Intermodal analyst Larry Gross has gone out on a limb. In his latest “Intermodal in Depth” report, Gross predicts the demise of TOFC, or trailer on flatcar service, within the next four years.

In some ways, this shouldn’t be a surprise. Trailers have become a smaller and smaller part of the intermodal world as railroads have emphasized domestic containers that can be double-stacked. TOFC is long gone in Canada and Mexico, and so far this year trailers represent just 8.5% of U.S. intermodal loads, down from 60% in 1988.

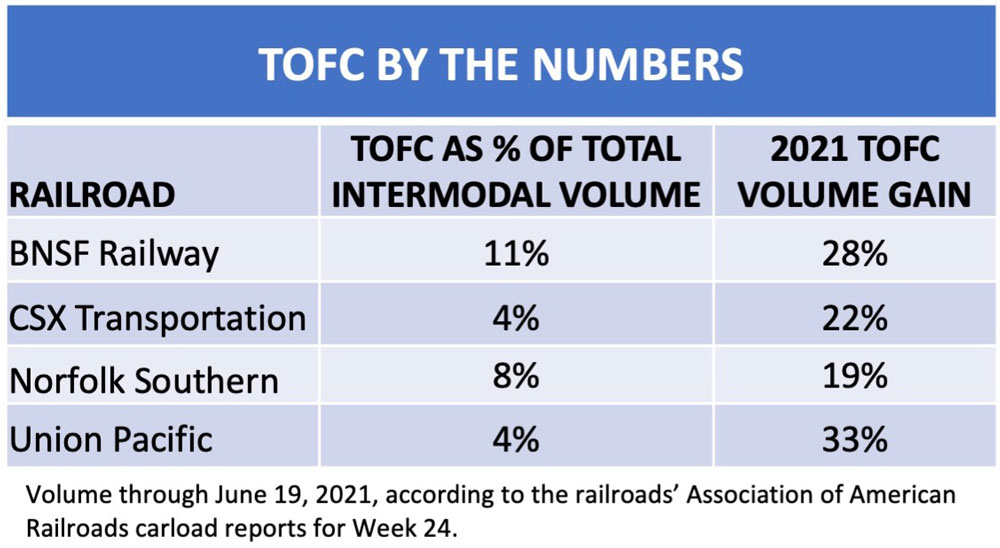

But trailers have seen an on-and-off resurgence over the past few years amid a chronic shortage of truck drivers and the rise of parcel traffic due to the boom in e-commerce. In fact, trailer volume has surged 26% through the first four months of 2021.

Now, Gross says, traditional TOFC users — including parcel and temperature-controlled carriers — are planning to significantly expand their container fleets. “Driven by the desire to simplify their operations and improve train capacity, the railroads are actively taking steps to convert the remaining TOFC volume to container,” Gross says. “These steps include eliminating TOFC services in specific lanes and at specific terminals, widening the rate differential between trailer and container, and providing trailer customers with warnings of even greater differentials to come. As a result, conversion is beginning to occur in these last bastions of TOFC use.”

This is the latest development in the trend of railroads simplifying their intermodal networks. Over the past few years, all of the U.S. Class I railroads have streamlined steel-wheel interchange and pared interline service linking lower-volume origins and destinations. And as part of their shifts to Precision Scheduled Railroading, CSX Transportation and Union Pacific have scaled back their intermodal service. “The future of TOFC is strictly limited in the PSR era,” Gross says.

This is the latest development in the trend of railroads simplifying their intermodal networks. Over the past few years, all of the U.S. Class I railroads have streamlined steel-wheel interchange and pared interline service linking lower-volume origins and destinations. And as part of their shifts to Precision Scheduled Railroading, CSX Transportation and Union Pacific have scaled back their intermodal service. “The future of TOFC is strictly limited in the PSR era,” Gross says.

