BNSF Railway and CSX are seeing immediate results from the interline domestic intermodal partnership that they announced in August linking the Southwest and Southeast.

Over the past six weeks, CSX intermodal volume is up 8%, according to the railroad’s weekly carload reports. Rival Norfolk Southern’s intermodal traffic has declined 6.8% over the same stretch, suggesting a shift of traffic from its network to CSX’s in the Southeast.

BNSF’s intermodal volume — which is 73% larger than CSX’s — has been flat, with its relative size masking the impact of the interline agreement. But a railroad spokeswoman says the interline service has produced volume gains from share shift in the East as well as over-the-road conversion from the new lane linking Phoenix and Atlanta.

The new service links BNSF’s Los Angeles area terminals — Hobart and San Bernardino — with Charlotte, N.C., and Jacksonville, Fla., via Atlanta. New service also was launched between Phoenix and Atlanta.

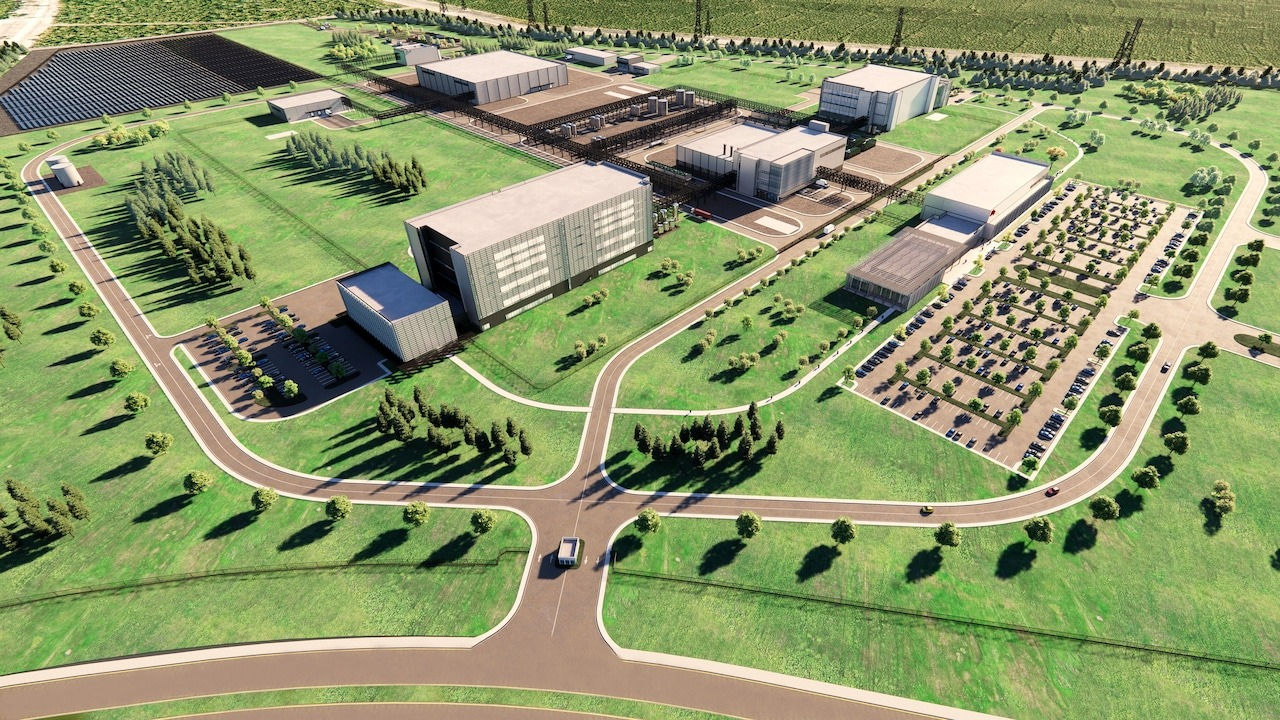

Under an agreement that dates to 2001 and was updated in 2006, BNSF enjoys haulage rights over CSX between their interchange at Birmingham, Ala., and the Fairburn intermodal terminal 20 miles southwest of Atlanta. The joint terminal, CSX’s busiest in the Southeast, underwent an expansion project completed in 2019 that boosted capacity to 750,000 annual lifts.

The interline agreement spawned the new Phoenix-Atlanta train Z-PHXATG on BNSF and the I187/I188 pair on CSX linking Charlotte and Birmingham. Other BNSF trains carrying the new interline traffic include Z-LACATG/Z-ATGLAC and Z-SBDATG/Z-ATGSBD, which handle loads for Charlotte and Jacksonville.

Although BNSF and CSX have said their interline deal was in the works before Union Pacific and Norfolk Southern announced their $85 billion transcontinental merger on July 29, the alliance is an example of how they say railroads can work together to provide seamless service without a merger. Their agreement also includes international service linking CSX-served East Coast ports with Kansas City.

UP and NS say that mergers are far more effective because they’re permanent and place decision-making under one railroad’s control.

“ALL” the way with Santa Fe!!!

Thumbs up John. If I recall the slogan was this: Ship and Travel Santa Fe, All the Way. But it’s been a while, the Santa Fe boxcars are long since extinct.

The mid-1970’s film “The Man Who Fell to Earth” was set in New Mexico. It showed strings of ATSF boxcars on a moving train. So you can look it up.

Prior to the 1995 BNSF merger, Santa Fe was considered the least changed of all the major railroads. In a sense it’s still not changed. The long haul from LA to Galesburg, Illinois, is 100% pre-merger Santa Fe, and some (not all) trains continue from Galesburg on to Chicago on ex-ATSF trackage. There aren’t all that many routes that so boldly show their heritage like ex-ATSF.