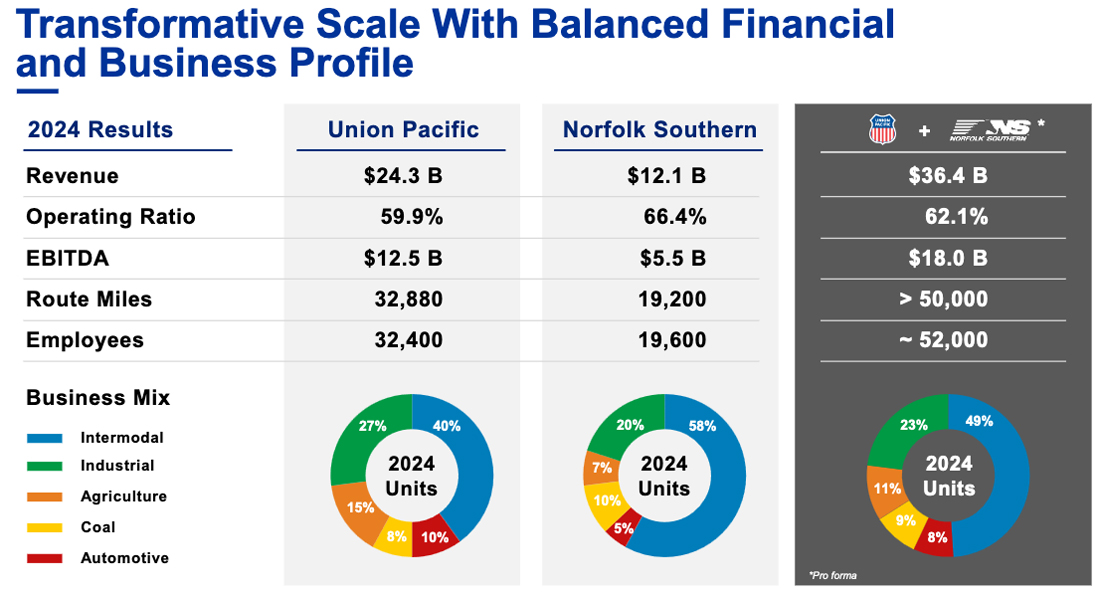

OMAHA, Neb. — Union Pacific and Norfolk Southern executives touted their proposed merger as a way to return to volume growth after losing market share to the highway since rail traffic peaked in 2006.

“We can only go so far independently. And let’s face it, this industry has faced contraction over the last couple decades in terms of volume growth,” NS CEO Mark George told investors and analysts on a conference call this morning. “We’ve been losing share to truck — and this is one way to reverse that trend.”

