Craig Fuller is the CEO at FreightWaves.

The freight market has been sending mixed signals for months, but one trend stands out clearly as we move deeper into 2026: Trucking spot rates have staged a meaningful recovery, while intermodal rates remain stubbornly anchored near cycle lows.

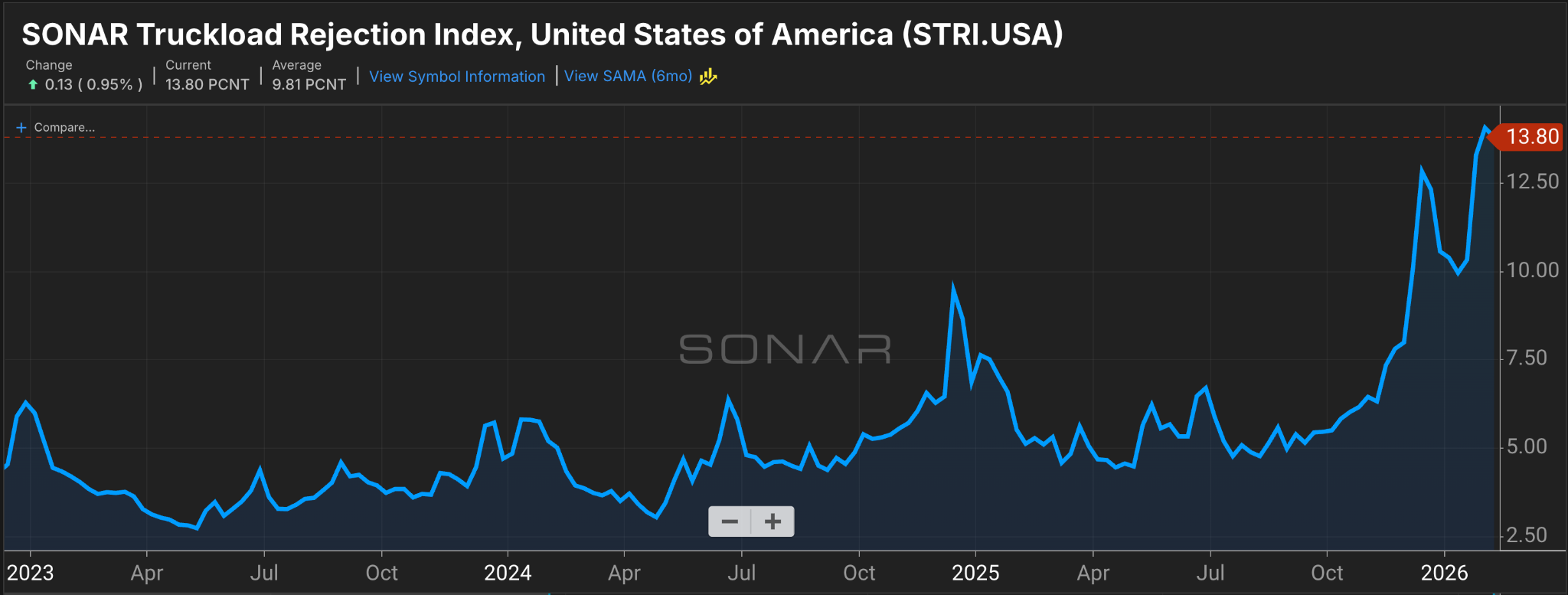

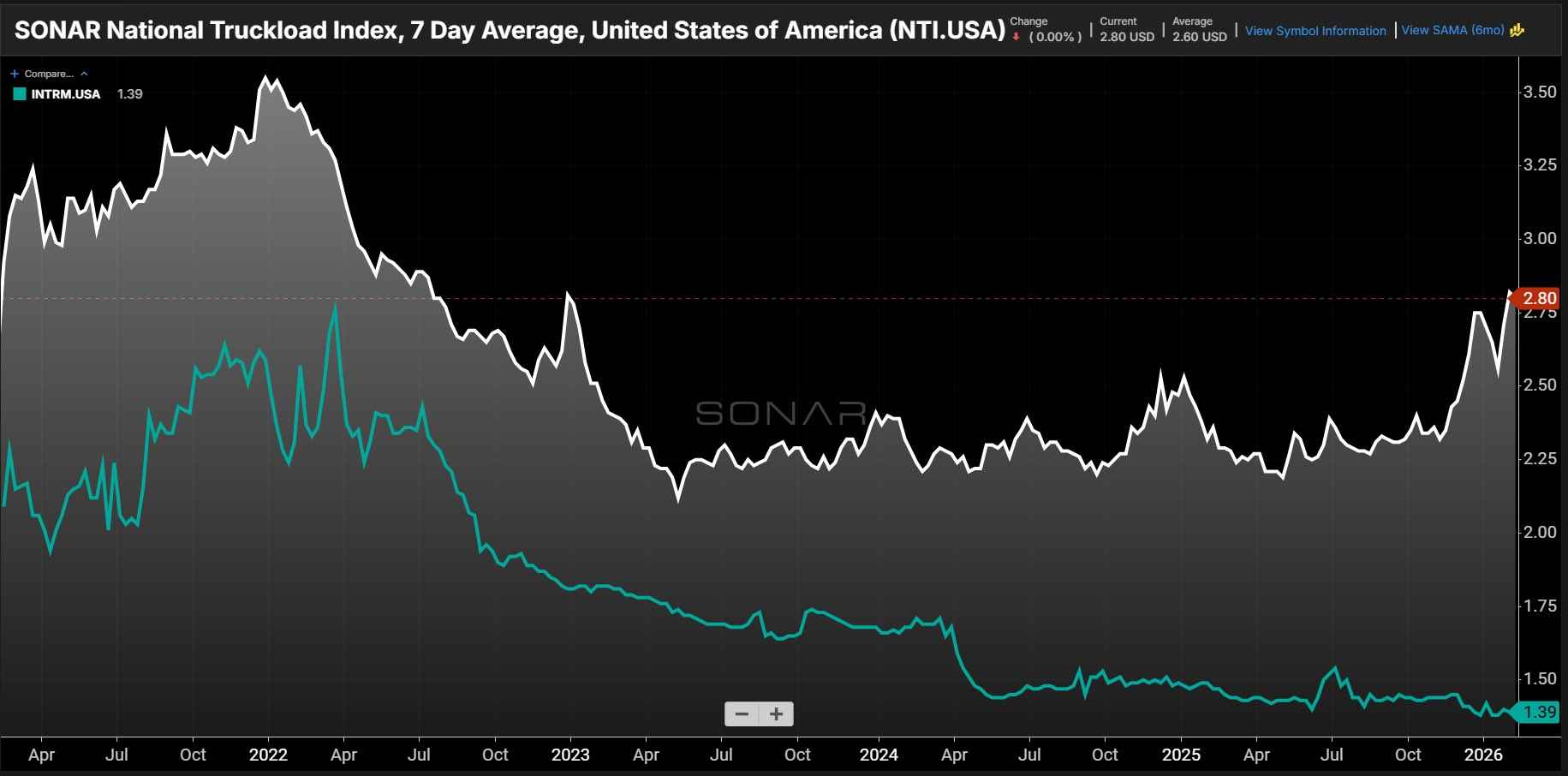

Look at the data. Truckload spot rates (inclusive of fuel) are holding elevated around $2.80 per mile nationally, per recent SONAR readings, up 23% from a year ago where it was at $2.33 per mile. Tender rejections are hovering near 14% — levels not seen consistently since the post-COVID unwind in 2022, and higher than anything in 2023, 2024, and 2025. Carriers are rejecting loads, pushing spot pricing higher, and creating real headaches for shippers’ routing guides.

Intermodal, meanwhile, tells a different story. Domestic intermodal spot rates (excluding fuel) sit at $1.39 per mile, down from $1.48 per mile a year ago, a decline of 5% — basically the same levels of where intermodal spot rates were during the COVID shutdowns in March 2020.

That’s despite strong intermodal volume performance, with slight fourth-quarter year-over-year gains fueled by reliable rail service and a significant rate spread versus truckload (often 20% to 30% savings on key long-haul lanes). Intermodal spot rates are running at half of their trucking counterparts.

This divergence isn’t new. For much of the past couple of years, shippers chased cost savings by shifting longer-haul freight to intermodal, especially as truckload capacity was abundant and spot rates soft. Railroads capitalized with excellent service reliability entering its second year of strong performance, excess container availability, and aggressive pricing to capture share. Intermodal volumes grew even as truckload volumes dipped negative in spots.

