WASHINGTON — Without fanfare, Amtrak last week posted its 2024 annual report, which also contains its funding appeal for the fiscal year beginning Oct. 1, 2025.

The company’s 137-page “General and Legislative Annual Report and Fiscal Year 2026 Grant Request” recaps financial results for fiscal 2024, operating metrics to date, and projections for future years. It also contains a wealth of information regarding on-time performance, expense, and revenue data by route, as well as tables that show how various federal grants have been distributed across product lines.

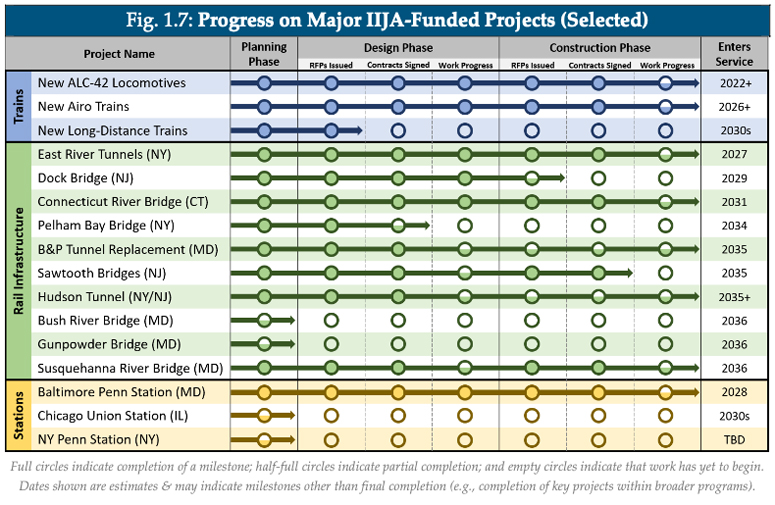

An interesting graphic (below) shows construction timelines for many federally funded infrastructure projects. An “Unmet fleet needs” box notes Infrastructure Investment and Jobs Act funding doesn’t provide “sufficient resources for all replacements needed to maintain current service, nor does it provide sufficient resources to procure additional fleet (and supporting facilities) needed for growth. Thus, adequate appropriations now and in the future will be key to our ability to meet the nation’s demand to maintain and increase service.”

The company is seeking about $76 million of additional security funding outside of the appropriation for its police department and 2026 World Cup events. In the “Reauthorization” section, Amtrak again calls for the next surface transportation legislation, due to take effect in 2027, to include a rail title and guaranteed annual funding. Among its requests is “Improved partnerships with host railroads,” facilitated by “sufficient funding … such that capital improvements are made at a level consistent with the law to ensure the overall fluidity of the nation’s rail network, both for the benefit of passengers and freight.

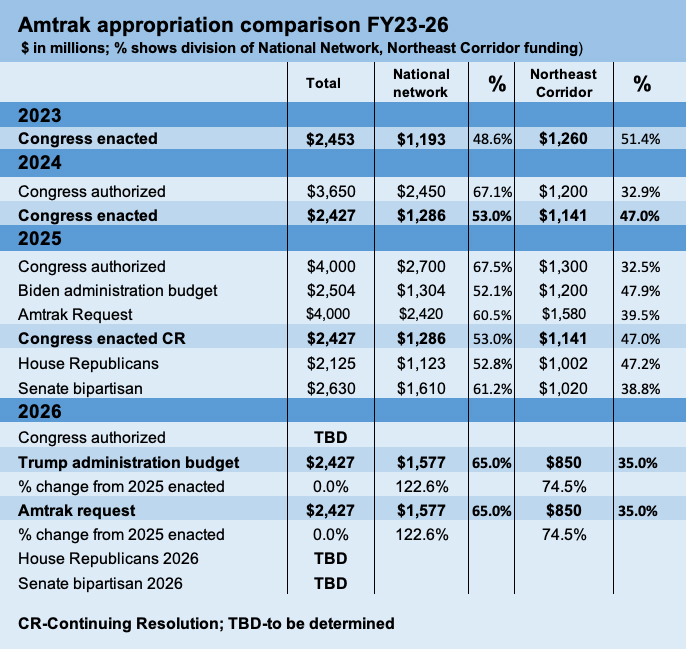

Amtrak’s blueprint for what it needs and why is normally released earlier in the year, and in general does not duplicate the presidential budget proposal. The change this year is presumably based on the assumption that getting funding from lawmakers would be less challenging if Amtrak’s request mirrored what the Administration is willing to provide [see “Trump budget greenlights …,” Trains News Wire, June 9, 2025].

