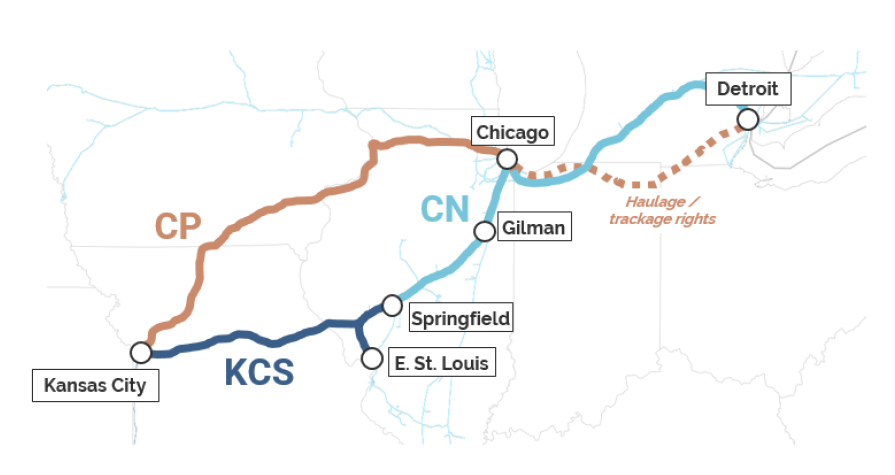

WASHINGTON — Canadian National says its proposed acquisition of Kansas City Southern’s Springfield Line would enable it to divert 80,000 long-haul truck shipments to rail annually by creating a new route linking Kansas City and St. Louis with Michigan and Eastern Canada.

The traffic projection — 33% more truck diversions than Canadian Pacific and KCS envision from their proposed merger — is included in environmental paperwork CN filed with federal regulators on Tuesday.

CN’s so-called responsive application, which will ask the Surface Transportation Board to condition approval of the CP-KCS merger on divestiture of the KCS Springfield Line, must be filed by the end of the month.

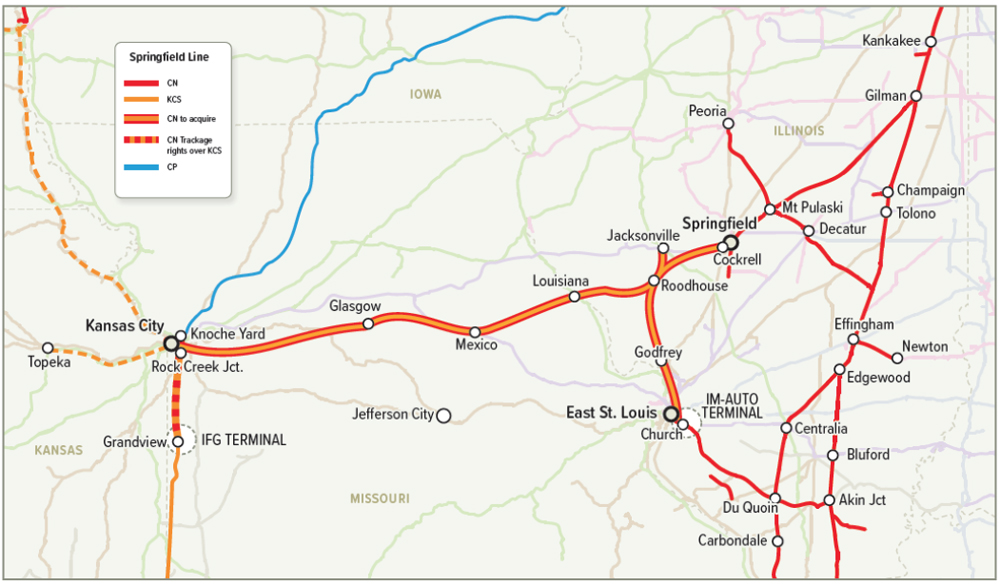

If federal regulators agree to the divestiture proposal, CN says it will spend $250 million over three years to improve KCS’s former Gateway Western trackage and tie it to its former Illinois Central Gilman Subdivision.

