But homeowner’s insurance wasn’t developed to cover losses pertaining to collectibles. Too often, policyholders learn the hard way that they aren’t covered, or that their settlement checks are nowhere near adequate.

Having owned an insurance agency from 1978 to 1993, and knowing current agents and representatives, I’ve come up with seven tips to help you ensure that your collection is properly protected.

To insure

When someone asks me whether or not he should insure his trains, I reply, “If you enjoy your toy or model train collection and want compensation from accidental damage, then you should consider insuring your trains.” This advice applies even if you have homeowner’s insurance, because homeowner’s policies have exclusions and limitations on personal property.

Your homeowner’s insurance is likely one of four types. The first type, Basic Form (also referred to as HO-1) and Broad Form (HO-2), provide minimal protection. If you have either one of these, consult with your insurance agent to see whether you qualify for one of the next two types.

The third type is Special Form (HO-3), which, until about 15 years ago, provided the best coverage of your residence for the money. It has been surpassed by what companies refer to as a Comprehensive, Gold, Platinum, or Super Policy (HO-5). Despite its advantages, this fourth type of policy often costs less than any of the first three.

Ask your agent which policy is best for you. Also ask whether you meet the requirements to obtain a Super Policy.

You should determine as well which exclusions and limitations affect you most. For example, an earthquake is considered to be an exclusion. Therefore, if you live where earthquakes occur and want protection, you will need to buy an additional rider or policy that covers earthquake damage.

In addition, homeowner’s limitations are handled differently. For example, most policies afford at least $500 coverage for loss of jewelry by theft. If you want more coverage, you need to buy an additional rider or policy.

Information pertaining to exclusions and limitations are printed in your homeowner’s policy. If you have misplaced or lost your copy, you can order a duplicate from your agent.

Contact your agent

If you decide to insure your collection, or just want more information, you should contact the agent or company that represents you. That way, you’ll give that person or business the first chance at helping you obtain the appropriate amount of insurance.

However, if your agent or company doesn’t carry collectible insurance riders or policies (also called Personal Articles or Fine Art Floaters), or is unable to provide information about such coverage, you need to move ahead.

Let your fingers do the walking! Depending on the size of your metropolitan area, insurance agents and companies sometimes advertise insurance for collectibles in the Yellow Pages or other telephone directories.

Better (and friendlier) places to find information about insuring toy or model train collections are advertised in toy train and antiques magazines and publications put out by national or local train clubs or organizations. These ads, and the insurance policies described within the ads, are specially designed and therefore targeted for the model train community. Insurers regularly advertise in the pages of Classic Toy Trains.

What to ask

Once you know whom to contact, you should proceed with an initial phone call. Experience has taught me that often the hardest part is knowing what to ask the person on the other end of the phone. However, if that agent or company has spent time and money advertising to insure model train collectibles, he or she should be able to answer your questions.

You should start by telling the person on the phone that you saw the firm’s ad about insuring toy trains and would like some assistance. Then let him or her get the ball rolling.

Of course, I recommend that you have some knowledge about insuring collections. That means knowing, first, that in most cases you need a written, itemized inventory of all of the trains to be insured. Also, depending on the state where you live and the insurance company you choose, a qualified appraisal (and possibly a personal inspection by the agent) may be necessary.

There are a variety of plans, including what’s known as a “blanket” policy. It usually doesn’t require a written inventory, but may not provide protection exceeding $100,000.

Such a plan may differ, based on the state where you live, but the key feature is the limit placed on total coverage. If you desire more than $100,000 worth of total coverage, then this type of plan probably isn’t for you. Ask about other plans that may provide the coverage you desire.

Regardless of what kind of policy you get, I recommend making up a written inventory for your protection and the company’s. Similarly, photographs of expensive items or even the entire collection may be necessary to obtain a particular policy, but I suggest doing this anyway. You can also use a video camera to make a visual record of your trains.

You can create an inventory by using a computer program designed for that purpose, or you can resort to the traditional notepad method. In columns, describe each item in your collection.

The description should include the manufacturer, type of item, catalog number, year (if known), road name, color and other key traits, and condition. Don’t forget to add information about the packaging and to note any reproduction parts or loads.

[When assessing the condition of a train, most collectors use the standards developed by the Train Collectors Association. To learn more about those standards, check the TCA website www.traincollectors.org. – Editor]

An example of a useful description could read like this: “Lionel, boxcar, X6454, 1948, New York Central, orange body, missing one step; Good condition; original box with no flaps.”

