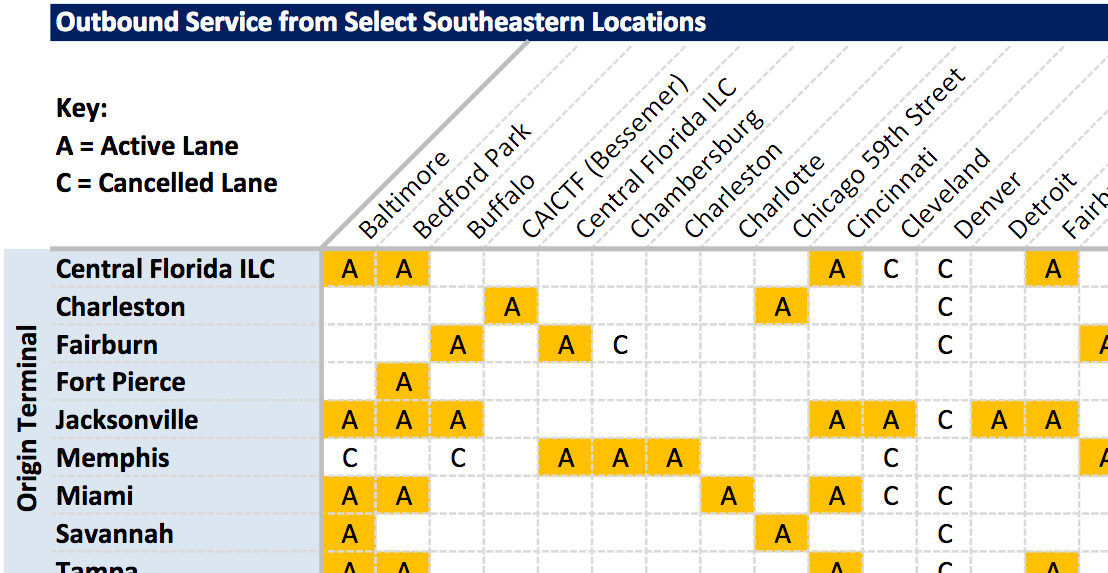

CSX is dropping outbound service from nine terminals in the Southeast to 20 terminals on and off the CSX system, the railroad informed customers on Tuesday. And it’s simultaneously ending inbound service to those terminals from 11 origins on and off CSX.

The affected terminals in the Southeast include five locations in Florida, plus Atlanta; Charleston, S.C.; Savannah, Ga.; and Memphis, Tenn. Combined, these Southeastern terminals will continue to originate traffic in more than 110 lanes and receive containers from more than 160 lanes.

CSX told customers the changes were being made “to improve service, efficiency, and better align product demand.”

CSX spokesman Rob Doolittle says the changes are part of a review of intermodal operations as the railroad implements Precision Scheduled Railroading.

“We are working to identify opportunities where we can improve service to our intermodal customers by leveraging other parts of our scheduled network to provide faster and more efficient service,” Doolittle says. “In some cases, this may mean using scheduled merchandise trains to support some intermodal customers’ requirements, and reducing the intermediate handling of intermodal traffic when possible, creating more reliable service and faster transit times.”

The railroad will curtail service between the Southeastern terminals and smaller markets in the Northeast, including Cleveland, Buffalo, and Syracuse, N.Y., as well as Montreal.

The changes are related to scaling back container sorting at the Northwest Ohio Intermodal Terminal. The unique terminal in North Baltimore, Ohio, is a key to the hub-and-spoke strategy CSX has used to serve lower-volume intermodal markets. But its days as a sorting hub are numbered, sources have told Trains News Wire.

Harrison declined to answer a question about the fate of North Baltimore — and the hub-and-spoke system — during CSX’s third quarter earnings call with Wall Street analysts on Tuesday. The railroad will provide additional details during its investor day presentations later this month.

The other announced changes from the Southeast terminals affect interline service with UP to and from destinations in the West, ranging from Portland, Ore., and Oakland, Calif., to Denver and Phoenix, as well as points in Mexico.

This is the latest wave of cutbacks related to traffic funneled through the North Baltimore terminal. Earlier this month, CSX announced a reduction of service to and from Louisville, Ky., Detroit, and Columbus, Ohio, to various points on and off the CSX system.

Last year North Baltimore handled 809,254 lifts, making it the second-busiest terminal on CSX.

CSX published a full grid of the changes online.

E Hunter Harrison is both America’s and CSX’ amswer to Dr Richard Beeching, who slashed and merged

the Big Four Railroads of Britian in the period after World War II .He slashed and elimated both lines and service

without any regard for passengers or customers. From his slash and burnmethods came British Rail which only much later on was broken up and privatized. Mr Harrison is doing the same thing with his running of CSX. I would believe that his actions and methods hisplan to get CSX for a possible merger or takeover by another

carrier…maybe Union Pacific or even CP.. However there may be a silver lining to this .We will see a new

generation and crop of shortline railroads taking over operations on lines and yards abandoned and tossed aside

by the Harrison cartel. Stay tuned as this whole strry plays out

Harrison is at it again trying to bankrupt another railroad. You saw what he did to CP Rail you saw what he did to CN and NS, and now he is bankrupting CSX Transport. CSX Transport get rid of him now!

