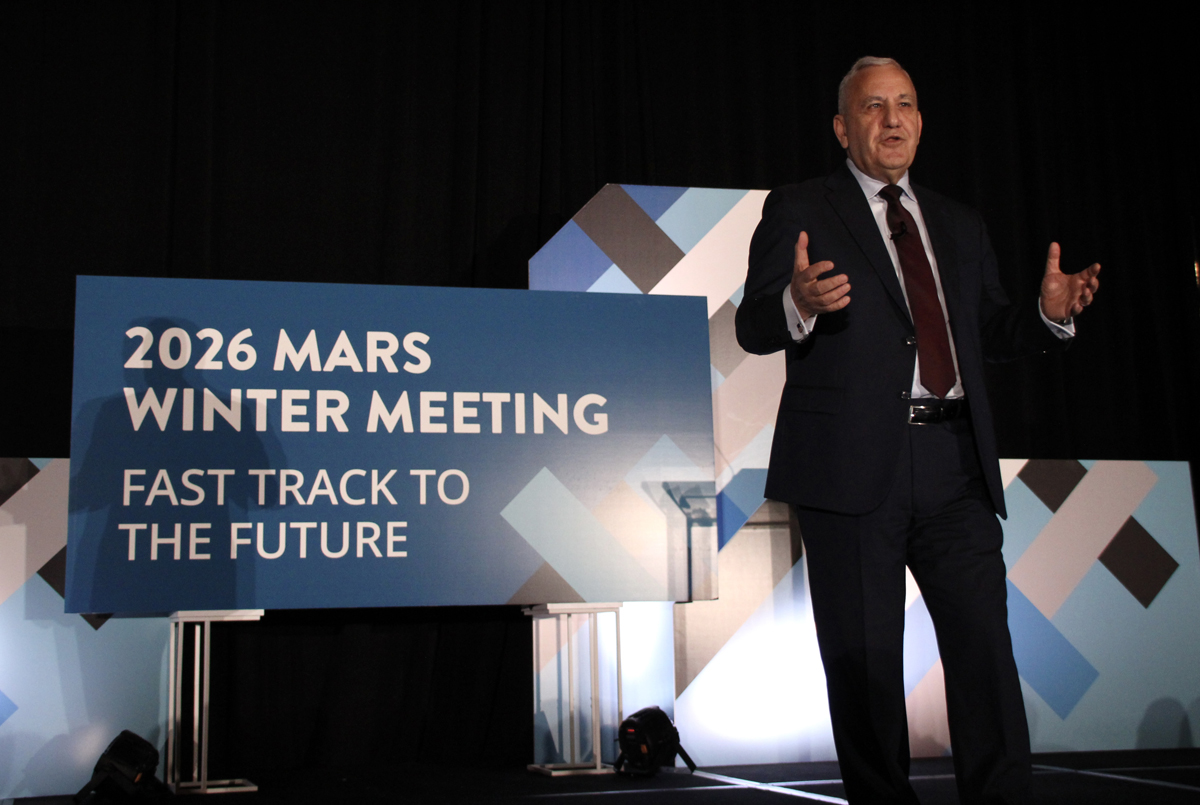

CHICAGO — Confidence was not in short supply when Union Pacific CEO Jim Vena held a rolling news conference last week to tout UP’s proposed acquisition of Norfolk Southern.

“I’m 99.999% sure that this merger is going to go through,” Vena said on Wednesday from the back of the Fox River theater car as UP’s business train wound its way from the Ogilvie Transportation Center to the railroad’s Global 4 intermodal terminal in Joliet, Ill.

The $85 billion deal to create a transcontinental railroad will win regulatory approval, he says, because it’s good for customers, employees, and the country. The only thing uncertain: what type of conditions the Surface Transportation Board will attach to its approval, Vena says.

If UP is successful — and can provide faster, seamless service from coast to coast — Vena says a BNSF-CSX merger is inevitable if they want to be able to compete effectively.

First, however, the UP-NS merger must face the untested and tougher major merger review rules that the STB introduced in 2001. Christina Conlin, UP’s chief legal officer, says UP and NS will have a first-mover advantage because they will get to shape the debate over how the new rules are interpreted.