In Illinois, CN proposes building a new siding and two siding extensions. In Missouri, CN would extend five sidings and relocate and expand a fifth. In the KCS yard in East St. Louis, CN would add 5,000 feet of track for auto traffic and 6,000 feet for intermodal traffic. At the KCS International Freight Gateway intermodal terminal south of Kansas City, CN would add 6,600 feet of track for automotive business and 20,000 feet to support its intermodal operations.

“With CN’s investments in the Springfield Line, CN is not merely preserving the Springfield Line as a competitive routing option, but improving it into a faster route with improved transit times,” CN wrote in its filing. “This will benefit intermodal and automotive customers. CN can move new traffic over the Springfield Lines efficiently in approximately two new trains per day. CN estimates that it can take more than 80,000 long-haul trucks off the road annually, including trucks between Kansas City and Chicago. This is a greater reduction in truck traffic than what CP/KCS have projected to achieve for their entire merger.”

CN lost the battle for KCS last year and now contends that the KCS Springfield Line should be divested because it parallels CP’s own K.C.-Chicago route. CN proposes giving CPKC haulage rights to access customers on the Springfield Line so no local customers lose competitive options. CN also would grant CPKC overhead haulage rights to interchange with other railroads in East St. Louis, Ill.

CP disagrees and last month told federal regulators that CN’s divestiture request is its latest effort to “delay or disrupt the CP/KCS transaction.”

CN’s proposal for divestiture of the line is “without merit,” CP argued in a Jan. 28 filing. [see “CP says CN’s request …,” Trains News Wire, Jan. 31, 2022]. There is no precedent for forcing a line sale as a condition of an end-to-end merger that does not cause any loss of competition, CP wrote.

Silly question, I think: does CN use the Gateway Western now, with rights from KCS? If Mr. Rowell is correct, under the old merger rules only current competition should be maintained. So if they don’t use it now, they can hardly demand it being handed over to them.

Let ’em get it, and monitor closely the promises over, say, 5-7 or 10 years. If it ends up they lied, they have to give it up, and someone gets prosecuted for fraud.

I would enjoy seeing the upgrades and any increased traffic would be welcome, even if falling short of projections. If this merger were being reviewed under the “new” standard, which requires that a merger increase competition, the STB just might require it. However, the “old” standard, which applies to this merger, only requires that competition be preserved, not increased. A sale is not required to preserve competition.

If the line would truly have that much traffic under CN than under CP, it should be worth a lot more to CN than CP. Make CP an offer they cannot refuse.

STB doesn’t have the authority to confiscate private property. It’s a total reach. It is a regulatory body, not a court.

CN and KCS acquired IC and Gateway Western, respectively, in the late 1990s. If this deal was so compelling then why is it only after two plus decades that this is now being proposed? (We all know the obvious answer, move along.)

That said, the STB will not grant any other railroads’ requests for merger conditions.

I don’t think in this case that the squeeky wheel (CN) will get the most grease!

Not saying this idea does not hold merit. But if this deal makes so much sense why didn’t CN seek to purchase this line the past 20 years it was owned by KCS?

“Get rid of 80,000 trucks annually”. How many times have we all heard that in mergers. They approve them and the number of trucks always goes up, not down. STB should never approve anything with that type of hipe.

I actually do see the merits in the proposal and it would create competition for NS and truckers– if CN actually follows through. However, I do not think CN has a leg to stand on in terms of legal argument. The STB I believe has never forced sale of lines during an end to end merger when rail competition has not been lost by a customer as CP has argued. There is a limit to STB authority, even if the proposal would be good for the environment and possibly customers.

Poach NS as well. CN baloney.

CN just trying to poach what traffic that KCS now has?

Yup —- CNR couldn’t get KCS, so it will do the next best thing — screw over CPKC.