The following is a series of edited excerpts from an interview conducted by David Popp with Jason Shron, owner and CEO of Rapido Trains Inc. on May 20, 2025 on the subject of United States tariffs in relation to the model train industry. You can find the complete interview on Trains.com Video by clicking here. – Ed.

David: Still a hot button topic, last week the tariffs on model trains manufactured in China changed from 145% to 30% for a 90-day period. To look deeper into what this means for the model train industry and what manufacturers are trying to do about it, I’m joined again by Jason Shron, owner and CEO of Rapido Trains Inc.

So, Jason, the last time I talked to you, we had just gone from a 10% to 20% tariff on model trains. After I talked to you, we jumped up to 54% and then an amazing 145% tariff. Last week that was scaled back to 30% for 90 days while the U.S. and China discuss the trade imbalance. As a manufacturer, what does 30% look like for you now?

Jason: Right now, I’m sitting in Rapido Train’s U.K. office and tariffs mean diddly squat here, so it’s a bit of fresh air to not to have to worry about that.

When the tariffs were at 145%, that was effectively what’s called a trade embargo. You can’t ship goods at that level of tariff. It’s just like when you get a contractor quote to build your new deck and he says it’s $100,000; that’s called a go away price which means, “I’m too busy doing other things.” A deck should cost $12,000 or so.

That’s why a tariff of 145% is a trade embargo. No one can bring products in at that level unless you’re just importing paper clips or something with a very low value where if the price goes up from $2.99 retail to $4.99, it’s not a huge difference in anyone’s life unless you’re a big paperclip distributor.

For the rest of us, 145% is bigger than our gross margins.

For example, if we pay $50 for a model and we sell it for $100, and there are definitely models that fall in that category, then our gross margin is $50. That’s before we’ve paid for all the tooling costs, overhead, salaries, designs, advertising, rent, and utilities; we have to pay all those costs out of that gross margin of $50.

That same product with a 145% tariff means we will pay close to $75 in taxes to bring that product to the U.S. The tariff not only wipes out the entire gross margin, but it also leaves us $25 in the hole on every model. It’s a nonstarter. You cannot bring model trains in at 145% tariff. So, all the model train manufacturers just stopped shipping.

Now, thankfully that period was only about five weeks. It wasn’t a huge disruption, but certainly there were already layoffs happening. Had the tariffs continued at that very high rate, Rapido would have had to lay off three quarters of our staff by mid-June and the rest of our staff at the end of August. And then starting in September, I would’ve been paying the interest on our loan out of my personal savings.

U.S. sales are 75% of our sales. For other American manufacturers, it could be as high as 95% or 98% in U.S. sales. International and Canadian sales are a smaller part of our business.

So, it’s a huge impact, obviously. Even now that it’s come down to 30%, it’s still too high.

David: Okay, that was my next question. Can you operate with tariffs at 30%?

Jason: It’s still very high, but Rapido is shipping, and other manufacturers also are shipping.

When we talked last time, I talked about how Rapido is giving a 52% discount on tariffs. So, if we pay 10%, we charge the consumer 4.8%; if we pay 20%, we charge 9.6%.

But 30% is too high for that, so we’re keeping our charge to the consumer at 9.6%. I know that a number of manufacturers like us are doing our best to swallow as much of the tariff as we can. And the simple reason is that our customers’ pocketbooks are being affected not just in their hobby buying, but in all their buying because of these tariffs.

So, we’re all sort of doing our part. We don’t have the margins to absorb any more than that; our margins are tight to begin with because we sell through distributors and hobby shops, and we have to give a big discount to hobby shops and distributors so that they can make money. It can’t just be Rapido making money; when you buy a model train, the factory in China is making money, Rapido is making money, the distributors are making money, and the hobby shops are making money. There are four organizations, all making money from that single model train.

If we were just selling direct to the public, we’d have the room to swallow a lot of tariffs. But not if you have to support that whole chain; there’s not much you can swallow. But we are keeping the tariffs to 9.6%. Every company is going to have to make their own choice based on their financial situation, so I can’t speak for the other manufacturers.

David: In all fairness, the supply chain is there for a very good reason, and that is to help you get your models in front of the public and into the hands of the people who want them.

Jason: Yes, that supply chain is called the economy.

One time when I was coming into the United States, I was bringing some samples to come see you [Model Railroader] actually, and I didn’t do my paperwork correctly. This young, very hotheaded border guard was screaming at me, “Are you trying to make money off the American people?”

And I’m like, “What did I do?”

Thankfully, there was a shift change, and he went away, and the new guard asked what the problem was.

