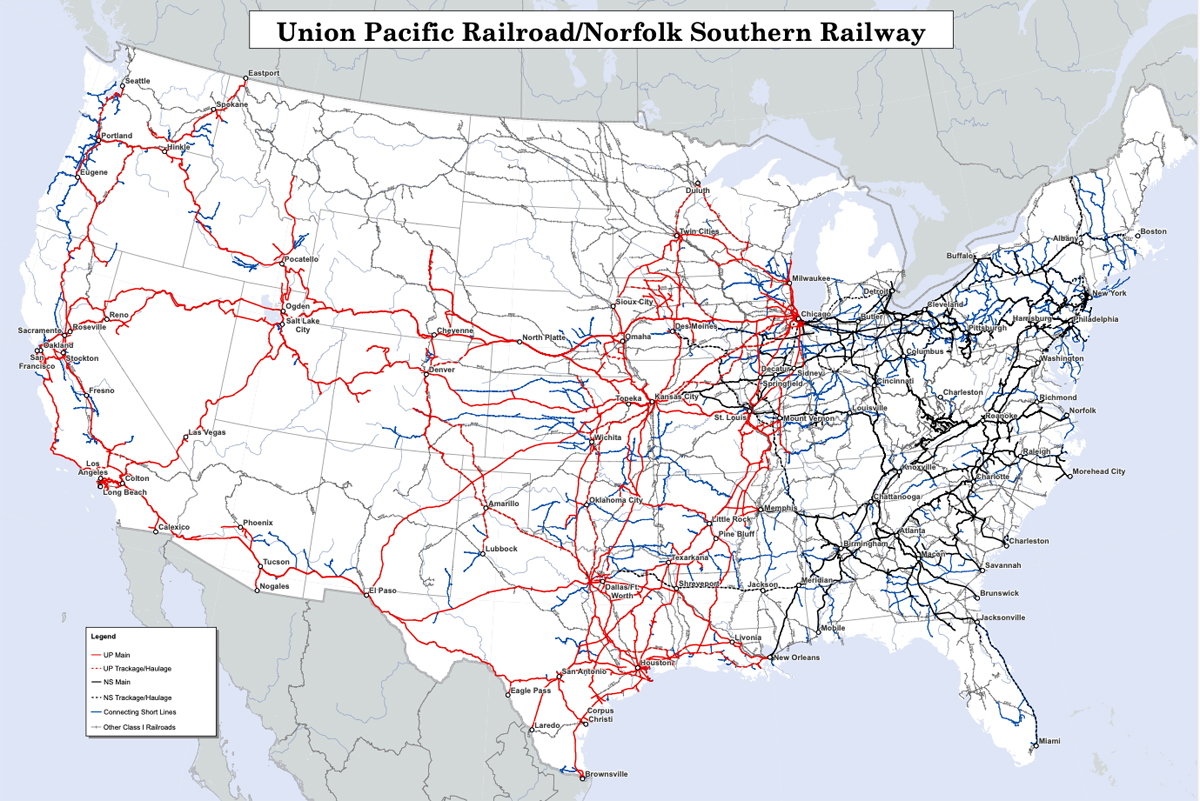

OMAHA, Neb. — Union Pacific and Norfolk Southern say their proposed transcontinental merger will take more than 2 million trucks off the road annually, boosting the combined system’s traffic by 1.4 million intermodal loads and 425,000 carloads.

The nearly 12% growth projection is among the details included in the 6,692-page merger application the railroads filed with the Surface Transportation Board on Friday (Dec. 19).

The combined railroad would see revenue growth of $4.2 billion three years into the merger, with nearly $1 billion in cost synergies. UP will spend $1.1 billion in capacity improvements, plus another $1.1 billion on technology integration and other investments.

“We look forward to working with the Surface Transportation Board as it reviews our historic application to create America’s first transcontinental railroad,” UP CEO Jim Vena said in a statement. “As time and technology continue to transform how freight is delivered, our industry must keep pace and move forward, reaching underserved markets with new rail solutions and strengthening the U.S. supply chain. Customers deserve stronger, more connected freight rail, and our merger will make that happen.”

