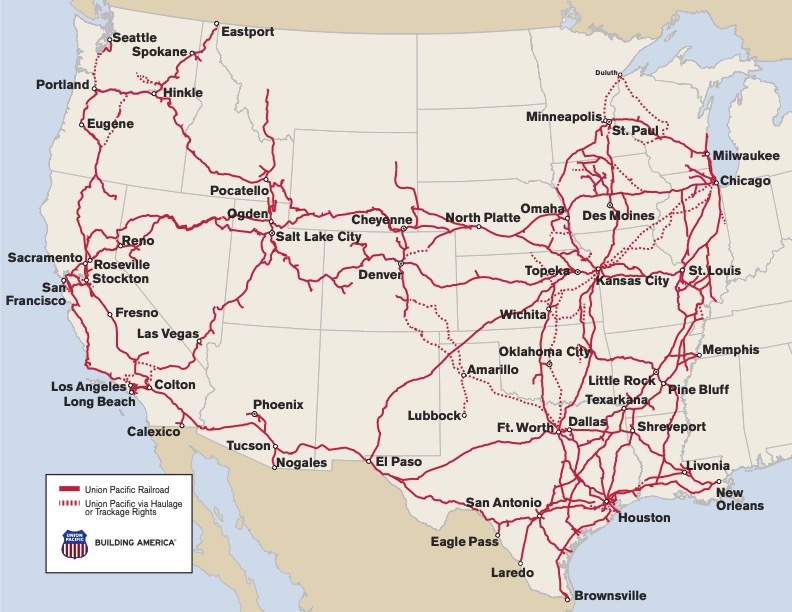

Combining Union Pacific and Norfolk Southern into the first transcontinental railroad in the U.S. would create a 52,215-mile colossus that could offer seamless service from coast to coast, bypassing longtime interchange choke points in Chicago and at gateways along the Mississippi River.

The two railroads confirmed today that they are in advanced merger discussions. The talks, they said, may not result in a deal. Plus, there’s the potential for a bidding war if BNSF Railway, UP’s Western rival, decides to make a move for NS. And there’s no guarantee that the first proposed merger involving two major Class I systems in more than 25 years would pass regulatory review in Washington.

But UP CEO Jim Vena, speaking on the railroad’s earnings call this morning, said the industry needs to move forward during a period of rapid technological change. “If you stand still, you get left behind,” he says.

A merger involving well-run railroads can boost the nation’s economy and help shippers because of the elimination of costly and time-consuming interchanges that can be unreliable, Vena says. “The more we can move off of highways onto our railroad, the more we allow our customers to be able to win in the marketplace,” he says.

The railroad would stretch from Seattle, San Francisco, and Los Angeles to the Northeast, Mid-Atlantic, Atlanta, and Jacksonville, Fla., with lines blanketing the country’s midsection from the Twin Cities, Detroit, and Chicago to Dallas-Fort Worth, Houston, and the Mexican border.

