Any way you look at it, Canadian Pacific’s proposed acquisition of Kansas City Southern is a blockbuster deal. It creates the first railroad to link the U.S., Mexico, and Canada. It gives shippers from both railroads more single-line service options. And it will boost competition – with other railroads and, more importantly, trucks – in the busy corridor linking the Midwest and Chicago with Texas and Mexico.

But it’s also a giant leap forward for CP, which has played second fiddle to rival Canadian National for more than two decades.

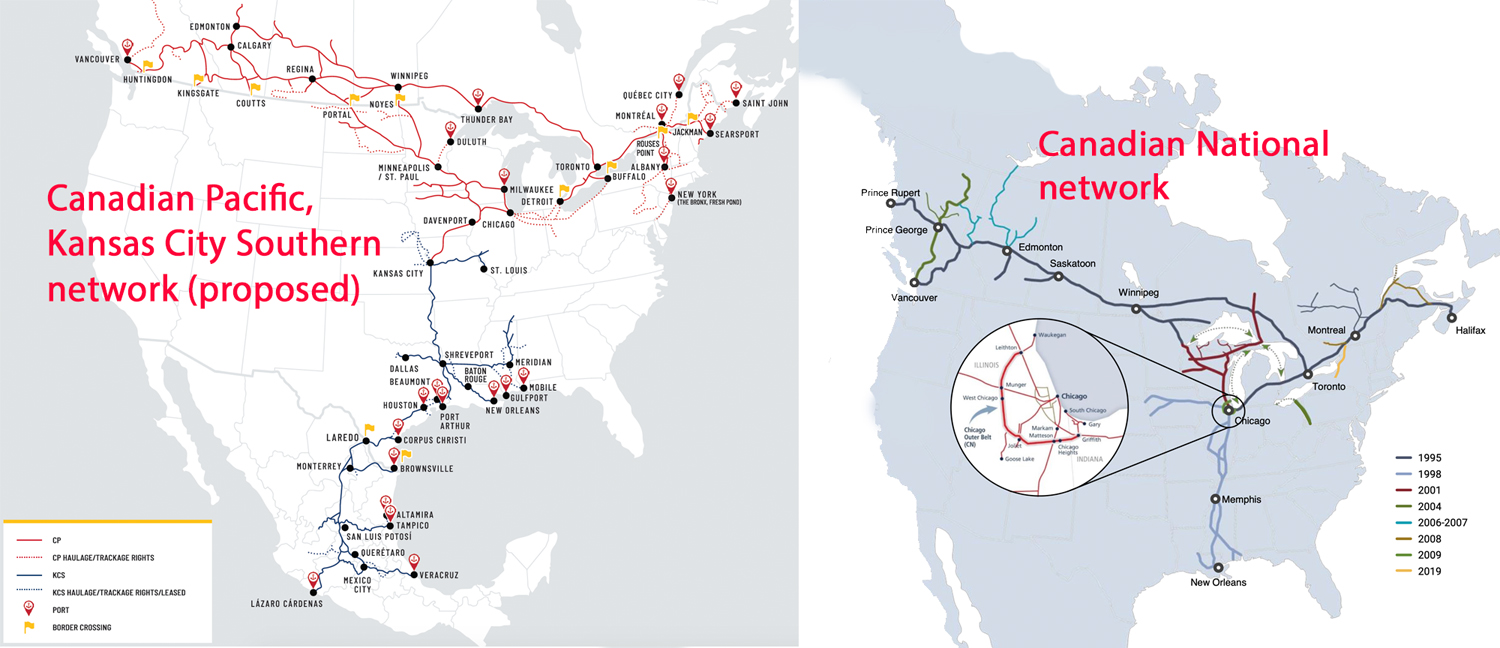

CN has run circles around CP by extending its reach through a series of acquisitions that began with the Illinois Central in 1999. That created the first railroad to touch the Atlantic, Pacific, and Gulf coasts. CN wasn’t done: By acquiring Wisconsin Central, Great Lakes Transportation, and the Elgin, Joliet & Eastern, CN neatly tied its system together through Chicago. And along the way it gobbled up 10 short lines, including regional BC Rail.

Canadian Pacific trailed Canadian National for years

CP’s response? In 2007 it paid too much for 2,500-mile regional Dakota, Minnesota & Eastern as part of an ill-fated plan to be the third railroad to reach the Powder River Basin coal fields of Wyoming. In 2012, less than six months into his stint as CP’s chief executive, E. Hunter Harrison killed the Powder River dreams and sold off the DM&E’s westernmost 700 miles.

