Class I railroad earnings growth will slow and their stock prices will slump if they can’t maintain improved service levels and win back volume lost to trucks, a Wall Street firm warns in a new report.

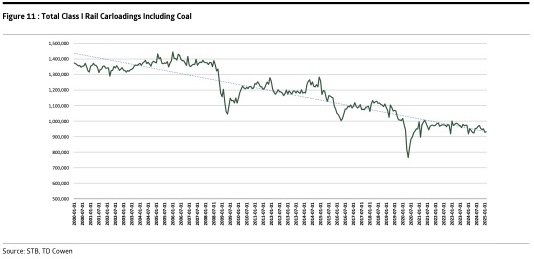

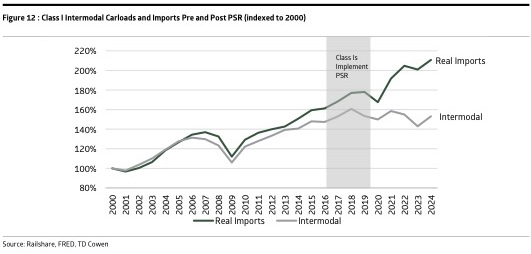

TD Cowen analysts note that rate-driven revenue growth, cost-cutting, and rising profit margins have sustained railroad earnings and stock prices despite continued market share losses to trucks and an overall 11% decline in U.S. rail traffic between 2014 and 2024.

The decline isn’t just due to coal. Even excluding coal, rail volume is down 1% over the past decade. When coal is excluded from the tally, U.S. rail volume is down 1% between 2014 and 2024. Trucking’s market share, meanwhile, has expanded to between 70% and 80%, TD Cowen notes, up from 60% to 65% in the early 2000s.

Inconsistent service is the root cause of rail’s share loss, TD Cowen says. The service gap is stark: Some 66% of shippers receive on-time performance of 80% or better from trucking partners, compared to just 16% from railroads.

“Although rail service metrics reported by the Class I’s have improved considerably, shipper experience remains lacking,” the report says, citing TD Cowen shipper surveys.

Just 6% of rail shippers receive service guarantees, compared to 37% from trucking carriers. And just 46% of rail customers receive a price quote within a week, compared to 94% of trucking customers.

To remain relevant in stock markets, the Class I railroads will have to do four things, TD Cowen says:

- Improve freight visibility through programs such as RailPulse, which allows shippers to monitor the location, status, and health of their cars in real-time.

- Make it easier for customers to interact with the railroad.

- Boost operational flexibility.

- Improve and maintain service levels.

“We view the levers of growth as largely in control of the railroads,” the analysts wrote.

“Despite service showing improvements, there is a gap between published railroad service metrics and shipper sentiment on rail service,” the report says. “Rail shippers have consistently (since we began digitally tracking our survey in ’16) wanted to put more freight onto the railroads, though poor service metrics have dissuaded them.”

A focus on growth is a better alternative to transcontinental mergers, the analysts say.

“Mergers have entered the conversation again recently as sources of growth are questioned. Establishing a transcontinental railroad would reduce interchange complexities and offer cost synergies. However, achieving this is a tall order from a regulatory perspective,” the report says.

“If the rails fail to prove they can grow with a concerted effort made by the industry, they may be forced to press the merger issue,” TD Cowen says.

The Class I railroads all say that providing consistent, reliable service will lead to volume growth and capturing market share from the highway.

But TD Cowen analysts say that in order to gain confidence in those predictions, they’d have to see “shippers acknowledge structural improvements in on-time performance,” railroads continue to press for improved supply chain visibility, stronger than expected reshoring of manufacturing, or major shifts in regulations covering major railroad mergers.

The TD Cowen report, “Growth Is the Logical Path Ahead; Rails at a Major Junction,” was published on June 11.

