Union Pacific’s proposed acquisition of Norfolk Southern — an $85 billion deal that would create the first U.S. transcontinental system and potentially lead to additional consolidation among the Class I railroads — is Trains’ top story of 2025.

The deal was hardly a surprise when it was announced on July 29. Rumors had been swirling since late 2024 that some Class I railroads were considering their merger options.

In an April interview with Trains, UP CEO Jim Vena touted the benefits of mergers — and acknowledged the regulatory risks facing the first combination that would be judged under the Surface Transportation Board’s tougher 2001 merger review rules. “I think it’s a win for our customers and a win for competition and it’s a win for how the country should move ahead. Now, on the regulatory front, it’s complicated,” Vena said at the time.

The magazine’s May 12 report, “Some Class I railroads take a fresh look at mergers,” sparked a wider public conversation that included rail executives, investors and analysts, and the business media. This was followed by a slow drip of leaks to media outlets, including news that UP and NS were involved in merger talks.

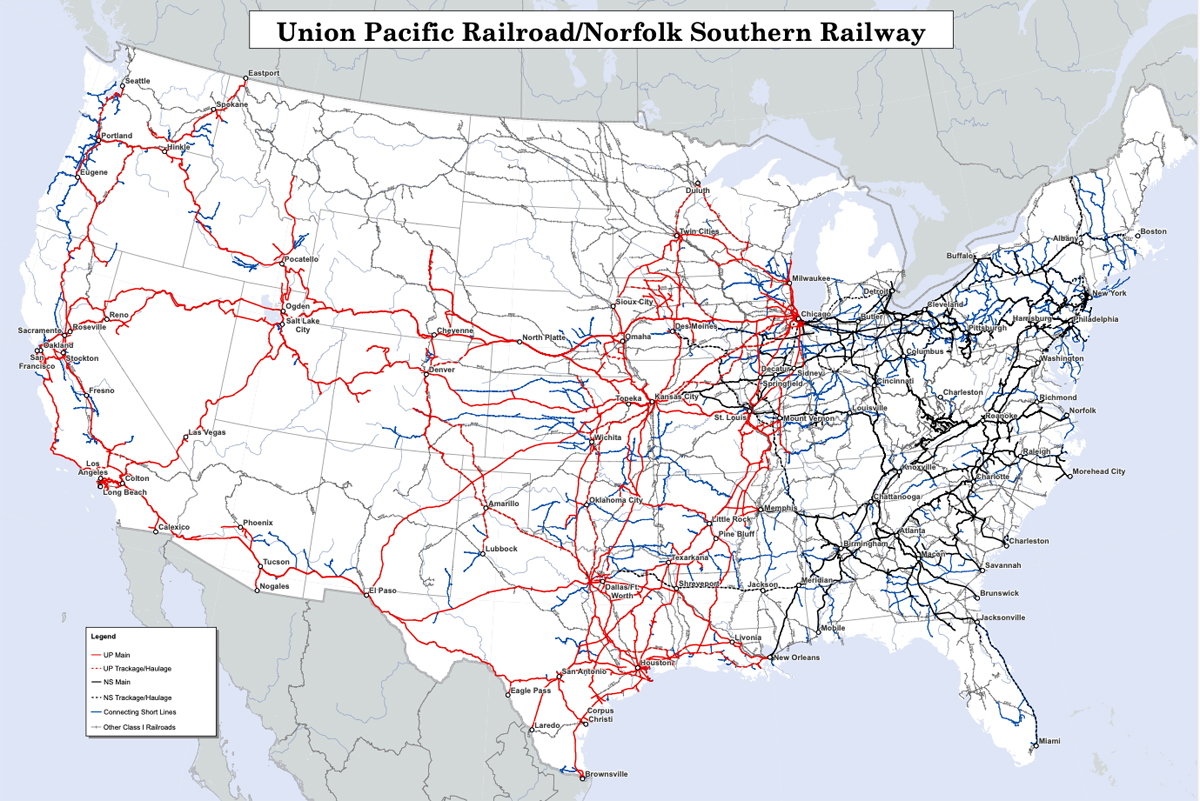

If approved, the UP-NS combination will create a railroad of unprecedented size and scope. The transcontinental UP would stretch 52,215 route miles, with track winding through 43 states. UP would have a dominant market share of 40% or greater in the majority of commodities that railroads haul, from containers and autos to chemicals and sand and gravel.

This dominance has some shipper groups and railroads crying foul.

They have warned that UP’s expanded market power will harm competition and lead to higher rates that will hurt rail customers, harm the broader economy, and ultimately raise costs for consumers. They also say the UP-NS combination poses the risk of integration-related service problems that have followed prior Class I railroad mergers. The difference, they say, is that if UP stumbles while meshing its operations and technology with NS, the problems will be felt nationwide.

UP and NS say the opposite: That their merger will boost competition, improve service, and lead to significant volume growth because shippers prefer single-line service. Eliminating handoffs between railroads in the country’s midsection will speed freight and reduce the time and costs associated with interchange, they say. And all this, UP says, will help the U.S. economy while making American companies more competitive in global markets.

UP executives also have promised a smooth integration, noting that they’ll take a go-slow approach to operational changes and that UP’s flawless cutover to a new computer system in 2024 is proof that they can extend UP’s systems to NS without trouble.

Executives from BNSF Railway, Canadian National, and Canadian Pacific Kansas City have all criticized the UP-NS deal. They say that many of the benefits of merging — including traffic growth — can be achieved through interline alliances without the risks involved in combining two railroads.

A case in point: An intermodal partnership between BNSF and CSX that was announced in August and expanded in November. The railroads say the alliance — which offers faster service between terminals on each network — predates the UP-NS merger announcement and was in the works for 16 months.

The BNSF-CSX service is converting truckloads from highway to rail and winning market share from Norfolk Southern. It’s proof, they say, that partnerships work and that mergers aren’t necessary.

These dueling views on the merger will play out at the Surface Transportation Board in 2026 as regulators consider the biggest rail combination in U.S. history.

— To report news or errors, contact trainsnewswire@firecrown.com.

Previous Trains.com coverage

Some Class I railroads take a fresh look at mergers, May 12, 2025

Union Pacific and Norfolk Southern reach $85 billion merger deal, July 29, 2025

How would UP+NS and BNSF+CSX transcontinental systems compare?, Aug. 8, 2025

UP and NS say their merger will take 2 million trucks off the highway annually, Dec. 19, 2025

Creel warns UP–NS merger is no ‘fait accompli’, Dec. 2, 2025

BNSF CEO reiterates opposition to UP-NS merger, Dec. 19, 2025

Union Pacific: We can avoid merger-related tech problems, Nov. 14, 2025

BNSF and CSX expand intermodal partnership to Midwest, Northeast, Nov. 17, 2025

Chemical producers say UP-NS merger would hurt shippers, consumers, Sept. 4, 2025

Shipper group, critical of UP-NS merger, says carload and unit train customers need competitive options, Aug. 4, 2025

It must be a good thing if all the other railroads are lining up against it… They seem to be saying, “don’t potentially mess with our slice of the pie…”