PITTSBURGH — Wabtec on Wednesday reported stronger earnings as the equipment manufacturer’s revenue and profits grew in both its freight and transit segments.

“We delivered a very strong quarter evidenced by continued growth in our backlog, sales, margin, and earnings,” CEO Rafael Santana said on the company’s earnings call.

The company’s operating income increased 17%, to $491 million, as revenue grew 8.4%, to $2.89 billion. Earnings per share increased 11% to $1.81.

Freight segment revenue was up 8.4%. Equipment sales were up 32% driven by higher locomotive deliveries, while Digital sales were up 46% thanks to the acquisition of Inspection Technologies. Components sales were up slightly, while Services sales were down 12% due to the timing of locomotive modernization deliveries.

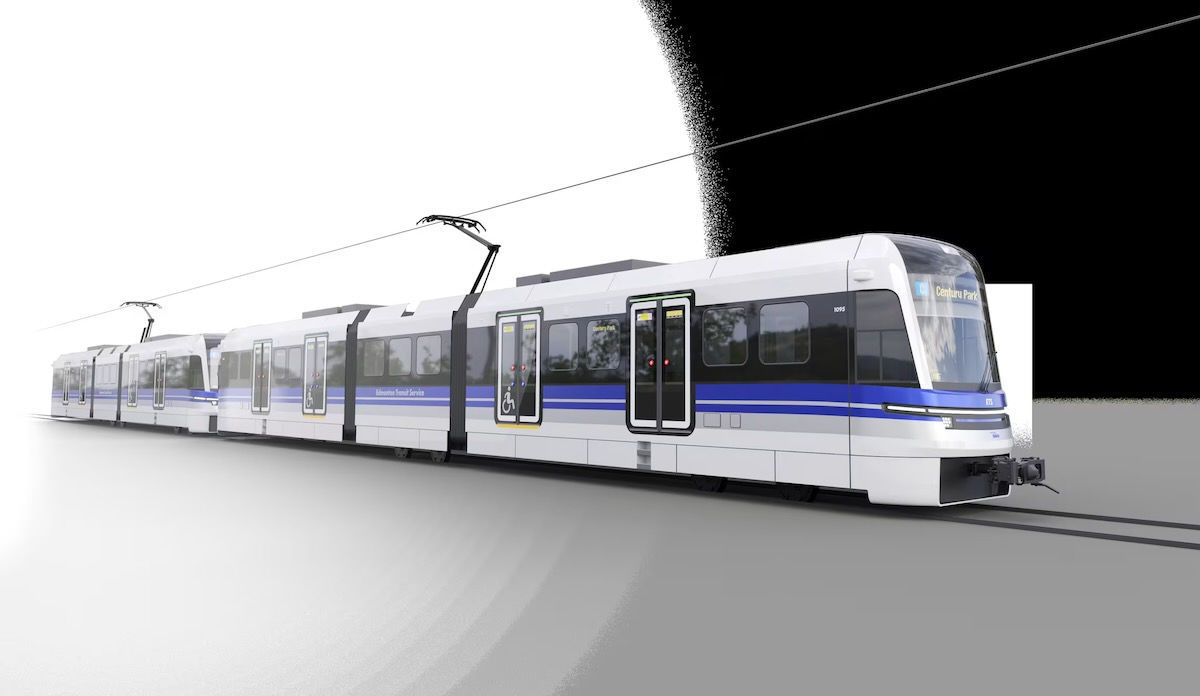

Transit segment revenue increased 8.2% on higher original equipment and aftermarket sales.

The freight segment’s 12-month backlog increased 9% year-over-year, while its multi-year backlog rose 18%. Transit’s 12-month backlog rose 7%, while the multi-year backlog grew 4%.

The freight backlog was aided by the record $4.2 billion locomotive order and service deal Wabtec landed in September from the national railway of Kazakhstan [See “Wabtec lands …,” Trains.com, Sept. 22, 2025.]

Wabtec said that transit order growth was supported by unprecedented backlogs at car builders, passenger growth in key markets like Europe, and investment in rail infrastructure around the world.

Wabtec raised its full-year financial outlook, with its estimated earnings per share rising 18.4% at the midpoint of its $8.85 to $9.05 range.

Nonetheless, executives had a cautious outlook about the broader economy.

“We are encouraged by the underlying momentum of our business and the continued strength of our pipeline of opportunities across the globe,” Santana says. “Despite the strong momentum that we’re experiencing, we’re continuing to exercise caution, to navigate a volatile and uncertain economic landscape as we move into the final quarter of the year.”

Do they break down loco sales between new and rebuilds? Rebuild market seems to be quite strong.