What in the world was CSX’s board thinking when they agreed to EHH? Were they as oxygen deprived as EHH is?

CSX is going to wish they never put this guy in charge.

So let me get this straight, EHH cuts cost to the bone, then cannot run profitable lower volume trains? Other than bulk material, you have to begin to wonder what is the railroad is for.

EHH is doing an outstanding job of providing job security for Truckers!

How can a railroad introduce new intermodal service lanes and expect them to go high-volume instantaneously? No wonder this guy couldn’t grow the traffic at any railroad he worked for, his so-called precision railroading does not allow any patience for growing the business.

Don’t be fooled: CN grew in the 2000’s through acquisition, but traffic levels actually fell off on most lines, generally by pruning lower-volume customers (and sometimes not-so-low-volume ones). CN also experienced several years of operating chaos, with cars being mis-routed, trains being cancelled by lack of available power or crew, or delayed by over-siding-sized trains that could only meet by splitting over two sidings. The ROW was allowed to degrade because basic maintenance budgets were truncated.

Only when Harrison left could CN actually start growing its traffic density, and for to happen, many policies had to be reversed and years of deferred maintenance remedied. Some local traffic has been lost forever (notably on the former WC and eastern Canada). As for CP, it is nearly a ghost railroad east of Moose Jaw and Chicago, almost devoid of trains. There are now so few loads paying for the burden of maintaining so many miles of nearly empty tracks that it is a miracle if this railroad actually covers its cost of capital. And now the “magic” falls on CSX too. You know what to expect.

CPR was unable to BUY/MERGE with CSX while EHH was there….MAYBE…JUST MAYBE ?? Their long term plan: Plant a saboteur in CSXT…Blow it up, and then CPR can move in buy the wreckage, after cleaning up the wreckage(over time). CPR becomes the THIRD Transcontinental??? Just a thought…..

Hey Harrison. Why don’t you just fire everyone and sell CSX for scrap now? After all, you’re running the company into the ground.

Good point on the loss of triangulation lanes impact Don Oltmann. I think a lot of this cutback at North Baltimore and now the southeast however is related to the sharp decrease in international IM from west coast ports.

Much of the less speculative North Balto benefit was to break down solid trains of boxes right off the ship, minimizing handling and destination sorting at LA/Long Beach. The market has spoken in terms of doing that sorting in Inland Empire DCs into domestic 53s for the middle interior. And the eastern third of the country being brought to Atlantic ports via the Panama Canal.

There was a more speculative benefit for domestic sorting at North Balto replacing rubber interchange in Chicago, but success there depended on cooperation from western railroads building whole trains for NB sans a Chicago (or even StL) stop-and-grind, and great execution at NB terminal itself, because domestic IM is so much more service dependent. From what I read about train entry and exit into that terminal alone, that execution was far from reality.

As for the western railroad cooperative service, I guess rubber tire interchange in Chicago with some through blocks going steel wheel is about the most we can expect short of transcontinental mergers.

Which I still think is the EHH endgame for CSX.

The man who is keeping the closest eye on what is developing here at the CSX fiasco is a fellow from Omaha, Nebraska. And he has no delusions about the real world whatsoever.

You have to be very careful when you blow away low volume lanes for efficiency. You can wind up damaging some of your high volume lanes because the trucking companies often your railroad as two legs of a triangle. If you take one of the legs away, you lose the whole thing.

Conrail learned this the hard way back in the mid 90s when they rationalized some lanes in order to get service levels back up. They wound up losing more traffic and revenue than they predicted. In the end, service levels improved and they worked hard to put back some critical lanes and win customers back.

Just a thought, is Mantle Ridge trying to do a fire sale? If so the sage from Omaha will definetly look for a bargain price.(His philosophy is buy cheap)

Garrett R- If only. NS isn’t exactly clicking on all cylinders these days, either. Compare their dwell and train speed numbers with 2013. Off quite a bit.

No one needs to kid themselves. You can bet Norfolk Southern is keeping a close eye on CSX and it wouldn’t come to surprise if it’s conducting an in-house feasability study to capture freight from former dedicated customers who are fed up with Hee Haw’s Public Be Damned attitude.

The nut is on an Ego Trip and thinks he is the Savior of railroads. Not to talk religion but Bible Pounders have a Savior. Hunter, on the other hand, needs to be cruxified….on a creosoted cross tie!

Sounds like they are at the point of ending CSXT service for the NE. What are they planning selling the Mainline Buff. To albaby to another railroad?

All I can really say here is that this mess that is now CSXT is really on the shareholders of CSXT that allowed this functioning lunatic to come in destroy their railroad. You get what you deserve I guess.

I am sure there is hard data and forecasts to back up these decisions. Harrison is betting that the forecasts come true.

Truckers love CSX.

Hopefully NS is paying attention and the operating department is sitting down getting ready to institute service in those lanes they don’t already cover that would be feasible for them to do so and/or increase current service to take up the slack from CSX…I mean take the business that CSX doesn’t seem to want.