A Kansas City Southern intermodal train heads for the Union Pacific Brownsville Subdivision at Robstown, Texas, in November 2017. Bill Stephens

A Kansas City Southern intermodal train heads for the Union Pacific Brownsville Subdivision at Robstown, Texas, in November 2017. Bill Stephens

WASHINGTON – Projected traffic increases from the Canadian Pacific-Kansas City Southern merger will put the critical Houston terminal into gridlock, BNSF Railway has warned federal regulators this week, citing a new analysis.

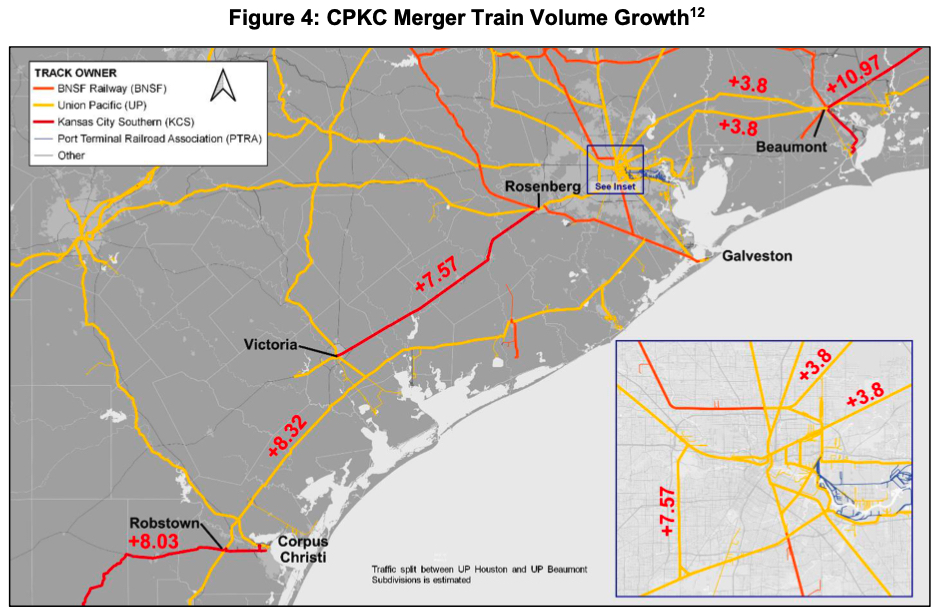

CP and KCS expect to run eight additional trains per day through Houston, thanks to new single-line service they’ll offer if their merger is approved. But the railroads have not proposed capacity expansion projects on KCS trackage-rights routes across South Texas, which are part of its international corridor between Beaumont and the Mexican border at Laredo.

“The CPKC operating plan train volumes, train lengths, and available siding lengths are incompatible. Without any additional infrastructure, the train sizes stated by CPKC would result in gridlock,” wrote Mark Dingler of HNTB Corp., who conducted a Rail Traffic Controller study for BNSF.

BNSF’s comments were among those filed on July 12, the deadline for interested parties to chime in on so-called responsive applications and other requests that ask regulators to impose various conditions on the proposed CP-KCS merger.

“Given the history of merger-caused traffic disruptions in the Houston area in past mergers and the sharp increases in traffic projected to move through Houston by Applicants, it is astonishing, and very troubling, that Applicants have identified no capacity additions in the Texas Gulf region that will be needed to handle the new merger traffic,” BNSF told the board. “Indeed, Applicants have not even formally studied the issue.”

Houston was ground zero for Union Pacific’s 1997-98 meltdown following its acquisition of Southern Pacific.

BNSF repeated its call for the STB to prohibit Canadian Pacific Kansas City from running more traffic through Houston until it funds and installs necessary capacity in Houston and elsewhere in Texas on trackage-rights routes, including the Neches River Bridge in Beaumont.

CP says concerns about Houston capacity have no merit.

“Even though CPKC will have no interest in overburdening this infrastructure, and thereby interfering with its own efforts to attract traffic moving via other rail routes today, UP and BNSF theorize that additional CPKC trains will be the straws that break the camel’s back,” CP wrote in its filing to the board. “This is nonsense. The Houston Terminal has extensive available capacity, provided it is managed efficiently, and extensive additional capacity is in the pipeline as a result of projects UP has underway today.”

CP says that capacity projects in Houston since the UP-SP merger have improved the terminal. “Unlike many rail terminals, Houston is blessed with multiple alternative through routes, all with multiple (double or triple) tracks,” CP wrote.

CP also noted that even with traffic increases it will remain a minority user of the Houston terminal, which is dominated by UP and BNSF. Their trains enter and exit yards; KCS trains pass through the terminal without switching.