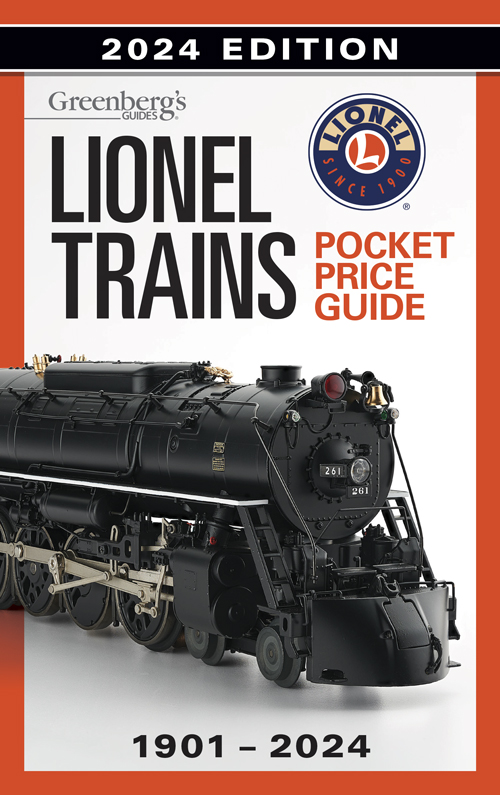

Next, you may want to consult the most recent Greenberg Pocket Price Guide to specify the retail value of each item. For the boxcar listed above, the value specified for “Good” condition is $50. The value given for that condition probably wouldn’t be lowered because of the missing step. However, having the original box, even if it’s missing all end flaps, might raise the value slightly.

What happens if the item described isn’t covered by a Greenberg Pocket Price Guide? In that case, I recommend that you consult one of the more detailed reference guides. If you aren’t sure about all the information, specify as much as possible, particularly about the manufacturer and catalog number.

There may be certain requirements that must be met to insure your collection. For example, you may have to store your trains at your residence only. Or you may have to live a specified distance from a responding fire department or even a fire hydrant. Such requirements may seem unfair, but they do keep down the cost of collectible insurance.

Insurance for collectibles was developed for items stored or displayed at home, as opposed to items taken to shows and other venues for possible resale. Items for resale are really business personal property and should be treated as such. That means they should be covered under a different type of plan. This also helps keep down the cost of collectible insurance.

Exclusions and limitations

Exclusions are part of each collectible insurance plan, but generally do not put up huge barriers. For example, riot or civil commotion may be excluded – be sure to ask.

Other exclusions include wear and tear (gradual deterioration and depreciation); damage caused by insects and rodents; damage caused by rust, dampness, cold, or heat; dishonesty by you, your partners or employees, or anyone with an interest in your property; theft from any unattended vehicle, unless otherwise stated; and items stolen from shows, unless otherwise stated.

Limitations can be part of a collectible insurance plan. They may include newly acquired items up to a certain percentage of your policy and a stated limitation, perhaps $15,000, while the collection is in transit.

Additionally, some plans exclude any type of paper-related collectibles. Deductibles range from $100 or more per occurrence. Some plans provide premium discounts for choosing higher deductibles.

For the most part, collectible insurance affords “comprehensive,” or “all-risk,” protection. That means everything is covered, except for whatever is outlined as a policy exclusion and limitation.

Keep in mind that collectible insurance plans probably differ from state to state and company to company. Therefore, ask the agent or firm that you contact to mail or fax those pages outlining exclusions and limitations so you can better evaluate their policy.

Costs

The costs of collectible insurance can differ from state to state, and company to company. Since I’m not familiar with every policy available and can’t anticipate each collector’s preferences and needs, I can’t say how much adequate coverage will cost.

Based on my experience, however, I can say that a fair annual rate for collectible insurance will be approximately $7 per $1,000 worth of coverage. That amounts to $70 for $10,000 coverage and $700 for $100,000 (or an equivalent thereof).

If these amounts strike you as somewhat high, you may be tempted to undervalue your trains in order to reduce the cost of your coverage. Be aware that should you suffer a loss and expect to be reimbursed by your insurance company for the full replacement cost, it will provide only as much coverage as you have purchased.

In other words, if you claim that your four Lionel postwar GG1 electrics are worth a total of $1,000, then that is what you’ll receive if they are lost in a fire. Good luck trying to replace them for that amount!

Terrorism

Entering the 21st century, homeowner’s and collectible insurance plans were clear about the exclusions and limitations in effect. They provided lots of protection for American consumers.

Since the terrorist attacks on September 11, 2001, the situation has changed somewhat, because insurance companies recognized that a new exclusion, or peril, had invaded the United States. Now they speak of “Terrorism” and “Acts of Terrorism.”

So far, this new peril has affected only commercial real estate, although home and auto insurance premiums seem to have increased accordingly. Large facilities, notably airports, shopping malls, skyscrapers, and stadiums, find it more difficult to obtain coverage for terrorism.

Ask your insurance agent or company whether “there are major concerns regarding terrorism.” Remember, those concerns can differ from state to state and company to company.

Don’t delay

I hope that you’re now more prepared to insure something as important and dear to you as your toy or model train collection. I also hope you understand that there’s more to insurance than having the so-called best company or just saving money.

Find out whether the agent or company that you choose can handle collectible insurance claims and not only homeowner’s. Always make sure you feel comfortable with them at all times and that they will explain exclusions, limitations, and claims in a clear and straightforward manner.

If you have concerns about an insurance company, contact your state’s department of insurance to find out how that company is rated. There are insurance deals advertised over the Internet, but I recommend speaking directly with an agent to get that personal touch.

Most of all, you need to trust that your agent or company will go to bat for you, even if it’s time to close shop for the day. You and your trains deserve at least that much.

For assistance with the research for this article, the author wishes to thank Timothy Maier, of J.A. Bash & Co.; Richard Turek, of Kotecki/Turek Agency; and R.S., his “career school buddy of 25 years.”

What are the names of these computer programs for making an inventory of a train collection, and how do I find these computer programs for the inventory purpose?