JACKSONVILLE, Fla. — CSX has fully bounced back from a bout of operational challenges that began with hurricanes last fall and worsened after the Feb. 1 closure of the Howard Street Tunnel in Baltimore, CEO Joe Hinrichs tells Trains.

The railroad’s on-time performance in May, measured by trip plan compliance for intermodal and carload shipments, has returned to December levels.

“I’ve learned enough from Mother Nature to never call the all clear. But we feel really good about the state of our railroad right now,” Hinrichs said in an interview on Wednesday (June 4). “The yards are in good shape. The network is performing back to where it was in ’23. And so the team’s done a great job … quickly getting the network back.”

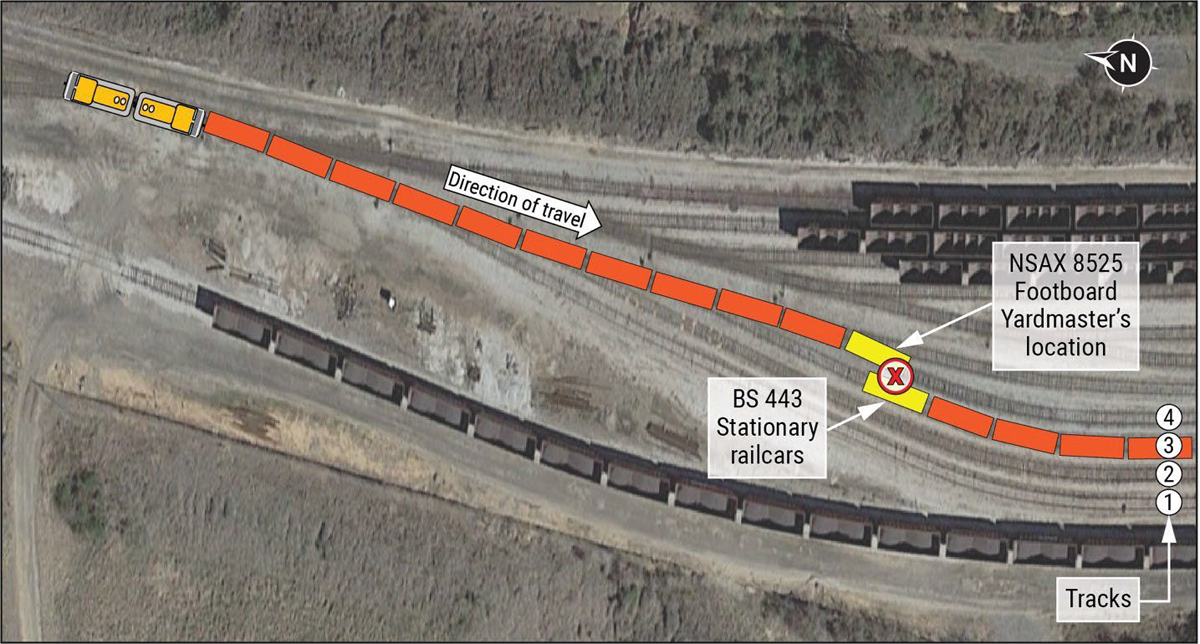

CSX was already struggling operationally when it shut down the Howard Street Tunnel for a six- to eight-month double-stack clearance project. This forced the railroad to detour more than 16 trains per day. The tunnel is a key link in both the north-south Interstate 95 Corridor as well as the east-west corridor that connects Baltimore with the Midwest and with coal mines in West Virginia and Pennsylvania.

By the first week in April, the CSX network had slowed to levels not seen since the 2022 service crisis that was caused by widespread crew shortages at all four big U.S. railroads.

The latest performance metrics, released today, tell the story of how CSX turned its operations around over the last seven weeks:

- Terminal dwell has improved 20.2% compared to the worst week this year.

- Average train velocity is running 15.4% above the lowest level posted this year.

- The number of cars online, a key indication of congestion, has decreased 11.7% compared this year’s high point.

And CSX is running faster than last year at this time, too. Last week’s dwell was 5.9% lower than the same week last year, while velocity was 3.4% higher.

As a result, combined trip plan compliance for intermodal and carload traffic stood at 82.5% in May – up from 68.1% in early April and in line with December 2024’s 82.7%.

The number of cars online is currently 0.7% higher than a year ago. But that’s a figure that reflects extended transit times related to detouring traffic around the Howard Street Tunnel and the out-of-service Blue Ridge Subdivision, which has been closed since September due to extensive damage from Hurricane Helene.

The recovery came faster than was initially expected. Executives had said service improvements wouldn’t come overnight and that the Howard Street and Blue Ridge Sub detours would continue to weigh on the railroad until the projects are completed in the fall.