I explained it, and he basically said, “Here, just fill out this form. What do you have there? Oh, a train? How much? $300 and it’s from China? Okay. Bye bye.”

What the hotheaded guy didn’t understand was that here is a Canadian company working with a Chinese company to make a model train. But then the American distributor and the American hobby shop were all making their money off that train as well. The whole idea of a globalized economy is that we all make a little bit of money from products made all around the world.

David: I don’t drive over to General Mills to buy my Cheerios straight from them in the morning. I have to go to the grocery store to get them.

Jason: Exactly. And the grocery store did not get them for General Mills; they got them from a distributor.

David: What is the current tariff between the United States and Canada? It was at 25%.

Jason: It’s still 25%, but there’s a whole bunch of exemptions, and I’m not up on it because our products are made in China. The tariff depends upon where the goods originated, so the tariff is still on China. If we want to ship something from Canada to the US, whatever the tariff rate on China is, that’s the rate that we have to pay, which right now is 30%.

The 145% tariff is on hold for 90 days while the two sides negotiate. We’re all hopeful that the tariff rates will either go away or come down to something lower; I think 10% is reasonable.

David: Which brings up the Hobby Industry Coalition.

Jason: The industry is hoping that we can have an exclusion for hobbies and or toys. We’re advocating for hobbies through the coalition because that’s our industry.

The toy industry is a very big industry, while we’re a very small one – a niche, really.

The Hobby Industry Coalition is a loose affiliation of manufacturers and people in the model train industry. It started with me sending an email out to about 20 different manufacturers on my email list. And then Stacy Walthers Naffah added on 20-odd or 30-odd people from her email list. We’ve now got about 75 other manufacturers who are part of this very loose coalition. And we haven’t really got the structure in place yet because we’re in the process now of getting the entire organization up and running.

The goal is to tell the story of what hobbies are; how incredible they are; how valuable they are to child development through STEM and education; and how they give solace and meaning to adults in their retirement years. Basically, hobbies are just a wonderful aspect of our lives.

The coalition is working really hard to tell that story. And there’s a lot of people within it who are doing that on their own as well.

Rapido is advocating through our social media. Scale Trains, Walthers, Atlas, and others are doing that as well. But we were all advocating on our own. The coalition is a way we can advocate together – there’s strength in numbers. [Click here for more on the Hobby Industry Coalition.– Ed.]

David: I know you’ve been working on some videos, too. I saw one of the videos that your team at Rapido put together for the coalition that included many other manufacturers.

Jason: We had nine manufacturers participate in that first video, which was wonderful.

David: It was very well done. What I really liked is that you guys kept the politics out of it and focused strictly on the impact of tariffs on the manufacturers and hobbyists.

Jason: I was in the Buffalo, N.Y., warehouse when I got the news on my phone that the tariffs on products from China had gone to 54%. There was no way we could do that. And that’s when… it’s funny, Stacey at Walthers and I were both simultaneously working on it… that’s when I sent the email about working together on this. She followed up with an email that showed she’d clearly been thinking about this too.

One of the good things [about the coalition] is that I’m getting to know fellow manufacturers better than I did before. We often work on our businesses in our own little silos. I don’t do a ton of shows myself because I’m just too busy, so I don’t get to meet with other manufacturers necessarily. But now we’ve got the owners of all of these different companies regularly getting on a call together and throwing ideas around.

That’s how the video came together. We had a call and I just said, “Let’s put together a video, you have a week to get clips to me.” Natasha, Rapido’s marketing manager, figured out what we wanted the video to say. Within a week, we had contributions from many of the manufacturers. Then Jeremy who makes Rapido’s videos pulled it together very quickly. I think that was a challenge. Everyone sent us something that’s 5 or 10 minutes long, and we needed to make a single five-minute video. We looked for lines here and there and pulled them out. Jeremy probably worked harder on that video than any others he’s done.

David: Being part of the hobby press, I was privileged to be able to attend some of these meetings during the formative phase of this. It’s something I never thought I would see in all the years I’ve worked in this industry; you’ve got the CEOs and the owners of all these different hobby manufacturing companies in the same room, and they’re all talking and working together to get through the tariff issue.

Jason: We’re all in this together.

The truth is, you look at it around the room of manufacturers, and you’ve got companies like Rapido that do these crazy detailed models right alongside manufacturers that are doing entry-level models, and you need all of them. You need to have the variety of products because not everyone coming into the hobby is able to drop $350 on a locomotive. You need to have a variety of price points.

David: Jason, before we move on, is there anything else you want to talk about related to tariffs?

Jason: Well, because not everyone watching this has seen our previous video, it’s important to just have a little refresher on what exactly tariffs are and what normally tariffs are.

