LOWELL, Ark. — J.B. Hunt executives say that if Class I railroad consolidation is really about competing with trucks, it will present an opportunity for the largest domestic intermodal provider to convert freight from highway to rail.

And they said during Wednesday’s earnings call that there’s no reason they cannot continue to work with both Norfolk Southern and CSX in the East if Union Pacific’s proposed $85 billion acquisition of NS wins regulatory approval.

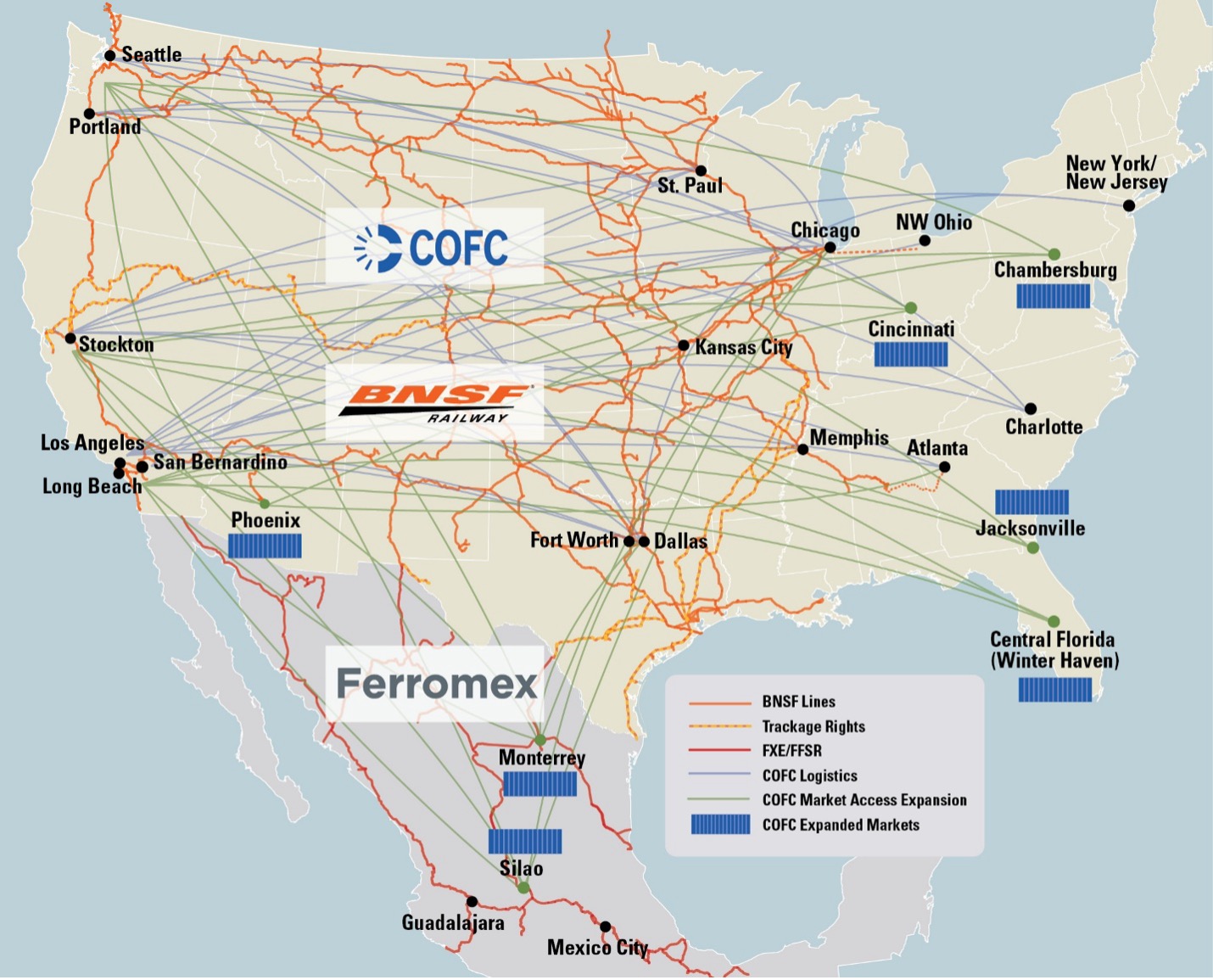

J.B. Hunt has an exclusive intermodal revenue-sharing partnership with BNSF Railway in the West, while NS carries more J.B. Hunt volume in the East than CSX. In the absence of J.B. Hunt comment on the merger, industry observers had speculated that the UP-NS deal would prompt J.B. Hunt to shift to CSX as its preferred partner in the East.

“That’s not accurate at all,” says Darren Field, president of J.B. Hunt Intermodal. “There’s nothing about a future-state new railroad that would mean our current Norfolk Southern footprint that we have today would be required to change.”

For decades, J.B. Hunt has offered seamless transcontinental intermodal service that links BNSF terminals with those on both NS and CSX.

“That opportunity could exist well into the future, regardless of the various outcomes we know are either announced or speculated in the market,” Field says. “We continue to see a large opportunity to convert highway shipments to intermodal. And if the motivation for consolidation is to compete more with trucks, we believe this will present our industry-leading intermodal franchise additional growth opportunities.”

J.B. Hunt will continue to have discussions with all of its rail partners, he says, and will work to provide its customers with the best intermodal solutions.

CEO Shelley Simpson says J.B. Hunt’s size — it handles nearly 25% of all domestic intermodal shipments — will help the company in any merger scenario.

“We recognize the opportunities and risk that consolidation presents. But our decades of experience — including navigating seven prior Class I railroad mergers and our thoughtfully developed long-term agreements and strong relationships with NS, CSX, and BNSF — should provide a basis for us to adapt to any changes in the industry. As the largest domestic intermodal provider, our scale and influence allow us to coordinate complex intermodal moves and deliver unique solutions for our customers.”

Roughly half of J.B. Hunt’s interline transcontinental volume moves between BNSF and the Eastern railroads via steel wheel interchange.

“This ratio can change dynamically and demonstrates our ability to be agile at scale to execute and meet our customer expectations,” says Spencer Frazier, executive vice president of sales and marketing. “Regardless of how the rail landscape and operating scenarios might change over the next couple of years, we remain committed to delivering exceptional service and growing with our customers.”

J.B. Hunt executives did not comment on the new interline intermodal agreement between BNSF and CSX, which links the Southwest and Southeast.

Hub Group, which relies on UP in the West and NS in the East, has supported the UP-NS merger and says it should help propel intermodal growth.

Schneider, which uses UP in the West and CSX in the East, has said it continues to evaluate the potential impact of the deal to create the first transcontinental merger.

JB Hunt is in a win-win position no matter what happens. They see the benefit of conversion of truck to rail no matter the outcome of the UP/NS transaction. BNSF will continue to maintain its predominant J B Hunt relationship while adding CMA-CGM as another partner. The UP/NS Transaction will provide for enhanced coast to coast for their cans either way so they are smart to support the merger while so many other shipping groups play Chicken Little, predicting the sky will fall. J B Hunt would seem to be a no to that argument, joining #2, The HUB Group in that assessment. And ANY rubber wheel to steel wheel conversions will be a plus for American consumers…