PITTSBURGH — Wabtec yesterday reported strong second-quarter results, with double-digit earnings growth and rising profit margins fueled by strength in its transit business and recent acquisitions.

Operating income rose 9.7%, to $472 million, as revenue grew 2.3%, to $2.71 billion. Earnings per share rose 19.5% compared to a year ago.

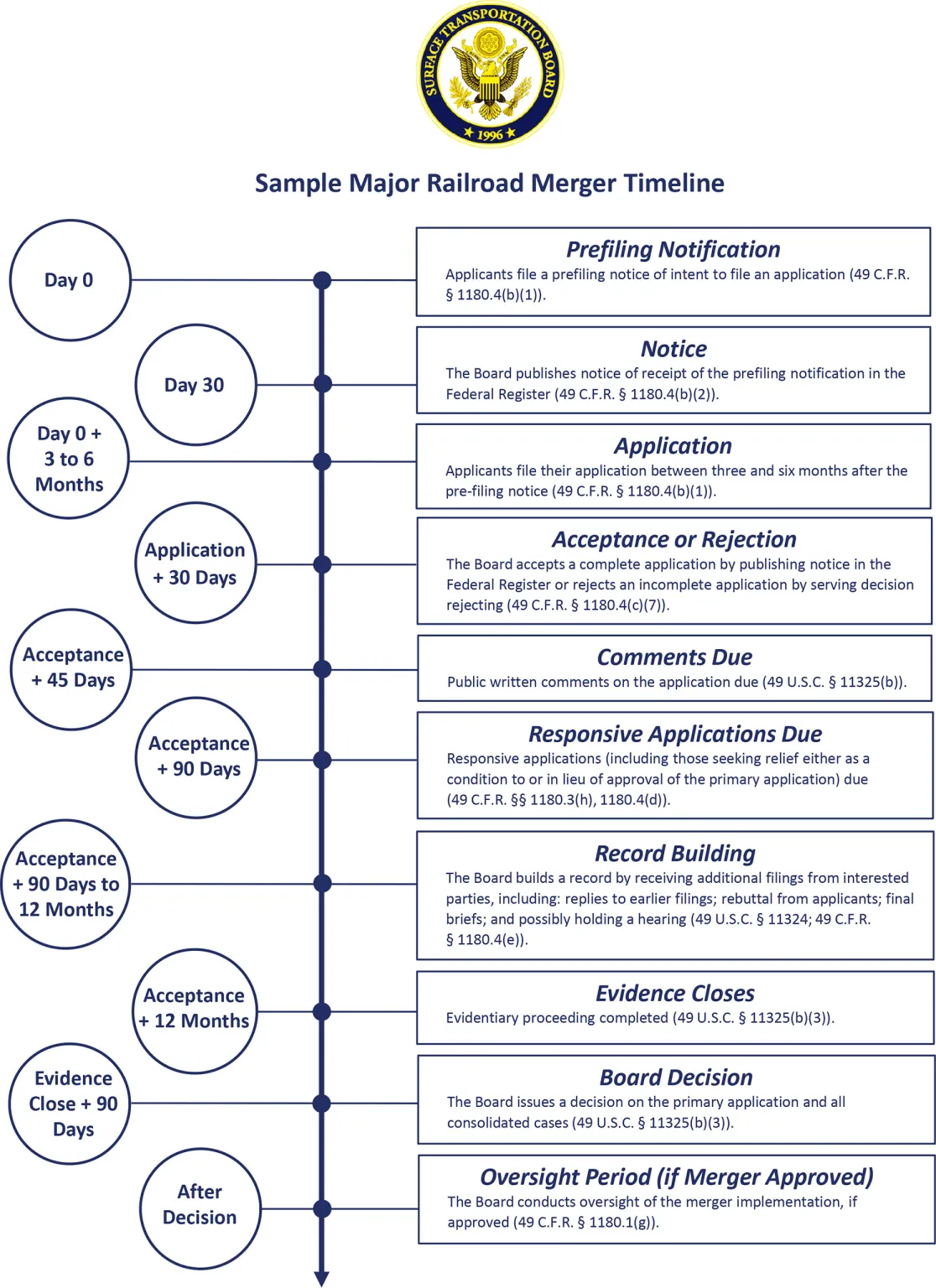

Wabtec sees the potential for rail volume growth from Class I railroad mergers that would create transcontinental systems, CEO Rafael Santana told investors and analysts on the company’s earnings call. Union Pacific and Norfolk Southern yesterday confirmed that they are in advanced talks regarding a merger.

“We see an opportunity for rail to win share out there as a result … and that would translate into growing volumes, which would be a positive for us,” Santana says.

Meanwhile, Wabtec sees demand rising for new locomotives as well as its locomotive modernization business as the average age of the North American locomotive fleet continues to rise amid what has been a prolonged slump in new orders.

“We continue to see significant opportunities in demand for new locomotives and modernizations as well as digital technologies due to our customers investing in solutions that continue to drive fuel efficiency, reliability, productivity, and safety,” Santana says.

Second-quarter Transit segment sales increased 8.7%, while Freight segment sales were flat as a 6% gain in services was offset by lower locomotive and mining equipment sales. Locomotive deliveries were impacted by a parts supply issue, with shipments expected to resume in the second half of the year.

Wabtec’s 12-month backlog was up $876 million from a year ago. However, the company’s total multi-year backlog declined $247 million year-over-year, or 2% when adjusted for currency.

The company also touted its merger strategy, which includes the acquisition of Inspection Technologies, DeLiner Couplers, and Frauscher Sensor Technology, all of which enjoy the top market position in their respective markets.

Wabtec raised its full-year 2025 revenue guidance by $200 million at the midpoint to a range of $10.925 billion to $11.225 billion.

With all the Stored Locomotives and the Ones that are going to be Scrapped and Mergers on the Horizon The Class 1s need to deplete Inventory Before Purchasing New