All this left CP as a 12,500-mile system outflanked by the 20,000-mile CN. Now in short order CEO Keith Creel has built CP into a faster-growing and much stronger competitor – and one with a network that nearly mirrors CN’s, but with access deep into the major consuming and manufacturing regions of Mexico.

Last June CP acquired 481-mile regional Central Maine & Quebec, part of its historic shortcut across Maine that links Montreal with the Atlantic at Saint John, New Brunswick. In December CP for the first time gained full ownership of its Detroit River Rail Tunnel, a key in its route linking Chicago with Toronto, Montreal, and Eastern Canada. And last month, of course, the $29 billion KCS merger was announced. CPKC will total 19,700 miles, a tally that will exceed CN’s after CN completes the sale of 650 miles of branch lines to Watco in Wisconsin, Michigan, and Ontario.

Maps taken from Canadian National, Canadian Pacific, and Kansas City Southern sources. Edited and stitched in Photoshop by Trains staff.

The KCS deal will cement Creel’s own legacy

Creel’s larger-than-life mentor, Hunter Harrison, considered KCS “a dog with fleas,” a reference to the risk that comes from KCS having merely a concession to operate KCS de Mexico rather than outright ownership. But Creel was convinced that KCS under CEO Pat Ottensmeyer has a deep understanding of Mexico that has allowed KCS de Mexico to thrive.

KCS’s cross-border traffic is the biggest railroad growth story in North America. KCS volume over its International Railway Bridge in Laredo, Texas, has more than doubled since 2012 thanks largely to intermodal, automotive, and refined products shipments. Yet periodic operational problems – including congestion at the Laredo gateway, in Mexico’s industrial centers, and on Union Pacific trackage rights in Houston – have prevented KCS from fully tapping the potential volume gains.

Although KCS has become more resilient over the past two years after adopting Precision Scheduled Railroading, tying the knot with CP should further improve operations. Since 2015 CP has been by far the most stable railroad based on its average train speed and terminal dwell figures. If CP can extend this performance to KCS, as expected, it can only help propel cross-border growth.

Railroad executives estimate that within three years CPKC will produce $780 million in annual merger-related synergies. Don’t believe it. CP has consistently underpromised and overdelivered on virtually everything since Creel became CEO in January 2017. The real number is probably closer to $900 million.

A true end-to-end merger

The combined CPKC system touches only at their shared Knoche Yard in Kansas City, Mo., and does not diminish most shippers’ existing railroad options. In fact, it creates more competition by adding a third single-line route linking Texas with Chicago and the Midwest. With 16,000 trucks crossing the border every day at Laredo, there’s plenty of opportunity to pick up traffic that now moves on rubber tires. CPKC aims to do just that with new single-line intermodal service.

Add all this up and it’s clear that CP-KCS should pass regulatory muster – whether it’s judged under the Surface Transportation Board’s old pro-merger rules or the tougher 2001 rules that have prevented a merger of Class I systems. And one thing’s for sure: If a merger of the two smallest Class I railroads can’t get through the STB, then nothing will.

You can reach Bill Stephens at bybillstephens@gmail.com and follow him on twitter @bybillstephens.

Clark, you are correct: CP and KCS aim to create the third-best route linking Texas and Chicago. But, as the intermodal analyst Larry Gross points out, it’s not like UP is scorching the ballast with 96-hour Texas-Chicago intermodal schedules. The CP-KCS promise of better intermodal service in this lane could work out simply on the economics, nevermind speed.

The CP line between Minneapolis and Kansas City is over 100 miles longer than the ex-Rock Island Minneapolis – Kansas City line. The KCS route between Kansas City and Houston is longer than either BNSF or UP let alone the line between Kansas City and Laredo. The merger doesn’t make sense to me.

My recollection of the DM&E takeover was that someone (a hedge fund, private equity, or even another railroad) threatened to take over the CP. The CP’s response was to pay a high price for the DM&E and load the company with debt thus making a CP takeover expensive and impractical with all that new debt. I don’t think the DM&E purchase timing was coincidental.

theirs something i don’t get what’s wrong if the canadian pacific and the kansas city southern just stay as seperate railroads anyway ?

CN’s netwrok always has and will be superior to CP’s. Even with KCS joining they still have a slow expensive route south. I see no competition with trucks or the other Class 1’s. Bulk traffic and some auto traffic will be the only traffic that benefits from this marriage.

Adding to Braden’s observation, KCS has never controlled their destiny through the UP owned quagmire that is Houston. The fixes are expensive and Uncle Pete doesn’t want them anyway.