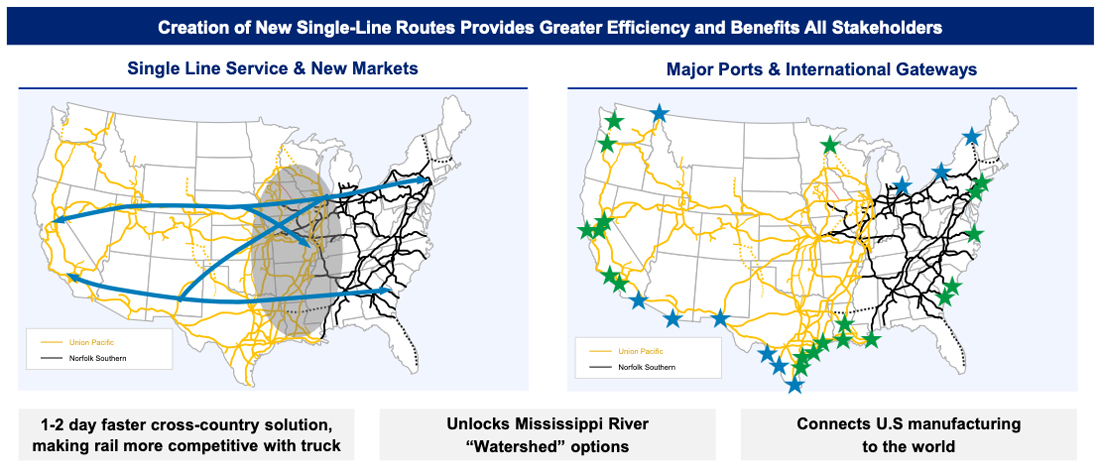

The historic combination — which would create the first transcontinental railroad in the U.S. — would unleash growth by eliminating problematic interchanges, speeding and simplifying service, and enabling the railroad to tap the so-called watershed markets along the Mississippi River. UP and NS envision reeling in $1.75 billion in growth-related revenue by the third year of their merger.

UP and NS currently exchange about 1 million shipments per year and are each other’s largest interchange partners. Single-line service will reduce strain on gateways such as Chicago and Memphis, end inefficient crosstown rubber-tire intermodal interchanges, and allow customers to receive rate quotes and bills from one railroad rather than two.

“In the future, those million carloads will immediately see a 24- to 48-hour improvement in their transit time,” Vena says. “ That combination of faster service and greater market reach is powerful, making our transcontinental railroad an attractive choice for both current and future customers.”

The transcontinental system’s traffic opportunities include providing seamless service from coast to coast — and most places in between — for intermodal, finished vehicles, food and beverage, chemicals, and steel shipments.

For intermodal and carload, the merger would open up service in the nation’s midsection that’s currently not well-served by rail due to the short hauls for the eastern or western carrier, or both.

“With our interchange with UP today, 95% of our interchange is over 2,000 miles, meaning only 5% is under 2,000 miles. We see an enormous opportunity to grow in lanes where we would be in that 1,000-mile or 1,500-mile range,” George says of intermodal. “So that’s just one example, and that kind of touches upon the entire watershed story.”

Railroads are not competitive on short-haul moves in the watershed, an underserved area that stretches from Wisconsin and Minnesota to eastern Texas, Louisiana, and Mississippi.

“When you’re going from west of it to east, or east to west, rail is never even contemplated because it’s just too much hassle, too much extended time, and frankly, too much cost,” George says. “So these are the areas where we see tremendous growth.”

Single-line service through the watershed on a combined UP-NS system would enable the railroad to compete for traffic moving between Houston and Charlotte, N.C., and Dallas and Columbus, Ohio, for example.

“There’s an awful lot of opportunity here where there’s virtually no rail moves. It’s all truck moves, and those are big markets,” George says, adding that revenue growth from truck conversion likely would exceed the railroads’ $1.75 billion estimate.

A merger also would allow the railroads to eliminate intermediate handlings for carloads.

“We will remove touch points, and every time there’s a touch point, you add 24 to 36 hours, even at the best, while you’re switching the rail car. That’s gone,” Vena says. “On top of that, at the interchange points, where we used to stop and hand off, those are removed. So every customer that today, when we are finally approved … we’re going to cut a day or two off of every transit time.”

And that, he says, will reduce costs for customers, who can reduce the size of their car fleets due to faster cycle times. It also will mean a more fluid railroad.

For new through trains, Chicago will become just another crew change point on the map. But Vena says it’s unlikely that there will be massive swings of volume away from Chicago, a chronic chokepoint where 25% of rail traffic originates, terminates, or passes through.

“We don’t see a huge amount of business changing from Chicago to go to Memphis or go to New Orleans because the out of route miles just don’t add up,” Vena says.

The transcontinental UP also will be able to repatriate international intermodal traffic that Canadian ports, particularly at Vancouver and Prince Rupert, British Columbia, have lured away from U.S. ports over the past two decades, Vena says.

The approval process

Executives also expressed confidence that their deal could gain regulatory approval. The UP-NS combination will be the first judged under the Surface Transportation Board’s 2001 merger review rules. The rules require a merger of Class I railroads to enhance competition — not merely preserve it — and to be in the public interest.

