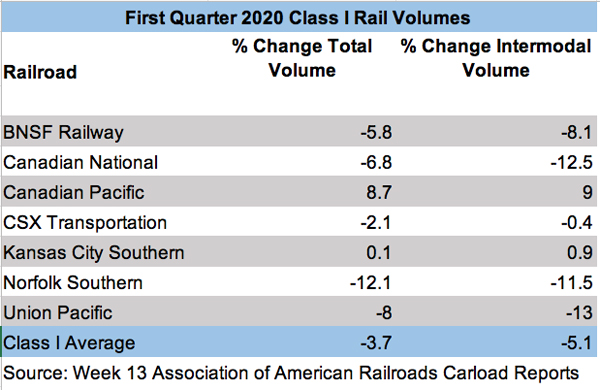

The publicly traded Class I railroads will begin to report first-quarter earnings this week, with Kansas City Southern kicking off results on Friday.

Investors may be more interested in learning how railroad management teams expect their systems to weather the economic storm caused by the coronavirus pandemic, which week by week has accelerated already-declining North American traffic volumes. Some analysts expect railroads to suspend their financial outlooks for the year given the uncertainty surrounding the potential depth and length of economic upheaval surrounding COVID-19.

KCS and Canadian Pacific are the only two railroads that Wall Street analysts expect to improve their first-quarter earnings compared to a year ago. Analysts expect earnings to decline at the other four big systems — Canadian National, CSX Transportation, Norfolk Southern, and Union Pacific — by an average of 7%, according to I/B/E/S consensus estimates.

KCS will report its quarterly earnings on April 17. Its traffic was flat for the quarter, and analysts expect the smallest Class I’s earnings per share to grow 14% as it reaps the financial benefits of its move to Precision Scheduled Railroading.

CP led the industry in growth, with an 8.7% traffic gain that was partly due to the impact of blockades that shut down rival CN. Analysts expect CP’s earnings to climb 42%.

CSX, which saw traffic sink just 2.1% for the quarter, will hold its earnings call on April 22. Analysts expect CSX’s earnings to dip nearly 9%.

Next up, on April 23, is UP. The biggest railroad’s volume slumped 8% for the quarter, but analysts estimate that UP’s earnings will slide just 2% thanks to ongoing cost and productivity improvements as it rolls out more changes related to Precision Scheduled Railroading.

CN, which had a tough start to 2020 due largely to circumstances beyond its control, will report its earnings on April 27. CN’s volume was down 6.8% as a month of protests blocked several points on some of the railway’s key routes. Analysts expect CN’s earnings per share to decline nearly 8%.

Last up: Norfolk Southern, which is scheduled to report earnings on April 29. NS saw the deepest drop in quarterly volume – 12% – partly due to the impact of its effort to improve profit margins by raising rates.

BNSF Railway, which is a unit of Berkshire Hathaway, is expected to report quarterly earnings alongside its corporate parent on May 2.

Railroad Museum Fundraiser

The Little River Railroad and Lumber Company

sells BANDANNAS.