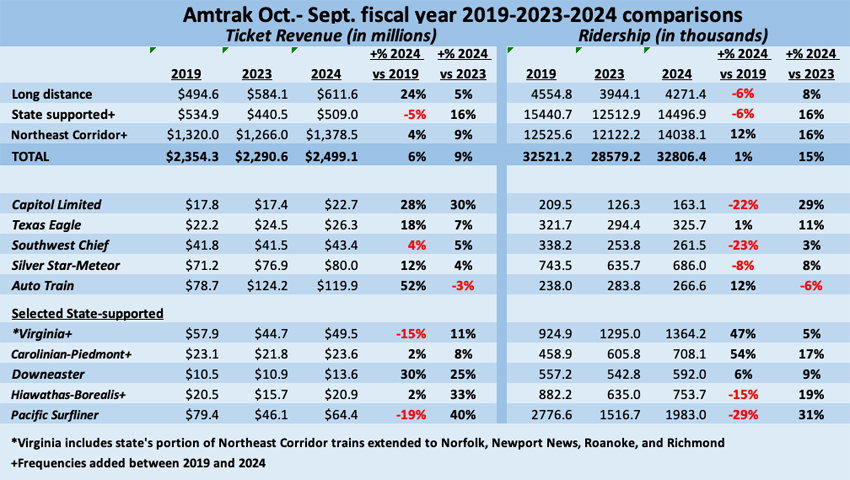

WASHINGTON — The increases weren’t large compared to pre-pandemic 2019, but more Northeast Regional frequencies enabled Amtrak to capture enough travel demand to beat the company’s previous overall record ridership in fiscal 2024. Also, a 24% gain in ticket revenue from long-distance trains compared to 2019, in spite of constricted coach and sleeping car capacity, generated a 6% rise in total revenue.

These are among the takeaways from Amtrak’s fiscal year ending Sept. 30, as revealed in the 2024 monthly performance report released late last week. A table below provides a closer look at how price and patronage interact on some services.

Long-distance passengers pay more

The money generated on trains that travel more than 750 miles (even if passengers aboard might not) is up sharply from 2019. Diminished capacity led to fewer riders on trains like the Texas Eagle, which operated with more sleeping car capacity (it had a transition sleeper) and additional coaches. The situation has recently been partially rectified [see “Amtrak adds to Texas Eagle capacity …,” Trains News Wire, July 29, 2024]. Southwest Chief patronage suffered because, until recently, it was routinely assigned only two Superliner coaches when the train previously had three or four in peak season. On the other hand, the Capitol Limited’s expansion of coach and sleeping car capacity between 2023 and 2024 paid immediate dividends. Another success story is Auto Train, the only long-distance train that maintained daily frequencies throughout the pandemic. It capitalized on higher gas prices in 2023 but marginally lost clientele in 2024 when gas prices retreated.

Added frequencies create exponential ridership gains

Hands-on management and a reliable funding commitment at the state level have allowed Virginia, North Carolina, and Maine to actively promote their service and add round trips. Price reductions coupled with more Virginia-sponsored frequencies to Norfolk and Roanoke have resulted in sustained growth, while additional Piedmonts between Raleigh and Charlotte, N.C., have made the service more relevant. Both Wisconsin’s Hiawathas and California’s Pacific Surfliner were among the operations hurt by a change in commuting patterns; landslide disruptions on the route to San Diego also injected cancellations. But the introduction of the Borealis as an extension to one of the Hiawatha round trips, providing an extra frequency on the previously once-daily Empire Builder route to the Twin Cities helped counteract that shortfall.

Capacity, frequency yields dividends

The complete document available on Amtrak’s website contains a variety of other “route level results.”

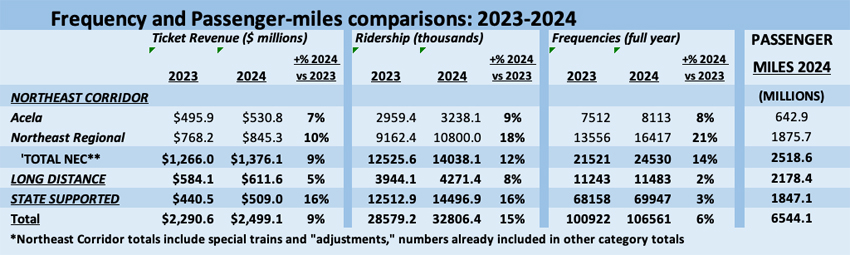

The table below, derived from that section, shows that a key factor in the Northeast Corridor’s strong performance is how the number of train starts grew from fiscal 2023 to 2024 (comparable data was not provided in the 2019 report). This was accomplished by introducing quick terminal turns with push-pull equipment for Northeast Regional trains and squeezing more departures out of an Acela fleet in which trainsets have been permanently sidelined. The small increases in the other categories were the result of Amtrak’s belated return to daily operation of some long-distance trains in the fall of 2022, and more Cascades, Piedmont, and Virginia round trips.

Also note the relationship between length of trips and frequencies. The Northeast Corridor’s 24,530 trains produced 2.5 billion passenger-miles while the long-distance network generated about 2.2 billion passenger miles with 13,047 fewer departures. Meanwhile, state-supported service delivered the fewest passenger-miles with almost 70% of the trains. While all these numbers may make eyes glaze over, they show the ways beyond ridership and revenue that Amtrak’s network can be valued.