The big four U.S. Class I railroads prefer containers because double-stack trains can carry twice the volume as a TOFC train of the same length. Trailers eat capacity in terminals and on single-track routes where sidings dictate train length. Trailers also complicate terminal operations because they require separate lifting equipment and must ride on the few remaining TOFC flatcars in the TTX fleet. So, there are plenty of good reasons railroads want an all-container intermodal operation.

But what’s simpler, more efficient, and more profitable for the railroads can be more complicated for their intermodal customers. Chassis supply is a perennial problem, and containers aren’t always the right tool for the job. And this means that only about half of current TOFC traffic will convert to containers, Gross predicts.

The rest, he says, will hit the road. Based on this year’s trailer volume trends, that would equal a loss of roughly 4% of U.S. intermodal volume.

Longer-haul moves in 53-foot trailers are the most likely to convert to domestic containers and remain on the rails, Gross says. The most likely traffic to be lost: business that moves in 28-foot pup trailers, which carry parcel shipments in small lots from origin to destination without a sorting move in between. UPS and FedEx will be unlikely to give up this efficiency and therefore will send these loads to the road.

Trailers will survive a while longer in oddball situations, Gross says, such as Florida East Coast’s service between Jacksonville and Miami, an imbalanced market with loads southbound and empties northbound. Norfolk Southern’s Triple Crown RoadRailer service between Detroit and Kansas City, meanwhile, will keep rolling until its equipment wears out.

The conversion to a fully containerized network will make intermodal more of a niche product than it already is. Railroads will essentially give up their ability to serve as a safety valve for truckload carriers that shift some volume to intermodal when driver supply gets tight, as well as for parcel carriers who rely even more on trailers during the holiday peak shipping season.

If TOFC is about to ride off into the sunset, it’s hard to see how this will help intermodal grow. At one time, railroads sought to expand the intermodal universe through innovations like RoadRailer and Canadian Pacific’s Expressway short-haul TOFC service. No longer.

A string of UPS trailers riding an intermodal train has long been a symbol of premium service and the hotshot that sees nothing but green signals on its trip across the railroad. A complete shift to containers won’t end this tradition, of course, but it will bring down the curtain on the piggyback era that began when Chicago Great Western loaded its first trailers on flatcars way back in 1936.

You can reach Bill Stephens at bybillstephens@gmail.com and follow him on Twitter @bybillstephens

From an LTL perspective Positives:

1. It’s cheap

2. No worries about empties coming back from headhaul lanes if using RR equipment (or RRs will bring carrier trailers back cheap).

3. Might be outlet for overflow

4. Might be fast enough if moving over weekend

Negatives:

1. Slow

2. Unreliable

3. Might be forced to use 53’ equipment which might be highly inconvenient in a network set up up for pups.

First, let me state that Larry Gross once fired me. So that’s context. Put it in your pipe and smoke it. We had our differences. I was subordinate and I lost.

Intermodal efficiency (costs) can be broken down into five elements:

1) Origin drayage

2) Origin terminal

3) Rail movement

4) Destination terminal

5) Destination drayage

I know, there are other things such as equipment ownership. But let’s just deal with these five. I can’t write a book here.

For #3, rail movement, double stack containers can’t be beat. As long as the railroads focus on long haul, frequently international ocean freight business, double stack containers are the way to go. The rail movement efficiencies of double stack overwhelm the other cost elements. LTL and temperature-controlled business can use these trains to a certain extent.

But containers in lieu of trailers drive up the other four cost elements. And these other four cost elements are extremely important in potentially profitable business the railroads are missing out on. Marketing and market development are glaring weak points with our railroads.

An intermodal terminal servicing large double stack trains is necessarily expensive to build and operate. Lots of land to own and pay taxes on, lots of equipment to own and maintain. And lots of expensive truck drayage miles because such terminals are few and far between. For intermodal to really grow it needs to be expanded beyond the current service lanes. This will necessitate serving smaller markets which cannot support the mega investment needed for a double stack container terminal.

