The service, announced on Thursday and set to begin in October, is unusual because it’s a short haul for both railroads, which runs counter to the industry trend toward focusing on more profitable longer hauls in high-volume intermodal lanes.

But CN aims to fill up its railroad in Eastern Canada, which over the past decade has not seen the robust growth experienced on its lines in Western Canada.

“Over the long term, the freight market will increasingly depend on demand driven by the consumer economy and the rail industry must create new intermodal services that can successfully rival the over the road options,” CN CEO JJ Ruest said in a statement. “This interline service fits perfectly with our strategic focus on feeding our unique network through organic and inorganic growth opportunities, including extending our reach into new geographic markets.”

The railroads appear to have business lined up from current international intermodal partners.

“Answering a need expressed by our customers, this new service positions us to capture market share from trucks and increases capacity in these expedited lanes, as larger container ships call at the Port of Philadelphia and Port of New York and New Jersey,” CSX CEO Jim Foote said in a statement.

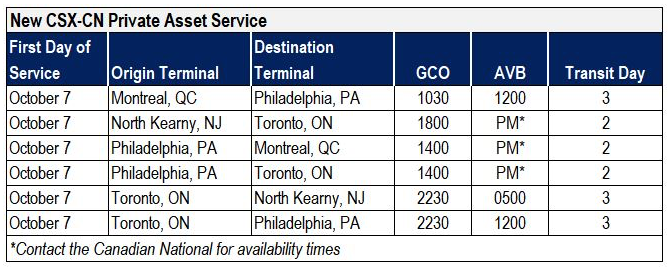

Transit time will be two days for northbound shipments and three days for southbound moves.

The new service, which will ride existing trains that CSX and CN use for interchange at Buffalo, N.Y., and Huntingdon, Quebec, will square off against intense truck competition.

Canadian trucks toting international containers are a common sight on the New York State Thruway. Some 1.2 million trucks crossed the Peace Bridge linking Buffalo, N.Y., and Fort Erie, Ontario, in 2018, according to the Buffalo and Fort Erie Public Bridge Authority. The Peace Bridge spans the narrow east end of Lake Erie.

Nearly 942,000 trucks entered the U.S. in 2018 at all of the Niagara River bridges linking Ontario and New York, according to the U.S. Bureau of Transportation Statistics. And more than 308,000 trucks entered the U.S. at the Champlain, N.Y.-Lacolle, Quebec, border crossing south of Montreal, the federal data show.

CN and CSX have a good opportunity to capture market share for Toronto traffic, intermodal analyst Larry Gross says.

“Newark, N.J., to Toronto is 487 highway miles, which including port and border delays makes it a difficult one-day truck haul,” Gross says. “There’s a good chance that intermodal can compete as rail circuity is pretty moderate.”

The New Jersey-Montreal market is a tougher nut to crack.

“For one thing, it’s considerably shorter at 375 miles,” Gross says, with Interstate 87 and Autoroute 15 offering a straight shot between the New York-area and Montreal.

“For another, the CSX-CN route … will be extremely circuitous,” Gross says. “CP of course would be a much more logical routing via the D&H. The economics of the proposed service would be very challenging to Montreal unless the pricing is somehow on a more incremental basis.”

The CSX-CN Montreal traffic will run up the West Shore of the Hudson River, then turn west at Selkirk on CSX’s Water Level Route to Syracuse, N.Y., before turning north on CSX’s Saint Lawrence and Montreal subdivisions. The Selkirk-Syracuse dogleg alone adds 150 miles to the rail route.

CSX’s 40-mph Saint Lawrence and Montreal subdivisions are among the lines the railroad put out to bid last year as it looks to spin off low-density routes. CSX declined to comment on how a potential line sale would affect the new intermodal service.

CN did not immediately respond to an email seeking additional details.

The deal with CSX is the latest effort CN has made to boost intermodal traffic in Eastern Canada.

CN purchased Canadian trucking company TransX and is acquiring the intermodal division of Alberta trucking company H&R Transport, which specializes in temperature-controlled shipments. The railway also is investing in a new container port at Quebec City and hopes to land more international traffic at an expanded container port in Halifax, Nova Scotia.

Over the years, various attempts to offer Montreal-New Jersey intermodal service have failed due to a lethal combination of low-cost truck competition, the short haul, and much faster highways.

The Delaware & Hudson tried Lacolle, Quebec-Oak Island, N.J., intermodal service, and Canadian Pacific later tried interline Montreal-New Jersey intermodal service with CSX on the direct D&H-West Shore route.

CSX also offered service between its now dormant intermodal terminal at Valleyfield, Quebec, and New Jersey and Philadelphia. Transit time was four days.

