WASHINGTON — Five of the seven Class I railroads operating in the U.S. were revenue adequate in 2021, the Surface Transportation Board said on Tuesday.

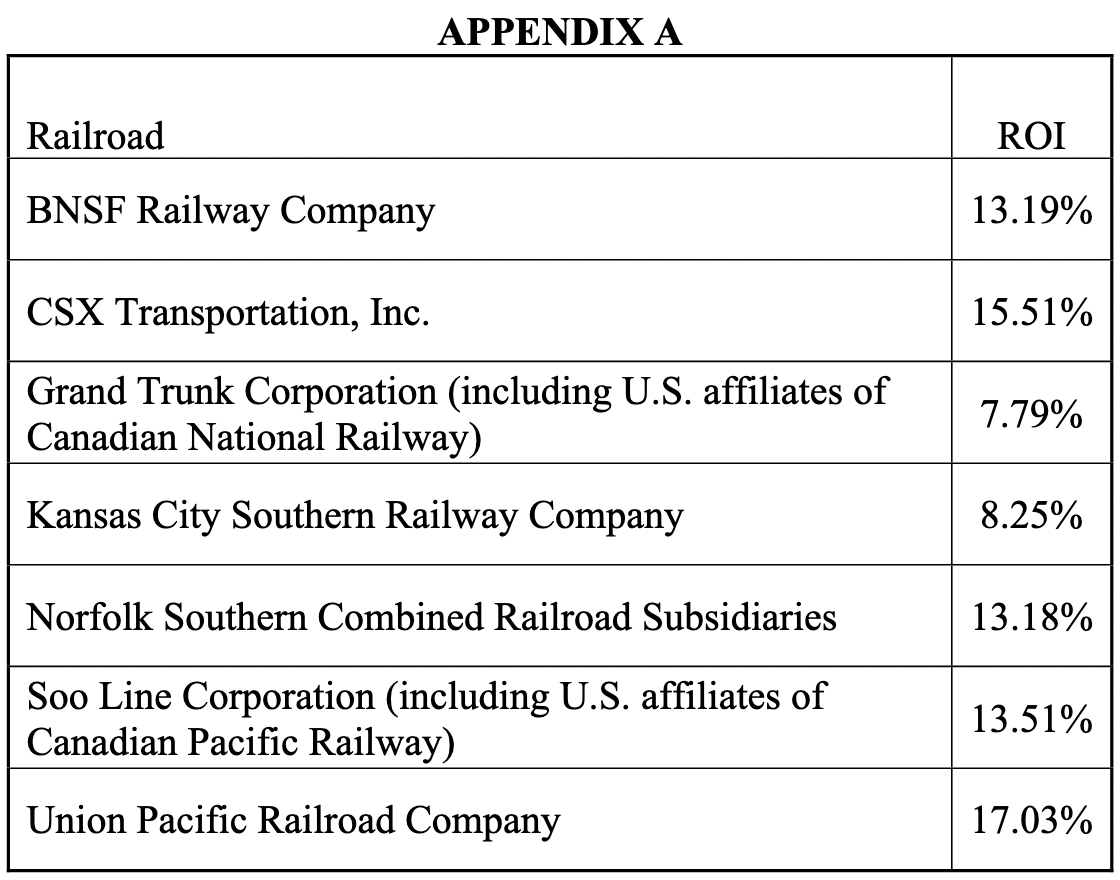

Being revenue adequate means a railroads achieved a rate of return equal to or greater than the board’s calculation of the average cost of capital to the freight rail industry. The average cost of capital was 10.37% last year, the STB concluded.

Last year BNSF Railway, CSX Transportation, Norfolk Southern, Union Pacific, and Soo Line — Canadian Pacific’s U.S. subsidiary — were all deemed revenue adequate.

That list left just Kansas City Southern, the smallest Class I, and Grand Trunk Western, CN’s U.S. subsidiary, short of the revenue adequacy mark.

And yet we haven’t got a pay raise since 2019, current customers are ignored, and potential customers are told to truck it. Wtf?

I don’t think its right to not share the benefits of the company you work for, however, capital expenses are usually not born by the rank and file in the control cab. Those are more on the operations side.

Capital investment can be in rolling stock, new engines, bridge replacements, welded rail, new yards, etc. One sign of a struggling railroad is their inability to invest capital that supports ongoing operations.

With the movement by some rail entities to leasing certain moveable items, much of the capital goes to upkeep of the plant. Many bridges, all built in the 1880-1920 rail expansion era are up for replacement. News Wire has been quite active in the reporting of many of these large investments in bridge upgrades.

The BNSF bridge in North Dakota. The ongoing upgrades of the Mississippi River bridges in St Louis. (Merchants, MacArthur) by TRRA. UP spent millions building the new Kate Shelley High Bridge. NS spent many millions for a new bridge in the Alleghenies. All replaced worn out and time expired spans and all required capital to be invested by their owners.

CSX and NS will be bearing a large amount of bridge update investments in the next 30-40 years as some of those Pennsylvania RR masonry arch bridges begin to degrade and fracture. They are works of art and have held up wonderfully, but they too are subject to the whims of nature and more use over the years.

Is “revenue adequate” a synonym for wealthy?

Not necessarily.

It means for each dollar of railroad capital expended, they got a certain percentage of return on that investment.

Since the benchmark return was 10.37% last year, it means the railroads on average got $1.1037 back for every dollar invested.

CN-US only got $1.0779 for every dollar invested. KCS only $1.0825.

These are usually used to measure if the company is placing its capital in the right places.

KCS is not a surprise being the smallest US Class 1. Less miles to get a capital return on, however I think CN-US is a little surprising. This may explain why some CN leadership acts like the route from Chicago to New Orleans is a branch line.