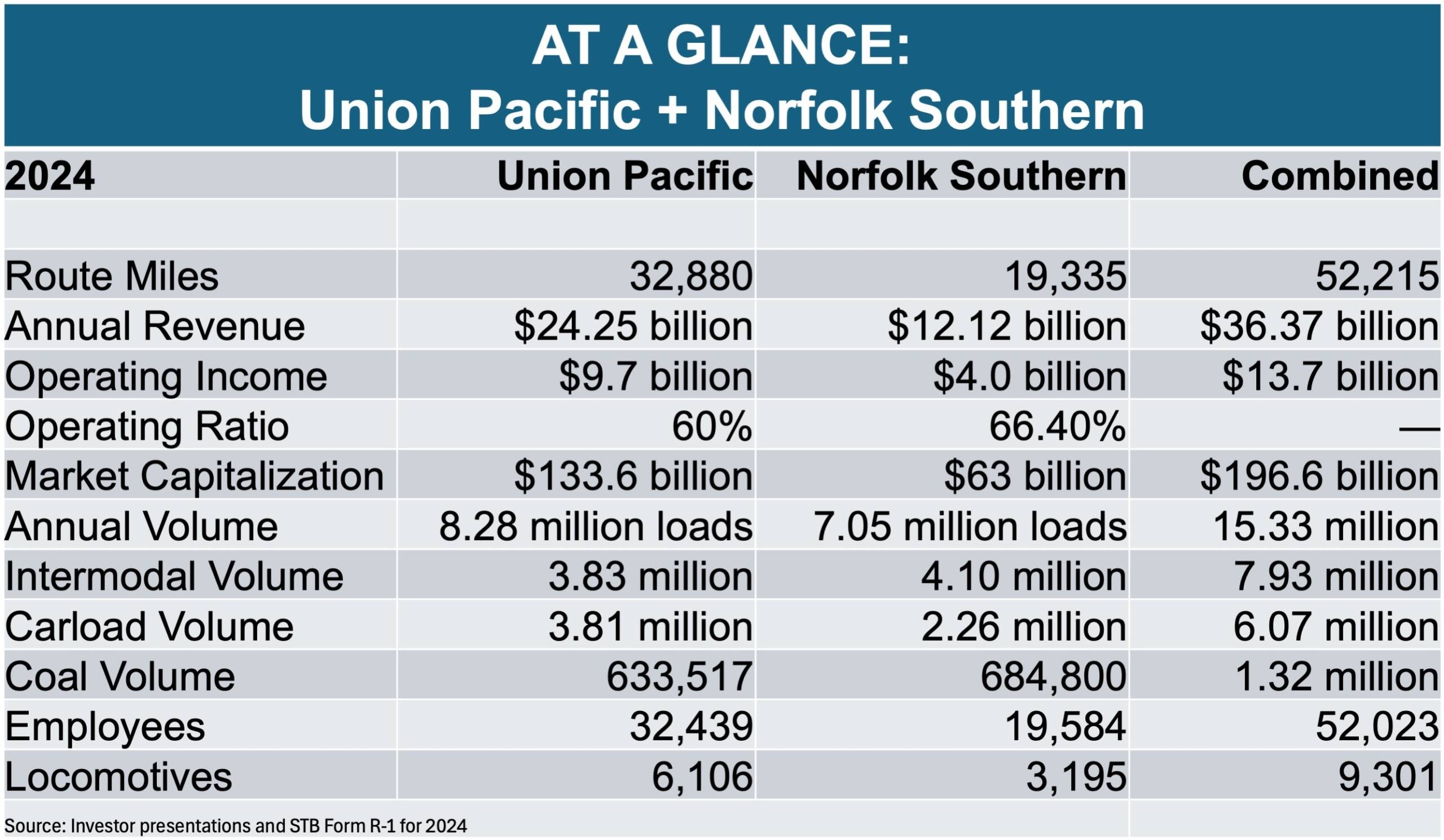

Based on 2024 performance, the combined system would generate $36 billion in revenue, handle 15.3 million carloads and intermodal shipments, have 52,023 employees, and a locomotive roster of 9,301 units.

Analysts say a merger likely would lead to a loss of headquarters jobs but eventually would produce growth and more jobs for unionized workers.

UP and NS would bring different strengths to a combined system.

UP boasts the industry’s largest carload network, which is anchored by its crown jewel: Dominant access to Gulf Coast petrochemical plants and lucrative chemical traffic. Currently the lion’s share of this business bound for eastern destinations is exchanged with CSX, but a merger could shift traffic bound for Conrail Shared Assets areas in New Jersey and Philadelphia onto NS rails via Sidney, Ill., or Memphis.

Norfolk Southern operates the largest intermodal network in the East — including superior access to the distribution center network in eastern Pennsylvania, which is a huge intermodal destination that supplies retailers and their big box stores from the New York metro area to Washington.

But what would happen to J.B. Hunt, the largest intermodal company that partners with BNSF in the West and relies primarily on NS in the East? Industry observers say J.B. Hunt likely couldn’t have a foot in both camps and would have to depart for CSX, which would leave a big volume hole in NS territory.

A UP-NS merger also would put together strong automotive networks. NS originates more finished vehicle traffic than any other railroad, and UP is the No. 1 auto carrier in the West and reaches all major gateways with Mexico. With single-line service, they could avoid interchanges that currently rely on the Indiana Harbor Belt and Belt Railway of Chicago, as well as the Alton & Southern in St. Louis.

Some intermodal and carload growth could come from the so-called watershed area, which involves origins and destinations within a few hundred miles of the Mississippi River, the de facto dividing line between the Eastern and Western railroads. For two railroads, splitting a 500-mile move isn’t desirable because of difficulties and disagreements about dividing revenue. But a 500- to 750-mile haul would be attractive when it’s a one-railroad move.