UP and NS said their merger would help stem the loss of rail market share, which declined nearly 10% from 2014 to 2023, according to the Bureau of Transportation Statistics. The single-line service created by the merger will level the playing field with trucks, the railroads said — noting that rail’s market share is two to three times higher for single-line moves than for freight moving in interline service.

“This transaction is intended to stop and reverse that share loss by offering more single line options to shippers so rail can compete more effectively with the highway alternatives,” Norfolk Southern CEO Mark George told analysts on the railroads’ Friday morning webcast.

Roughly 75% of the projected merger-related traffic growth will come from converting truckload business to rail, he says, with the balance diverted from competing railroads.

A transcontinental UP system will create 10,000 new single-line service lanes, which will eliminate the costly and time-consuming interchange of 2,400 carloads and containers per day at gateways from Chicago to New Orleans. UP also points out that interline merchandise traffic moving between 1,000 and 1,500 miles costs an average of 35% more than a comparable move involving just one railroad.

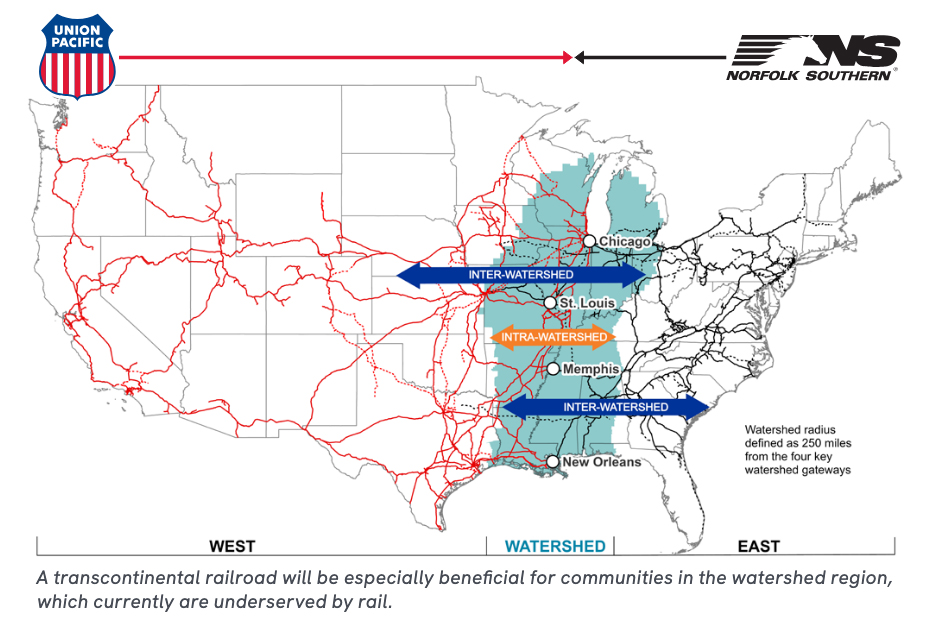

UP sees significant growth in the so-called watershed markets — the vast swath of the American heartland that lies within a few hundred miles of the Mississippi River, the de facto dividing line between the Eastern and Western railroads.

Eliminating interchange friction, short hauls, and revenue division challenges will enable 105,000 carloads of merchandise traffic to shift from road to rail in the watershed, UP said, citing estimates from the Oliver Wyman consulting firm.

“We see meaningful opportunity in the watershed, which we define as the manufacturing and agricultural heart of the country that lies roughly 250 miles from our major gateways along the Mississippi River,” NS Chief Commercial Officer Ed Elkins said on the webcast. “Today, rail massively underperforms in these watershed markets, capturing less than 10% of the volume.”

Operational changes

UP’s operating plan adds merchandise and intermodal trains that avoid stops at current gateways, including Chicago.