Tariffs are taxes imposed by a government to protect their domestic industry.

So, for example, and I’ve given this example to you before, Canada has a thriving clothing manufacturing industry. Any clothing brought into Canada from outside North America, where we have a free trade agreement, is subject to an 18% tariff to protect the domestic Canadian clothing industry. That is an example of how tariffs are used as a vital tool for protecting domestic industry.

The problem comes when you apply them across the board for all industries. Then it just becomes an extra tax, to be honest, because there are very few model trains made in the U.S. And there’s no one making super detailed model trains like us.

David: I understand you have a few products to show us.

Jason: Since I’m in the U.K., I thought I’d do some show and tell. This is our new Class E. [An 0-4-4T steam locomotive built by the Metropolitan Railway in 1898, worked as London Transport no. L44 until retirement in 1961, and survived in preservation. – Ed.]

David: Oh, that’s nice.

Jason: Isn’t that gorgeous? These next models are leaving the factory in a few days. It’s our new E1.

No one is making models in North America with that level of detail, so the tariffs aren’t protecting a North American industry that exists. We put all the gauges and piping inside the cab; we do all that detailing inside there, even though you can barely see it. That’s just not done in North America.

David: Speaking of new trains, do you want to talk a little bit about the new things you’ve got in the works for the North American market?

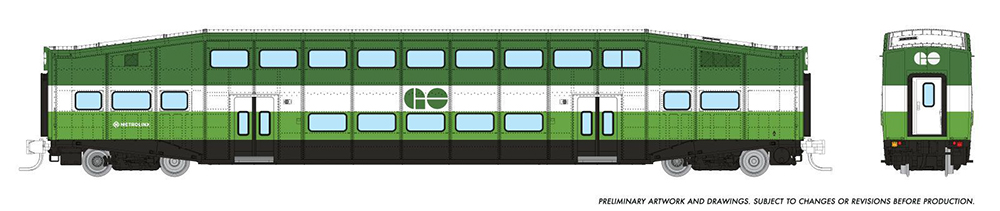

Jason: Of course, we’ve got tons of stuff going on now. I’m happy to say that our N scale commuter trains are all in tooling. So that includes the F59PH locomotive, the Bombardier bi-level coaches, and then you’ve got the F40PHM-2s and the Burlington Northern Chicago gallery cars.

What we often do in N scale, and now we’re doing with some HO products as well, is that we announce the model as a conditional announcement. We say we’re considering making project “X.” The BART train was conditional when we did it. We’ve got some freight cars we’re doing now that are conditional.

We design it then make the announcement. You get two months to order it, and you get a 5% early bird discount. And if the orders are strong enough at the end of those couple of months, then we’re ready to tool it. For example, the N scale gallery cars reached the number we needed after two weeks. But for most, we’ll look at the preorders after two months, then we’ll say yay or nay. We’ve only canceled one or two projects.

We have to be realistic. We’ve designed a couple of real oddball freight cars, and we just don’t know what the sales are going to be. I don’t want to risk spending the money to tool them and discover that everyone wants just one for their layout. It’s not going to make its money back if that’s the case.

We went ahead with the helium car, which is a beautiful model. It’s the first ready-to-run model of a helium car in HO scale, but so far, the orders are quite low. I think the reason is that people are ordering just one. In retrospect, it should have been a conditional model.

There is another car that’s sort of as weird as the helium car, but it’s going to be a conditional announcement. We want to make sure that once we pay for the tooling, product cost, design cost, we don’t end up making just $11 total.

David: Speaking of freight cars, I was looking at your announcements from Rapido before I came on to do this interview with you and the Greenbrier 72-foot refrigerator cars with sound and LED lights look totally cool.

Jason: Yes, they are one of our biggest selling freight cars ever.

David: The good news is you usually need a bunch of those.

Jason: Yes, and they’re still making them. We’ve tooled all the versions, including the ones they’re still making. So, we can go back to that well in the future because they keep making them.

Jeff Lassahn is the project manager for that, and he lives in Chicago. He loves modern freight. He loves modern Chicago ‘L’ trains too.

We’re moving forward with that project. The HO ‘L’ trains are not conditional, and they are going ahead for sure. The N scale L trains will be conditional because we have to see what the demand is. The N scale market is hit and miss; some projects do really well and some don’t sell. And I’m telling you N scale guys that it’s not your fault. No one’s to blame. But the market as a whole sometimes moves this way and sometimes that way.

We were told by some N scale guys that we should do an RDC. And some other N scale guys said, “No way; it will never sell because Kato had done so many of them back in the day.” Well, our N scale RDC has sold more than a lot of our HO locomotives.