J.B. Hunt seeks protections to reach Mexico

Among the other filings to the STB were the first comments from intermodal shipper J.B. Hunt, which echoed concerns raised by Class I railroads regarding the Laredo gateway, the busiest rail border crossing in North America.

J.B. Hunt, like the railroads, urged the STB to impose protections on the Laredo gateway as part of any approval of the CP-KCS merger.

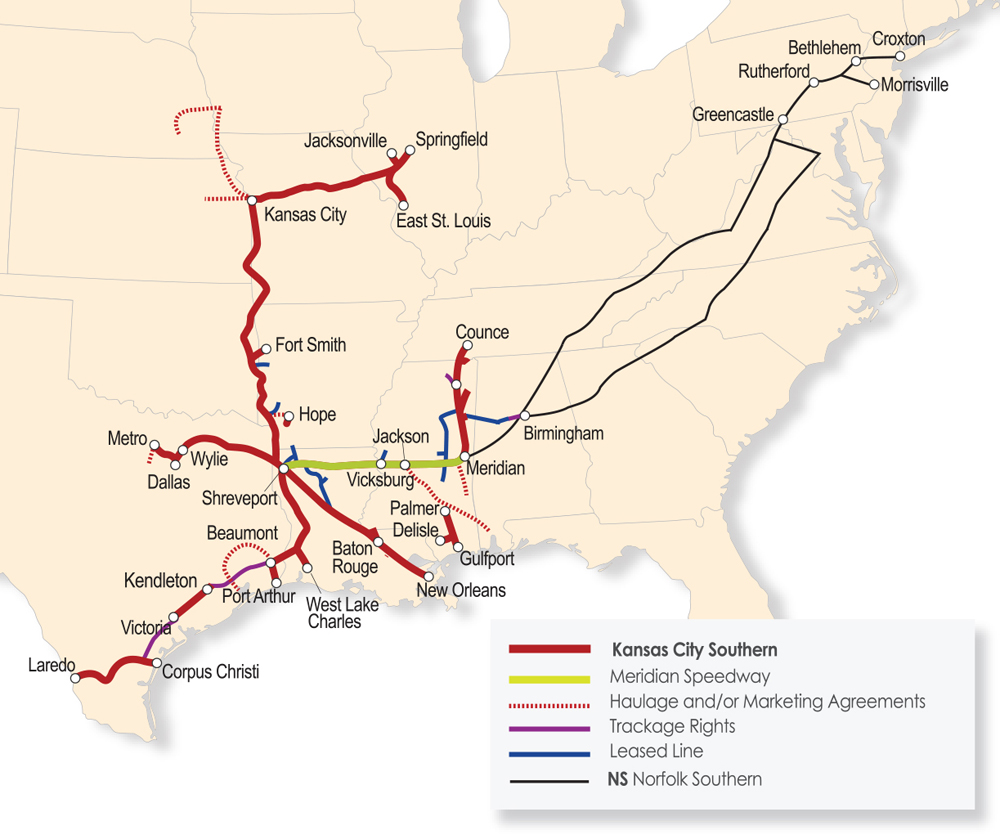

J.B. Hunt’s traffic to and from Mexico moves via BNSF Railway, KCS, and KCS de Mexico under an interline service agreement that dates to 2016. About 85% of Hunt’s cross-border traffic originates in Mexico, with Chicago being the largest single destination.

KCS and KCSM have had an incentive to cooperate with BNSF and J.B. Hunt because they can’t reach Chicago without interchange. But J.B. Hunt fears that cooperation will vanish under a CPKC merger, because the combined railroads will aim to divert intermodal shipments to their new single-line service between Mexico and Chicago.

BNSF has talked with KCS about extending the interline service agreement so that J.B. Hunt can continue to compete effectively for cross-border traffic after the merger. No deal has been reached, Hunt says, aside from a short-term extension of the interline service agreement. Separately, Hunt also was unable to reach an agreement with CP and KCS about maintaining the viability of its service to Mexico via BNSF.

CP and KCS have promised to keep all gateways open, both physically and commercially. But J.B. Hunt has asked the STB to condition its approval of the merger on protecting the Laredo gateway.

“In order to effectively preserve existing rail-to-rail competition for cross-border Mexican traffic through the Laredo Gateway there must be an enforceable mechanism for establishing an actual, competitive proportional rate for the movements by the merged CPKC in Mexico and to and from Robstown that would be part of through rates offered by other Class I rail carriers,” J.B. Hunt told the board.

The issue could be resolved, Hunt says, if CPKC would agree to a long-term extension of the existing BNSF-KCS interline service agreement and making it a condition of the merger.