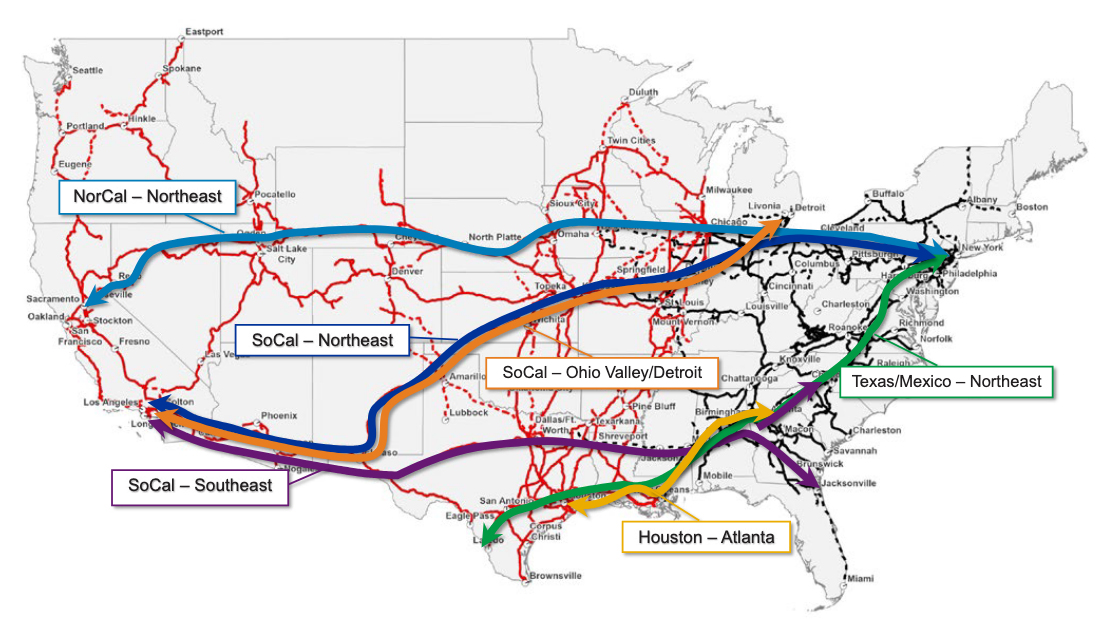

Union Pacific and Norfolk Southern anticipate adding several routes, including two new daily intermodal train pairs connecting the East and the West with more direct service – reducing estimated transit times from Southern California to the Ohio Valley and Northeast by up to 20 hours and from Southern California to the Southeast by more than two days.

To meet expected intermodal growth, the combined company plans to introduce a total of six premium intermodal lanes operating seven days a week.

A new intermodal train connecting Southern California to the Ohio Valley and the Northeast will use UP’s Sunset and Golden State routes to Kansas City, where it will get on Norfolk Southern’s former Wabash main line to Butler, Ind., the connection with the NS Premier Corridor main line to the East Coast. Eliminating the interchange in Chicago will shorten the trip by up to 252 miles and reduce estimated transit times by up to 20 hours.

In another example, UP and NS will shave approximately 70 hours of transit time on intermodal traffic moving from Southern and Northern California to the Southeast, including Georgia, Florida, and North Carolina, and approximately 95 hours on westbound traffic by routing it via the Shreveport, La.-Meridian, Miss., Meridian Speedway rather than via Memphis.

The combined railroad also will introduce six new manifest trains to bridge the East-West divide more efficiently, reducing over 600 daily car handlings.

“We’ve estimated that 40% of the combined company’s manifest routes will benefit from fewer handlings. Driving these results is a simpler, streamlined, and more efficient rail network,” John Orr, the NS chief operating officer, told analysts.

He adds: “This equates to almost 900,000 fewer handlings, about 1.7 million fewer train miles and a reduction of nearly 22,000 car miles.”

Main line and terminal capacity expansion projects will enable a transcontinental UP to handle projected traffic growth, executives said.

“Major projects identified include Union Pacific Sunset and Golden State routes as well as Norfolk Southern’s Kansas City to Butler, Ind., and New Orleans to Atlanta corridors,” Eric Gehringer, UP’s executive vice president of operations, said on the webcast.

The investments will add sections of double track, extend sidings, and add other improvements that will improve transit times and service, he says.

UP will expand seven intermodal terminals, two hump yards, and two auto ramps with projects set for Texas, Southern California, Tennessee, Ohio, and Florida. “Key locations for investment include Houston, Port of Laredo, L.A.’s Inland Empire, Chattanooga, Toledo, and Jacksonville,” Gehringer says.

Impact on competition

UP and NS said their combination would enhance railroad competition. Only three customer locations — out of more than 20,000 — are served by UP and NS but no other railroad. UP says it will provide the three locations with competitive options.