My favorite example is Sioux City, Iowa. The Sioux City area generates a whole lot of long-haul freight. This long-haul business now moves overwhelmingly by truck. There’s no intermodal terminal in or near Sioux City. The commodity is red meat. Iowa and Nebraska produce over 25% of the red meat in the US, and that’s a lot of loads. The railroads can move this commodity just fine. Production is centered around the Missouri River which is the Iowa-Nebraska line, AKA the Sioux City area.

To get this business the railroads would need an intermodal terminal at Sioux City. UP to the west, CN to the east. The low-cost entry would be a TOFC terminal using the former CP Expressway system. A double stack terminal would be an expensive entry barrier. A TOFC terminal would be lower cost and the marginal cost of adding the meat loads to existing trains would be quite low.

Isn’t gonna’ happen. The railroad marketing people just don’t have a clue.

How do railroads make money by leaving their customers behind. Railroads are in business to make money but also as a service industry to shippers. Might as well sell the trailers to the truckers who want the business.

So many comments about how this is another example of railroads “shooting themselves in the foot”. Indicative of misunderstanding a business’ reason to exist – to make money. The vast majority of contained freight suitable for railroad hauls moves in containers, not truck trailers. That’s not just a trend, it’s reality. The railroads are responding to that. As long as UPS, FedEx, et al continue to use trailers instead of containers, and are profitable customers, the railroads will continue to move those trailers. The article says TOFC has already disappeared in Canada, and CP and CN seem to be doing very well without it.

You must remember that CN has stolen so much of our intermodal traffic.

None of the executives that are making these mistakes will be around to reap the rewards. They will just take their excessive short term bonuses and ride off into the sunset (with that retirement money invested in something other than railroads).

“Niche Product”. What was and is supposed to be the future of railroading and THE source of growth, is now a “Niche Product”.

Bill, it’s time to stop and take a hard look where PSR is leading us. The following is the “PSR line of thought” for each traffic source:

-Coal traffic keeps declining. Any other fossil fuels eventually will peter out.

-The goalposts keep moving backwards on non-FF unit trains. But is grain or stone really going to drive growth anyway?

-We’re waving the white flag on carload traffic, as discussed in previous analyses.

-Automotive will become more challenging, as autoracks are unwieldy to handle in massive trains with unblocked loads and empties. EV batteries keep catching fire while in transit out west, so will we need to transition to temperature-controlled racks? What railroad is going to want to invest in that?

-Intermodal, well any statement of growth by an exec was apparently lying through their teeth. And autonomous trucks will eat the railroads’ lunch.

NICHE. FREAKING. PRODUCT. This industry is doomed as long as PSR continues to dictate planning.

Clearly, railroads are bent on committing suicide and giving up their place as viable transportation competitors and sacrificing themselves on the alter of short term stock value. Fools!

JEFFREY – Why change now? Continue to do what has never worked in the past.

Why not create a 28 foot container ?

Already tried before with BN didn’t work out.

ATSF as well

Though who’s to say they won’t make a return?

By their own actions, railroads are making themselves ever more irrelevant. A grand march toward oblivion.

The end of high speed mail and package trains as we know them. UPS, FedEx and others still use a lot of trailers, so I can’t see this being good for their service. One aside. The same packers load both trailers and containers, so I don’t understand the comment about specialized equipment for trailers.

UPS was a long time holdout on switching to containers. It’s a very big customer (still number one on the BNSF?) so the railroads are likely to keep carrying some of their trailers in some lanes. Probably some trailers are specialized for particular loads where no equivalent modified container exists. The big percentage increases in TOFC traffic in 2021 may be due to shippers trying to get around the shortage of containers (container manufacturers are backlogged into 2022).

Yet again in chase of marginal gains long term pain. The deepest cuts tend to be self inflicted.

Nice to see that the little Granger road, the CGW got the recognition it deserved.

Agreed. They were innovators on so many levels. The CGW lashed up a dozen F-units to the front of a 10,000 foot train decades before the current roads started using PSR.

Stephens’ articles are always interesting and valuable. He’s a big asset to Trains.

This is just another nail in the coffin of railroading — a hammer blow dealt by the railroads themselves.