Union Pacific’s proposed $85 billion acquisition of Norfolk Southern is the logical outcome of nearly two centuries of rail history, retired NS CEO David Goode says.

“The story of railroading has always been the story of mergers and expansion,” he says. And creating the first transcontinental railroad is no exception.

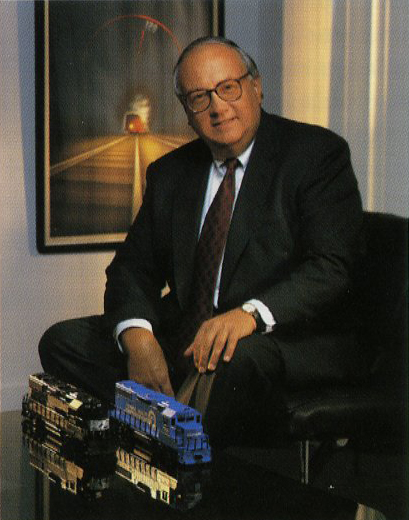

These days Goode looks at the rail industry, its large multinational customers, and the need for more single-line service and says the timing is right for a transcontinental deal — something that he could never pull off while he was leading NS.

Goode, who was NS chief executive from 1992 through 2005, played a pivotal role in the most expensive rail merger of the 1990s: The $10.1 billion split of Conrail between NS and CSX.

After CSX and Conrail announced an $8.1 billion merger in October 1996, Goode’s NS launched an all-out bidding war for the Northeastern freight railroad. NS ultimately came away with 58% of Conrail, largely shaping the railroad’s network into its current form.

Goode expects that UP-NS will mirror the Conrail split by leading to significant growth. Once NS put integration problems into the rearview mirror, the railroad gained 1.1 million intermodal loads in four years.

“It far exceeded our dreams,” Goode says, noting that the success of the NS intermodal corridor strategy hinged on the railroad’s expanded single-line reach into the Northeast.

The same fundamentals are in place for a UP-NS combination despite decades of change in the railroad industry and the national and global economies, Goode says. “I think there’s every reason to be optimistic about this transaction,” he says.

But he does not downplay the magnitude of the challenge involved in bringing two major railroads together. “I know how hard it is to put together big transactions, having done that and stumbled some in my own time,” Goode says.

NS experienced information technology system glitches on June 1, 1999 — Day One of the Conrail split. The problems immediately sent NS and its 7,200 route miles of Conrail into a downward service spiral.

It took NS a year to recover from one of the worst meltdowns in rail history. CSX experienced post-split operational problems, too, although not as severe as those on NS.

Goode says it wasn’t easy to split Conrail or to unite Norfolk & Western and Southern Railway to form Norfolk Southern in 1982. But in each case, service improved with a larger rail network able to reach more markets more effectively, he says.

“I’d be very confident that the service would be better after a transcontinental than it was before,” Goode says of combining UP and NS.

A transcontinental system would improve the U.S. rail network and its ability to boost the economy and support an industrial renaissance, Goode says. “One of the advantages we have is the efficient rail transportation system … which is the best in the world,” he says. “I think we forget that sometimes.”

The rail industry has been built on dreams and vision, Goode says, going all the way back to William Mahone’s Atlantic, Mississippi & Ohio, a 19th century Norfolk & Western predecessor. The railroad never made it out of Virginia, but Mahone’s dream of linking tidewater with the Ohio and Mississippi river systems never died. “That tells you everything about railroading,” Goode says.

“There’s no shortage of forward thinking, and I think that’s true today,” Goode says. “These guys are thinking about the future, and they’re thinking about making things better — and that’s what you want out of business.”

His claim to add 1 million new intermodal loads needs to be qualified. Is this completely NEW loads that never existed before the merger, or are these loads simply existing Conrail loads? If the latter, the benefits are suspect.

If they allow this merger then BNSF and CSX should merge as well. the other trans- con is the kcs-cp merger that exists today. They need these mergers for efficiency and competition. If BNSF and CSX were prohibited to merge then they would be at a disadvantage.

CPkc is not a trans-con. Maybe in Canada. But in the US it is a cross-con. With UP adding NS we are talking an end to end, true coast to coast transcontinental railroad. Transit times could be cut by up to TWO DAYS. Trucks can’t compete with that at their current prices and trucking costs would have to either drop, or become rail centric. Trains run in all weather. The first time snow/ice is mentioned, the trucks head south (adding days to the trip) or they go intermodal and keep moving but there is an additional cost to that. This all-rail transaction eliminates those costs. It better for everyone who ships anything. It would be faster than using the Panama Canal with no exchanges or low-water delays… Think about the changes that happened and benefitted Americans after May 10, 1869. That is even more true in this transaction. But if everyone decides to take more than their “pound of flesh” out of this proposal, it will die and that will be the end of any future mergers of this scale, and the time savings and efficiencies it offers.