be brought down to the bottom line and increase value of their investment.