BNSF Railway led the big six Class I railroads in growth in 2021, a year in which rail volume rebounded from the pandemic-related lows of 2020 yet struggled to overcome kinks in the global supply chain.

BNSF Railway led the big six Class I railroads in growth in 2021, a year in which rail volume rebounded from the pandemic-related lows of 2020 yet struggled to overcome kinks in the global supply chain.

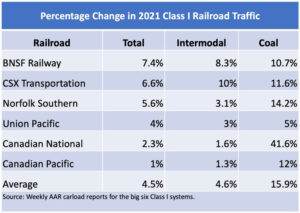

BNSF’s traffic was up 7.4% for the year, with intermodal surging 8.3% and coal up nearly 11%.

CSX Transportation was in second place, with 6.6% growth in 2021 compared to 2020. CSX saw double-digit gains in intermodal and coal traffic.

Norfolk Southern, which experienced the sharpest traffic declines in 2020, bounced back with traffic up 5.6% in 2021, propelled by a 14% rise in coal and a 3% gain in intermodal.

Union Pacific’s traffic was up 4% last year, with intermodal up 3% and coal up 5%.

The Canadian railways saw the slowest growth in 2021, due partly to the impact of extreme weather. Wildfires over the summer in British Columbia closed the directional-running zone shared by Canadian National and Canadian Pacific, followed by devastating floods in the fall that closed Canada’s busiest route once again.

CN’s volume grew 2.3% in 2021, while CP’s was up 1%.

CN’s coal traffic grew nearly 42% thanks largely to winning the contract to haul Teck Resources metallurgical coal from the CP interchange at Kamloops, B.C., to ports at Vancouver and Prince Rupert, B.C.

Overall, U.S. rail traffic rose 5.7% in 2021, according to the Association of American Railroads. North American rail traffic grew 4.5% for the year.

“For most categories, rail traffic in 2021 was substantially higher than in 2020,” said AAR Senior Vice President John T. Gray. “On the carload side, chemicals set a new annual record and grain had its best year since 2008. Coal carloads were up substantially because of sharply higher natural gas prices, while carloads of motor vehicles suffered as microchip shortages forced automakers to cut output. For intermodal, a record-setting first half gave way to a lower second half as supply chain challenges persisted. Still, 2021 was the second-best U.S. intermodal year ever, behind only 2018.”

Share this article