MONTREAL — Canadian National executives defended their intermodal growth strategy today, saying it’s the best way to compete with trucks and bring new profitable traffic to the railway over the next decade.

Activist investor TCI Fund Management, which has launched a proxy fight to replace CEO JJ Ruest and four board members, has been critical of CN’s operational and financial performance over the past five years, including its deteriorating operating ratio, or O.R.

“CN is a growing company. We’re very committed to intermodal,” Ruest told an investor conference on Tuesday morning.

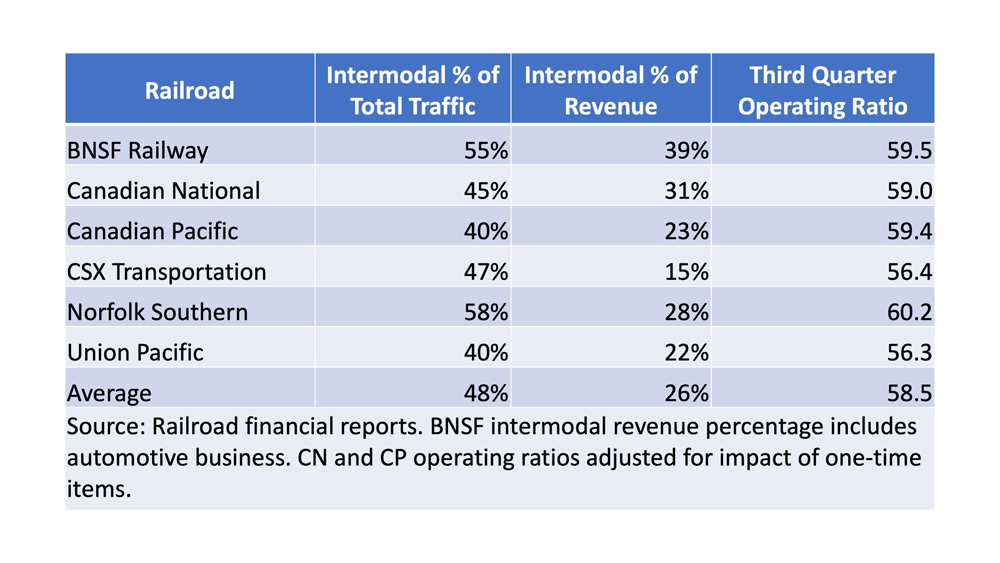

A relatively high percentage of CN’s revenue comes from intermodal traffic, which has a higher operating ratio than carload or bulk traffic, says Ruest, who is retiring in January. “We have 30% of our revenue in the third quarter that came from intermodal, just like BN[SF]. As a reference point, on the low end you have CSX, who only had 15% of their revenue coming from intermodal,” he says.

CN’s intermodal business also makes a positive contribution to the railway’s earnings, return on capital, and free cash flow, Ruest notes. “Intermodal is a profitable business. And we’re making it even more profitable right now,” he says, noting CN replaced some lower-margin international intermodal business with higher-rated intermodal traffic for retailers who chartered containerships from Asia to British Columbia ports.

The future of railroad growth belongs to intermodal, Ruest contends.

“It’s also the best product the railroad could have to compete with the highway and attract business that really should be on rail. But it does not have the same O.R. as carload or bulk. A unit train of coal might have an O.R. of 45. Carload might be an O.R. of 55. Intermodal might have an O.R. of 65,” Ruest says.

But that’s no reason to pass up the opportunity to gain more intermodal traffic. “Intermodal is part of our growth story,” Ruest says.

CN set a 57% operating ratio target for next year as part of a plan to cut costs while boosting profits and earnings. Last year CN’s operating ratio, adjusted for one-time items, was 61.9%. The railway has completed layoffs and several other cost-cutting moves that were announced in September, Chief Financial Officer Ghislain Houle says.

CN says its Full Speed Ahead plan is designed to balance the needs of shippers, shareholders, employees, and the economy. “The operating ratio we define as how low should we go versus how low can we go,” Ruest says.

“As you improve the O.R., you’ve got to keep great customer service, and safety has got to remain a core. You cannot improve the O.R. at the cost of customer service. And hence why we have a balanced approach,” Houle says.

Chief Operating Officer Rob Reilly says CN’s key operating metrics have improved over the past couple of years and will continue to improve as the railway adopts more technology, from automated track and car inspection to more fuel efficient and alternative-fuel locomotives.

The CN executives spoke at the Fourth Annual Scotiabank Transportation & Industrials Conference.

JJ is one of only two visionaries in Class 1 leadership positions right now. Unfortunately, he’s “pulling the pin” in January. Hopefully CN’s board selects a new CEO with the same degree of forward focus that JJ has brought to the job.

I don’t think anyone has ever accused hedge fund TCI of having any understanding of railroad economics (its solution to CSX’s low earnings a few years ago was just to raise rates). Railroading is a very high fixed cost, low variable cost business. Added traffic helps to absorb fixed costs while not adding a lot to variable costs. In addition the great advantage of intermodal is that capital investment is used far more intensively; intermodal cars are not making just one trip a month so the return on capital is much higher (compare an Amtrak train making a 5 day roundtrip between LA and Chicago versus an airplane making 2 round trips a day). CNR in fact is about the only growth railroad in between Price Rupert and Halifax plus its earlier acquisitions of the EJ&E, BCR, and DM&IR.

I see a lot of trucks going by my house, and the railroad behind it, going by with containers that should be on the rails, in my humble opinion.