That’s the dollar value – it’s a cheaper model to make in N scale and so the dollar value is higher than a lot of our HO scale locomotives. People preordered them like crazy. We had no idea that would happen.

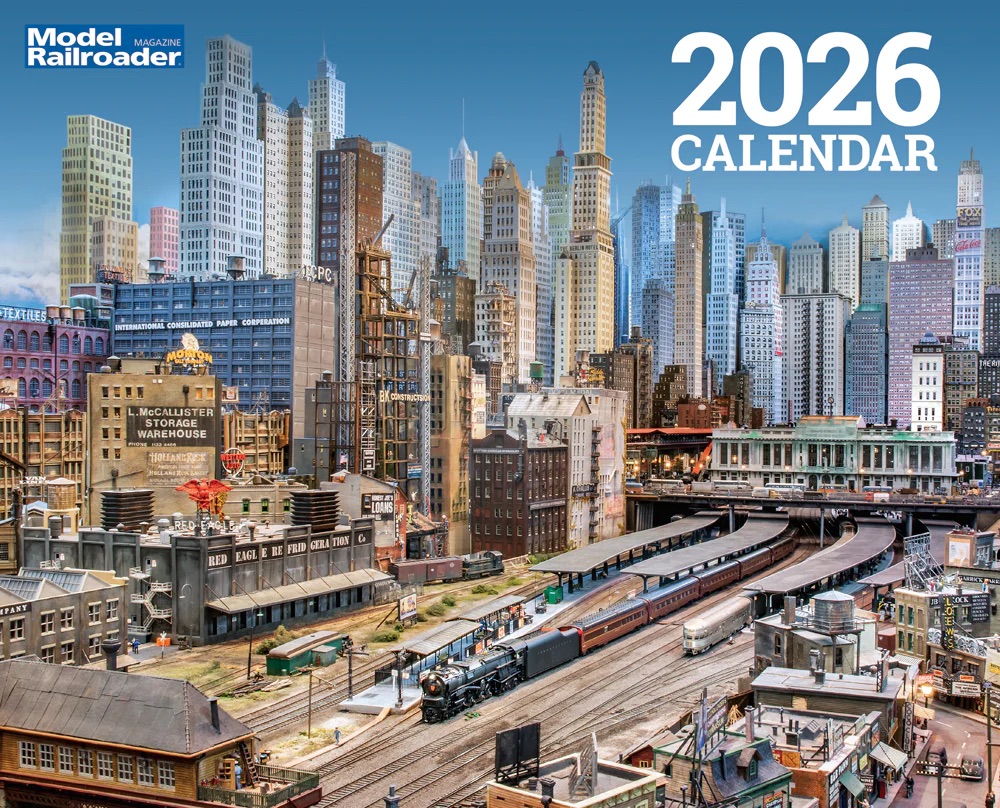

David: Well, you know, the Chicago ‘L’ trains in N scale would go perfectly with your Chicago METRA trains. And if you’re going to do METRA commuter railroading, N scale is the way to model it because you have to have stations and running room in order to make it work.

Jason: I will let you know that for our HO scale ‘L’ trains, and we’ll have to see about N scale, we’re doing track – elevated track.

David: That’s awesome! I know there are some wood kits, but it’s really hard to model from scratch.

Jason: Yes, it will be available either fully built up or as a kit. We’re hoping to do both right now, but it just depends on the cost. It’s going to be double track with curves and straights.

If you want to go with something more creative, like crossovers, go get a laser cut kit to do all your custom work. Our ‘L’ track will make a nice loop around your layout.

Jason: So, there’s a lot of fun stuff we’re doing – a lot of mass transit. The BART trains sold out. They did very, very well.

David: I was looking at your newsletter, and the photos from the guy doing the BART layout with the tubes and everything else was amazing.

Jason: That’s a modeler named Mark Estrada.

David: The irony is that years ago, when I first started at Model Railroader, I made a London Underground modeling April Fool’s joke.

Jason: I remember that one.

David: It was about modelers putting pipe in their back yards for the trains and then burying it all again. I looked at the photos and thought, “Oh my gosh, he did it!”

Jason: Our Toronto subway models should be out before the end of the year. I’m actually rebuilding one entire deck on my layout so I can put in the Toronto subway. I’ve got Union Station in my layout room, but there’s a guest room on the other side of the wall. I’m going to build a shadow box of the Union Station subway station in the guest room, and then the trains will just come into the shadow box from the next room. There’ll be a timer so the trains stop at the station, then continue on. It will have sound effects, so you’ll be able to sit in the guest room and watch those little red subways will come through.