The rules, drawn up after a series of disruptive megamergers in the 1990s, require UP and NS to show that their merger enhances competition and is in the public interest. The terms are not defined. But Conlin says the STB will look at how railroads fit into the broader freight transportation system, and not just how the merger would affect rail competition.

Railroads carry only 12% to 14% of all of the freight tonnage that moves in the U.S., executives noted. “The STB’s charge when they are looking at the public interest, which includes enhanced competition, is making sure that there is a strong rail network for the U.S.,” Conlin says. And that includes measuring how effectively railroads compete against trucks and waterways as well as other railroads.

Vena says the current regional duopoly — with UP and BNSF in the West and CSX and NS in the East — hampers long-haul shipments because of the need to interchange traffic at gateways from Chicago to New Orleans.

Having one railroad handle shipments from origin to destination will eliminate interchange friction, reduce transit times, and allow shippers to move the same amount of freight with fewer freight cars, he says. It also will streamline things like billing and car location tracing.

But BNSF, CPKC, and Canadian National disagree and favor partnerships between railroads. They say a UP-NS merger will stifle rail competition, reduce options for shippers, create service problems, and lead to higher rates.

Several shipper associations and industry trade groups also have thus far said that they oppose the merger, although hundreds of individual shippers have written letters supporting the deal.

Political winds have swirled around the STB since the merger was announced on July 29.

First, President Donald Trump on Aug. 27 fired Robert Primus, the only STB member to vote against the Canadian Pacific-Kansas City Southern merger in 2023.

Second, after meeting Vena in the Oval Office in September, Trump said the merger “sounds good to me,” which ignited speculation that the STB would receive political pressure from the White House. Last week, however, former STB Chairman Martin J. Oberman wrote in a commentary for Trains that the current board members would give the merger a rigorous, objective review.

And then last month UP raised eyebrows when it was listed among the 37 companies that have contributed to Trump’s controversial White House ballroom project. The donation was made to the National Park Service, which UP has supported for more than a century. Vena declined to say how much the railroad contributed, but insisted the donation was nothing more than the railroad being a good corporate citizen.

The transcontinental merger proposal can win based on its merits, Vena says. “The reason we’re confident is it’s a great story … Otherwise, we could have given $100 million and it would not have made a difference,” Vena says.

Vena also says it makes no difference if the STB reviews the merger with its current three members or with a full contingent of five members. Trump nominee Richard Kloster is awaiting Senate confirmation; no one has yet been nominated to fill the vacant seat, although Primus is challenging his dismissal in federal court.

“We should always have had a railroad system that allowed people to seamlessly move products across the United States of America,” Vena said, pointing to the pair of transcontinental systems that have spanned Canada for more than a century. “And too bad because of the amount of amalgamation that we had to do that it’s taken us this long.”

The railroads have said they expect to file their merger application in early December.

— To report news or errors, contact trainsnewswire@firecrown.com.

To add to Landon’s comment, there probably would probably be less of a cultural challenge if UP merged with CSX, and NS with BNSF. UP and NS have well-ingrained philosophies of how a railroad should operate. We’ve seen what happens if there’s no accomodation between “partners.”

Sounds like David Levan in the fall of 1997… Oh, well.

There are significant benefits to this merger proposal since it is largely end-to-end and eliminates significant interchange.

There is also considerable overlap in the Midwest, where it will take significant conditions to increase competition. It will be interesting to see what those conditions are. It will also be interesting to see if UP will negotiate the conditions with other railroads and shippers, or if the STB will have to come up with them.

There would have been less overlap if UP were merging with CSX, and BNSF with NS. BNSF and CSX should be pushing for lots of conditions.

Vena has already defused Labor opposition with his guarantees of job preservation. Easier to do when it’s an end-to-end combination.

He will similarly defuse customer opposition, by saying the Two Magic Words: Reciprocal Switching.

He knows that works, coming from Canada, where it has worked for 100 years. And he knows that’s what the Board wants.