In September, UP and NS said they expected that potential concessions necessary to gain regulatory approval might reduce merger-related synergies by $750 million. But now, after preparing the merger application, they say that’s no longer the case.

“We now do not believe significant concessions are needed given the strong value offered by the merger in combination with the enhancements that we are offering,” UP Chief Financial Officer Jennifer Hamann told analysts.

The railroads said they will keep all current gateways open. “Committed Gateway Pricing,” the railroads said, will streamline pricing for interline moves that otherwise may not directly benefit from the merger.

“Without CGP, a fully served UP industrial chemical customer in Texas shipping to a fully served CSX customer in South Carolina would not see any benefits from our transaction,” Kenny Rocker, UP’s executive vice president of marketing and sales, said on the webcast. “With CGP, however, the CSX will be able to market directly to that customer using a formulaic competitive rate based on shipments moving in that market and extending the benefits from our merger. Committed gateway pricing is purely additive, providing an extra rate and service option without removing any existing choices.”

UP will not divest any principal routes after the merger. But it will divest shares of the Terminal Railroad Association of St. Louis and the Peoria & Pekin Union Railway to prevent what otherwise would become majority ownership post-merger. In addition, UP says it will eliminate potential competitive concerns involving TTX — the railcar pooling company — by reducing its TTX stake to not greater than 50%.

Phased integration

To avoid the disruptions that have accompanied other major railroad mergers, UP and NS say the transition to a combined system will move forward in phases. They also said that the end-to-end nature of the merger reduces the risk of service disruptions because most traffic moving on the two networks will not be affected, and that most yards and terminals will not experience any significant merger-related increase in traffic.

The application also outlines how the railroads will combine best safety practices under a safety integration plan that was created in conjunction with the Federal Railroad Administration.

More than 2,000 letters of support — including 500 from customers — are included in the merger application.

Add all this up, UP says, and the merger meets the regulatory requirements for approval: It enhances competition and is in the public interest, the two higher hurdles that are part of the STB’s tougher 2001 merger rules.

The UP-NS combination is the first to be judged under those rules, which were put into place after rapid and initially chaotic mergers in the 1990s.

The rules also require merging railroads to address the so-called downstream effects of their combination, such as how it might prompt other mergers. UP and NS punted on this, telling the STB that they could not predict whether other Class I railroads may choose to pursue mergers. They also argue that even if other railroads merged in response to the UP-NS combination, “it would not diminish the substantial public benefits of the proposed transaction.”

Further mergers, railroads said, wouldn’t result in any harm if they mirrored the UP-NS merger, took steps to protect competition, and carefully planned their integration.

The STB now has 30 days to accept the application as complete or reject it as incomplete.

— Updated at 7:45 a.m. CT with additional details. Updated at 7:58 a.m. with graphics. Updated at 1:30 p.m. with additional detail from morning webcast with analysts. To report news or errors, contact trainsnewswire@firecrown.com.

Perhaps any merger should REQUIRE the new company to PROVE this claim after one year of operation, with actual cash penalties on the managers responsible if no proof is forthcoming.

To be clear: NOTHING done by railroads, passenger or freight, has removed rubber tired vehicles from the highways. Every truck or automobile where the operator or customer decided to use trains has been replaced by another. It is a system that runs to congealing. The only thing that decreases traffic is a downturn in the economy and that’s across all modes.

Based on the class one railroad performance since the early 80s and the mergers and abandonments that have followed deregulation, how is anyone supposed to believe that this merger will take even one truck off the road. All it will do is put more money in the pockets of Wall Street investors. That’s not necessarily a bad thing as that’s what businesses are supposed to do, make a profit. But Vena shouldn’t promise to do what railroads can’t bring themselves to do which is to grow the business and increase market share.

So, if the UP / NS merger is touted to take 2 million trucks off the highways, does it not logically follow that 2 million truck DRIVERS will lose their jobs? Is UPNS going to hire all those truckers to work on the new service lines? And if those 2 million trucks are no longer needed on the highways, to what junkyard to they go?

That’s 2 million loads annually.

IMO, a bunch of nonsense. Every time there is some merger thing, its always touted that XXX number of trucks will be taken off the roads. Has this ever happened as there seems to be no shortage of trucks running all over the Country, especially when the RRs can’t/won’t deliver when they claim they will. Just eye candy as there is no way to determine and verify these claims.