OMAHA, Neb. — Union Pacific and Norfolk Southern say their yard and terminal capacity expansion plans will help ensure that the combined railroad can handle an anticipated traffic surge within three years of their merger.

The transcontinental combination, if approved, will lead to 11% volume growth compared to 2023, the railroads say in their merger application.

“By offering the single-line rail service customers prefer, a merged UP-NS would attract an estimated 1.86 million rail carloads and intermodal units annually,” according to Oliver Wyman’s traffic analysis in the merger application. Of that total, “442,000 diversions are from other railroads, 67,000 are extensions of UP intermodal moves that dray over 250 miles, and 1.36 million are from traffic currently moving by truck.”

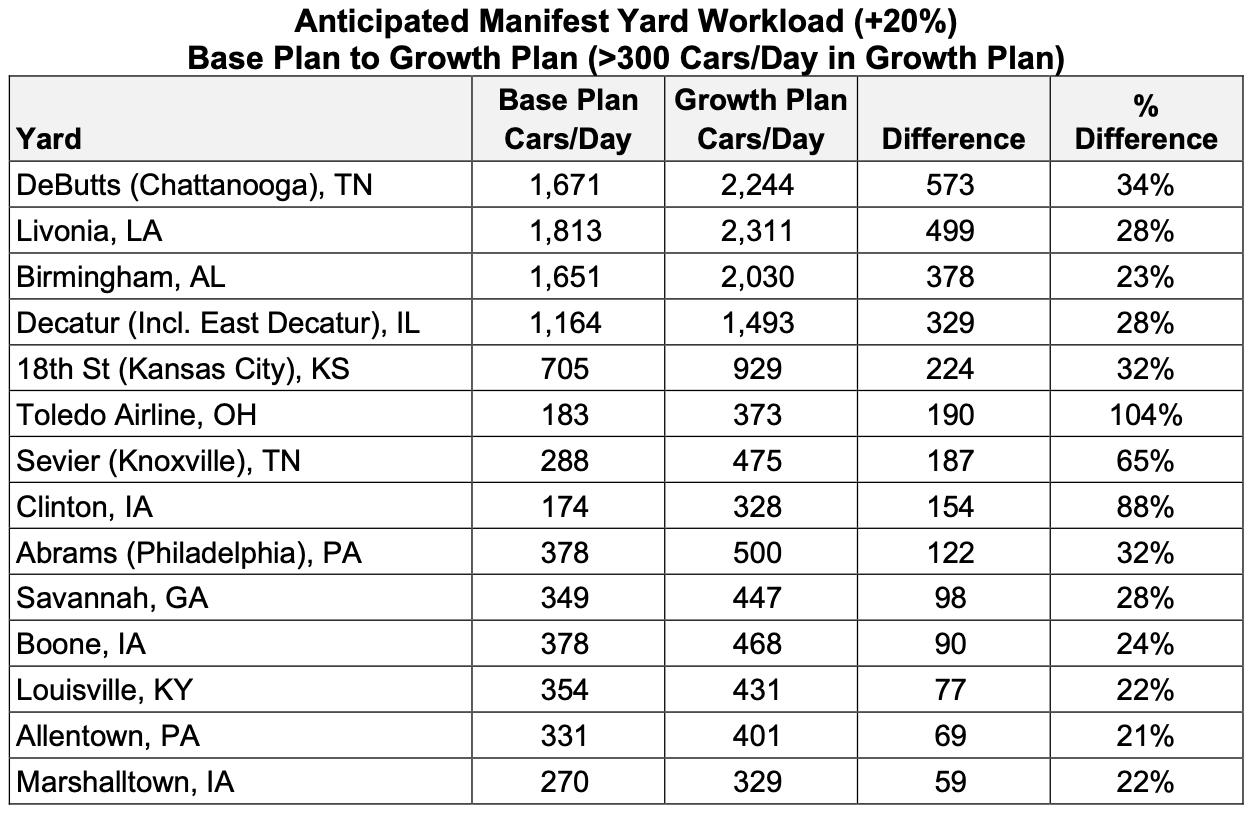

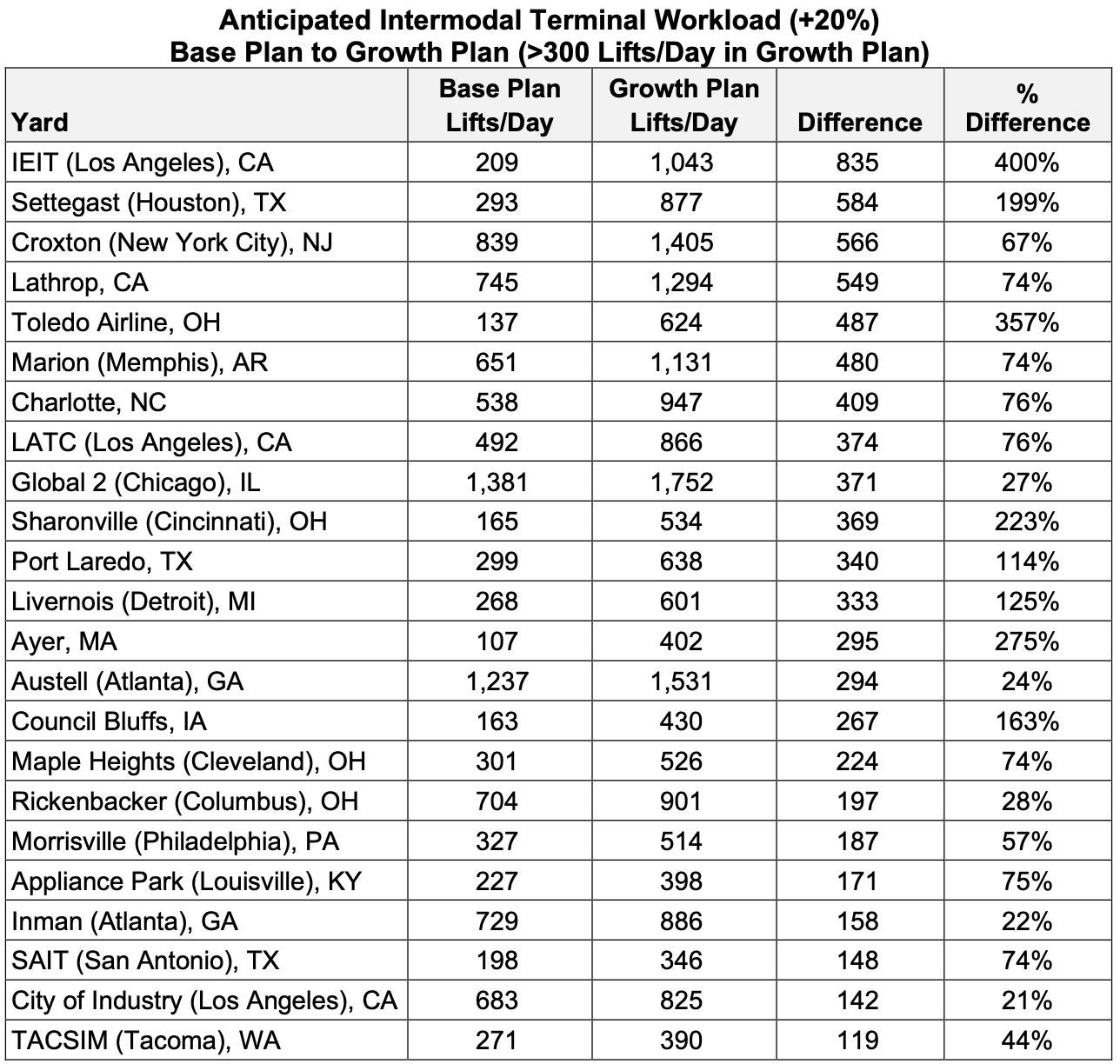

Under the railroads’ three-year Growth Plan, 23 intermodal terminals and 14 yards would see their workloads increase by more than 20% over the Base Plan. To handle growth, UP will spend $516 million to expand yard and terminal capacity where the projected activity levels exceed existing capacity.

“Applicants have a plan in place for the combined railroad to address the issue ahead of projected traffic growth,” the railroads told the Surface Transportation Board. The railroads have prepared a Base Plan, which reflects their separate, current operations; an Optimized Plan, which takes advantage of the merged railroad’s network to reduce car handlings and train starts; and a Growth Plan, which builds on the Optimized Plan and allows the railroad to absorb projected volume growth three years after the merger.

The projected workload increase at carload facilities is the result of both improved train and blocking patterns in the Optimized Plan and added traffic in the Growth Plan, the railroads said. Six new merchandise trains will bypass traditional gateways and carry traffic further into the UP and NS networks.

“For example, Livonia [La.], North Little Rock [Ark.], Chattanooga [Tenn.], and Birmingham [Ala.] are heavily used in the Optimized Plan to improve blocking for deeper network benefit,” the application says. “These changes, coupled with projected manifest traffic growth between Texas and the Gulf Coast to the Ohio Valley and the Northeast, results in significant increases in volumes at these locations. Similarly, Elkhart [Ind.] is projected to experience increased traffic as a result of traffic growth between the Northeast and the Ohio Valley, on the one hand, and the Midwest and the West, on the other hand.”