We’ve found a really nice niche [transit models] and we’re enjoying it. We’re also meeting a lot of new modelers who are not modelers; they’re transit fans. The transit models don’t make money hand over fist, but they’re exciting and they’re cool to do.

We’re about to announce, conditionally, a Toronto CLRV streetcar which was brought out in 1979. It’s a very modern looking design. They were just retired in 2022 I think, but they ran for a good 40 years.

We’re trying to figure out traction and how do we do this stuff. We’re looking at what people have done before, and then we’re breaking all the rules. We’ve designed power trucks with tiny motors in them. That way you can have a full interior on a transit model.

David: Two questions for you before we go, Jason. The last time I talked with you, you were buying a building in Buffalo, New York. Did that deal go through?

Jason: Yes, we own a building in Buffalo now. Don’t come by just yet because Ryan is there by himself, and he’s too busy at the moment. But eventually you will be able to visit. We’ve got a big empty space, and we want a model railroad club in our building. We’re already speaking with a Buffalo club, but if anyone watching is interested, please reach out to me and you can be involved.

It’s a beautiful space for a layout. It’s about 47 x 22 feet. There’s a cellar underneath for storage and shop and stuff like that.

We want to get a model train club in there, hopefully in the next few months. We’re hoping down the road to have a swag store there too, the idea being if you’re driving across the U.S. on vacation, you can stop in Buffalo at the Rapido swag store. It will probably be a 2026 thing, but we’ve got big plans for Buffalo.

David: The other thing I was going to say is that you are a huge advocate for preordering models. Do you want to talk about that?

Jason: Pre-ordering is very, very important, especially during the tariffs because there’s a lot of uncertainty. People are wondering, “Well what’s the final price going to be? Maybe I shouldn’t preorder.”

Please – everyone should preorder; we need to know what to make.

Tariffs are temporary. They went up to 145% then came back down five weeks later. They were at crazy numbers and they came back again.

Five weeks is not a year. Five weeks is not two years. And when you’re pre-ordering now, the products could be coming six months from now or a year from now. We don’t know where the tariffs will be when the products arrive, so it’s worth it to preorder.

In the worst-case scenario, if there’s another big fight and the tariffs are at 100%, we’re not going to ship the product. I’m holding my price increase to 9.6%. And if the tariffs go over 30% again, we’ll wait to ship the product until it comes down.

Also, if you preorder, and then the economy really hits you hard when the goods arrive, you can cancel your preorder because of the tariffs. We’re going to understand.

We have customers all over the world. Because of the tariff situation, we’re moving all of our American customer inventory to Buffalo, which means we’re paying a tariff on it.

If you live in Canada, the UK or Europe, or wherever else, such as Australia, and you want Rapido American models, you have to preorder if you don’t want to pay the U.S. tariffs. All non-U.S. preorders we have before the product leaves China are sent to Canada, so no tariff. But we can’t leave American models sitting in Canada hoping that Canadians will buy them; we’re going to send them to where the customers for them are.

David: Jason, thank you so much for taking time today out of your busy schedule, as I know you’re traveling.

Jason: It’s my pleasure. Besides, it’s an early morning call for you, but here in the U.K., I’ve been up half the day already.

David: We wish you and the industry all the best.

Didn’t AHM bring out a RTR HO helium tank car in the ’60’s?

There was once a substantial model train/hobby/toy OEM industry in the U.S. Then, it migrated overseas due to lower costs and higher profits. “Something” needs to be done to bring it back. And, even in H0 scale -but especially in N- there’s a point of diminishing marginal returns on increased levels of detail. There is a need for lower-cost products in both scales to get people interested and keep them interested.

It was never about higher profits, it was always about the lower cost and increased details demanded by a lot modelers. You’ll never bring manufacturing like that back to the U.S. and people need to understand that. There’s no way a company will go from having things built by workers that make the equivalent of $5-10/day U.S. vs the $30-50/hour people in the states would want for that tedious detail work. We are a service economy now and everyone should get used to it. Over 70% of GDP is from consumer spending…that is the new normal!

Sorry but they’re not coming back. The US made models were either unaffordable or junk.

I couldn’t afford the high end stuff and I couldn’t ever get the affordable stuff to run well so I stopped modeling completely.

About 2 decades ago I came across a Kato n scale Metra train and on a lark bought it. It was affordable and ran well.

So I started modeling again. You probably think I ruined the hobby. No I didn’t. Before I did not buy anything. Not I buy imported models from US hobby shops and I buy a lot. That hobby shop owner has a home and family here. He’s making money and spending it on the American economy.