The UP and NS bulk networks — which haul grain, coal, rock, and other unit train commodities like frac sand — likely would remain relatively unchanged by a merger, analysts say.

As an end-to-end merger, there is relatively little overlap between the UP and NS systems. Nearly all of it is in Missouri, where both railroads operate routes between Kansas City and St. Louis, and in Illinois.

One of those main lines — Norfolk Southern’s former Wabash from Detroit to St. Louis and Kansas City — would provide UP with a route from Kansas City to Chicago via Springfield, Ill., the connection with its former Gulf, Mobile & Ohio. Currently UP sends a pair of high-priority Z-symbol intermodal trains over BNSF trackage rights between K.C. and Chicago. The former Wabash-GM&O route would be slower, and the connection between UP and NS in Kansas City is over BNSF rails, however.

Current major UP-NS interchanges are located in Chicago, St. Louis, Kansas City, Memphis, Shreveport, La., and New Orleans.

The combined railroad likely would try to shift as much traffic out of Chicago and New Orleans as possible. Winners might be Kansas City, Memphis, and the Shreveport gateway — which links UP to NS via the CPKC-NS Meridian Speedway joint venture — and ties together the fast-growing Southwest and Southeast regions.

Independent analyst Anthony B. Hatch downplayed the impact of today’s announcement. “The only real news is that they are in advanced talks … but we knew last week they were in talks,” he says.

