MIAMI— In the first full month following a strategy revamp in early October, Brightline showed promising revenue growth, driven by increased premium-class seating on its Orlando trains and additional customers riding more frequent West Palm Beach-Miami service.

However, its mounting, increasingly expensive debt load is causing concern among investors as a hefty interest payment is scheduled for this Thursday, Jan. 15.

Patronage trends

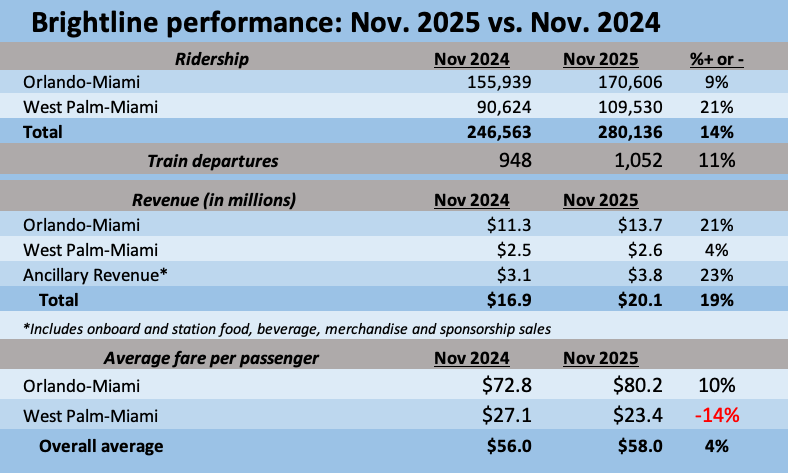

At the beginning of October, the company moved away from hourly service between South Florida and Orlando. It now generally offers one departure every other hour while boosting Miami-West Palm Beach frequencies [see “Brightline revamps schedules …,” Trains.com, Sept. 30, 2025]. With the arrival as of December of another 10 Premium-class coaches, featuring 2-1 seating and upgraded amenities, the table below shows additional higher-priced tickets have led to more revenue even though full-route trips were cut almost in half.

Significantly, the comparisons with the same month in 2024 also show that South Florida-Orlando ridership grew despite sharply reduced train starts, although questions about air travel during the federal government shutdown in October and November may have had an impact.

The increased short-haul train frequencies were accompanied by fixed off-peak and rush-hour pricing, rather than subjecting daily riders to the whims of the supply-and-demand fluctuations of yield management programs.

A Trains analysis of fare levels for the Orlando service during the past week shows significant price variation on journeys more than three days in advance but a narrower range at higher levels on close-in dates. This appears to indicate that capacity is tracking in parallel with demand. Premium-class fares commanded roughly $40 to $80 more per passenger on the same train. The company reports on the investor relations portion of its website that long-distance passengers have generated a 68% increase in baggage fees. This is largely responsible for increasing “ancillary revenue.”

Debt concerns

While scheduling and pricing adjustments enabled by greater capacity have improved overall revenue and ridership results, the additional train starts have almost certainly added to operating costs. A monthly expense analysis is not available, but there is a candid investor relations discussion about the need to incur an additional $100 million in debt to meet upcoming bond payments and “potential adverse outcomes of certain litigation.” This likely refers to two current suits. One is the dispute with Florida East Coast over trackage rights and non-payment of maintenance fees [“FEC suit against Brightline …,” Nov. 17, 2025]. There is also a $60 million lawsuit filed in December by a former engineer who asserts he contracted post-traumatic stress disorder when the company forced him to handle the aftermath of highway crossing accidents beginning in 2018.

The Florida operator restructured its financial obligations last summer [“Brightline remarkets $985 million…,” Aug. 13, 2025]. It notes, “The terms and conditions of our existing indebtedness include restrictive covenants that limit our ability to incur debt,” including permission from existing bondholders.

A paywalled Wall Street Journal article says Brightline ridership “continues to underperform,” compared with estimates when the bonds were first sold. Also, the South Florida news site Sebastian Daily reports the company has put its Fort Lauderdale parking garage up for sale and intends to lease it back. The asking price is $20 million. The publication also notes that at least one investor has recognized changing fundamentals “aren’t as dire as bond prices suggest” after Standard & Poor’s downgraded Brightline bonds five notches to CCC from BB-minus in December.

Attracting riders

Florida tourism is up slightly, but still to be determined is the potential impact of a new $250 fee for international travelers from countries not participating in the Visa Waiver Program. The new “Visa Integrity Fee” enacted by Congress does not affect those from Canada or most European countries, and is supposed to be refunded upon departure if all terms of entry are followed. Still, Forbes reports tourism officials estimate it could cost the U.S. $11 billion in travel business.

Public radio station WUSF reports the state saw a slight increase in overall tourism during 2025’s third quarter, from 34.24 million to 34.34 million. This came despite a drop of more than 15% in tourism from Canada because of strained relations with the U.S., with Visit Florida estimating a decrease to 507,000 from 597,000 in the same quarter in 2024.

To counteract those existing and potential headwinds, Brightline continues to actively solicit repeat local riders and members of its new loyalty program via email with special promotions. It offers free shuttles to major sporting and concert events in South Florida, where highway traffic congestion shows no sign of subsiding. On tap this summer: seven World Cup soccer games in Miami, with the first scheduled for June 15.

Looking ahead

The November revenue and ridership results indicate that S&P’s projections of 15% revenue growth for 2026 may not accurately reflect the current trajectory, based on Brightline’s operational changes. Perhaps bond market investors aren’t paying enough attention to a strategy shift triggered by the benefits of increased capacity coupled with cultivating high-value passengers. Amtrak and its regional state sponsors should also take note.

How the Fortress Investment Group chooses to use the deep pockets Brightline relied on to launch its Florida venture will likely play a role in the ability of this private rail operator to compete against publicly funded highways and air travel support systems. The passenger rail business model is on trial here, with implications for the impending construction and eventual success of the high-speed, Las Vegas-Southern California Brightline West. Whether gains can be sustained and how the company navigates its credit crunch will be determined in the months ahead.

— To report news or errors, contact trainsnewswire@firecrown.com.

Debt payments seem to be the albatross on Brightlines neck. But how do ‘above the rail’ numbers look?: Are operating revenues exceeding operating expenses?

If Brightline does go belly-up, I hope that Amtrak can learn some lessons about how to properly market and tailor similar services to grow ridership and revenue, particularly regarding corridor operations.

I hope this cash-crunch issue is just a matter of ‘growing pains’ and this stat-up passenger train business succeeds as a profitable corp.

I agree. It is refreshing to see another approach to rail passenger service other than Amtrak. Perhaps Brightline did overbuild to some extent (like the all-new 125 MPH segment) and now that debt is a problem. But the rest of this article shows some encouraging trends. It seems that hourly service to Orlando wasn’t that necessary. The issues mentioned in the article can trouble any new start-up trying a new approach to a tough business. Let’s wish Brightline the best in resolving all this. Perhaps one day they will go to Jacksonville or even Atlanta.