Conversion of truckload freight to intermodal will drive increased volume at intermodal terminals, the railroads say.

“The projected traffic growth in these terminals primarily results from added traffic in the Growth Plan. For example, volume increases at Croxton [N.J.] and Lathrop [Calif.] are driven by new traffic to the Northeast from the West Coast,” the application says. “Volume increases at Settegast [Houston] and Austell [Ga.] are driven by new traffic between Texas and the Southeast. Optimized train plans that eliminate UP-NS interchanges in the Chicago gateway will offset some demand at Global 4 [Chicago area]. In addition, terminal consolidations in the Optimized Plan contribute to traffic increases at 47th Street, Global 2, [both in the Chicago area] and Marion [Ark.].”

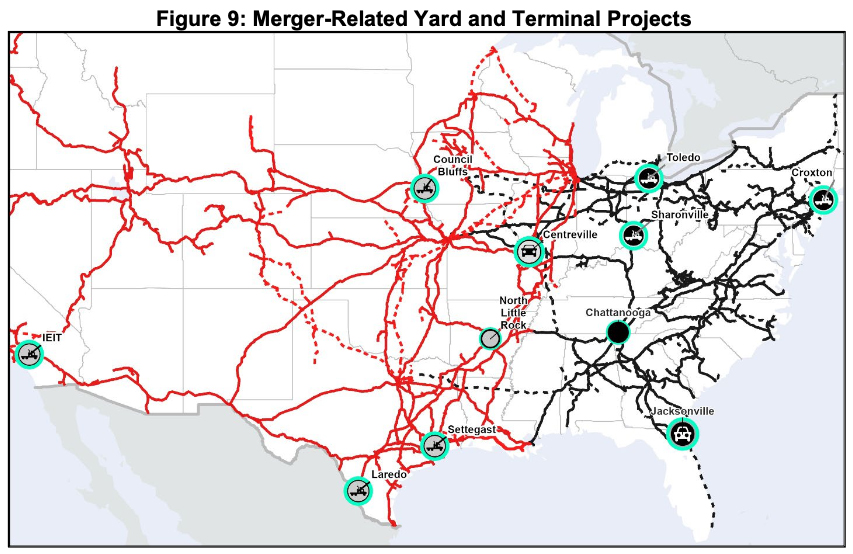

Intermodal terminals that will be expanded to handle anticipated volume growth include Settegast in Houston; Council Bluffs, Iowa; Port Laredo, Texas; the Inland Empire Intermodal Terminal in West Colton, Calif.; Croxton, N.J.; Sharonville (Cincinnati), Ohio; and Toledo, Ohio.

The most dramatic expansions in annual lift capacity will occur at Inland Empire (to 500,000 from 195,000), Settegast (to 360,000 from 140,000), Sharonville (to 202,000 from 90,000), and Detroit Livernois (to 277,000 from 147,000). The terminal upgrades include a combination of additional working tracks, more lift equipment, and more parking spaces.

UP and NS also plan to reactivate three intermodal terminals that NS has idled over the years: McCalla in Birmingham, Ala.; E-Rail in Elizabeth, N.J.; and Greencastle, Pa.

The railroads also will expand auto ramps in Centreville, Ill., and Jacksonville, Fla.

— To report news or errors, contact trainsnewswire@firecrown.com.

This merger is the tail wagging the dog.

If all these traffic opportunities exist, why has soooo little attention been paid to them?

This smells more like a Vena legacy/vanity project everyday that passes.

I think some of the growth on the ex-CNW Overland Route (Clinton, Marshalltown, and Boone, Iowa, with some of that going to Council Bluffs, Iowa) might be due to the new bridge over the Mississippi river at Clinton (have they started on that, yet?). It was proposed to be a high-level bridge so as to no longer necessitate a movable span. Many more trains can use the double-track main across Iowa if the river bridge never needs to open.

intermodel does not take trucks off highways. everyone of those containers on a train will be a truck on the highway. the ONLY way to take trucks off the highway is by using a railcar dock to dock

TOP|SPG categorizing intermodal yards based on origin or destination rather than lift capability has to be one of the dumbest ideas implemented this century. UP re-opening E-Rail, Greencastle, etc. hopefully would reverse this, take some of the unneeded bloat off Croxton, Harrisburg GI8 and 47th street and gain back customers who left due to the nightmare of having to drop or pick a trailer at a yard designed almost exclusively for containers.

We can hope that these optimistic growth projections are realistic, maybe even exceeded. But what tends to happen is investments in future growth are cut for the sake of today’s bottom line. I’m crossing my fingers that real growth is in store.

One needs to be skeptical. The precision of the projections can paper over the fact that these are just guesses (best case) or pure nonsense (worst case).