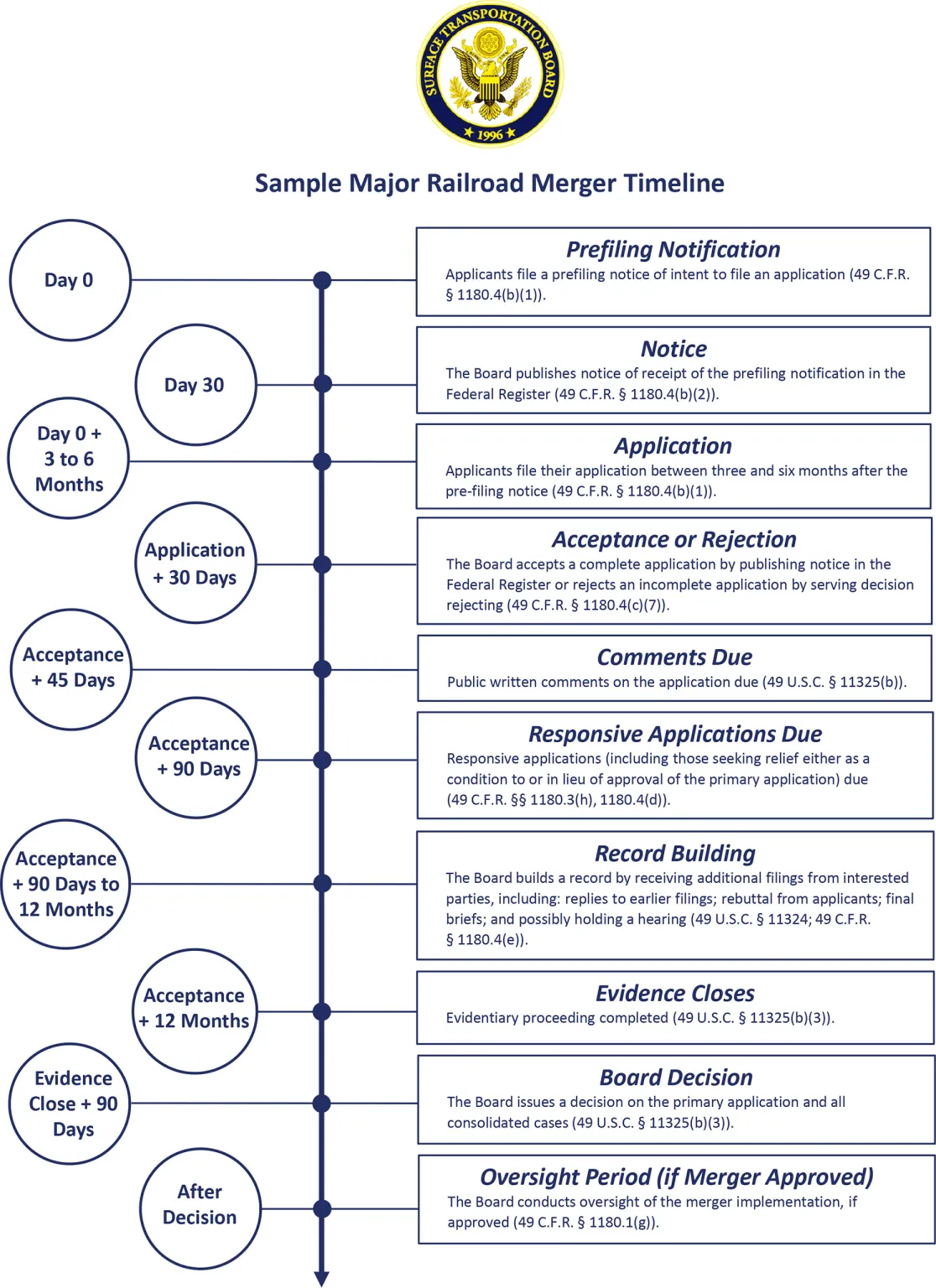

Hatch believes it’s likely that the railroads will reach a deal and file a merger application, and raised his odds of regulatory approval to 75%. But he said it’s unclear how UP and NS would satisfy the “enhanced competition” and “in the public interest” standards that are a part of the Surface Transportation Board’s untested 2001 merger review rules.

He also expressed concern about the downside risk of concessions or regulatory conditions that might be imposed on a merger, such as reciprocal switching that would give sole-served facilities access to a second railroad.

The STB’s 2001 rules also require merger applicants to address so-called downstream impacts of their combination, such as whether it would spark other mergers.

It is widely expected in industry circles that a first transcon would spark a second involving the remaining Western and Eastern carriers. BNSF and CSX representatives declined to comment today.

CSX CEO Joe Hinrichs, speaking on the railroad’s earnings call yesterday, said that the railroad was focused on its own efforts to improve service and gain volume. But he also said the railroad was interested in any opportunities that would reward shareholders and drive profitable growth.

BNSF has said that it does not see a catalyst for a transcontinental merger, since shippers, policymakers, and communities are not demanding one.

Should this merger proceed, NS communities in PA, WV, VA, GA, KY, IN, OH, IL, and OH will all see significant blue and white collar job losses. UP will consolidate and eliminate thousands of good jobs as always. Worst idea ever.

To consolidate my two earlier comment, UP and CSX are a better fit. From an earlier post, UP and CSX connect at their eastern/western endpoints – New Orleans, Memphis, St. Louis, and Chicago. No overlap. BNSF and NS do have a bit of an overlap, but it’s a shared mainline from Kansas City to Carrollton, MO, where they part ways to go to Chicago and St. Louis respectivefully. Otherwise no very duplicative routes, just what appears to be two balanced, competitive systems – what was wanted back east.

And add this historical thought – a “Chesapeake Pacific” (CSX+UP) could lay claim to being “America’s Railroad.” CSX predecessor Chesapeake and Ohio long advertised itself as “George Washington’s Railroad” from its origin as a canal company that our first President was associated with. Union Pacific, along with the Central Pacific (future Southern Pacific) came into existence when Abraham Lincoln signed into law the Pacific Railroad Act.

Give the short lines and regionals access to serve customers along the lines and access to yards, giving customers options. Service would improve as well as competition.

Perhaps universal trackage rights for all connecting railroads at a rate set in the merger should be the baseline condition, but connecting lines must provide the same, along with some type of performance criteria of Delay Minutes per 10,000 Train Miles for trackage rights trains with a financial penalty that would actually spur new sidings and capacity? It might not get too out of control as a railroad would have to lease/own a freight terminal yard for such trains, providing some stability. The STB would should be instructed to eliminate the intermodal exemption for modern boxcar / double-stack container trains as otherwise I have no idea how the Meridian Speedway could be regulated.

Should the merger between Union Pacific and Norfolk Southern come to fruition, the name should be “Union Pacific” as UP maintains the present name since its founding in 1862 by legislation passed by Congress and signed by President Abraham Lincoln. The name is more universal (with the word “Union”) as well as being an American legacy that survived several mergers so far.

Shouldnt it be “Union Atlantic & Pacific”? Only the MILW got away with having the “Pacific” moniker in their name east of Illinois. Don’t like it, but if accuracy prevails……..