These are critical times for the industry. They had better find a solution or we may end up with government owning what is left of the mess once its collapses. The industry has only them selves to blame for their failure to keep or gain new customers. They continue to abandonee track miles depriving many fair sized communities of potential rail service and business development. Just look at what CXS is doing to the old B&O across Illinois as an example. It will require the imagination and same spirit that built the railroads to again revive them. The question is to we have the men and women in today’s industry to do the job.

There are a lot of customers that don’t care how long something takes in transit as long as they have the raw materials at a certain time each day. RR’s can certainly cater to that business model.

I used to work at a paper mill in northern Maine. When I started 85% of outbound traffic was by rail. By the time I left, some years later, that was down to about 15%. Trucks could make a round trip to a customer in a day. The train, even with three switches a day, could take as long as four days. The cars pulled from the shipping dock were hauled to the local yard and had to make the southbound BAR train that evening. If not, they sat until the next day. Then they were switched to Maine Central at Northern Maine Junction and then switched again to the Boston & Maine at Rigby Yard in South Portland. They were then dropped at the yard in Lawrence, MA where a local switcher would take them to the customer or our warehouse. The customers wanted today’s paper to be used for tomorrow’s newspaper. Trucks could do that, but railroads couldn’t.

Nothing to see here folks….. move on. Railroads will have to grow business. Duh. Mergers won’t fix it.

Wayside defect detectors can’t be replaced be rail pulse wayside defect detectors can be reliable as well as rail pulse

And the truckers are laughing all the way to the bank. You railroad guys have never figured out how to account for the phenomenal growth of the JB Hunt-Santa Fe partnership now once again referred to as Quantum. With the exception of the linehaul everything is controlled by the trucking company. Message???

What is in short supply in the railroad industry are three things: creativity, innovation and leadership. The original Quantum concept was the brainchild of a career railroader named Mike Haverty, who it turns out found a kindred spirit in a good old boy trucker from Arkansas. As an aside here I’ve often wondered what would happen if BNSF outsourced its carload transload business to JB Hunt. That’s a question that I believe Mr. Stephens has never asked or raised.

Quantum did not exist in 1989 and now JB Hunt is the single largest intermodal carrier in North America. If you analyzed the JB Hunt business model you would discover they have de-marketed their traditional point-to-point truckload business in favor of something I call dedicated contract carriage as well as new segment focusing on first mile-last mile. In other words, everything but the legacy traditional truckload business.

In 1988 UPS figured out the best way to reduce the intermodal drayage expense was to build the UPS Sorting Center right next to the Santa Fe main line. Willow Springs remains a genius concept in how to improve the intermodal supply chain.

One more thought. When Mike returned from getting his MBA at Chicago the McKinsey guys told the clowns in Santa Fe’s “crack” marketing department about Mike’s trucking partnership idea. They all scoffed at it and said Mike was just an operating guy and in effect did not know what he was talking about. Well history has proven who the real genius was here.

Interesting turn-about. The Wall Street vultures first demanded cost-cutting to the bone via PSR and low-low-low OR’s. Then when that had the obvious effect of blowing up service levels as well, they finally awakened to the fact that the railroads are now in a classic flat-spin environment. Suddenly it’s time to improve service metrics, aggressively seek out new business, and maybe even seriously consider trans-con mergers. How ironic. “What ye sow, ye shall reap”!

Stalin said during WW2 “how many divisions does the pope have”. A question is how many shares or board members at class 1s does TD cowen have?

Hedge funds and pocket-stuffing executives have ZERO interest in long term growth. Their attention spans are measured in months or a few quarters. Spending as much or more on buybacks as CapEx is not a growth strategy; it us eating the seed corn.

There is NOTHING short of regulation that will change this picture. Investments in capacity have to be imposed. Class 1s have a 40 year track record of shrink mode.

Awaiting a retort from the AAR saying they didn’t measure the right things.

However, if your customer does not believe you are doing a good job, no matter what your internal metrics show, you won’t be able to grow business.