Port of New Orleans

The New Orleans Public Belt Railroad Commission and the Port of New Orleans oppose Norfolk Southern’s request for conditional trackage rights over KCS’s line between Shreveport, La., and Wylie, Texas, outside Dallas.

NS is seeking the trackage rights to protect its interline intermodal service with KCS that links Dallas and the Southeast via their Meridian Speedway joint venture. The trains currently use haulage rights west of Shreveport. The trackage rights NS seeks would become active only if CPKC suffered service failures and NS exercised its option to purchase the Wylie Terminal. NS contends that a combination of traffic increases and operational changes are likely to impair intermodal service.

The port and railroad told the STB that giving NS trackage rights would not solve congestion issues. “In fact, adding more trains run by a second carrier over the segment would likely exacerbate the problem,” they told the STB.

KCS currently handles intermodal traffic between the port and Dallas, and port officials fear that any congestion would harm the port’s customers.

CP says NS misread the operating plan and that traffic would be reduced on the Meridian Speedway due to consolidation of trains. Increases on KCS between Shreveport and Wylie would be small, CP says.

Meridian Speedway dispute

Norfolk Southern, meanwhile, says regulators should reject CSX Transportation’s attempts to blow up its exclusive right to move intermodal traffic over the Meridian Speedway.

CSX argues that the Meridian Speedway agreements NS and KCS negotiated in 2006 are unlawful, limit competition, and should face STB review as part of the CP-KCS merger.

But NS says CSX’s claims are baseless, particularly since the railroad raised no concerns when the joint venture was formed 16 years ago. In response to the NS-KCS interline service, CSX and BNSF reached a deal that gave BNSF intermodal access to Atlanta, NS notes.

All this is is BNSF (and other railroads) calling CP’s bluff. If this merger is going to be such a traffic bonanza, then it should have been consummated long ago – and instead of first trying to merge with CSX and NS or anyone who would have them. CP knows they are vastly inferior to the CN in both US and Canada, and with a merger with any other Class I railroad evidently out of the picture, KCS is the default “last man standing.” They also know that even the merged CP/KCS will have routes vastly inferior to the rail competition. So, if we know Houston is a perpetual flustercluck and we know adding more trains without adding additional infrastructure will exacerbate the situation, it’s only logical that CP would be more than happy to do their part and put their money where their whine is. But they don’t wanna do that. Why? Because they know in their heart of hearts their lofty projections of 8 or more trains per day is not going to happen and therefore the cost of infrastructure upgrades to accommodate that many trains is not a good investment. And so do the other railroads. So they’re just calling the CP for what it is: Having their cake (projecting huge traffic increases so the STB approves it) and eating it, too (but not paying to accommodate that amount of traffic because they know it won’t come to pass).

Houston is still a fragile place and KCS has on many occasions complained about getting around Houston is way to slow. CP and KCS don’t show they have good memories regarding Houston. UP really blew it again when they cancelled the new yard south of Hearne, Tx (after spending $500 million on it ) that would have really helped congestion in Houston. Blame PSR for that, It still just sits there.

Where is SOLOMON when he is needed.

Just Let the Merger Take Place and All the Other Concerns with the UP BNSF NS Have There Costumers Service Be Solved Respectfully Take Care of Yourself and Each Other

Interestingly, the map in the article provided by KCS does NOT have Houston even labeled. Talk about ducking the issue! Agree with Daniel– Invest in your business. (Indeed an earlier Trains wire article re CH US investments looks like it was not going to invest in an additional capacity in the US. Inspired by another article today on the NWire.)

Sorry CH was supposed to be CN

What I’m seeing over and over again is the necessity for BNSF and CP[KC] to work together in South Texas. Both are minor players in Houston and Uncle Pete has zero impetus to cooperate. BNSF wants better access to Laredo and needs to placate JB Hunt. CP[KC] needs an alternative to Houston if they have any desire to make their merger work. MAKE A DEAL!

Penelope, WAY too logical for today’s empty-headed management amateurs, and doesn’t fit with PSR penny-pinching anyhow.

Houston was a small simple railway hub in the 1870s. Additional tracks could be added between Beaumont, Houston and Rosenberg with investment shared by Amtrak Union Pacific,CP/KC and BNSF to enable daily operation of Amtrak’s “Sunset Limited” and increased freight train traffic.

Has there been a merger that didn’t logjam Houston?

Erie-Lackawanna but that’s it.

Thanks for a Good Laugh 🙂

Good Grief !!!!!! What a bunch of crybabies. What a negative industry railroading has become.

Clearly the answer to all these capacity issues is to run ever fewer trains.

It’s CPKC’s fault that Houston is a hot mess. Nothing to do with, perhaps Union Pacific or maybe BNSF?????