Vena said that if the STB systematically reviews the deal while asking if a transcontinental railroad is better for customers and the country, they will approve it. “We’re very confident of that, or we wouldn’t have taken the step,” he says.

Only 20 customers are currently jointly served by UP and NS where their networks overlap in the Midwest. “We intend to provide a competitive alternative,” Vena says, noting that specifics will be included in the merger application.

The railroads also structured their deal without the use of a voting trust. Rail mergers have typically involved placing the railroad being acquired into a voting trust in order to maintain the railroad’s independence and to allow its stockholders to cash out while the merger is under regulatory review.

The STB in 2021 rejected Canadian National’s request to put Kansas City Southern in a voting trust, saying it wasn’t in the public interest. The decision scuttled the proposed CN-KCS merger and led to the Canadian Pacific-KCS combination, which was judged under the less restrictive old merger review rules due to an exemption granted to KCS, by far the smallest of the Class I railroads.

UP and NS are not taking that chance.

“We actually believe that a voting trust would complicate and potentially delay the transaction,” UP Chief Financial Officer Jennifer Hamann says. “So we want to go to the STB with a fully developed merger application that allows us to really lay out the fundamentals of this merger and provide all the necessary details that supports our position that this will not only enhance competition, but is absolutely in the public interest.”

Plus, without a voting trust UP won’t have to fund the deal until it gains STB approval, which is estimated for 2027 based on the STB’s statutory guidelines.

Promises of smooth integration

Railroad mergers in the modern era have had one thing in common: Service problems that occur while meshing operations and information technology systems.

UP’s operational decisions in Houston after the 1996 acquisition of Southern Pacific created a massive traffic logjam in 1997 and 1998. On the heels of that, information technology problems led to immediate service problems on Norfolk Southern after the 1999 split of Conrail with CSX, which later stumbled with its own service issues.

“A transaction of this size and scope won’t be easy to execute. We understand that,” Vena says.

The railroad will maintain an adequate buffer of locomotives, train crews, and other resources in order to be able to better respond and recover to service issues, he says.

“We’re very aware of what led to the merger moratorium back in the 2000, 2001 time frame, and it was just a bunch of bad integrations,” George says. “And we are committed to make sure that doesn’t happen in this case.”

The two-year review process will allow sufficient time for planning, George says, particularly on information technology systems.

CPKC’s problematic computer cutover in May in former KCS territory in the U.S. produced congestion, missed switches, and delays that CPKC has now mostly mopped up.

Last year UP had a smooth cutover to its new cloud-based NetControl computer system, which processes everything from rail car inventory and scheduling to waybill processing and train, locomotive, and terminal management. “It was a non-event,” Vena says. “It was like nobody knew it actually happened.”

Much of the $2 billion the railroads have earmarked for increased capital spending will go toward information technology investments.

Merger synergies of $2.75 billion

Assuming shareholders approve the deal, UP will acquire NS in a stock and cash transaction that values NS at $320 per share, a 25% premium. The combined company would have an enterprise value of more than $250 billion. The railroads said the merger would create $2.75 billion in annual synergies, split between $1.75 billion in revenue growth and $1 billion in cost and productivity savings.

UP will finance $20 billion of the deal through a combination of cash on hand and new debt. Both railroads will stop their share buyback programs through 2028 but will maintain dividend payments.

Shipper and labor opposition

The railroads pledged to preserve union jobs, which are the vast majority of the combined system’s 52,000-strong workforce. “All of our union employees who have a job today will have jobs tomorrow in our merged company,” Vena says. “And a company that is growing its business and spurring economic development creates even more jobs.”

Nonetheless, the SMART-TD union that represents conductors said it would oppose the merger [see “Union says it will oppose …,” Trains News Wire, July 29, 2025].

Yesterday shipper associations told News Wire that they would oppose further consolidation in the rail industry.

How will the railroads handle objections from shippers and rail labor? “We’ll handle them one by one, but I think as people start to come to understand what we’re putting forward, they’re going to see the benefits,” George says.