Vena says “a lot of technological change” requires a merger. I call BS. You can’t even track half your stuff on the route you have, you refuse to extend your 1.5 mile sidings, when you run 3 mile trains, you force customers with time sensitive cargo into your schedule, not theirs.

You have routes growing weeds, but refuse to sell them to someone who wants to put them to use, but you refuse because it can’t meet some elevated hirdle rate.

You remind me of AT&T in the last 25 years who thought that increasing the level of vertical integration was absolutely necessary to “grow”, when in fact it was merely asset stripping the acquisition and then dumping the parts and the debt on someone else.

Not sure which hedge fund has UP by the ears, but this kind of corporate speak is out of Wall Street.

Analyzing the concept is one thing, but selling it as beneficial for reasons unrelated is something else. If you really want a cross nation footprint, be prepared to give up something, like a lot.

Has the UP learned anything from the disastrous SP merger? T hat should be the STB’s main question.

The major difference is the Espee was a beautiful mess at their end. It worked but mostly via trial knowledge. When Uncle Pete tried to make it conform to Uncle Pete’s playbook it congealed. NS, on the other hand, is a well tuned machine. A slow amalgamation will still be smoother than anything involving the mess that was Espee.

Major question. How compatible are all their computer systems? All of these would have to mesh for a smooth merger. And how about corporate philosophies and operational approaches. Remember Penn Central.

Completely on a tangent, but if this happens we could see America’s first Class I locomotive numbered with 5 digits…

Exactly we are already there with Union Pacific having two reporting marks, those being UP and UPY.

Here is something for the railfan. Picture Big Boy running on Horseshoe curve.

Regardless of who ends up with NS I see Kansas City east, perhaps to Fort Wayne, getting double tracked or at least a ton of capex.

A UP+CSX would be a better fit and probably easier. Very little overlap; direct connections at the endpoints of New Orleans, Memphis, St. Louis, and Chicago. Less litigation, protection agreements, legal fees, and construction requirements. Vena (ops guy) and Hinrichs (sales guy) would compliment each other. A real end-to-end deal.

There is a lot of overlap in Illinois, too. How would they address it?

UPNS (or whatever its name will be) will want the former Wabash shortcut to the East. Combined with the former Alton north of Springfield, it is an improved Chicago-KC route. But they won’t want to get rid of the former MoPac line across Missouri because the former Wabash doesn’t have the capacity to absorb the traffic.

They could grant BNSF and/or CSX rights between St Louis and Kansas City on the former MoPac. They could sell St Louis to Mexico to CPKC, which would shorten CPKC’s St Louis-KC line. They could also grant CPKC trackage rights from Springfield to Detroit, which would be a good shortcut for CPKC. Since UP already serves Des Moines, they could sell CPKC their rights over BNSF between St Louis and Des Moines. This could shorten CPKCs route between St Paul and St Louis, via a connection at Ottumwa.

In Illinois, both RRs operate Chicago to St Louis. If UPNS wants to make a Chicago-KC line out of the old Alton and Wabash, they won’t want to part with the former Alton, at least not north of Springfield. I suppose they could part with the former Wabash line between Chicago and St Louis. That still leaves the Bloomington-Normal area going from two RRs to one.

Perhaps the best approach here would be to sell the former Wabash Chicago-St Louis line to CN, along with the Peoria branch as far as Bloomington. Since CN is already in Peoria, sell Bloomington-Peoria to Tazewell and Peoria, giving Bloomington-Normal customers access to Peoria’s railroads. I would also suggest granting Iowa Interstate trackage rights to a CPKC connection in Springfield. or maybe all the way to St Louis.

They may also need to allow trackage rights and reciprocal switching across the US not just in the Midwest. This seems like a lot, but the new standard is to increase competition, not just preserve competition. The more they are willing to deal, the better the chances of approval. Also, they would be setting a high bar for BNSF and CSX, should they decide to merger.

Wow. Mr. Rowell, your broad knowledge is remarkable. Thanks for offering these insights and ideas as they enhance this reader’s understanding.

“UPNS (or whatever its name will be)”

History says UP.

Sounds like a LOT of “Plant Rationalization” in the offing….

Sidney, not Sibley.

Ironic that the typo is a town located on the former Wabash line between Bement and Chicago.