Union Pacific, which has long put profitability ahead of volume growth, has turned over a new leaf. UP now says it is focused on gaining traffic – and that it will grow faster than the rate of industrial production over the next three years by diverting freight from highway to rail.

UP’s emphasis on growth, which follows the implementation of its Precision Scheduled Railroading operating model, is a turnabout for Omaha. And it’s good news for the entire rail industry when the largest railroad says it wants to regain market share from the highway.

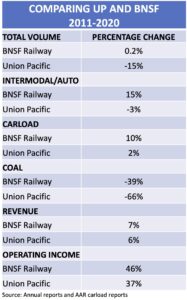

Union Pacific’s focus on profitability has limited its growth potential despite having what’s arguably the best railroad network in North America. Over the past decade, rival BNSF Railway’s overall traffic has been flat. What did UP’s volume do? It declined 15% from 2011 to 2020. That’s a staggering difference when you consider that the railroads compete in the same markets.

Nearly all of UP’s decline is from the loss of coal traffic. Partly this is due to the long-term decline of coal as utility fuel, and partly because BNSF snagged much of UP’s coal volume by offering lower rates. BNSF coal traffic sank 39% over the past decade, while UP’s plummeted 66%.

Take away coal, though, and UP still underperformed BNSF – just not by as wide a margin. BNSF’s intermodal and automotive traffic grew 15%; UP’s fell 3%. BNSF’s carload traffic (that is, everything that’s not intermodal, automotive, or coal) grew five times more than UP’s.

The picture looks different when you glance at each railroad’s revenue and operating income figures. Despite the volume gap, UP’s revenue was up 6%, right behind BNSF’s 7% growth. And UP’s operating income remains higher than BNSF’s. Clearly UP’s profit-driven strategy has worked as intended.

Hunting for profitable growth

Union Pacific executives hope to maintain the railroad’s profitability as it gains new intermodal and carload traffic, they said during investor day presentations last week. In fact, they said UP would reach its long-sought 55% operating ratio goal next year.

So what’s changed? CEO Lance Fritz says service improvements and a lower cost structure under Precision Scheduled Railroading enable UP to compete where it was either unable or unwilling to do so before. And UP is embracing growth.

“Similar to the cultural shift we have experienced with PSR, learning to grow and aggressively pursue growth requires a change in mindset,” Fritz says. The UP sales team’s compensation is now based partly on winning new business at market rates, rather than trying to push rates higher. Officials say the idea is to develop a “hunter mentality” to gain new traffic. Local operating employees, meanwhile, are being asked to sniff out new business opportunities in their territories.

UP aims to grow volume at a 3% clip over the next three years, which is just above the forecast for 2.8% growth in industrial production. Take out the impact of coal’s continued decline, and UP’s intermodal and carload business should grow 3.5%. If that plays out, it’s a significant change from volume trends at UP over the past decade. Given that history, some Wall Street analysts were understandably skeptical.

But UP does seem intent on growing

For intermodal, UP is adding a small but long overdue intermodal terminal in California’s Inland Empire to better tap the growing transload market. It’s building a grain transload facility at the Global IV intermodal terminal in Chicago to boost containerized exports. And a new intermodal terminal in Pocatello, Idaho, will open this fall to handle export of hay and other agricultural commodities.

A giant carload opportunity is renewable diesel, which could grow tenfold over the next four years. UP aims to handle inbound moves of soybean, corn, and canola oils and ethanol, as well as outbound shipments of biodiesel. Other carload growth areas include handling beverages like spiked seltzers; recycled glass; and traditional rail-hauled commodities like forest products and metals.

What’s essential for traffic to grow, UP executives say, is making it easier for customers to do business with the railroad and gaining a better understanding of shippers’ supply chains. There are early indications this is paying off: UP won Tesla finished vehicle business through technology that allows the electric vehicle manufacturer to use its own computer systems to tap into service data from UP, including shipment notifications, precise vehicle locations, and estimated time of arrival.

Why is UP’s growth strategy important to the entire railroad industry? UP’s carload network is so big that decisions made in Omaha can ripple across the North American rail network. So when UP pushes the growth lever, it should create a rising tide that lifts all boats, including volume on connecting short lines and Class I railroads.

You can reach Bill Stephens at bybillstephens@gmail.com and follow him on Twitter @bybillstephens

If you loose a lot of traffic, as in coal, it leaves a lot of operating space on the main stem. But for the UP this just might be the flavor of the month. It changes all the time. From a former stock holder.

But once you’ve driven customers away to other modes of transportation, how do you win them back? As the saying goes, “burned once, shame on you. Burned twice, shame on me.”

@Robert Ray I thought UP decided not to build out the new yard in New Mexico about 6 months after they adopted PSR. Or do I have another Texas yard mixed up with this one. The yard I thought they did not build after aquiring the land was in NM outside of El Paso.

You’re thinking of the yard they started to build in Hearne, Texas. Like many other yards it was abandoned with the introduction of PSR. El Paso was a bottleneck for years with little space to expand. They finally (after getting New Mexico to cut its fuel tax) built a new yard in 2014 just west of El Paso in Santa Teresa NM. The UP’s biggest growth potential is that Abel, Buffett’s likely successor at Berkshire Hathaway, is a fan of PSR which will damage BNSF’s service reputation. Supposedly Matt Rose retired early because of Abel’s interest in PSR.

Thanks for providing the specifics and clarifying the facts for me.

….”winning new business”…. Now there’s a novel approach; do you think they might have learned that from the shorts and regionals? Naaaah, what do those guys know about real railroading??

Where’s Ana Harding? We miss her.

I miss Robert McGuire and Curtis Larson. Hope they’re okay.

This is a change and a change again. Under Davidson the UP was notorious for underbidding the BNSF. One glaring example was the UPS coast-to-coast business which the road got from the BNSF. Unfortunately trying to run 70 mph trains over the single track SP Golden State line filled with drag freights tied up the whole railroad. UP had to send the shipments by truck in order to stay fluid. The UP has also been slow to invest; one example was the El Paso bottleneck which lasted for years before the road fixed it with a new yard in New Mexico. A recent Trains article on customer response showed the CSX and BNSF were the only roads to promptly respond to a shipper request; the others were going to take days to get back. UP is going to have change a lot to get business on a service basis.

No more PSR kool-aid ?

You cannot keep throwing customers away and expect to remain relevant.