“I’m proud of the team, but I’m not surprised because I know the capability of this organization,” Hinrichs says.

Hinrichs says he also wasn’t surprised by the fragility of the network given a string of unusual events. Sixty miles of the Blue Ridge Sub — the former Clinchfield Railroad on the rugged North Carolina-Tennessee border — were wiped off the map in September. Hurricane Milton struck the Southeast right on the heels of Hurricane Helene. Midwestern yards were congested when CSX shut down the Howard Street Tunnel. And then recovery efforts were complicated by spring flooding that hit Kentucky and Tennessee.

“In hindsight, we should have made sure that those yards were in better shape before we took the Howard Street Tunnel down,” Hinrichs says.

“I don’t expect we’ll have that kind of sequence of events happen again, but we did learn some lessons,” he says. “Clearly, we’ve got to keep our yards in great shape. And we have to make sure that we stick to our … service plans, because therein lies our success.”

If there is another weather-related disruption, Hinrichs says CSX will be better prepared to respond because the network is running well.

“We’re in good shape now and, obviously, our plan and our goal is to keep it running there,” Hinrichs says. “ What’s encouraging is we’re getting to these levels before we get the Blue Ridge and Howard Street Tunnel back. So we run like this now and we get those two … projects completed, we’re going to be even in better shape.”

CSX’s operational problems followed a familiar pattern: As a railroad slows down and gets congested, it eventually runs into crew and locomotive shortages, which makes it harder to run to the operating plan — much less clear congestion. And when transit times rise, customers then add cars to the system, which further snarls operations.

But what made CSX’s 2025 meltdown unusual was that it was not accompanied by a wave of customer complaints.

Hinrichs credits this to proactive communication with shippers and close coordination between customer service and operations. The customer service team asked customers to prioritize their shipments. The information was then passed along to operations, which put an emphasis on moving the hot cars. In some instances, CSX trucked containers and trailers around rail congestion so that they would arrive on time.

“We did a number of extraordinary things to keep our service focused on our customers and to respond to customer needs,” Hinrichs says. “ And so what we found really important to customers was visibility and proactive communication. And I think that’s why you didn’t hear a lot of complaints.”

CSX took several steps to clear congestion. Among them: Pulling 45 locomotives from storage, ordering 20 additional locomotive rebuilds, adjusting engineering work blocks to align with natural lulls in traffic, storing 2,000 cars, and collaborating with customers and short line railroads to pre-block traffic and increase the frequency of interchanges.

Hinrichs says the railroad was adequately staffed on the routes that have had to shoulder the burden of the Howard Street Tunnel and Blue Ridge Sub detours, which account for about 12% of the railroad’s daily train starts. But crew supply got tight once congestion put crews and locomotives out of position.

To boost crew levels, the railroad temporarily transferred crews to 13 locations and consolidated extra boards at eight locations. Hinrichs also made two appeals to train crews and other employees to make themselves available, particularly on weekends, to help get traffic moving.

Did those bulletins make an impact? “I’ll just say I’m really proud of how our team responded. I believe in treating all of our 23,000 railroaders as equals and I felt they needed to know what was happening and what help was needed and where we needed additional help. And they responded,” Hinrichs says.

Independent analyst Anthony B. Hatch says CSX did a remarkable job turning its operations around. To please customers, the railroad has been absorbing the extra costs related to the detours. “So CSX is taking the hit, not shippers,” Hatch says.

Rick Paterson, an analyst with Loop Capital Markets who closely follows railroad performance metrics, says CSX got back on its feet faster than expected.

“Typically, when railroads get into trouble it takes longer to climb out of the operating hole than it took to fall into it. CSX bucked this trend, with an 11-week deterioration on the back of the Howard Street tunnel closure, followed by just a six-week recovery,” Paterson says. “Obviously we would have preferred CSX not fall into the ditch in the first place, but at least the accelerated recovery was a welcome surprise.”

CSX’s first-quarter profits fell as congestion hurt volumes and revenue while driving up the railroad’s expenses.

Note: Updated with comments from Loop Capital Markets analyst Rick Paterson at 11:10 a.m. Central.

It’s the Terminals. It’s always the Terminals. They’re where the Complex Work of Railroading occurs. Line-of-road is more visible, and so management pays it greater attention. But if the Terminals back up . . .

Mr. Rioce,

Your comment seems to make perfect sense to me. Somehow, ignoring the eventual value of those “contingent costs” seems quite short-sighted.

“Hinrichs says he also wasn’t surprised by the fragility of the network given a string of unusual events.”

Because your predecessors either pulled up or spun off your capacity that would allow you to handle contingencies.

Contingent capacity is a cost that hedge funds don’t allow railroads to maintain. So in turn you have to invest (or pay more) more in emergency response to get your fewer mainlines back in service.