That especially applies to labor because the company would add jobs as it gains new traffic, he says.

Media needs to quit saying this merger will create the first Transcontinental Railroad. That title went to Union Pacific and Central Pacific (nee Espee) in 1869. It will, however, create the first “Coast to Coast” transcontinental railroad and that is everything Wall Street, Economists, Shippers and Customers say they want. These two railroads have little overlap and that is mostly in the central part of the country, If this transaction cannot meet the requirements of the Surface Transportation Board, then no merger will ever meet it. And that is just a fact.

Of course the pocket-stuffing CEOs say the merger will enhance competition. As will their Wall Street benefactors and profiteers. And the so-called “analysts” and consultants.

Market concentration NEVER benefits customers or the public. Trains and Freigh Waves should provide detailed reporting otherwise. Press releases make a thousand excuses why the industry provides better service while growth has been stagnant.

UP needs to come up with tens of billions to finance this nightmare. It has to be paid for… by their customers, the public and the environment.

It will be Penn Central redux…

“It will be Penn Central redux…”

Not a chance.

You know full well there are very little similarities here to NYC+Pennsy, a merger that should have never happened. Penn Central was based on many false assumptions, including “elimination of duplicate facilities”. And wasn’t Penny’s OR somewhere in the 90’s at merger time?

And why do you keep bringing up the environment?? That is an emotional response that in meaningless in this discussion.

Even with all mergers completed (UP/NS, CSX/BNSF) there will still be a significant amount of interchanged traffic -between the mega-transcons, short-lines, etc. so the interchange issues, especially capacity need to be addressed.

As I noted in another post capital dollars need to be invested at points where the two railroads connect and unlike PSR don’t wait until it breaks before adding capacity. Just because Chicago is a crew change does not mean the train will actually get through Chicago in less than 24 hours.

Great talk about the 1,000 – 1,500-mile Midwest market, but both carriers offer single line service in North-South corridors. In terms of mode share they do not show any strength and the number one lane on parallel interstates is wall to wall semis. So UP needs to put a lot on the table to get a merger.

Finally, this is risky. If the combined systems (UP/NS and CSX/BNSF) become gridlocked post-merger this will be a one-way street to nationalization.

You are assuming that BNSF and CSX are going to merge. BNSF is privately owned and Warren Buffet owns over 60% of it, probably more than that. If he says they have no interest in a merger, then why would anyone think otherwise? His biggest customer is the largest intermodal shipper in the US and one of the biggest in the world. He has to take care of JB Hunt and he isn’t going to mess around with that customer. The fact is he doesn’t need a merger because he doesn’t have to please Wall Street. HE IS WALL STREET… Railroads that have many shareholders, including investment firms and funds like Ancora have to keep those guys happy, BNSF only has to keep JB Hunt happy and they seem to be doing a great job of that…

Public Comment on the Proposed Union Pacific–Norfolk Southern Merger. A conditional “thumbs up.” A railroad of this magnitude is public policy.

Brian Watt – Freight Logistics Consultant – Winter Haven, FL

As a logistics consultant with over four decades of experience in intermodal transportation and freight development, I’ve worked directly with both Union Pacific and Norfolk Southern — and I want to acknowledge that both companies have historically been open to engaging with smaller brokers, independent operators, and non-aligned carriers. I’ve made money using their platforms and equipment. I’ve also seen firsthand that UP and NS, unlike other vertically-aligned rail players, have maintained a degree of market accessibility and flexibility even amid industry consolidation. Both companies, to this day, still talk with smaller companies, still listen to smaller companies, and in my case – let me make money using their services and equipment. UP isn’t a “JBHU Quantum” railroad.

That said, this merger is a structural shift, not just a handshake deal between two railroads. It deserves full-spectrum scrutiny.