The table above reveals that is exactly what happened — to the dollar. However, the final number will await an overall budget deal. That remains elusive. Negotiations are likely to drag on through the summer and could result in another “continuing resolution.” If no new spending plan is reached, Amtrak can argue Congress has provided the same amount for the last two years, so why not a third?

Profitability promise

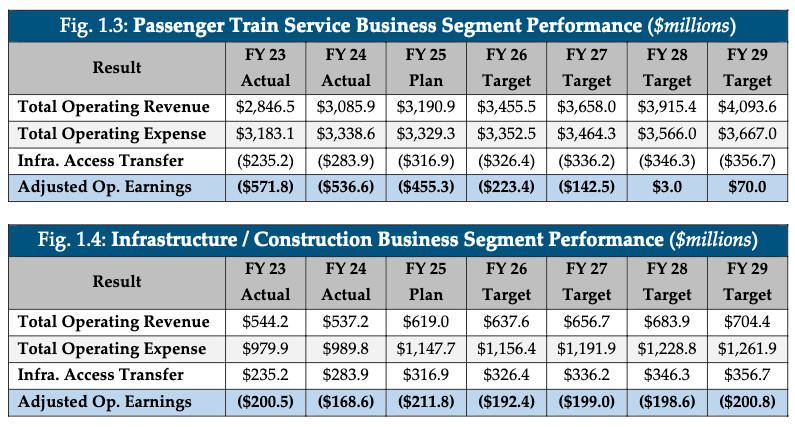

In recounting previous years’ financial results and projecting how they are expected to change in the future, given recent revenue growth, management is claiming the company will reach “operating profitability” by Fiscal 2028. This would be achieved by dividing Amtrak’s core functions into two business segments: passenger train operations and infrastructure/construction.

The table below shows past and projected performance restated using an accounting convention identified as an “Infrastructure Access Transfer.”

Why? The report only says, “It makes more sense [emphasis added] to subdivide consolidated operating loss into separate results for the business’s two key segments: actual passenger train operations and infrastructure/construction activities. In FY 24, Amtrak’s $705.2 million consolidated operating loss was driven by a $536.6 million operating loss on passenger operations and a $168.6 million operating loss on infrastructure/construction activities. New infrastructure / construction costs will continue to grow in the near term; meanwhile, passenger train service is projected to recover a growing share of operating costs.” An “Explanation of business segments” appendix says “Infrastructure/construction … manages Amtrak’s physical rail network, stations/facilities, and other real estate assets.”

Not provided is an explanation of how “Infrastructure Access Transfer” is calculated. But because most of the company’s physical plant and construction activities are connected to Northeast Corridor assets, what this seems to do is offload more expenses required to run Acela and Northeast Regional trains to a separate ledger item that won’t adversely affect those services’ “profitability.” The NEC asset revenue stream includes payments from commuter operators, who are all under financial pressure because of projected federal funding shortfalls.

The implicit message here that Congress should not mess with the vision of current management, because company is on a path to eventual profitability. This differs slightly from the “glidepath to self-sufficiency” prophecy of George Warrington, Amtrak’s president from 1998 to 2002. That deck of cards was based largely on how mail and express revenues and Acela service would allow the company to no longer require a government subsidy. Instead, Amtrak flirted with sky-high interest payments on boxcar and locomotive purchases, deferred maintenance, and bankruptcy. It was rescued by mortgaging New York’s Penn Station and hiring of David Gunn as Warrington’s replacement in 2002.