One more thing CSX and Canadian National should talk with Canadian Pacific and come to an agreement to use the former Delaware & Hudson line to run the intermodal from Montreal south to the port of Albany that has a track connection to CSX,s main yard in Selkirk NY. which then could run down the river line to NJ. You could also hook up to routes going to long island , Mass. Conn. going out of Selkirk, seems silly that these Exec, didn’t think from point A to B by ways of C is wrong . Montreal to New JERSEY by way of Syracuse is wasting FUEL ,TIME,EFFENCY !

CSX will close its intermodal center in Salaberry-de-Valleyfield, according to local newspaper “Journal Saint-François”.

The only problem I see with using the former D & H line that CP Rail now owns is that most of it is single track a few sidings , so trains will be sitting and wasting time waiting at sidings , case in point went to Montreal on Amtrak and a CP freight broke down some where ahead of us and we sat for 3 1/2 hrs and got in to Montreal way later then expected , so if you are going to increase train traffic you better install a second track simple put!

CP of course would be a much more logical routing via the D&H…. Delmonte fruit from port of Camden NJ runs by truck to Montreal day and night. I know a direct train through Albany, not by way of Syracuse or Buffalo could beat the trucks.

“The new service, which will ride existing trains that CSX and CN use for interchange at Buffalo, N.Y., and Huntingdon, Quebec, will square off against intense truck competition.“

This tells me it’ll be more like cuts of international boxes filling out existing manifest trains.

Maybe; CSX, CN, and CP should think about joint ownership of the D&H line

Canadian forest products could be backhauled for export from Montreal. If this idea is even on the table. I wouldn’t be surprised to see blocks of manifest traffic filling these trains out either.

I direct your attention Mr. Plous to this paragraph.

“Answering a need expressed by our customers, this new service positions us to capture market share from trucks and increases capacity in these expedited lanes, as larger container ships call at the Port of Philadelphia and Port of New York and New Jersey,” CSX CEO Jim Foote said in a statement.”

The news release is not clear about whether these carriers are seeking steamship or domestic traffic.

This type of business is the only thing left for the railroads to try and capture. Barring a major influx of imports, the longer hauls have been tapped out.

“Transit time was four days.”

48 hours to go about 480 miles. So…10 MPH. I think I found your problem.

I wonder if this means CSX has now decided to retain the Syracuse – Montreal line? This was one they had earlier listed as a candidate for spin off.

Yes Paul, CN has a project for a second intermodal terminal in the Toronto area, in Milton. Can’t come too soon.

I would also wonder how many shippers will remember Conrail Quality and Conrail’s promotion and then dumping of shorthaul lanes back in the late 80’s or 90’s.

Jf, good points. I think apart from the BIT terminal capacity point though, the way I interpreted what I read is that these ocean boxes would roll on existing manifest/carload trains “PSR style”. Which again accounts for the relatively low velocity, which doesn’t matter as much for international IM from an overall supply chain perspective.

So in some sense it’s almost “negative cost” for CN and CSX because the revenue from all the loads – including the extra ocean boxes – on that train is spread across the only very marginally higher operating cost due to the extra well cars. Unless they need to add a locomotive or something (doubtful).

And isn’t CN trying to build an additional Toronto Area ramp?

I think they should try the more direct CSX-CP (ex D&H) routing via Albany again. Unless this is all about CSX getting a bigger rate division (those CN hauls are short! but I do understand the rate division probably isn’t solely mileage based) or CN wanting to deny CP the Montreal traffic.

What about block swaps to/from CSX IM trains at Philly or Kearny that serve the Carolinas, Georgia, and Florida? I know this is mostly about international boxes from the mid-Atlantic ports but why not aggregate in some domestic 53s?

This brings a lot of questions. This is a very short intermodal haul by today’s standard, involving two railroads, and that would likely generate low volumes at start. This is the exact type of intermodal service lanes that were pruned by CSX and CN in the past years (see what happened with CN’s service to Auburn,ME and Saguenay,QC, for instance). PSR does not tolerate low-margin, low-volumes business, and does not provide any patience to grow the business until it reaches sufficient volumes to be profitable.

Moreover, capacity is completely maxed-out at Brampton Intermodal Terminal these days. CN has dumped most of its eastern Canada intermodal operations in the Halifax-Chicago corridor in the past two decades, partly because the capacity at BIT is used for more lucrative long-haul western Canada service. And now it is proposing using whatever available capacity for a slow,interline service with CSX? Where’s the logic in that?

And if there is indeed available capacity at BIT, why not instead aim to recoup the lost traffic between Montreal and Toronto that is now running on 401/A20? At 350 miles, it would remain a short-haul, but CN would keep 100% of the revenues.

Edward Kandl,

I take it you didn’t read the story then, it states that with port delays and border crossing delays a truck is hard pressed to complete that 480 mile trip in ONE day, there fore it takes a truck at least 2 days for that same 480 miles.