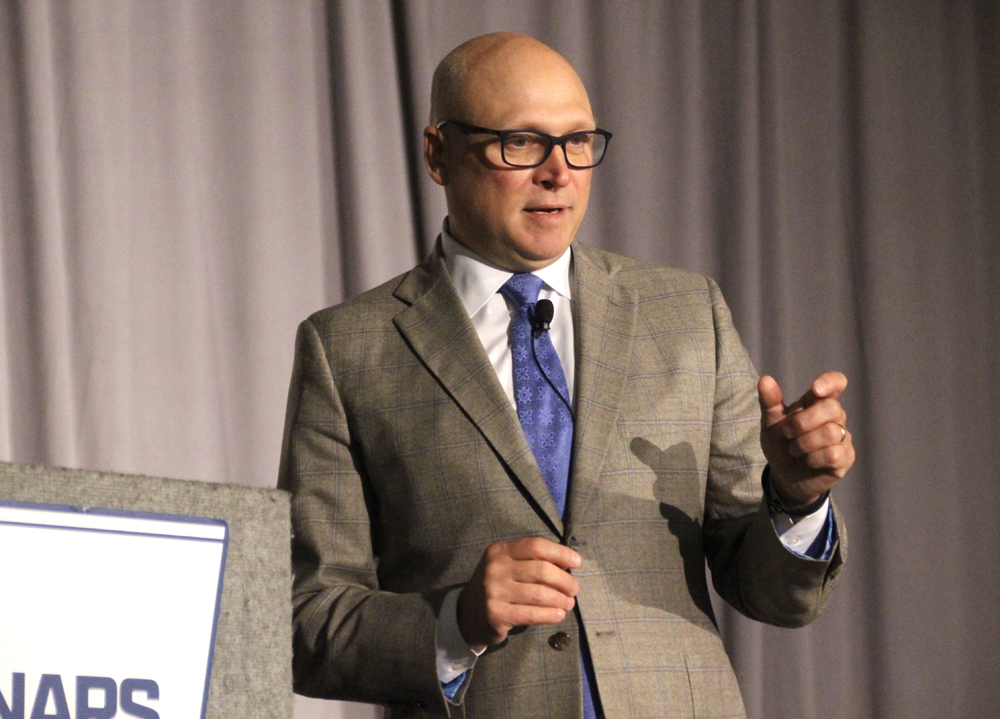

KANSAS CITY — Canadian Pacific should file updated traffic data with the Surface Transportation Board pertaining to its planned merger with Kansas City Southern well ahead of a May 27 deadline, John Brooks, CP vice president and chief marketing officer, told the North American Rail Shippers conference on Wednesday.

The STB requested updated baseline traffic data on April 28, after concerns were raised over differences in data in the CP-KCS merger application and in information for the STB’s environmental analysis [see “STB settles CP-KCS merger data issue,” Trains News Wire, April 28, 2022].

“I can tell you that effort has been going on for at least the last month,” said Brooks, substituting for CP CEO Keith Creel, who had been scheduled to appear. “… We’ll be ahead of that [deadline]. I think you should expect us to respond within the coming days.” The railroad believes the data question, which paused the merger process, will not affect an STB ruling on the merger, which it continues to expect in the first quarter of 2023.

Brooks also said that CP has continued to engage a number of parties who are seeking mitigation or conditions to the merger. “That is very ongoing and fluid,” he said. “I think in some cases we’ve found common ground and areas of alignment and success with those stakeholders. In others, we just haven’t.

“That’s not that we won’t continue to work on those efforts, but certainly, we believe that, in the case of some our competitors, that some of the asks are a little overreaching from what we would expect from the STB, and frankly, that positions us to maybe just take our chances with our case versus theirs.”

Brooks highlighted a number of service aspects of the merger during his 40-minute presentation. Among them:

— CP and KCS are preparing to run another test train between Mexico’s port at Lázaro Cárdenas and Chicago as part of a continuing effort to demonstrate the route’s viability as an alternative to shipping through the ports of Los Angeles and Long Beach.

“We’ve had a ton of success with it,” Brooks said, citing previous tests in which just seven days elapsed from a ship’s arrival at Lázaro Cárdenas to delivery of containers to Chicago. “That’s with interline service with a connection. We think we can tighten down that number with dedicated service and ultimately be able to compete on a day-to-day basis. …

“Maybe there’s an opportunity to take some share from our competitors through Mexico up into those [Midwest] markets, but really, I think, this opportunity is about driving another option. It’s about providing the steamship lines and big-box retailers the option to take another route and diversify their portfolios.”

— The plan for the merged CPKC to focus the majority of $275 million on route improvements between Kansas City and Minneapolis-St. Paul is similar to the effort CP made to upgrading its Toronto-Calgary route, which now hosts the railroad’s premier intermodal service.

“Hunter [Harrison] started it and Keith finished it,” Brooks said. “The infrastructure went in from Toronto to Calgary. We did it for a reason. We knew that was going to be our flagship service. … This playbook is going to be very similar. We are going to focus our investment on that north-south route to create a reliable superhighway for those opportunities.”

— Along with that, growth opportunities for the combined railroads will be bolstered because key intermodal facilities have room to expand.

“What I think makes us unique, certainly in Canada and I think as part of the proposed acquisition of the KCS, is we have land capacity at our terminals that allows us to grow. If you look at a lot of our competitors — I know particularly in Canada, but I believe also in the U.S. — the ability to expand your footprint at your terminal matters.

“You can create all the over the road capacity you want. You can triple track, quadruple track that main line. But if you can’t get it in and out of the terminals, you can’t ultimately get it to the destination and to the customers. … We were blessed by a lot of landholdings in Canada. We’ve got hundreds and hundreds of acres around our terminals that we have not monetized in terms of selling, we have monetized in terms of creating more capacity or partnering with customers to use that land to enable supply chains. And I get totally excited when I visit the terminals on the KCS … I think the land opportunities at the key terminals really is a differentiator.”

Brooks did not fully explain Creel’s absence in saying the CEO apologized for not appearing as scheduled. “We live in these crazy times that we’re all experiencing right now,” Brooks said, “and you can probably connect all the dots with that, but unfortunately he felt it was far safer not to travel.”

The Canadian Pacific and Kansas City Southern are Ment to Become a Great Merger Because they Join Forces in

Many Areas that Are Efficient and Reliable