WASHINGTON — An Amtrak press release issued last week, “Ambitious 2024 Initiatives Propel Amtrak Ridership Growth,” outlines the company’s goal of doubling ridership by 2040. This is based on “improving passenger train service for our customers and efficiently and effectively carrying out a massive major infrastructure capital program aimed to modernize and upgrade our infrastructure, stations, fleet, and technology,” according to President Roger Harris, with investments “advancing infrastructure, driving transformation, growing the business, delighting customers, and empowering people.”

Not addressed, however, is reversing the long-distance train capacity shortage that limited that category’s gains in fiscal 2023, compared to Northeast Corridor and certain state-supported routes. In those areas, extra space triggered pricing flexibility that led to ridership and revenue growth.

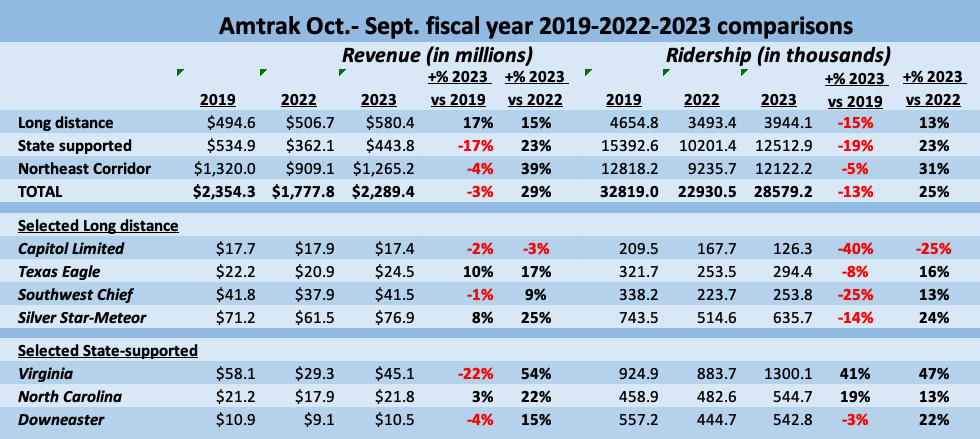

A Trains News Wire analysis compared how each business segment and individual services fared pre-COVID-19 with both 2022 and 2023 delivery in the table below.

The figures illustrate:

— Although the long-distance group was the only category to deliver more revenue in 2023 than 2019, it did so with 15% fewer passengers. While long-distance capacity remained static between 2022 and 2023, the state-supported and Northeast Corridor segments showed stronger gains in both ridership and revenue because sufficient capacity positioned them to convert demand into stronger patronage and more dollars.

— Virginia is a textbook example of using pricing flexibility to grow ridership leading to longer-term gains. A reliable stream of state funding enabled the Virginia Passenger Rail Authority to add frequencies on all routes. This ultimately led to huge year-over-year jumps in 2023. More people riding additional trains to Norfolk. Newport News, Richmond, and Roanoke means a broader transportation relevance.

— North Carolina’s Piedmonts and Carolinian, and Maine’s Downeaster, paved the way for double-digit gains in 2023 by actively marketing promotional discounts on full schedules. The Tar Heel State added a fourth Raleigh-Charlotte Piedmont round trip mid-year [see “Special report: North Carolina to add another Piedmont trip …,” News Wire, May 24, 2023]. This enabled its Rail Division Amtrak trains to carry a record 641,000 passengers in calendar 2023.

— On the other hand, the Capitol Limited and Texas Eagle were especially hard hit with a demonstrable shortage of Superliners that severely stunted their growth. Throughout both 2022 and 2023, Amtrak was unable to provide enough equipment to capture travel demand, as evidenced by those trains’ meager returns. The Capitol gained a second sleeper in the summer, though not a second coach until after the fiscal year ended, causing months of daily sellouts. The Eagle benefitted from its symbiotic relationship with Chicago-St. Louis corridor trains (getting an additional coach for that segment), but was never assigned a transition sleeper to allow flexible roomette pricing when the train wasn’t sold out. It still isn’t slated to get one this year.

— Similarly, the Southwest Chief lost an opportunity to generate more first-class revenue without a transition sleeper for most of the year; getting a reservation on this train was nearly impossible unless booked months in advance. It did get that car beginning in October; but that’s also when the second standard sleeping car was dropped. As a result, the first Chicago-Los Angeles bedroom when booking on Oct. 7 wasn’t available until Nov. 12.

— Amtrak’s New York-Miami trains also lost ridership compared to 2019. The Meteor was dropped for most of FY2022 (additional cars were added to the Silver Star). The additional daily departure fueled gains into 2023, although the duo never recovered 2019 ridership totals.

By not restoring long-distance train capacity to 2019 levels in the same way it was able to furnish additional Horizon coaches to Amtrak Cascades service last year, Amtrak management has effectively sized its national network for low-demand periods [see “Top 10 stories of 2023, No. 4: Amtrak’s ongoing capacity issues,” News Wire, Dec. 28, 2023]. Coach pricing can be raised as departures fill up, but sleeping car fares are kept high all year because sellouts are certain. More available coaches and sleeping cars could exponentially increase revenue and ridership, dwarfing the cumulative cost savings the company thinks it has achieved by not fully deploying its assets. The dichotomy of results between the business segments clearly demonstrate this.

Amtrak has said that by October, 63 railcars will have been returned to service from long-term storage and damage repairs. Trains News Wire learned in December that the company plans to selectively add transition sleeping cars to a number of trains and a second Seattle coach to the Empire Builder. The deliberate pace of additions, though, lacks the urgency that would benefit the national network.

Are the new Acela trainsets anywhere near being ready for use or still bogged down in problems and testing? Amtrak’s record of receiving ordered equipment on time and defect free is, at best, dismal. And nobody seems to care. Way past time for a personnel housecleaning.