But the market is shifting under our feet. Trucking capacity continues to tighten — driven by ongoing carrier exits, regulatory pressures on drivers (English proficiency rules, non-domiciled CDL restrictions, ELD enforcement), winter weather disruptions, and early signs that domestic freight demand is returning, particularly in the Rust Belt.

Tender rejections remain multi-year highs throughout the country, but especially in the Midwest, where capacity remains incredibly tight. National spot rate averages exceed typical seasonal norms. Trucking spot rates surged in recent weeks and it is now obvious to even the most cynical observer that the recent surge is not simply a weather phenomenon.

Trucking is set for a banner year, with both tightening capacity and demand moving in the direction that favors motor carriers. We believe that shippers could experience multiple rounds of rate increases by the end of the year, with some models showing double-digit contract rate increases by December.

Intermodal’s pricing advantage, while still attractive, is starting to look vulnerable. Truckload provides the effective “ceiling” for intermodal rates — railroads can’t price too far below trucking without risking margin erosion, but they also can’t ignore a tightening over-the-road market forever. As spot truckload strength persists and potentially bleeds into contract renewals later this year, intermodal providers will face pressure to adjust.

Several catalysts could accelerate this:

- Capacity attrition in trucking: If exits continue (and early 2026 data suggests they are), the supply-demand balance tilts further toward carriers, making truckload more competitive on transit time, visibility, and door-to-door service — exactly the areas where intermodal has won share.

- Demand surprises: Consumer spending has held up better than expected in places. If inventories contract while urgency returns (e.g., via tariff-driven frontloading or unexpected surges), shippers may pay up for speed, pulling freight off rails and onto trucks.

- Rail strategy: Railroads have enjoyed volume gains from cost-conscious shippers. But with truckload rates firming, holding intermodal pricing flat risks losing that momentum. Expect selective increases to capture better margins, especially on high-volume lanes.

Don’t expect a dramatic flip overnight — intermodal’s structural advantages on long-haul economics remain. But the wide rate spread that fueled modal conversion is narrowing, and intermodal rates are poised to catch up as trucking’s tightness exerts upward pressure across surface modes.

Shippers should prepare for this shift. Those locked into long-term intermodal contracts may see renewal pressure; spot users could face less aggressive discounts. Carriers and railroads alike will be watching tender rejection trends and spot indices closely — because when trucking leads, intermodal often follows.

The freight market rewarded patience through the downcycle. Now, it’s rewarding those positioned for the inevitable rebalancing. In 2026, intermodal’s lag ends — and rates rise to reflect the new reality.

— To report news or errors, contact trainsnewswire@firecrown.com.

It would be interesting to see a split by railroad, as two railroads have all the incentive now to keep rates low to show volume growth.

Besides that merger question, It seems the “utility” from domestic container intermodal is now less in the private trucker’s eyes. The move to grounded container terminal operation, where stacks of containers are created under or near the crane reach, has lengthened pickups for the smaller drayage companies. Just look to social media to see stories of drivers returning multiple days in a row to try to get access to a container in these stacks and one can imagine that this cost is getting baked into the total basket of costs for a domestic load, depressing spot market linehaul rates.

It would be interesting to see if the merger commitments might allow for greater access for connecting line operated intermodal trains, as long as they had their own terminal site, if this would bring the return of some type of rapid load TOFC for private equipment.

If the report for trucking is inclusive of fuel and the report for rail not inclusive of fuel. Doesn’t that seem like an apples to oranges comparison.

Phasing out TOFC from small truckload and LTL carriers in favor of the largest customers (JB Hunt, Schneider) or railroad-controlled containers with less emphasis on schedule speed has always been a foundation of PSR’s game plan on intermodal. JBH and Schneider’s ability to wrest market share from truckers is all dependent on what the railroad does.

I think no matter how the rates behave, or unless some more small trucking companies invest in containers of their own, railroads simply won’t haul extra small-time TOFC because of this inflexibility. And with STG filing for bankruptcy I don’t blame trucking companies if they’re afraid to make that kind of investment. Won’t be surprised if class 1s just sleep through this and again end up worse off because of it.