Categorizing expenses

Financial details disclosed by route for fiscal 2024 include:

— Operating revenue: This adds about $30 million of state financial support to ticket revenue for that segment of trains.

— Operating expense: In previous years, fixed and variable costs for every route were broken out, but those details have been omitted in 2024. The exact method in which expenses are derived and allocated is a murky area; members of the States for Passenger Rail Coalition continue to press Amtrak for clarity. There are no comparable advocates for long-distance trains to examine line items in accounting, including corporate overhead, that impact expenses that determine operating “earnings” or “loss.”

Of course, many factors contribute to the expense of running a passenger railroad, such as compensating patrons for missed connections or cancelled service. Partially as a result of how costs are treated differently on Northeast Corridor compared to the rest of the system, however, the recently released report says the addition of 3,610 Boston-Washington, D.C. trains resulted in an operating expense increase of $55 million, compared with $68 million more for 240 additional long distance departures between 2023 and 2024.

With federal funding priorities possibly changing for 2025 as a new administration and Congress takes over, it is important to understand how these numbers are derived for the mobility value produced.

OK , I see the revenue but where are the total expenses and the bottom line results?

The photo again shows the old Milw. Rd. grade separation. And Mr. Landey is correct in calling for a Milw. west suburban stop.

Yep, there is a market for rail travel that hits the sweat spot of not needing to be on a plane to cover ground in a short time frame and or not wanting to stuck in ever congested traffic. It will be huge if VA, NC and the Feds can truly bring former S-Line up to speed & add the desired frequency. It will only get better once Brightline gets to Tampa and they will be filling trains out west from day one and as fast as they can add them just from the relatives who live in Vegas & So Cali. Heck, CaHSR could have crush it in Central valley on 125 mph service if you have ever travel Hwy 99 lately from Sac to Bakersfield

…

The reality is that there is a need along specific congested interstate corridors through out the country. But please, please Amtrak quit assuming it is the same for Duluth, MN or another Chicago to a cornfield on an another Iowa or Illinois route. The Midwest is ripe as well but as Charles noted, actually pick metro areas where people are travelling to and from. Or at minimum add frequency (even consider brightline concession) to the corridors from Chicago to Milwaukee/Twin Cities, to St Louis, or to Detroit where you can build upon a very reliable ridership.

Choosing 2019 as a year to compare long-distance ridership with for 2024 is problematic. Sure, 2019 was pre-Covid, but long-distance trains in 2019 were experiencing a more lethal disease: Richard Anderson. Cuts in amenities, station staffing, and lack of marketing continued the long, slow decline in ridership. Ten years ago in 2014, while there may have been apathy about its long-distance service, there was not evidence of a deliberate desire dispose of these trains. Comparing 2024 with 2014 gives us these numbers: Ridership declined: Coast Starlight, 22%; Empire Builder 14%, Southwest Chief, 25.7%, Capitol Limited, 30.9%, Cardinal 14.8% and Sunset Limited 26.8%. All told, long-distance ridership over a 10-year span is down 9.8% (and this is excludes considering the Palmetto because in 2014 the train didn’t carry passengers between New York and Washington inclusive, as it does now). Clearly, Amtrak management over the past decade did not care about growing the business.

Excellent observation Mark. The elimination of regional marketing and efforts to tell travelers where Amtrak trains go (including timetables)– instigated by Wick Moorman and Richard Anderson with acquiescence by Amtrak’s Board of Directors–diminished efforts to fill seats. The year 2014 also preceded the corporate decision to exchange Amtrak’s pension system with performance bonuses based on cost-cutting to meet or beat annual financial plans, not invest in the future of the company’s assets or employees. This most likely led to the decision to not repair four marginally-damaged Superliner coaches involved in a March 2016 Southwest Chief derailment in Kansas. The company could use that equipment now.

Such a joke that the Texas Eagle is one of only two long distance routes to have surpassed pre-pandemic ridership, yet Amtrak’s board hasn’t brought back one amenity they took away during the pandemic after all these years!!! The train is STILL running without a Sightseer Lounge!! Dining service remains downgraded to reheated food which coach passengers don’t have access to! Meanwhile customers on ALL the other western routes get to enjoy freshly cooked meals and get panoramic views from a Sightseer Lounge car! Pretty astounding that Amtrak’s board dislikes this train despite its strong performance! While gifting themselves bonuses of over $200,000 each every year. Sightseer Lounges have been spotted on state supported trains! Right now at least three are currently running on the Illini and Saluki trains to comply with the axle count. Other Superliner car types are available to use in the meantime! It just shows that Amtrak’s board has no desire to improve the onboard experience on some train journeys.

Sadly, instead of celebrating this the next administration will likely pull the same stunts as it’s first round. Will be interesting.

Darn it, we missed being in that photo of the Borealis by 24 hours. We rode the next EB, November 1st. A trip that exceeding all expectations.

Now imagine if there were a west suburban station stop, Wauwatosa or Brookfield or Pewaukee or Oconomowoc. As it is now, Milwaukee to Columbus is too big a gap.

Yes, Bob Johnston, there is a market for rail travel. How many Amtrak trains are there in some of the big Midwest cities (Indianapolis, Columbus, Cincinnati, Cleveland, MSP). Somewhere between zero and a tiny handful. People won’t ride the trains if there aren’t any to ride.