________________________________________

1. Efficiency Gains Must Not Come at the Cost of Optionality

Yes, the operational efficiencies of a coast-to-coast carrier are real — fewer interchanges, faster transits, and new routing potential. But railroads do not just move goods — they control access to the flow of commerce. Once this deal is approved, the resulting entity will own the full spine of transcontinental rail. And no matter how well it is run, a network of that size inherently shifts the balance of power away from shippers, intermediaries, and competitors — and toward the asset holder.

Access, once removed, is rarely restored.

________________________________________

2. This Merger Will Trigger a BNSF–CSX Response. We Should Plan for That Now.

While UP and NS don’t directly overlap, this merger sets off a chain reaction. If approved, a BNSF–CSX combination becomes not just plausible — but inevitable. That would leave nearly 90% of U.S. rail freight in the hands of two corporate structures. And we shouldn’t pretend that this possibility lives in a distant future. It will be on the table by the time this merger is complete.

If the STB wants to preserve even the appearance of competitive equilibrium in U.S. freight rail, it must begin crafting policy for a two-railroad landscape today, not after the second merger closes.

________________________________________

3. Now Is the Moment to Fully Automate U.S. Rail — Or Lose the Innovation War to Trucks

Rail should be outpacing highway freight — not the other way around. And yet, autonomous trucking is rapidly approaching commercial viability, while the rail industry lags behind on automation despite having the right-of-way, predictable corridors, and proven technology.

This merger presents a national opportunity: require full-system automation benchmarks as a condition of approval.

From automated brake systems and track inspection to distributed locomotive control and AI-driven dispatching, the tools already exist. What’s lacking is regulatory will and capital commitment. If we’re entering a world where only two carriers will move most American freight, then efficiency must scale accordingly. There is no excuse for a 2030 rail system that still depends on 20th-century crew models while trucks pass it by — driverless.

________________________________________

4. Respectfully: Good Partners Can Still Become Gatekeepers

My critique here isn’t personal. UP and NS have been strong industry partners. They’ve worked with independent operators like myself, and they’ve helped power intermodal innovation. But scale changes structure, and structure shapes behavior. The larger the rail entity, the fewer checks exist on how that power is exercised — especially over pricing, routing, and equipment availability.

This merger will naturally reduce shipper leverage, regardless of service quality. If approved, STB must implement enforceable safeguards to preserve access, guarantee open routing, and prevent the kind of structural exclusion already happening in other parts of the logistics ecosystem.

________________________________________

Conclusion:

If the STB believes in a modern, resilient, and responsive U.S. rail network, then this merger must not go forward without:

• Mandatory reciprocal switching rights,

• Open access guarantees at major interchange points (Chicago, Memphis, St. Louis),

• A clear automation implementation roadmap, benchmarked to the state of autonomous trucking by 2030,

• And active policy development to regulate a post-CSX-BNSF merger reality — because that day is coming.

Lastly, done well, this merger could be the start of a more connected and competitive freight future. Done poorly, it will become a case study in how good railroads became indifferent monopolies by accident — or inertia. We all remember Penn Central and UP-SP. The STB and both railroad companies must be mindful of the two corporate respective internal cultures and respectful of the transport communities they serve. A railroad of this magnitude is public policy.

Respectfully,

Brian Watt

The 1634 Company

Winter Haven, Florida

excellent analysis in the din of frothing foamers.

Reciprocal switching and open access at interchange points is a “I’ll believe it when I see it”. The shippers want it, the railroads don’t because they see it as a money loser. They do not want their rates of return squeezed.

UP will do what they did in the SP merger. They will negotiate new and expanded trackage rights agreements with BNSF and CPKC in Texas, since the large chemical shippers will demand it. CN can probably get trackage rights to Mexico via Laredo and/or Eagle Pass if they try hard enough. But don’t expect UP to give up the farm. Hauling chemicals is highly profitable and UP isn’t going to go for anything that dilutes that profitability too much other than trackages rights to another carrier and allowing customer access.

Growth? LOL.

The first phone call would be from UPS asking for a transcon hotshot and it will still be priced out of this world.

Cost cutting, of course, lots of potential there, but “real” growth, not likely.