Inserting an “operational profitability” goal, however, also potentially justifies a continuing focus on short-term expense reduction rather than long-term National Network investments to improve frequencies, capacity, and relevance.

Remember that beginning in 2017 under Northeast Corridor-oriented CEOs Wick Moorman and Richard Anderson, the company jettisoned most regional marketing personnel; National Train Day events; timetables and route guides to tell frustrated travelers where the trains go; hands-on train inventory management to fill seats at lower prices; and local community engagement activities. Current management now treats the lack of such essential marketing initiatives as a given; restarting them would incur costs while not producing an immediate positive impact.

Perhaps it is just playing to the audience, i.e., Congress, but the report states, “Amtrak always strives to operate as efficiently and effectively as possible; however, many details of our approach — e.g., service levels on certain routes — reflect specific directives from Congress, not all of which prioritize cost recovery. … If Congress and the administration choose to emphasize further improvements in financial performance, providing robust near-term funding support and accepting the requisite tradeoffs, Amtrak’s train service will achieve operational profitability by the end of FY 28.”

The message to lawmakers is that Amtrak’s priority is maximizing cost recovery, and to do anything beyond what the company proposes, the legislators will need to invest accordingly. This is the thinking that drove the attempted truncation of the Southwest Chief in 2018, which lawmakers counteracted in a subsequent Amtrak reauthorization and Trump’s Federal Railroad Administration budget recently reiterated.

In fact, current management should be able to develop and defend a growth plan by utilizing some of the newly allocated National Network dollars. There is now an opportunity for that without affecting those considerations with the self-imposed “operationally profitable” mantra.

Airlines aren’t responsible for tarmacs, runways & terminals they just rent gates from airports & TSA is funded by the taxpayers. Regarding the article will this maneuver make Amtrak’s spending more transparent? Will they no longer be able to spread the enormous cost of the NEC infrastructure across the entire national system making it look like the LD routes are losing money? The NEC really needs to be transferred the DOT (providing it hasn’t been axed) making Amtrak & the commuter agencies pay to use it & their fees going towards it maintenance & bring Amtrak service on the corridor under the same guidelines as other states supported service instead of being comped by the nations taxpayers!

Right – there is no budget item on the JetBlue operating analysis for the federally funded tarmac, runways, and terminal buildings. Why in the world is Amtrak trying to show infrastructure capital maintenance as an operating expense in this analysis?

I am having a hard time understanding why Amtrak thinks the “Infrastructure Access Transfer” concept makes sense or is even helpful to calculate when “passenger train service will become operationally profitable”.

For the owned lines, Amtrak seems to still consider funds placed into capital maintenance (very little capacity expansion is being made) Capital but for lines owned by others what is essentially a capital lease by means of trackage access these funds will still be operating, but now will be booked as “Infrastructure Access Transfer”. The only change appears to be that they are booking so much operating expense running the capital programs that they had to do something about it or the NEC would look bad.

So why not just call all funds spent for infrastructure, both capital maintenance and trackage access fees, you know, infrastructure i.e. Below-the-Rail costs. Then the messaging is simple, federal funds will only flow to you know infrastructure? Roughly speaking Amtrak was spending if FY18 $1.93 B in Below-the-Rail costs, infrastructure, accident risk, and security costs. The source I used to calculate that is not published, but inflation alone would take it to $2.3 B, or about the federal average spending over the last few decade absent the IIJA big true capital projects.

My guess – if Amtrak accounted for infrastructure to mean both capital and operational funds devoted to everything Below-the-Rail, similar to highway and aviation government/private consumer responsibilities, it would expose the multi-decade mismanagement of the Long Distance services as the longer, higher capacity routes have been operationally profitable Above-the-Rail for some time, including vehicle depreciation.

Can you imagine JetBlue putting an “Airways Infrastructure Access Transfer” line item in the operating analysis to cover depreciation of tarmacs, runways, and terminal building shells along with TSA?

Why doesn’t congress turn Amtrak into a fully public corporation instead of the semiprivate corporation that it currently is?